Aera is a treasury management remedy for crypto tasks. So what is distinctive about this task? Let’s discover out with each other with Coinlive by way of this posting!

What is Aera? Treasury management remedy for crypto tasks

What is Aera? Treasury management remedy for crypto tasks

What is Aera?

Aera is a decentralized treasury management protocol, developed to increase treasury manage for DAOs and crypto tasks. Aera gives options this kind of as information-driven investment method suggestions, automated portfolio rebalancing, and transparency by way of DAO governance.

The Aera web site

The Aera web site

Features of Aera

Aera gives buyers the following options:

-

Choose quite a few strategic goals for treasury, which include: managing threat by way of focusing on volatility, escalating liquidity, producing returns from idle holdings, and diversifying assets inside treasury.

-

Take benefit of constant, automated rebalancing of treasury pursuits to track goals devoid of the need to have for regular governance votes.

-

Whitelisting of assets and protocols by means of Aera-managed sensible contracts, making sure treasury assets are only exposed to pre-accepted types of threat

-

The reporting dashboard displays information from the total onchain protocol, making sure transparent, serious-time information and facts on investment overall performance

-

Non-custodial design and style guarantees that consumers keep total manage of their assets and can withdraw at any time devoid of penalty

Aera Highlights

-

Increase capital efficiency: With Aera the treasury can meet its paying wants. This lets protocols to lessen charges and lengthen additional loans.

-

Save on shipping expenses onion: Aera can aid DAO meet liquidity wants in the most adverse instances at no value.

-

Minimize administration: Using Aera, the DAO will outsource treasury management to a decentralized network of participants incentivized to maximize the DAO’s goals though minimizing governance interference.

