DeFi, or decentralized finance, has grow to be more and more common in current many years as a new way of conducting economic transactions without the need of the need to have for intermediaries this kind of as banking institutions. So, what is DeFi? Let’s find out about the nature of DeFi with Coinlive in the report beneath!

What is DeFi (decentralized finance)? Discover the probable and dangers of decentralized finance

What is DeFi (decentralized finance)? Discover the probable and dangers of decentralized finance

What is DeFi?

DeFi stands for Decentralized Finance, this is a phrase that represents a kind of decentralized finance, formulated on the infrastructure of blockchain platforms. It has attracted unique interest from traders in the cryptocurrency market place in current many years.

This phrase frequently refers to a economic program formulated on blockchain, permissionless and transparent, with powerful interoperability with platform-primarily based protocol stacks. wise contractscommonly the Ethereum blockchain model.

What is DeFi?

DeFi definitely innovates existing economic providers by bringing scalability and selling transparency. In unique, it does not rely on intermediaries and centralized organizations this kind of as banking institutions to control users’ assets. Instead, DeFi is primarily based on open protocols and decentralized applications, i.e Dappto transfer resource management rights to end users and they will presume all duty for the management of their sources.

In the decentralized economic market place, each and every agreement and transaction will be created through supply code, transactions will happen in a rather safe and verifiable method, and legal standing modifications will nonetheless be permitted, stored on a public blockchain.

This economic model then generates a robust interoperable economic program with unprecedented ranges of transparency, giving equal entry and lowering dependence on central monitoring centers, stock broking or banking providers, as the vast majority of pursuits are carried out through wise contracts .

Characteristics of DeFi

Given the nature of working on the blockchain platform infrastructure, the DeFi model establishes itself via the essential characteristics of blockchain engineering. First, decentralization (decentralized) of DeFi it implies it is not topic to the management or intervention of any intermediary Otherwise, transactions are as an alternative created primarily based on programming code in wise contracts on the blockchain.

Monday, Distributed DeFi can make transaction information authenticated and stored on the program of nodes globally, guaranteeing the accuracy and protection of the program.

Characteristics of DeFI

Transparency it is an essential attribute in DeFi, when all transaction details and supply code in wise contracts are created public, enabling anyone to search and authenticate transparently.

Wednesday, Open and without the need of permission of DeFi permits end users to freely build DeFi applications or participate in the use of providers obtainable on the Internet without the need of requesting any private details.

Anonymity This is an essential benefit, as the only details end users need to have to share is their wallet deal with, assisting to guarantee their anonymity and privacy.

The last, Personal custody of DeFi offers end users comprehensive management in excess of assets and blockchain wallet Through personal critical or seed phrase encrypted, offering them versatility and autonomy in the DeFi market place.

The heart of DeFi

Blockchain, with its chain construction and decentralization, has evolved into a digital ledger that information each and every transaction in the network, creating it available from anyplace. Blockchain’s immutability and open supply code build transparency, encrypt information, and present protection via protection keys and privacy.

This attribute of blockchain is an great platform for wise contracts, also regarded as wise contracts, to produce and broaden the DeFi business. These contracts are instantly permissionless and do not depend on the believe in of other individuals thanks to the decentralization, immutable information, and transparency of the blockchain.

Smart contracts are not just a set of principles and terms, but are also element of a protocol layer that grows on prime of the blockchain infrastructure. They are stored and run in parallel with the blockchain network’s validators, as a protocol layer that grows on prime of the blockchain infrastructure.

Compared to existing internet applications and protocols, exactly where we can only interact with the programming interface, DeFi wise contracts are open to end users, enabling them to effortlessly entry and management them, controlling the inner protocol logic through open supply code. This generates outstanding transparency and interoperability in the globe of decentralized finance.

