In the Base ecosystem, numerous possible tasks are attracting the focus of venture capital traders, and Avantis is a single this kind of noteworthy undertaking. So, what is Avantis? Join Coinlive to find out about this Perpetual undertaking and why Coinbase values it as a result of the report under!

What is Avantis (AVNT)? What’s unique about the Coinbase-backed derivatives trading undertaking?

What is Avantis (AVNT)? What’s unique about the Coinbase-backed derivatives trading undertaking?

What is Avantis?

Avantis Finance is a decentralized finance protocol (DeFi) is intended for leveraged trading in the cryptocurrency, foreign exchange and commodities sectors. In individual, it utilizes a one of a kind oracle-based mostly danger rating process to safeguard traders from substantial cost fluctuations.

Avantis leverages synthetic leverage making use of stablecoins USDC as a promise, generating the basis that Avantis has Liquid assets successful. This will allow end users to have range in deciding upon tradable assets and leverage ratios (up to 100x).

The Avantis undertaking also supports thorough danger management for liquidity suppliers as a result of time parameters and danger indicators, assisting each liquidity supplier to grow to be a marketplace maker for all styles of futures contracts.

Special capabilities of Avantis

Purpose and significance of Avantis

Avantis aims to create a futures trading protocol that expands the area of decentralized finance by combining standard economic goods and serious assets in the cryptocurrency marketplace.

Although the creation Real planet resource (RWA) Tokens are no longer new, but this style of asset is generally not conveniently usable by the regular consumer and is generally intended to assistance lengthy-phrase traders rather than quick-phrase traders. Therefore, Avantis features a fully new platform, which will allow trading of each cryptocurrencies and serious assets with up to 100x leverage.

Fix issues in on-chain transactions

Although on-chain derivatives goods have existed for above two many years, the growth of answers that do not demand an purchase guide and the use of liquidity suppliers is nonetheless restricted. Liquidity suppliers are generally not lively in on-chain futures markets for the reason that they are not able to cautiously control danger and return.

However, Avantis will allow liquidity suppliers to alter trading danger and lock up capital for increased compensation, attracting a various neighborhood of LPs.

Avanti Platform

Avantis is constructed on Optimism Superchain, a scalable alternative Layer two belongs to Ethereumsupplying a far better expertise to traders and liquidity suppliers than centralized exchanges.

Next interface

The Avantis undertaking offers liquidity suppliers with state-of-the-art equipment to enable them adapt their danger-return construction and traders have entry to leverage across various asset courses seamlessly and concurrently, although possessing total manage above their assets across contract portfolios intelligent.

Co-founder’s skills and expertise

Avantis co-founders, especially Harsehaj Singh, have substantial awareness of standard and cryptocurrency markets, as nicely as various expertise with numerous asset courses. Harsehaj manufactured a important contribution by setting up the sale of land well worth $50 million Iluvium emphasis on infrastructure, gaming and DeFi at Pantera Capital.