Aera’s working model

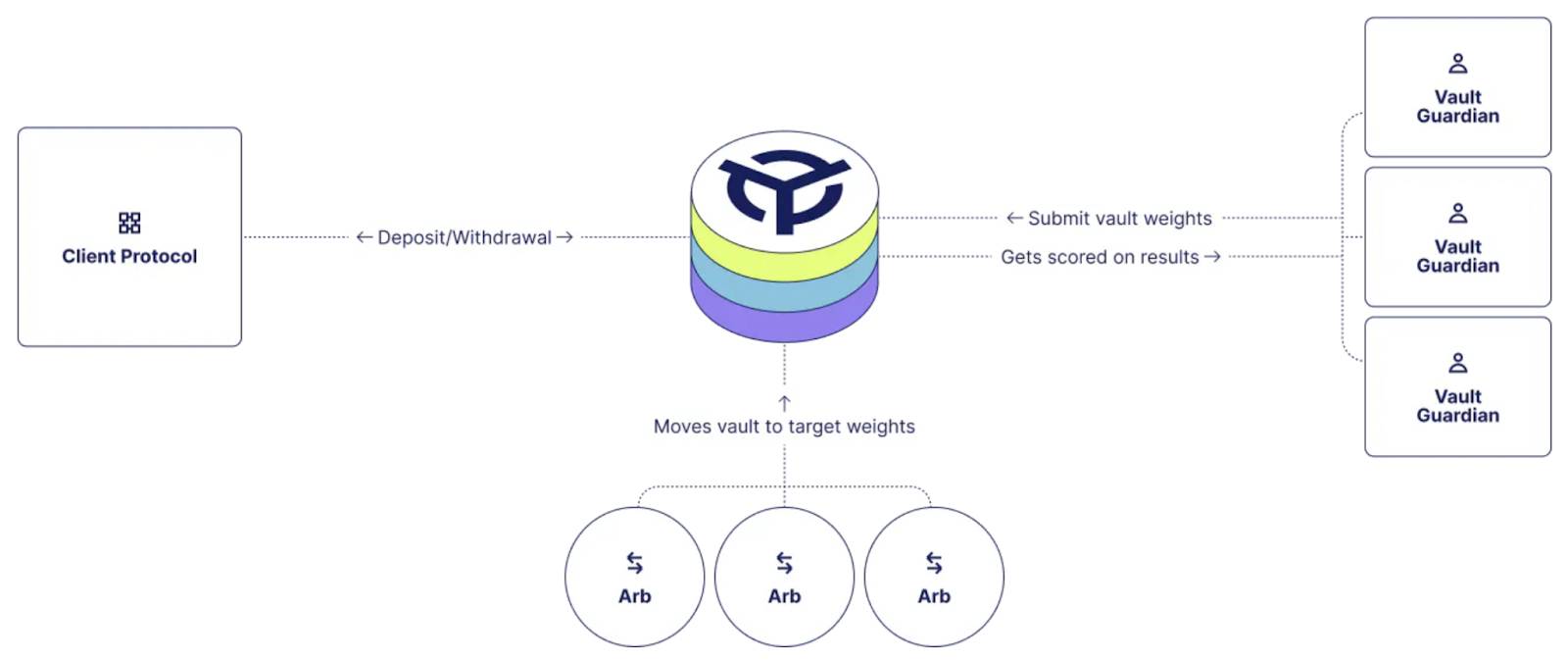

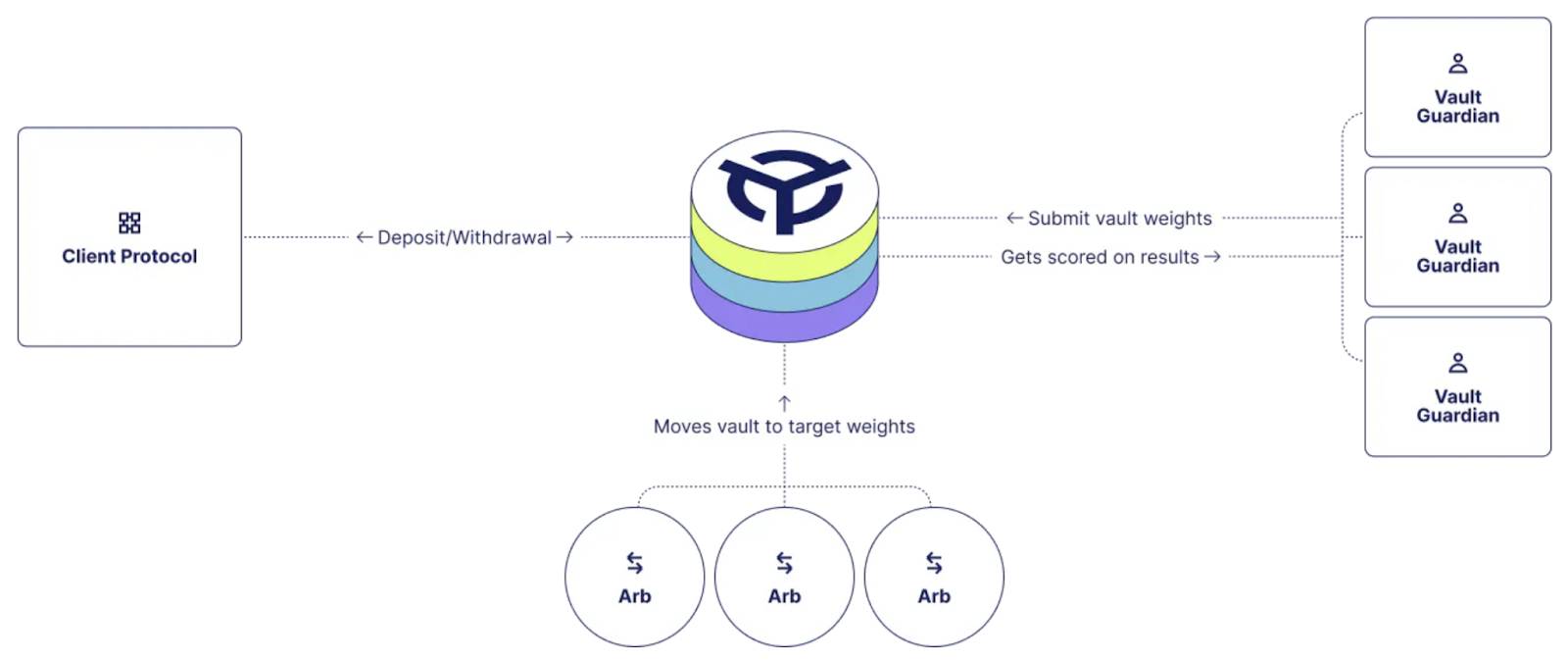

Each task coming to Aera will be offered with a vault to deal with its treasury. Each vault in Aera will elect a group of guardians to carry out operations. The vault guardian can be divided into two components: assignment and execution. The allocation will establish the aim for the portfolio allocation. The implementation will establish how to allocate the portfolio to attain the target.

Aera proposes a decentralized treasury management mechanism by rewarding/punishing vault guardians primarily based on the benefits of their perform. The task necessitates vault guardians to stake their assets and assess the degree of achievement of goals. Every rebalancing proposal in Aera necessitates funding and benefits in a public track record for participants.

Aera Vault operational model

Aera Vault operational model

Factors working Aera Vault:

-

Crypt Guardian: The custodian is the get together that sends metrics (asset reviews) to the Aera vault to establish the asset allocation in the vault. To participate, custodians should stake assets and threat losses if their parameter selections execute poorly.

-

Client protocol: Client Protocol is any DAO that deposits a portion of its treasure into the Aera vault to approach for long term costs or commitments.

-

Arbitrage: An arbitrageur is any get together that rebalances by exchanging assets with a vault. Arbitrators are incentivized to continually rebalance the deposit to target allocations established by custodians.

What sorts of assets does Aera help?

The V2 model of Aera lets consumers to deal with two primary asset sorts: ERC-twenty, ERC-4626.

Basic information and facts about the Aera task token

Currently, this task does not approach to difficulty tokens. Coinlive will update you as quickly as there is more information and facts on the task.

Assignment of tokens

Updating…

Roadmap for growth

The Aera growth roadmap will be divided into three primary phases:

Launch

Extend

Decentralization

Investors

In October 2023, Project Aera announced that it had finished its initial round of financing with participation from Bain Capital Ventures and Jump Trading. The complete sum of income Aera has acquired from traders quantities to $eight million.

Development group

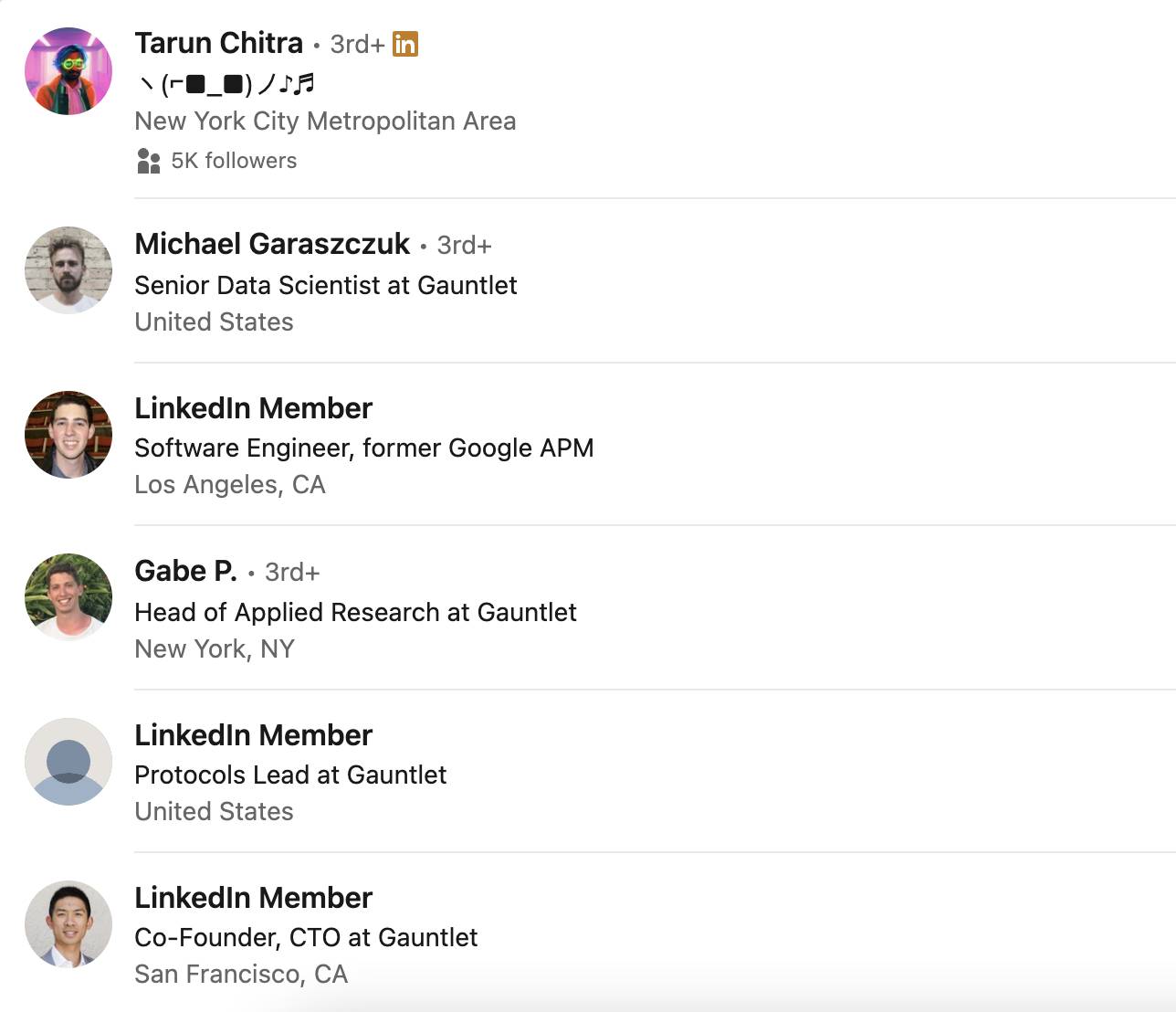

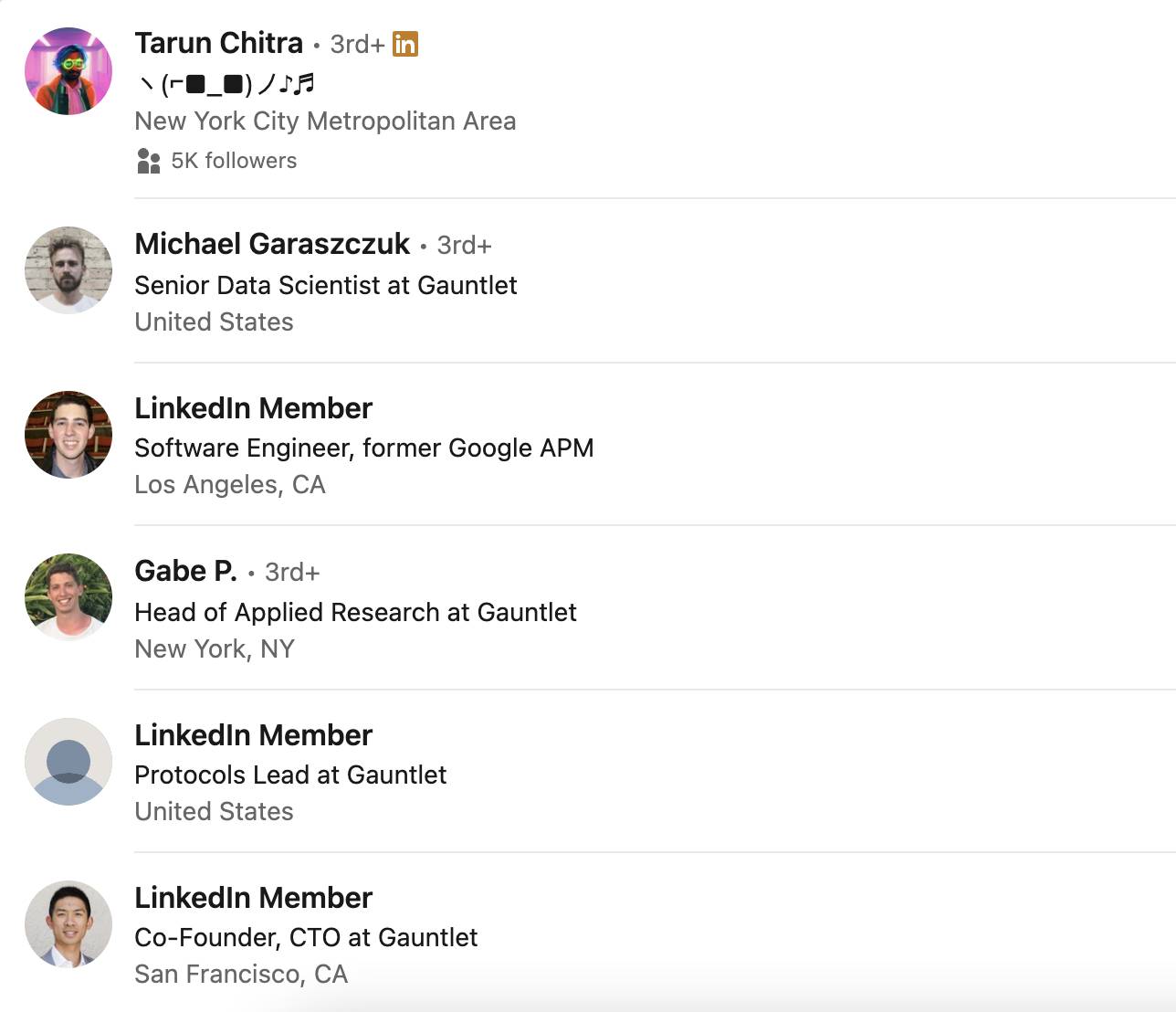

Aera is produced by the group behind the Gauntlet task. Key members of this task include things like:

-

Tarun Chitra: CEO of Gauntlet

-

Gabe P: Head of Applied Research at Gauntlet

-

Rei Chiang: Technical Director of Gauntlet

summary

Aera is a remedy that aids DAOs and crypto tasks deal with their treasuries additional effectively. This task is fairly new and at this time has no programs to release tokens to the industry. Through this posting, you will likely have some primary information and facts about this task.

Note: The information and facts in this posting really should not be regarded investment guidance. Coinlive is not accountable for any of your investment choices.

Aera is a treasury management remedy for crypto tasks. So what is distinctive about this task? Let’s discover out with each other with Coinlive by way of this posting!

What is Aera? Treasury management remedy for crypto tasks

What is Aera? Treasury management remedy for crypto tasks

What is Aera?

Aera is a decentralized treasury management protocol, developed to increase treasury manage for DAOs and crypto tasks. Aera gives options this kind of as information-driven investment method suggestions, automated portfolio rebalancing, and transparency by way of DAO governance.

The Aera web site

The Aera web site

Features of Aera

Aera gives buyers the following options:

-

Choose quite a few strategic goals for treasury, which include: managing threat by way of focusing on volatility, escalating liquidity, producing returns from idle holdings, and diversifying assets inside treasury.

-

Take benefit of constant, automated rebalancing of treasury pursuits to track goals devoid of the need to have for regular governance votes.

-

Whitelisting of assets and protocols by means of Aera-managed sensible contracts, making sure treasury assets are only exposed to pre-accepted types of threat

-

The reporting dashboard displays information from the total onchain protocol, making sure transparent, serious-time information and facts on investment overall performance

-

Non-custodial design and style guarantees that consumers keep total manage of their assets and can withdraw at any time devoid of penalty

Aera Highlights

-

Increase capital efficiency: With Aera the treasury can meet its paying wants. This lets protocols to lessen charges and lengthen additional loans.

-

Save on shipping expenses onion: Aera can aid DAO meet liquidity wants in the most adverse instances at no value.

-

Minimize administration: Using Aera, the DAO will outsource treasury management to a decentralized network of participants incentivized to maximize the DAO’s goals though minimizing governance interference.

Aera’s working model

Each task coming to Aera will be offered with a vault to deal with its treasury. Each vault in Aera will elect a group of guardians to carry out operations. The vault guardian can be divided into two components: assignment and execution. The allocation will establish the aim for the portfolio allocation. The implementation will establish how to allocate the portfolio to attain the target.

Aera proposes a decentralized treasury management mechanism by rewarding/punishing vault guardians primarily based on the benefits of their perform. The task necessitates vault guardians to stake their assets and assess the degree of achievement of goals. Every rebalancing proposal in Aera necessitates funding and benefits in a public track record for participants.

Aera Vault operational model

Aera Vault operational model

Factors working Aera Vault:

-

Crypt Guardian: The custodian is the get together that sends metrics (asset reviews) to the Aera vault to establish the asset allocation in the vault. To participate, custodians should stake assets and threat losses if their parameter selections execute poorly.

-

Client protocol: Client Protocol is any DAO that deposits a portion of its treasure into the Aera vault to approach for long term costs or commitments.

-

Arbitrage: An arbitrageur is any get together that rebalances by exchanging assets with a vault. Arbitrators are incentivized to continually rebalance the deposit to target allocations established by custodians.

What sorts of assets does Aera help?

The V2 model of Aera lets consumers to deal with two primary asset sorts: ERC-twenty, ERC-4626.

Basic information and facts about the Aera task token

Currently, this task does not approach to difficulty tokens. Coinlive will update you as quickly as there is more information and facts on the task.

Assignment of tokens

Updating…

Roadmap for growth

The Aera growth roadmap will be divided into three primary phases:

Launch

Extend

Decentralization

Investors

In October 2023, Project Aera announced that it had finished its initial round of financing with participation from Bain Capital Ventures and Jump Trading. The complete sum of income Aera has acquired from traders quantities to $eight million.

Development group

Aera is produced by the group behind the Gauntlet task. Key members of this task include things like:

-

Tarun Chitra: CEO of Gauntlet

-

Gabe P: Head of Applied Research at Gauntlet

-

Rei Chiang: Technical Director of Gauntlet

summary

Aera is a remedy that aids DAOs and crypto tasks deal with their treasuries additional effectively. This task is fairly new and at this time has no programs to release tokens to the industry. Through this posting, you will likely have some primary information and facts about this task.

Note: The information and facts in this posting really should not be regarded investment guidance. Coinlive is not accountable for any of your investment choices.