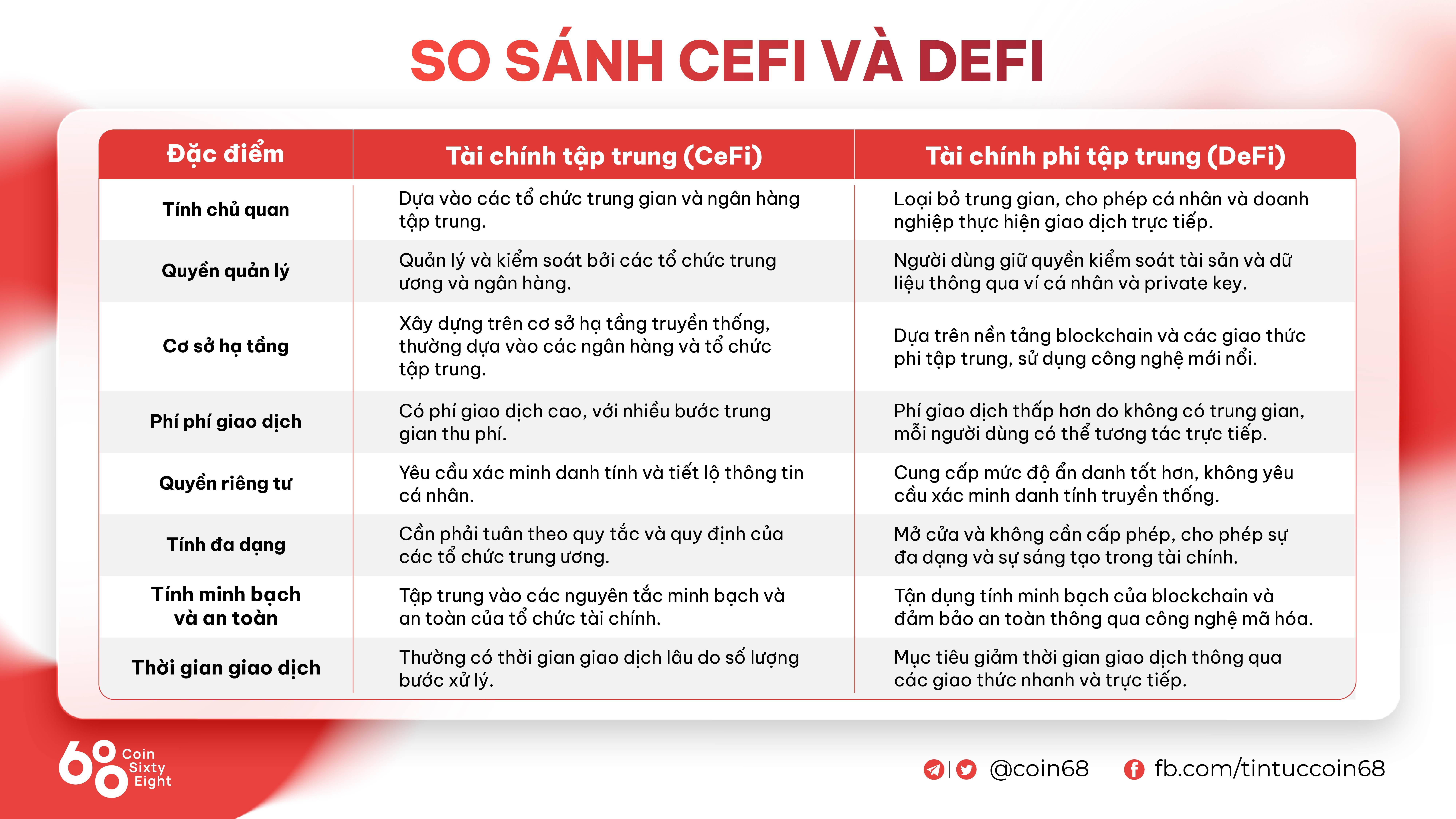

Compare CeFi and DeFi

Compare CeFi and DeFi

Decentralized finance (DeFi) marks a comprehensive distinction from common economic institutions and banking institutions, which operate on the principle of decentralization.

In centralized finance, cash is held by banking institutions and third events, who support move cash in between events, charging a charge for every support made use of. Every credit score card transaction begins with the merchant and goes via the obtaining financial institution, which then forwards the card information to the credit score card network.

DeFi, on the other hand, eliminates intermediaries by enabling men and women, merchants, and organizations to perform economic transactions via emerging engineering. Using peer-to-peer economic networks, DeFi utilizes protection protocols, connectivity, software package, and hardware developments.

People can execute economic transactions such as borrowing, trading, and borrowing via software package that information and verifies economic pursuits in a distributed database. The program is obtainable from anyplace with an Internet connection, collects and aggregates information from all end users, and employs a consensus mechanism for verification.

However, the anonymity of DeFi is not comprehensive, even if transactions do not show person names, they can nonetheless be traced by entities with entry, such as governments and law enforcement, to secure private economic interests. DeFi, for that reason, provides management and comfort to end users, when opening up the challenge of managing privacy.