Characteristics of the Avantis undertaking

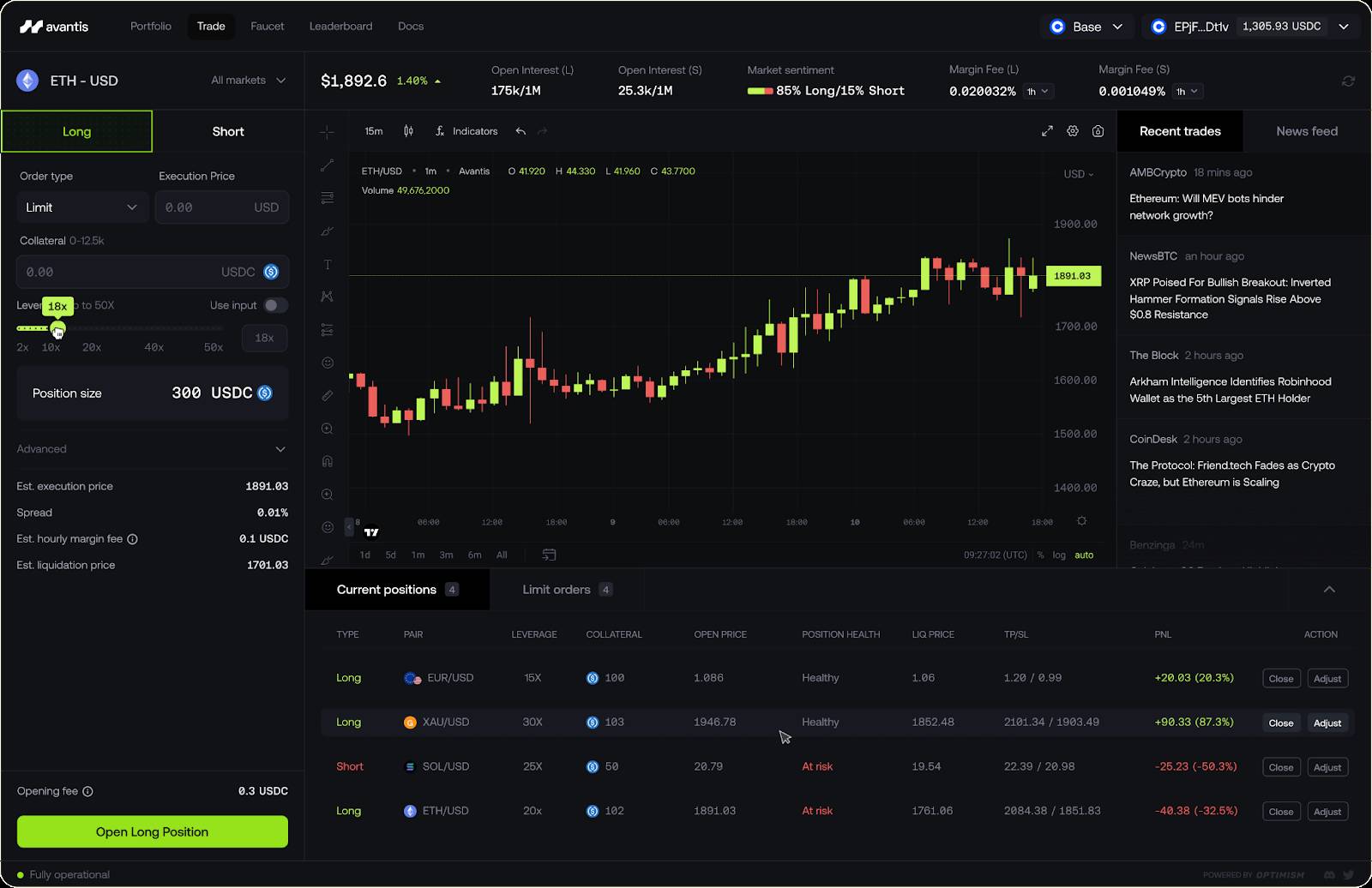

Merchant

- Avantis offers a derivatives trading platform for numerous styles of assets this kind of as cryptocurrencies, gold, silver, oil, and so forth.

- It supports large leverage up to above 50x.

- The trader retains manage of his assets (unguarded).

- Supports AA wallets (Account abstraction).

- Optimized consumer interface.

Liquidity supplier

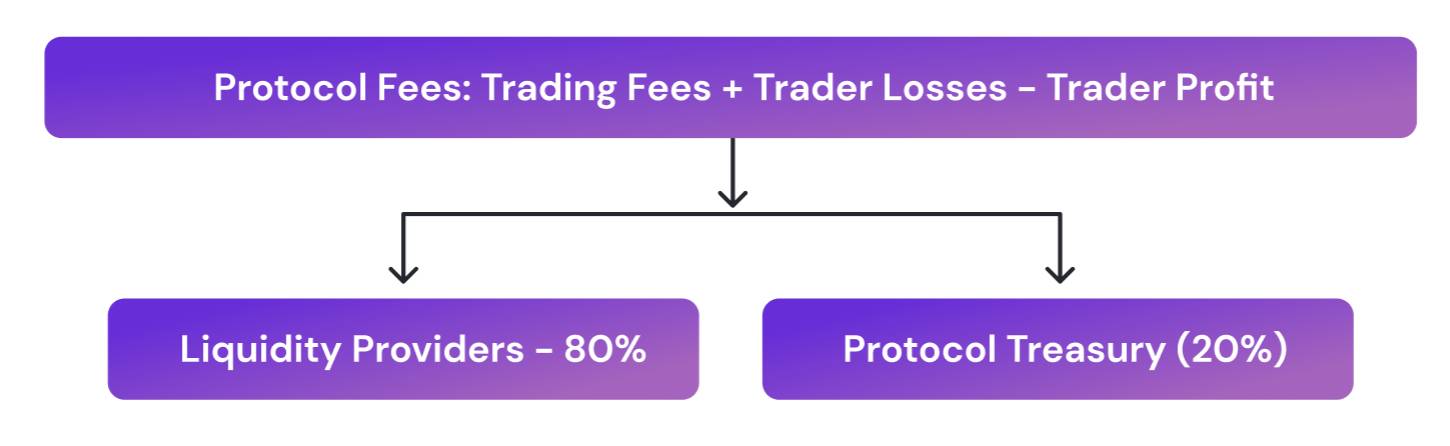

- Earning from trading pursuits: LPs make revenue from trading commissions and traders’ losses.

- Control danger degree: LPs can select their very own danger degree by choosing unique danger buckets.

- Protocol safety: Features intended to safeguard LPs from substantial losses.

