Request

As reported by Coinlive on October twelve, 2022, the United States Securities and Exchange Commission (SEC) started investigating Yuga Labs claiming that the APE and NFT land token sale in Otheride was “an open sale of securities.”

Do you uncover these phrases “familiar” to you? This is popular press coverage all through cryptocurrency background, as the SEC has repeatedly accused each ETH and XRP of staying stocks.

The writer has an report that analyzes the situation of Ethereum two., you can reread it to realize it far better The Howey check – a idea that runs by means of discussions on the classification of a offered cryptography as protection.

This time close to, the situation of Yuga Labs is additional particular, as it truly is an NFT examine and the SEC’s target audience is NFTs in the metaverse globe. Therefore, the Yuga Labs situation is of good curiosity to each the crypto local community and the legal occupation, for the reason that NFT is an object that the SEC desires to include things like in the securities framework.

Related objects

The Howey check

The basis for the SEC to classify a undertaking token as protection or not. See additional explanation right here.

Yuga Labs

Web3 and NFT firm, creator of the NFT Bored Ape Yacht Club assortment. Currently proprietor of the BAYC, CryptoPunks, Meebits collections and the Metaverse Otherside undertaking. Aim to establish a Yugaverse from these tasks.

Bored Ape Yacht Club (BAYC)

The NFT assortment of amazing sculptural monkeys has produced Yuga Labs a identify for itself. Initially only representative distinctive photographs (PFPs), BAYC has grown to grow to be a “definition” of NFT with a huge local community and a quantity of derivative tasks.

Eminem and Snoop Dogg also brought NFT Bored Ape to the VMAs.

ApeCoin (APE)

Originally produced to be the token representing NFT BAYC. But along with the expanding hype of monkeys, the ecosystem expands, so do the traits of the BEE.

Currently, APE serves as each a governance token and a utility token in the BAYC ecosystem.

APE is made use of for:

– Administration: APE holders can participate in the ApeCoin DAO, vote, vote the proposals in the DAO.

– Consumption: The APE is the payment currency for assets in the APE ecosystem. If you want to get NFT, trade or get linked items, everybody requirements APE. However, it is specifically essential to note that end users even now have to spend a fuel tariff of ETH for the reason that APE is an ERC-twenty token.

– Access rights: APE holders have accessibility to other solutions in the BAYC ecosystem this kind of as video games, motion pictures, presents in type, and so on.