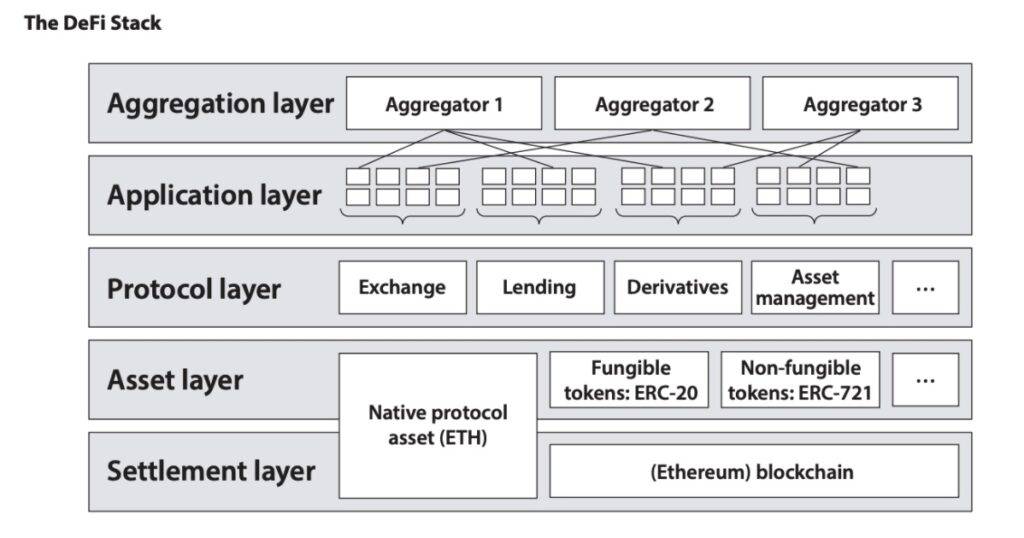

Components of DeFi

DeFi is not a easy economic model but a complicated infrastructure program with numerous overlapping layers, every layer serving a various goal. This blend generates an open, really composable infrastructure that can make it uncomplicated to build, share, and leverage a variety of layer abilities.

It is essential to comprehend that every layer of DeFi has priorities and that protection is only assured primarily based on the protection of the reduce layer.

For instance, if the transaction processing layer on the blockchain is compromised, all layers over it will grow to be insecure. Likewise, employing a permissioned ledger as a basis will lower the overall performance of decentralization efforts on subsequent layers.

Layers in the DeFi program

Transaction processing and authentication layer (settlement layer)

This layer involves blockchain and native tokens this kind of as ET, BNB. This layer supplies the basis for securely storing ownership details and creating rule-primarily based state modifications. Blockchain serves as a layer to resolve disputes and execute transactions.

Resource degree

This layer shops assets, such as all assets produced primarily based on the principal blockchain. Known as tokens, they are representations of the worth and added benefits of applications formulated on the principal blockchain.

Protocol degree

The protocol layer supplies specifications for particular use instances this kind of as decentralized exchanges, debt markets, derivatives, and on-chain asset management. Implemented as wise contracts, these protocols are really interoperable and available by any consumer.

Application degree

This layer generates applications that talk straight with protocols. Intelligent interaction is encapsulated via an intuitive consumer interface, assisting to make DeFi uncomplicated to use.

Aggregator layer

The aggregator layer is an extension of the application layer, exactly where aggregator internet sites present a platform for end users to connect to numerous applications and protocols. They help end users in doing complicated duties by connecting to numerous protocols concurrently and combining relevant details in a clear and concise method.

DeFi items

Stablecoins

Stablecoins, aka secure coins, are developed to hold worth and are frequently tied to the cost of serious-globe assets like the USD. The peculiarity of stablecoins is their skill to continue to keep their worth secure and their issuance on the blockchain with the tokenization of assets. The issuance mechanism involves off-chain collateral, on-chain collateral and algorithmic issuance, generating a versatile and dependable economic instrument.

You can see much more right here: What are stablecoins? The five ideal stablecoins in the cryptocurrency market place

DES

The decentralized exchange, also regarded as DEX, is an essential part of the blockchain, as it permits for peer-to-peer transactions without the need of the need to have for asset custody. The exceptional attribute of DEX is the skill to trade without the need of requiring account registration and asset escrow. DEX working versions differ from common exchange to P2P and trading ADMINgenerating a versatile atmosphere for end users to enter the market place.

You can see much more right here: What is DEX (decentralized exchange)? Difference…