GammaSwap is an oracle-absolutely free derivatives trading platform that produces markets for each traders (Long Gamma) and LPs (Short Gamma). The venture efficiently raised $one.seven million in the seed round with participation from investment money this kind of as Dialectic, Space Whale Capital,… Join Coinlive to master about GammaSwap by way of the report beneath!

What is GammaSwap? Free derivatives trading platform for traders

What is GammaSwap?

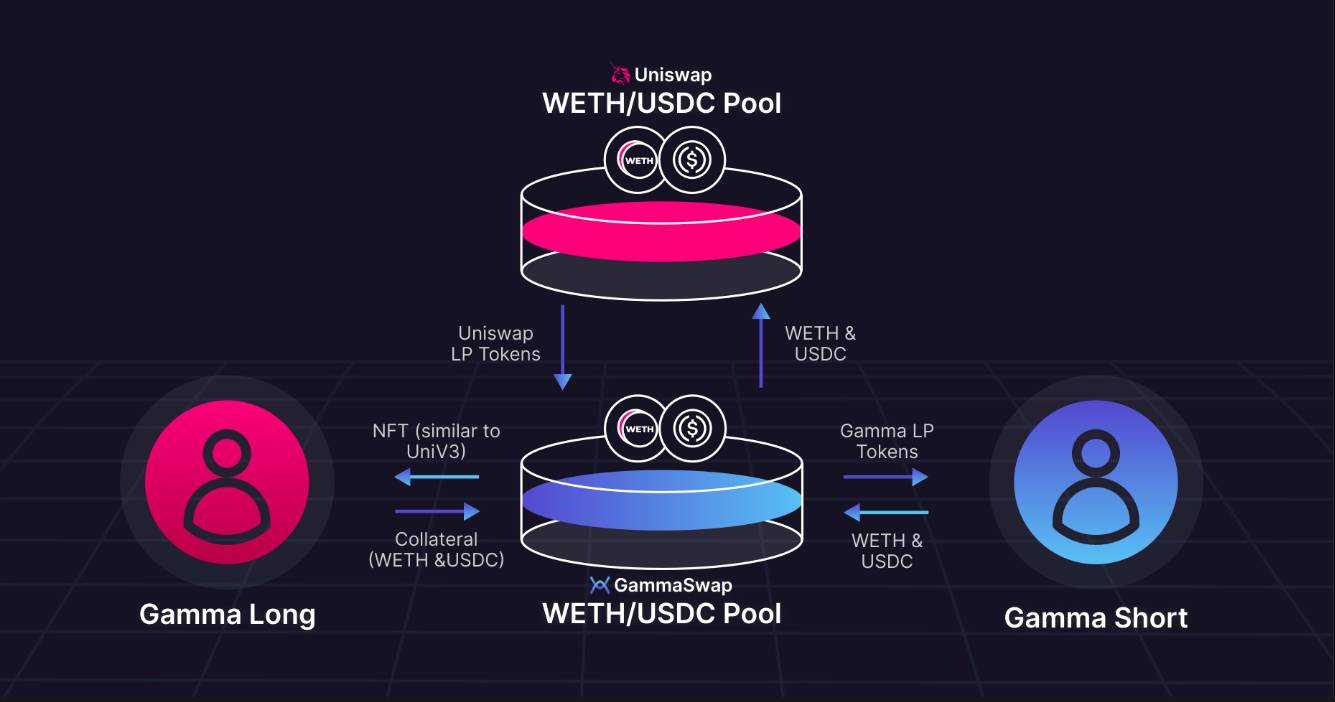

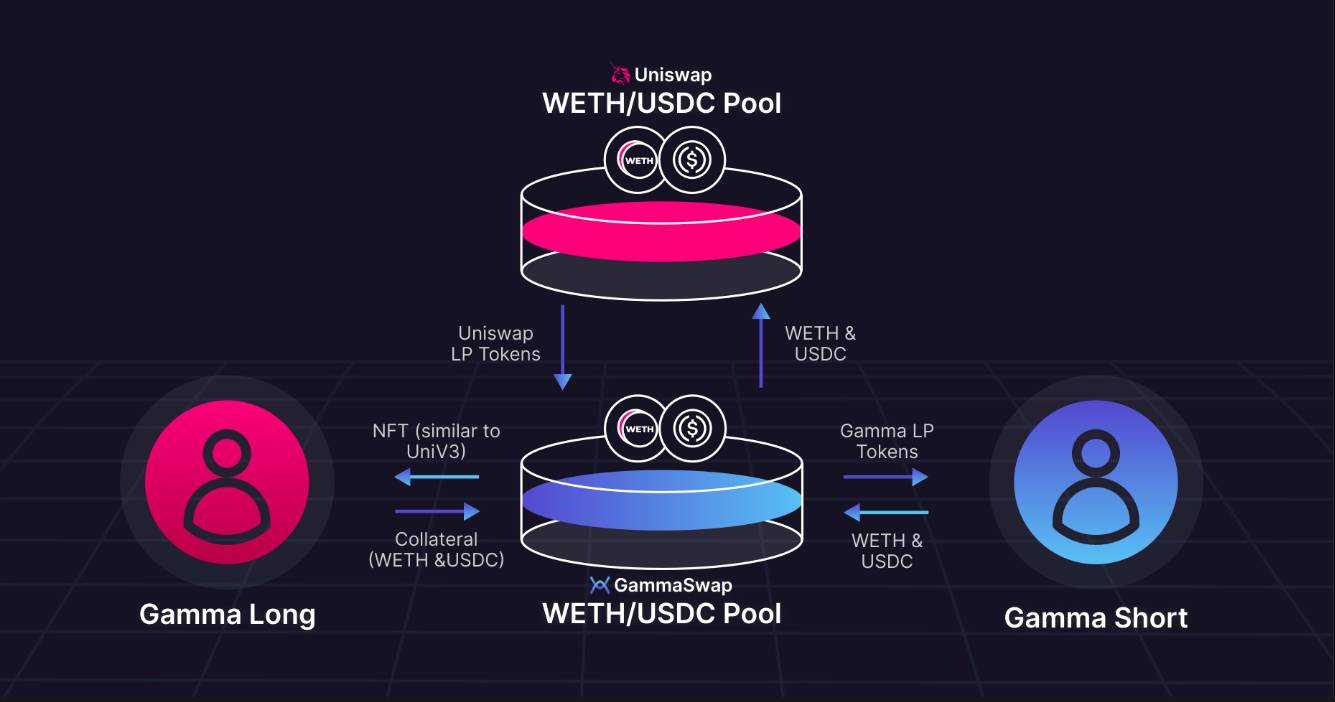

GammaSwap is an oracle-absolutely free derivatives trading platform that produces markets for each traders (Long Gamma) and LPs (Short Gamma). GammaSwap lets traders to conveniently trade alternatives contracts and LPs offer liquidity for Constant Function Market Maker – CFMM this kind of as Uniswap, SushiSwap through GammaSwap.

What is GammaSwap?

With GammaSwap, traders can conveniently trade get in touch with alternatives (get alternatives) and place alternatives (promote alternatives) with versatile leverage. Additionally, LPs can offer liquidity to CFMM through GammaSwap and acquire LP tokens representing their positions.

Components in GammaSwap

Dealer (Long Range)

In GammaSwap, traders are people who will buy leveraged alternatives primarily based on the value of the token pair. Furthermore, traders do not have a funding price when trading alternatives but need to spend everlasting curiosity. This is due to the fact collateral and debt are primarily based on the value equalization mechanism in CFMMs (yet another variant of AMM).

Traders have three positions in GammaSwap, together with: prolonged place (get place), brief place (promote place) and Straddle place (each get and promote place).

Long place

The prolonged place or prolonged place in GammaSwap is associated to the LP place borrowed by the trader. In this situation, the collateral will be scaled to the other token’s ratio at two/three of the existing AMM ratio for most pools.

For illustration: If the complete worth of LP tokens is one thousand USDC and .five WETH, when the value of ETH moves to the existing market place value of 2000 USD, the place will be adjusted to 800 USDC and .six WETH respectively. The goal of restructuring is to produce extra route in the negotiation course of action.

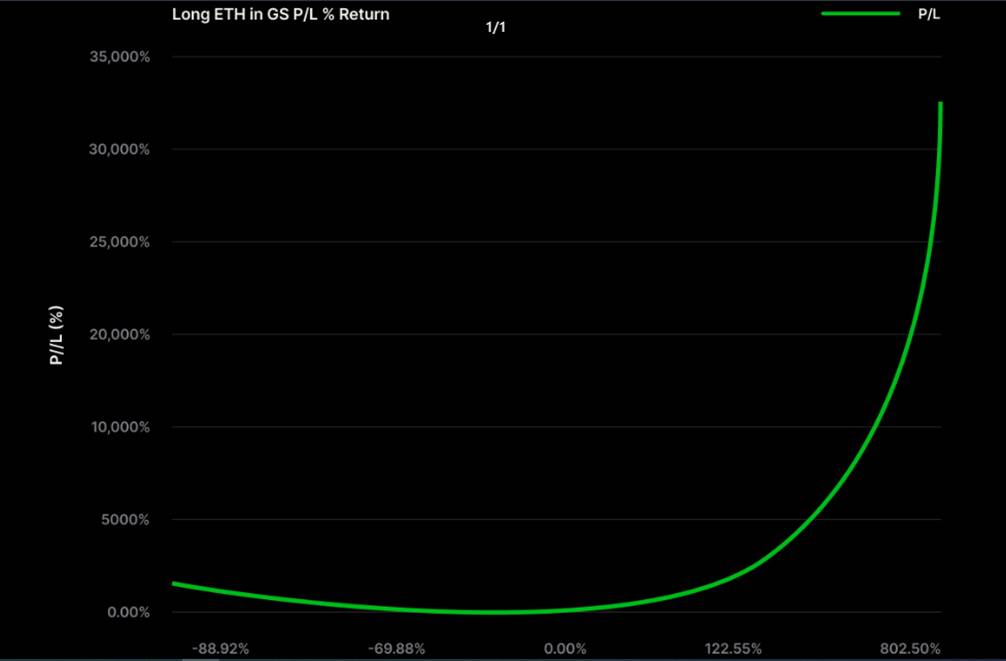

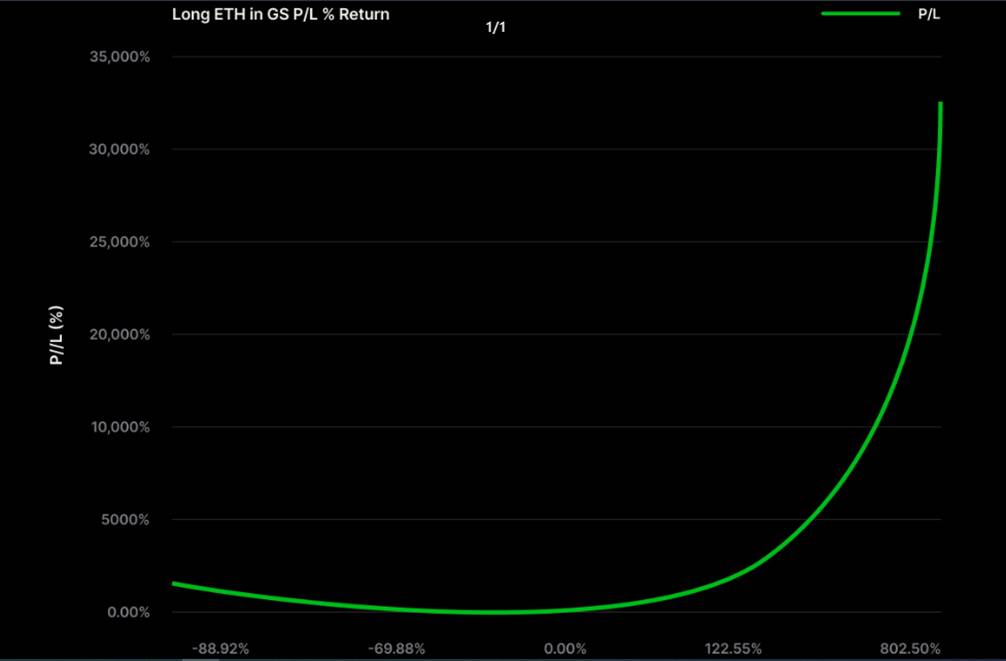

PnL of the prolonged place

This place simulates the returns of a covered get in touch with solution in standard economic markets. If the value rises, the trader’s PnL will improve at an exponential price and the trader will also be protected from liquidation when the value falls.

Short place

The brief or prolonged place in GammaSwap is associated to the LP place borrowed by the trader. In this situation, the collateral will be scaled to the other token’s ratio at three/two the existing AMM ratio for most pools.

For illustration: If the complete worth of LP tokens is one thousand USDC and .five WETH, when the value of ETH moves to the existing market place value of 2000 USD, the place will be adjusted to 1200 USDC and .four WETH respectively. The goal of restructuring is to produce extra route in the negotiation course of action.

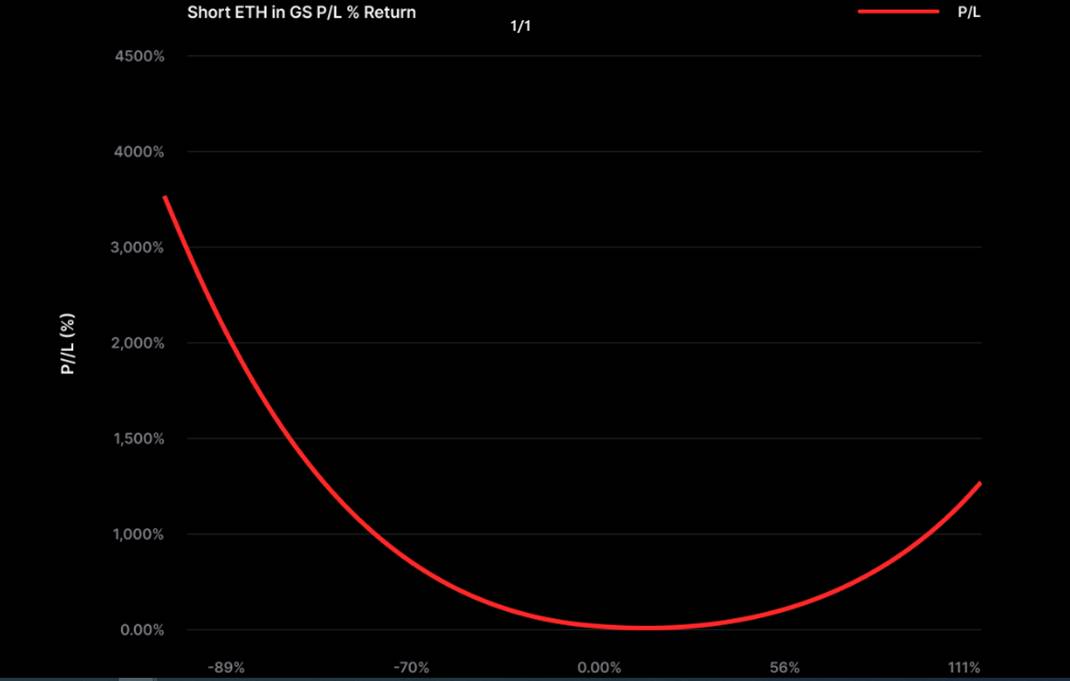

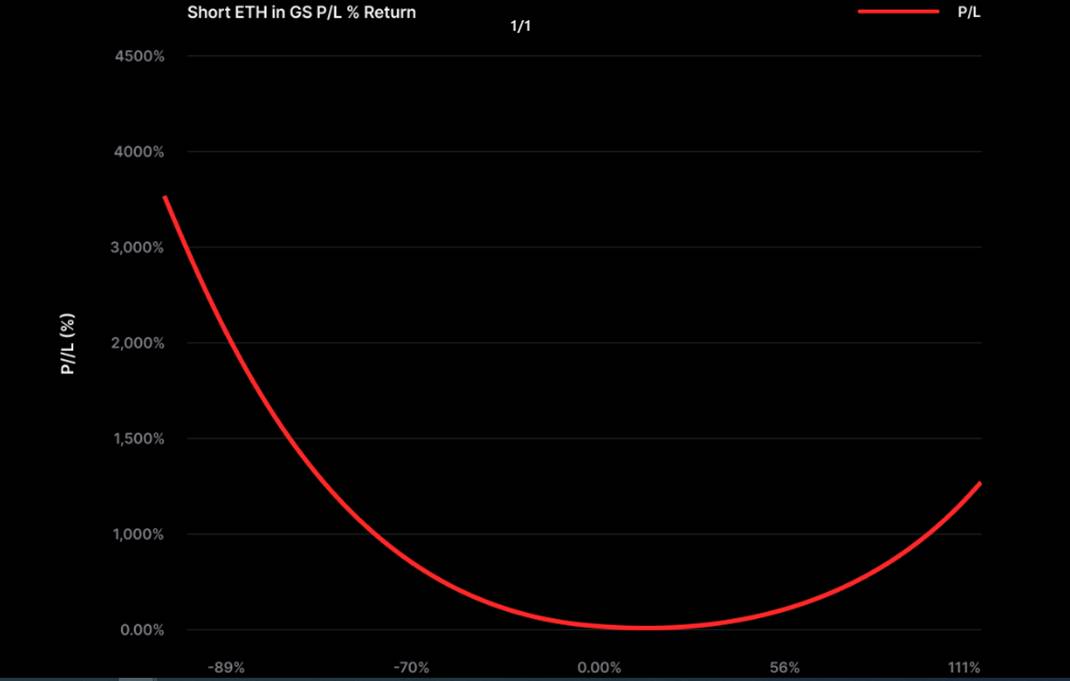

PnL of the brief place

This place simulates the returns of a covered Put solution in standard economic markets. If the value increases, the trader’s PnL will improve at an exponential price and the trader will also be protected from liquidation when the value increases.

Straddle place

Usually, the Straddle place seems in alternatives trading equivalent to hedging in futures. Traders can open a Straddle place on GammaSwap, they will concurrently get and promote a Call solution and a Put solution for the exact same asset with the exact same strike value and expiration date. When the value fluctuates strongly, revenue also improve, but when the value fluctuates tiny, traders can eliminate dollars due to the fact they have to spend commissions for two sorts of alternatives at the exact same time.

In GammaSwap, the Straddle place has the exact same tendency as Hedging and Straddle in alternatives but has some distinctions. Specifically, Straddle is basically an LP place borrowed at the time At The Money (ATM) due to the fact it is open at the existing value.

Traders must get a Straddle place when they want to get volatility irrespective of the value route or when they want to safe an LP place. In other phrases, if the trader expects that the market place will knowledge solid fluctuations in the potential, irrespective of no matter whether it rises or falls, then Straddle is a superior alternative.

A Straddle place in GammaSwap is the very best way to hedge an LP place due to the fact it is immediately associated to brief liquidity. Straddle positions in GammaSwap have no time limits and are accessible for any token pair. Additionally, Delta adjustments at the exact same price as an LP place in an AMM.

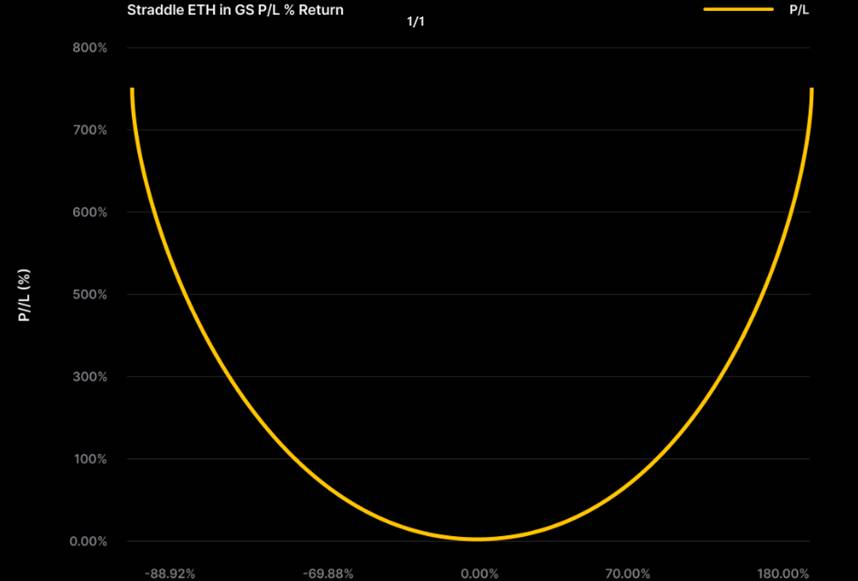

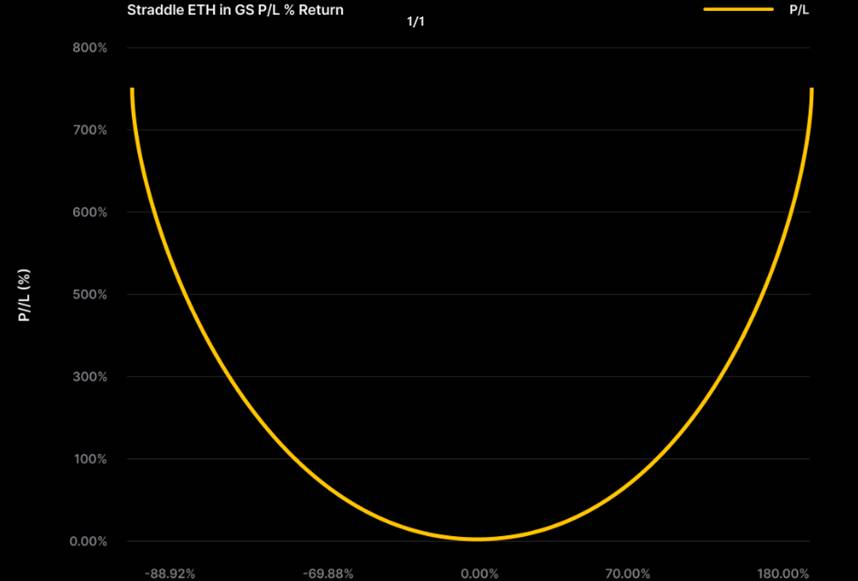

PnL of the straddle place

LP (Short Range)

GammaSwap serves as a liquidity brokerage platform for lots of DEX AMMs this kind of as Uniswap, SushiSwap, and PancakeSwap. LPs can use GammaSwap to offer liquidity and revenue from loans. LPs acquire GammaSwap LP tokens and revenue from transaction charges and lending charges.

LPs in GammaSwap revenue by supplying liquidity and minimizing dangers brought on by value fluctuations. GammaSwap utilizes market place forces of provide and demand to modify LP returns. Therefore, the revenue in GammaSwap is generally at least equal to the revenue in AMM or can be increased.

Compare the LP revenue formula in Uniswap and GammaSwap as follows:

-

LP Profit on Uniswap = Swap Fee – Risk Impermanent reduction (THE)

-

LP Profit on GammaSwap = Swap Fee – IL Risk + Lending Fee

GammaSwap solutions

Wrapped pools

Wrapped Pools are exactly where end users can deposit tokens as collateral to run Gamma Long or Gamma Short. Wrapped Pools serve the exact same perform as a lending platform like Aave but for one particular asset style, LP tokens, on other AMM platforms.

Wrapped pools

Native swimming pool

Native Pool is a type of personal liquidity provision for GammaSwap’s AMM. LPs on Native Pool only acquire curiosity from Long Gamma and do not share transaction charges like in normal AMMs.

Times

GammaSwap supplies deposits made to immediately hedge the dangers of impermanent reduction. These vaults will immediately stability resource sorts primarily based on the default parameters at first set in the good contract.

According to GammaSwap, these deposits can be deployed on other AMMs this kind of as Uniswap and can be conveniently integrated with other protocols to produce DeFi solutions in the derivatives section.

DEX without the need of sensation

GammaSwap has also designed a Feelless DEX to permit traders to conveniently trade tokens. The project’s aim is to integrate with DEX Aggregator platforms like 1inch to meet the substantial demand from retail traders. GammaSwap can build Feeless DEX due to the fact it does not have to spend incentives to LPs.

Basic info about tokens

GammaSwap at the moment has no unique info on the token’s launch. Coinlive will update as quickly as there is the most recent info on the venture.

Roadmap for growth

Currently, GammaSwap does not have unique info on the potential growth roadmap. Coinlive will update as quickly as there is the most recent info on the venture.

Development group

Prominent members of the GammaSwap growth group consist of:

-

Daniele Alcarraz: He is co-founder and CEO of GammaSwap.

-

Roberto Martinez: He is co-founder and CPO of GammaSwap.

-

Devin Goodkin: He is co-founder and COO of GammaSwap.

Investors

GammaSwap efficiently raised $one.seven million in Seed round with participation from investment money this kind of as Skycatcher, Dialectic, Space Whale Capital,…

GammaSwap Investors

Company

GammaSwap partners with major DEX AMMs together with Uniswap, SushiSwap, PancakeSwap and Balancer.

Partner of GammaSwap

summary

GammaSwap is an oracle-absolutely free derivatives trading platform that produces markets for each traders (Long Gamma) and LPs (Short Gamma). With GammaSwap, traders can conveniently trade get in touch with alternatives (get alternatives) and place alternatives (promote alternatives) with versatile leverage.

Through this report, you will in all probability have some simple info about the GammaSwap venture to make your investment selection.

Note: Coinlive is not accountable for any of your investment choices. I want you good results and earn a good deal from this prospective market place!

GammaSwap is an oracle-absolutely free derivatives trading platform that produces markets for each traders (Long Gamma) and LPs (Short Gamma). The venture efficiently raised $one.seven million in the seed round with participation from investment money this kind of as Dialectic, Space Whale Capital,… Join Coinlive to master about GammaSwap by way of the report beneath!

What is GammaSwap? Free derivatives trading platform for traders

What is GammaSwap?

GammaSwap is an oracle-absolutely free derivatives trading platform that produces markets for each traders (Long Gamma) and LPs (Short Gamma). GammaSwap lets traders to conveniently trade alternatives contracts and LPs offer liquidity for Constant Function Market Maker – CFMM this kind of as Uniswap, SushiSwap through GammaSwap.

What is GammaSwap?

With GammaSwap, traders can conveniently trade get in touch with alternatives (get alternatives) and place alternatives (promote alternatives) with versatile leverage. Additionally, LPs can offer liquidity to CFMM through GammaSwap and acquire LP tokens representing their positions.

Components in GammaSwap

Dealer (Long Range)

In GammaSwap, traders are people who will buy leveraged alternatives primarily based on the value of the token pair. Furthermore, traders do not have a funding price when trading alternatives but need to spend everlasting curiosity. This is due to the fact collateral and debt are primarily based on the value equalization mechanism in CFMMs (yet another variant of AMM).

Traders have three positions in GammaSwap, together with: prolonged place (get place), brief place (promote place) and Straddle place (each get and promote place).

Long place

The prolonged place or prolonged place in GammaSwap is associated to the LP place borrowed by the trader. In this situation, the collateral will be scaled to the other token’s ratio at two/three of the existing AMM ratio for most pools.

For illustration: If the complete worth of LP tokens is one thousand USDC and .five WETH, when the value of ETH moves to the existing market place value of 2000 USD, the place will be adjusted to 800 USDC and .six WETH respectively. The goal of restructuring is to produce extra route in the negotiation course of action.

PnL of the prolonged place

This place simulates the returns of a covered get in touch with solution in standard economic markets. If the value rises, the trader’s PnL will improve at an exponential price and the trader will also be protected from liquidation when the value falls.

Short place

The brief or prolonged place in GammaSwap is associated to the LP place borrowed by the trader. In this situation, the collateral will be scaled to the other token’s ratio at three/two the existing AMM ratio for most pools.

For illustration: If the complete worth of LP tokens is one thousand USDC and .five WETH, when the value of ETH moves to the existing market place value of 2000 USD, the place will be adjusted to 1200 USDC and .four WETH respectively. The goal of restructuring is to produce extra route in the negotiation course of action.

PnL of the brief place

This place simulates the returns of a covered Put solution in standard economic markets. If the value increases, the trader’s PnL will improve at an exponential price and the trader will also be protected from liquidation when the value increases.

Straddle place

Usually, the Straddle place seems in alternatives trading equivalent to hedging in futures. Traders can open a Straddle place on GammaSwap, they will concurrently get and promote a Call solution and a Put solution for the exact same asset with the exact same strike value and expiration date. When the value fluctuates strongly, revenue also improve, but when the value fluctuates tiny, traders can eliminate dollars due to the fact they have to spend commissions for two sorts of alternatives at the exact same time.

In GammaSwap, the Straddle place has the exact same tendency as Hedging and Straddle in alternatives but has some distinctions. Specifically, Straddle is basically an LP place borrowed at the time At The Money (ATM) due to the fact it is open at the existing value.

Traders must get a Straddle place when they want to get volatility irrespective of the value route or when they want to safe an LP place. In other phrases, if the trader expects that the market place will knowledge solid fluctuations in the potential, irrespective of no matter whether it rises or falls, then Straddle is a superior alternative.

A Straddle place in GammaSwap is the very best way to hedge an LP place due to the fact it is immediately associated to brief liquidity. Straddle positions in GammaSwap have no time limits and are accessible for any token pair. Additionally, Delta adjustments at the exact same price as an LP place in an AMM.

PnL of the straddle place

LP (Short Range)

GammaSwap serves as a liquidity brokerage platform for lots of DEX AMMs this kind of as Uniswap, SushiSwap, and PancakeSwap. LPs can use GammaSwap to offer liquidity and revenue from loans. LPs acquire GammaSwap LP tokens and revenue from transaction charges and lending charges.

LPs in GammaSwap revenue by supplying liquidity and minimizing dangers brought on by value fluctuations. GammaSwap utilizes market place forces of provide and demand to modify LP returns. Therefore, the revenue in GammaSwap is generally at least equal to the revenue in AMM or can be increased.

Compare the LP revenue formula in Uniswap and GammaSwap as follows:

-

LP Profit on Uniswap = Swap Fee – Risk Impermanent reduction (THE)

-

LP Profit on GammaSwap = Swap Fee – IL Risk + Lending Fee

GammaSwap solutions

Wrapped pools

Wrapped Pools are exactly where end users can deposit tokens as collateral to run Gamma Long or Gamma Short. Wrapped Pools serve the exact same perform as a lending platform like Aave but for one particular asset style, LP tokens, on other AMM platforms.

Wrapped pools

Native swimming pool

Native Pool is a type of personal liquidity provision for GammaSwap’s AMM. LPs on Native Pool only acquire curiosity from Long Gamma and do not share transaction charges like in normal AMMs.

Times

GammaSwap supplies deposits made to immediately hedge the dangers of impermanent reduction. These vaults will immediately stability resource sorts primarily based on the default parameters at first set in the good contract.

According to GammaSwap, these deposits can be deployed on other AMMs this kind of as Uniswap and can be conveniently integrated with other protocols to produce DeFi solutions in the derivatives section.

DEX without the need of sensation

GammaSwap has also designed a Feelless DEX to permit traders to conveniently trade tokens. The project’s aim is to integrate with DEX Aggregator platforms like 1inch to meet the substantial demand from retail traders. GammaSwap can build Feeless DEX due to the fact it does not have to spend incentives to LPs.

Basic info about tokens

GammaSwap at the moment has no unique info on the token’s launch. Coinlive will update as quickly as there is the most recent info on the venture.

Roadmap for growth

Currently, GammaSwap does not have unique info on the potential growth roadmap. Coinlive will update as quickly as there is the most recent info on the venture.

Development group

Prominent members of the GammaSwap growth group consist of:

-

Daniele Alcarraz: He is co-founder and CEO of GammaSwap.

-

Roberto Martinez: He is co-founder and CPO of GammaSwap.

-

Devin Goodkin: He is co-founder and COO of GammaSwap.

Investors

GammaSwap efficiently raised $one.seven million in Seed round with participation from investment money this kind of as Skycatcher, Dialectic, Space Whale Capital,…

GammaSwap Investors

Company

GammaSwap partners with major DEX AMMs together with Uniswap, SushiSwap, PancakeSwap and Balancer.

Partner of GammaSwap

summary

GammaSwap is an oracle-absolutely free derivatives trading platform that produces markets for each traders (Long Gamma) and LPs (Short Gamma). With GammaSwap, traders can conveniently trade get in touch with alternatives (get alternatives) and place alternatives (promote alternatives) with versatile leverage.

Through this report, you will in all probability have some simple info about the GammaSwap venture to make your investment selection.

Note: Coinlive is not accountable for any of your investment choices. I want you good results and earn a good deal from this prospective market place!