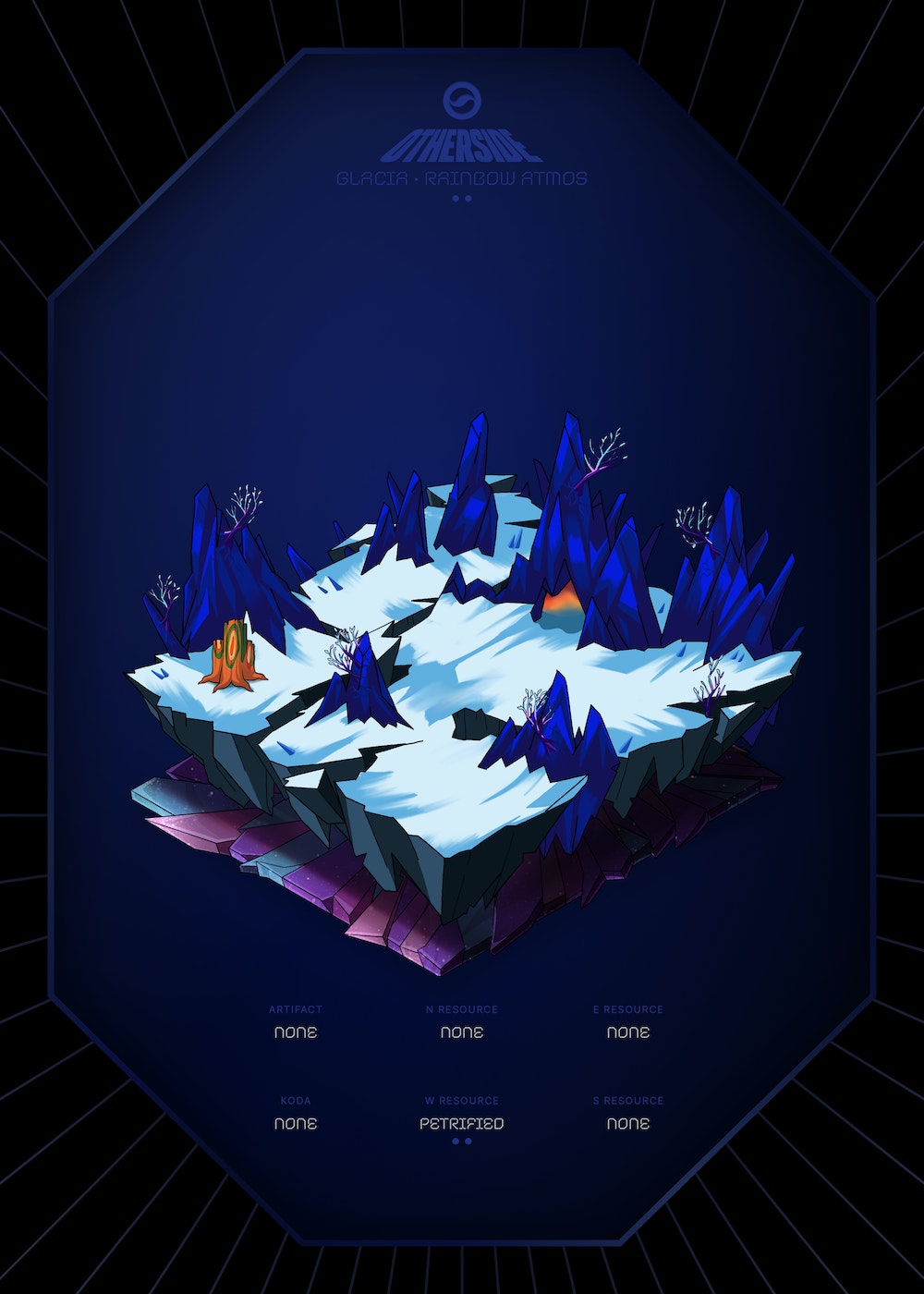

Other side

The metaverse undertaking is primarily based on the BAYC platform. There is now a demo of the game that has acquired a whole lot of praise. In this metaverse, the NFT monkey will grow to be the player character and the APE token serves as the in-game currency.

Another act

Otherdeed is the identify of the lands in the Otherside globe. Land NFT has grow to be the “specialty” of metaverse tasks, producing hype when owning “virtual” actual estate in the fantasy globe.

This NFT land sale brought about a stir in the local community, primary to a blockade of the total Ethereum network. And also the principal topic of the SEC allegations.

Howey’s check for NFT Land of the Otherside

A funds investment?

Obviously, purchasing Otherdeed plenty is a financial investment. At the time of the sale, a piece of land was really worth 305 APE, or about five,000 USD.

Yuga Labs offered a complete of fifty five,000 parcels of land, earning in excess of $ 300 million. Since then, it has been recorded as “the largest NFT land sale in history”.

Investing in a joint venture?

This is also very apparent. With fifty five,000 pieces of NFT, there are at least 1000’s of owners. Everyone expects a popular pattern that is the metaverse globe of the Otheride.

Do you anticipate a return on investment?

Very clear. NFT customers anticipate potential revenue. They anticipate the Othside to realize success, hence pushing the selling price of NFT increased. “Buy low, sell high” is the similar as traditional stocks.

Does this revenue come from the organization’s efforts to promote the investment?

Indeed it is. Buyers and owners of NFT Otherdeed anticipate Otherside’s potential advancement, or rather, Yuga Labs’ advancement technique.

The globe of Otherside is wholly in the hands of Yuga Labs, what they want to establish for the undertaking, when it will be launched and what characteristics it will include things like. And Otherside’s advancement path will impact the NFT selling price, therefore affecting the investor’s revenue.

To place it plainly, if Yuga Labs now declares that they no longer build Otherside, “putting your kids out of business”, the NFT selling price will absolutely “go home”. Conversely, if Yuga Labs announced that it would use $ 300 million to open the sale of land and reinvest it all in Otherside, the NFT selling price is absolutely sure to improve drastically.

If this passage is even now tough to realize, let us contemplate yet another instance. Surely everybody is aware of about the warmth of CryptoPunks. NFT punk holders also anticipate revenue (there are a whole lot of folks just for the sake of collecting, of program), but this revenue comes from the uniqueness of the undertaking itself.

CryptoPunks is the very first NFT assortment, it has a quite higher collectible worth and with the existing NFT industry problem, the older the punk, the additional useful. Although Yuga Labs owns the copyright to this assortment, it plays no purpose in producing, including characteristics, or making several worlds. CryptoPunks itself isn’t going to need to have to establish an ecosystem close to like BAYC and even now maintains its existing intensity.

And of program, Yuga Labs will no longer announce that it is not producing CryptoPunks for the reason that there is no need to have to build anything at all now.

Therefore, all 4 definitions of The Howey Test are met, so analysts think that Yuga Labs is dealing with a quite higher threat of staying “whispered” by the SEC.

In that situation, not only had been Yuga Labs or the Otherside undertaking “nominated”, but NFT owners had been not spared from the consequences both.

What if the NFT is classified as a “security”?

Of program, the over is only the argument of some analysts. The SEC just showed it is investigating, but it has not concluded anything at all nevertheless. So naturally Yuga Labs is even now working legally.

But this discussion prospects to a additional essential query: what if NFT was classified as a stock?

For Yuga workshops

Yuga Labs will be accused by the SEC of conducting “open sale of unregistered securities”. And he will be fined in accordance to the securities laws. If staying fined is not that essential, then the upcoming problem is essential.

For the markets listed NFT

NFT Otherdeed is offered on several markets, the most essential staying OpenSea.

Once NFT has been classified as a protection, the SEC will force OpenSea to delist for the reason that OpenSea does not have the correct to open trading in securities. If these marketplaces do not comply with the SEC’s request, they will be charged with “violation of federal securities laws.”

From there it will be tough to operate in the United States, 1 of the most essential markets in the sector.

For traders and NFT owners

It appears that the NFT purchaser is the “victim” in this story. At the time of purchasing NFT, we did not know it was a stock, so it would not be the SEC’s target.

But imagine that as soon as Yuga Labs was fined, NFT was declared a title and a should delete among platforms. So what will the NFT selling price be like? The dump does not quit!

It is tough to envision how considerably the selling price of the NFT will fall, but that reduction is borne only by the investor. Nobody can “compensate” or compensate for damages.

Giovanna

Maybe you are interested: