Framework Ventures is a single of the to start with money to invest in the DeFi sector. So how does this investment fund have a tendency to invest? Let’s discover out with Coinlive by means of this posting!

What is Framework Ventures? The investment fund has produced a identify for itself in the discipline of DeFi

What is Framework Ventures?

Framework Ventures is a venture capital company primarily based in San Francisco, California (USA), managed by Michael Anderson and Vance Spencer. This investment fund operates as a technologies business centered on developing merchandise and companies to assistance the blockchain tasks in which it invests.

Framework is most effective identified for currently being a single of the to start with venture capital companies to invest in the DeFi sector in 2019, when the whole sector was much less than $one billion in dimension. As the DeFi sector has observed quick development, the business has grow to be identified as a single of the greatest and earliest traders in a variety of multi-billion-dollar protocols this kind of as: Chainlink, Aave, The Graph, and lots of other excellent tasks. As the blockchain gaming and social media industries have grown, Framework has swiftly expanded its investments into these new locations, by means of tasks this kind of as Zapper and Illuvium.

History of growth

Framework Ventures was founded in the to start with quarter of 2019. The business was founded by Michael Anderson, who invested a lot of his profession operating for significant tech organizations like Dropbox and Snapchat, along with co-founder Vance Spencer.

On August 27, 2020, Framework Labs acquired $eight million in seed investment from Station 13 and numerous other investment money, to enable develop Framework Labs’ workforce of researchers, traders and engineers for the DeFi market place. Framework Labs is heavily concerned in staking Synthetix and giving liquidity for Uniswap. With the new funding, Framework has recruited lots of seasoned members this kind of as Raymond Pulver of IDEX and Roy Learner of Wavemaker Partners.

Since its founding, Framework Ventures has grown steadily to grow to be a single of the greatest investment money in the globe with complete assets underneath management reaching $one.four billion.

Members run Framework Ventures

Vance Spencer – Co-founder

Vance graduated from the University of Southern California with a degree in Econometrics. He joined the Ethereum local community in 2014 soon after finding Bitcoin a couple of many years earlier. Prior to Framework, Vance worked at Netflix in Los Angeles and Tokyo, wherever he was accountable for rebooting the business enterprise in Japan. Vance has deep expertise making technologies merchandise and is a self-taught engineer.

Michael Anderson – Co-founder

Michael Anderson has various get the job done expertise in lots of fields. He co-founded Framework Ventures in 2019. Michael was previously a item manager at Snap Inc. from October 2016 to May 2018. Previously, he held a variety of roles at Dropbox, which includes Product Manager from September 2015 to October 2016 and Director of system and business enterprise operations from August 2013 to August 2015.

Jay Stolkin – General Counsel

Jay Stolkin is basic counsel at Framework Ventures. Prior to joining Framework, Jay was an assistant at O’Melveny & Myers and Paul Hastings.

Roy Learner – Fund Manager

Roy Learner is a fund manager at Framework Ventures. He has expertise in business enterprise growth, blockchain technologies and the startup sector. Previously, he held the positions of Fund Manager at Wave Financial, Director of Market Development at Enterprise Ethereum Alliance and Senior Director of Business Development at Optoro.

Daniel Mason – Operating Partner

Daniel Mason is a managing spouse of Framework Ventures. He was co-founder of Spring Labs.

Adam Badawi – Communications Partner at Framework Ventures

Adam Badawi is communications manager at Framework Ventures. Prior to operating at Framework, he served as Communications Manager for Chainlink Labs throughout the hyper-development phase of this task.

Capital request

On April 19, 2022, Framework Ventures raised $400 million for its third investment fund, named “FVIII”, bringing the complete worth of assets underneath management of this investment fund to in excess of $one million, .four billion of bucks. The FVIII Fund will target on investments in three key locations: blockchain gaming, Web3 and DeFi.