LP’s reward distribution model

Unique Oracle-based mostly danger rating performance

Avantis does not immediately execute cost validation inside the trading platform, but receives the most effective trading cost information from other oracles. Combination of Pito AND Chain shirt will enable the Avantis undertaking eradicate unreliable pricing sources, preserve information accuracy and reduce latency.

In individual, Avantis clever contracts be certain that transactions never ever take place when there are as well substantial discrepancies involving cost information, as a result stopping malicious actions from damaging the protocol.

The way Avantis will use Chainlink will be as a backup alternative that maximizes decentralization and minimizes transaction danger. This blend assists supply precise pricing and guarantees protection in situation of cyber attacks or inaccurate pricing details.

About AVNT Tokens

Updating…

Project growth roadmap

4th quarter 2023

- Launch vault on testnet and get suggestions from beta testers.

- Launch classes web page on testnet, get suggestions from beta testers.

- Public testnet launched: Support for far more asset pairs, enhanced UI and pricing.

- Testing clever contracts.

- Continuously examine to alter protocol parameters.

- Organize partners for Mainnet Alpha.

First quarter 2024

- Mainnet Alpha.

- Perps pairs expanded to consist of best ten cryptocurrencies and numerous other foreign exchange pairs.

- Tariff adjustment.

- Improved consumer interface.

- Expand TVL for LP.

- Cut some insects.

- Avantis Points: new DeFi loyalty plan.

Second quarter 2024

- Test launch for Mainnet.

- Improved consumer interface.

- Change transaction limits.

- Expand TVL.

- Add far more assets (memecoin, foreign exchange, commodities).

Plans for late 2024 and past:

- Full Mainnet launch (no TVL/transaction limits).

- I commenced doing work on the layout of the Avantis possibilities trading platform.

- Explore roll-up vendors to launch a focused Layer two roll-up based mostly on the OP platform.

- Develop methods to apply Avantis safes (on-chain casinos, leveraged safes).

Lead undertaking growth workforce

Sehaj: Co-founder, he has substantial awareness of standard markets and cryptocurrencies.

Pack: Co-founder, specializing in huge information and fintech software package.

Raymond: Collaborator, with major expertise in small business growth and operations.

Investors and undertaking growth partners

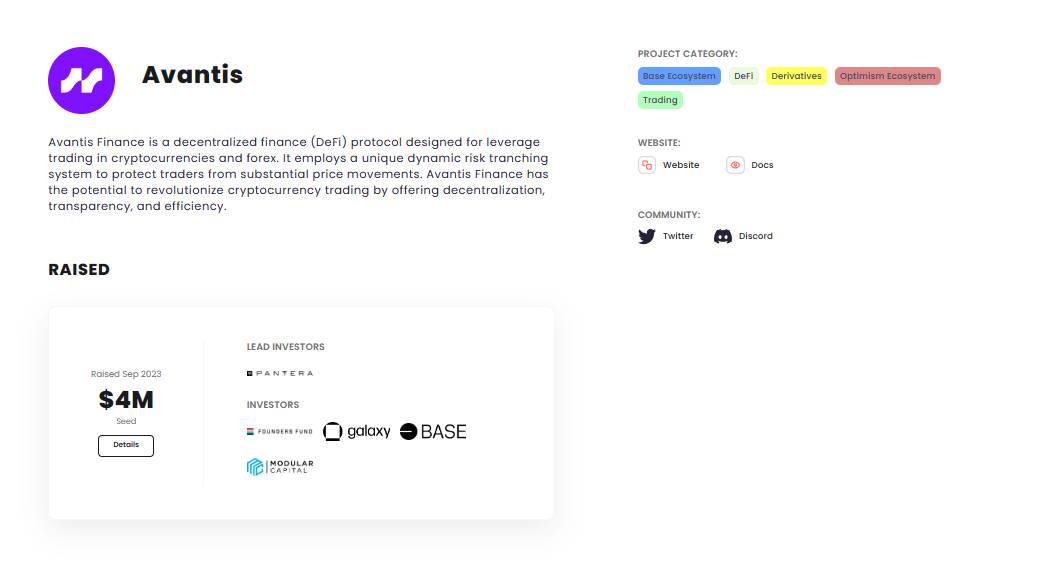

September eight, 2023: Avantis acquired investment from the Base Ecosystem Fund led by Coinbase Ventures.

Investors and Avantis

Investors and Avantis

September 26, 2023: Avantis efficiently raised $four million in Seed investment round, led by Panther Capitalwith the participation of Modular Capital, Galaxy, Founder Fund and Base.

summary

Through the over report by Coinlive, it can be noticed that Avantis is at the moment emerging as a pioneering undertaking in the area of derivatives trading, synthetic assets and has serious return traits on the Base ecosystem. Attracting the curiosity of substantial investment money like Pantera will proceed to entice cryptocurrency traders to the Base ecosystem.

Note: The details in this report ought to not be viewed as investment information. Coinlive is not accountable for any of your investment selections.