Exceptional tasks in Framework Ventures’ investment portfolio

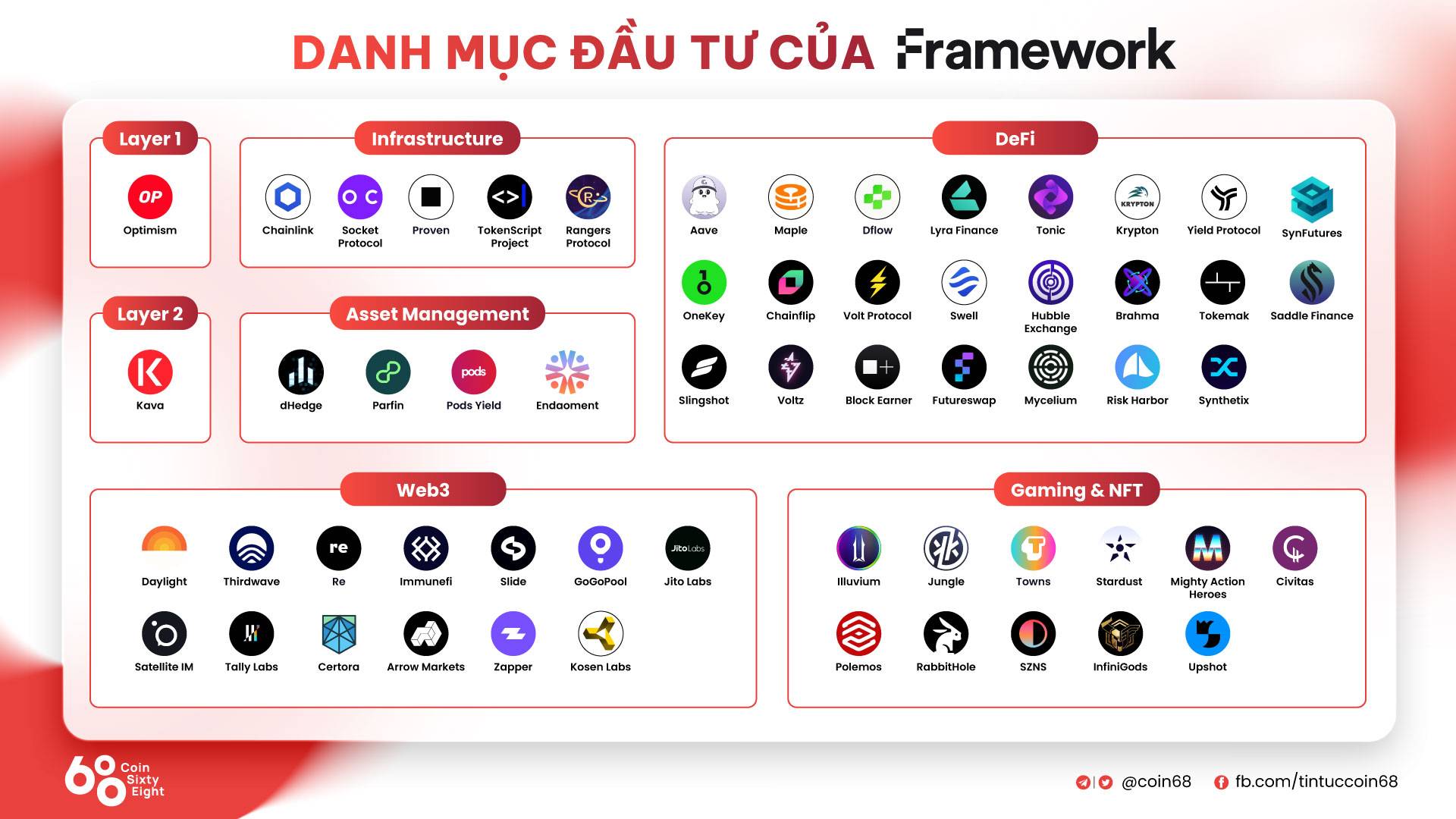

Framework Ventures Portfolio

Framework Ventures Portfolio

Through Framework Ventures’ investment portfolio, we see that this investment fund dedicates a good deal of assets to investments in three locations, which includes: DeFi, Web3 and Gaming & NFT. In unique, DeFi is the discipline in which the most tasks are invested, and it is also the discipline that has produced the identify of this investment fund globally given that its inception.

Some excellent tasks in Framework Ventures’ investment portfolio:

-

Optimism: Optimism is an extensible Layer two alternative for Ethereum formulated to enable consumers cut down transaction charges and improve transaction velocity for a greater consumer expertise. Optimism is primarily based on Optimistic Rollups technologies. Currently, Optimism is a single of the Layer two options getting the most awareness from traders moreover Arbitrum, Starknet, Base and zkSync.

-

Chainlink: Chainlink is a task that presents Oracle options for most of the major tasks in the cryptocurrency market place with in excess of 1800 diverse partners.

-

Illuvium: Illuvium is a 3D fantasy purpose-taking part in game produced with Unreal Engine four.26 technologies and runs on the Immutable X network. At the time of its launch, Illuvium was fairly a possible task and attracted lots of traders. Participate in acquiring NFTs of this game.

-

Synthetix: Synthetix is a decentralized finance (DeFi) protocol that lets consumers to situation derivative worth tokens, named synthetic assets, that signify underlying assets.

-

Lyra Finance: Lyra is a decentralized possibilities trading platform that employs an optimism-primarily based AMM mechanism. The AMM mechanism lets consumers to purchase and promote crypto asset possibilities primarily based on accessible liquidity pools.

-

Zapper: portfolio management device, integrated with lots of characteristics this kind of as Swap, Bridge,…

summary

Framework Ventures is a single of the world’s major investment money, managing up to $one.four billion in assets. This investment fund entered the DeFi discipline quite early and accomplished some successes. However, with the quick transform in the cryptocurrency market place, Framework Ventures rapidly shifted its investments to Web3 tasks, video games and NFTs. Through this posting, Coinlive hopes that you have grasped the important information and facts about this investment fund.

Note: The information and facts in the posting should really not be regarded investment information. Coinlive will not be accountable for any of your investment selections.