Impermanent or short-term reduction is a type of threat that takes place when the Liquidity Provider (LP) offers liquidity to DEX AMMs. However, LPs proceed to offer liquidity being aware of that transaction charges will offset the impermanent reduction encountered. Let’s understand about impermanent reduction with Coinlive by way of the write-up under!

What is impermanent reduction? Learn far more about “transient losses” when supplying LP liquidity

What is impermanent reduction?

Impermanent reduction or short-term reduction is a type of threat that takes place when Liquidity Provider (LP) offers liquidity on AMM DEXs this kind of as Uniswap, PancakeSwap, SushiSwap,… Impermanent reduction takes place due to selling price alterations involving pairs of coins. /token into a pool in which LPs offer liquidity when the cryptocurrency industry is remarkably volatile.

What is impermanent reduction?

Impermanent reduction is 1 of the characteristic flaws of DEX AMMs in contrast to CEXs since they do not have an buy guide, but are just a pool containing numerous styles of crypto assets. When a consumer withdraws an volume of assets from the pool, he will modify the coin/token ratio in the pool, resulting in an impermanent reduction to LP.

So why do LPs proceed to offer liquidity even although they know there is a threat of reduction? The reply is that impermanent reduction can nonetheless be conquer with transaction charges. In truth, even pools on Uniswap vulnerable to impermanent reduction can be worthwhile thanks to transaction charges.

Uniswap costs LPs .three% for every token swap transaction. If a offered pool experiences higher trading volume, supplying liquidity can be worthwhile even if that pool experiences numerous short-term losses. However, this depends on the protocol, the distinct liquidity pool, the assets deposited and the cryptocurrency industry situations.

Why is impermanent reduction identified as “temporary loss”?

Impermanent reduction takes place only when the exchange fee involving two styles of assets alterations in contrast to when LP is deposited to offer liquidity. They will return to their previous worth if the exchange prices of these two assets return to their unique degree. However, short-term losses can turn into long lasting losses if their prices in no way return to the very same degree or if LPs withdraw money from the liquidity pool when prices have fluctuated.

How does Impermanent Loss perform?

Coinlive will consider an instance when LPs offer liquidity for USDT and ETH pairs on Uniswap. Let’s say the LP named Bob at first deposits one ETH and a hundred USDC into the liquidity pool on Uniswap. In DEX AMMs, the token pair deposited into the pool have to have the very same worth, that means the selling price of ETH is a hundred USDC at the time of liquidity provision.

Additionally, the pool has a complete of ten ETH and one,000 USDC offered by liquidity offered by other LPs. So Bob has a ten% “share” in the pool and complete money well worth $two,000.

Most liquidity pools on AMM DEX use a formula x*y = k to help retaining a continuous correlation involving two tokens. Here k equals ten,000.

Suppose the selling price of ETH rises to 400 USD, arbitrage traders will consider the possibility and obtain ETH with USDC from the pool since the selling price of ETH will be more affordable than other exchanges to make a revenue. . From right here, USDC is additional to the pool and ETH is withdrawn, the ratio immediately after the modify will be five ETH and two,000 USD, making sure the continuous k stays ten,000.

Bob decides to withdraw his ten% “share” in the pool of .five ETH and 200 USDC, for a complete of 400 USD. Bob has produced great earnings because he offered $200 well worth of liquidity. However, if Bob holds one ETH and a hundred USDC alternatively of supplying liquidity, he will have 500 USD when the ETH increases in selling price. From right here, we can see that it would be far more worthwhile for Bob to hold rather than offer liquidity to the pool.

In this situation, Bob voluntarily accepted the threat of impermanent reduction to compensate with trading commissions, and his reduction was also insignificant since the preliminary deposit was rather compact. However, he reminds that impermanent reduction can lead to significant losses if the industry is remarkably volatile.

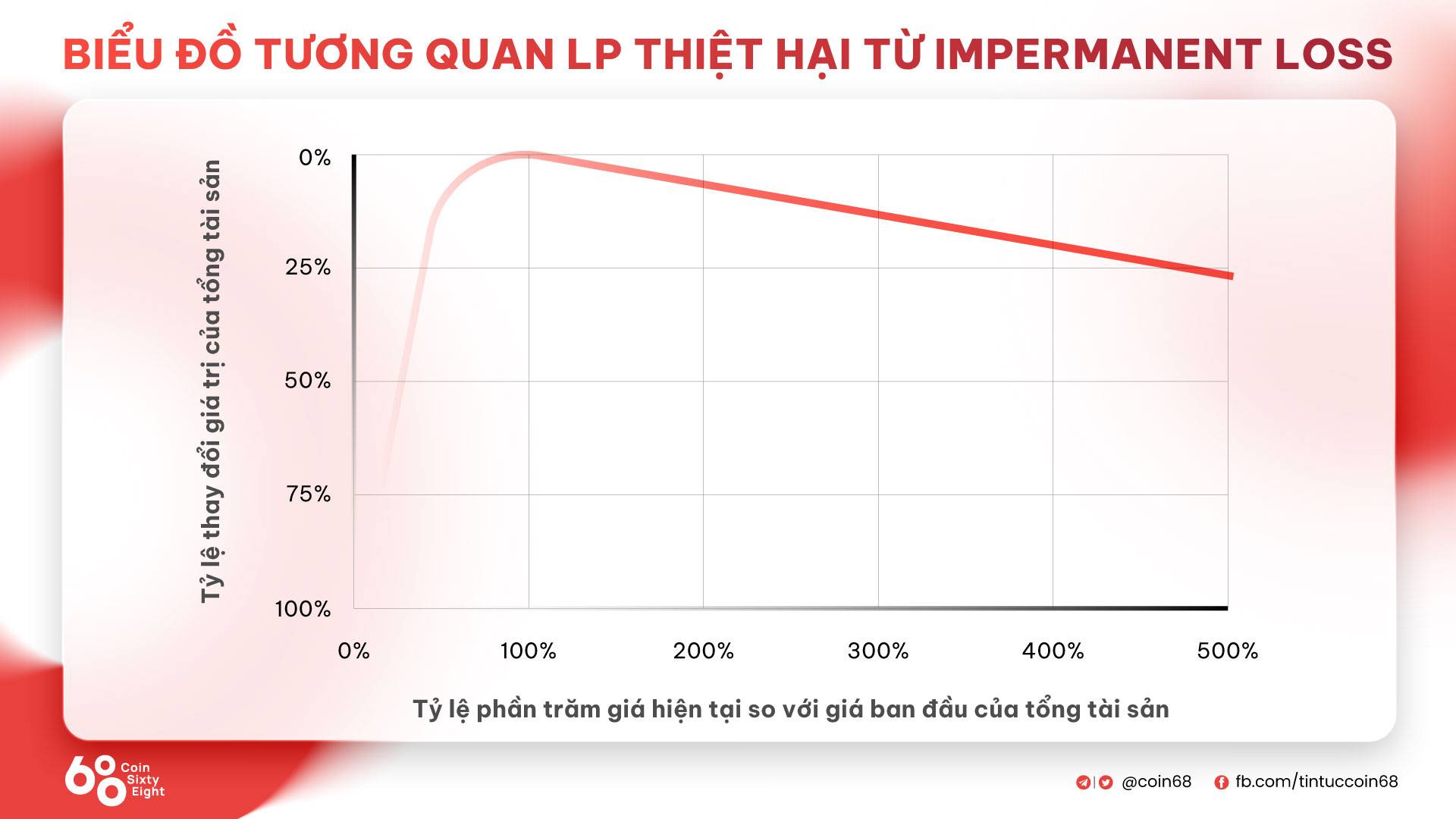

Estimation of impermanent reduction for LP

Impermanent Loss takes place in each instructions when the coin/token increases or decreases, which indicates LP suffers from Impermanent Loss which is inevitable. The estimated short-term reduction for LPs when supplying liquidity is as follows:

-

Price modify x1.25, LP reduction .six%.

-

Price modify x1.50, LP reduction of two.%.

-

Price modify x1.75, LP reduction three.eight%.

-

Price modify x2, LP reduction of five.seven%.

-

Price modify x3, LP reduction of 13.four%.

-

Price modify x4, LP reduction of twenty.%.

-

Price modify x5, LP reduction of 25.five%.

Correlation graph when LP will take injury from Impermanent Loss

Correlation graph when LP will take injury from Impermanent Loss

Ways to reduce the threat of impermanent reduction

Provide liquidity with compact capital

First, LPs have to to start with offer liquidity with a compact volume of capital to gauge the degree of threat from impermanent reduction. Additionally, LPs can also offer liquidity when the industry is sideways to have the lowest impermanent reduction fee.

Provide liquidity to the stablecoin pool

If LPs have lower threat tolerance, they can select stablecoin pools this kind of as DAI/USDT, USDT/USDC,… to pretty much fully stay clear of impermanent reduction. Stablecoins are all pegged to the USD, so they will have decrease volatility than other crypto assets. However, this indicates that LPs will obtain fewer earnings than pools with higher-threat coin/token pairs.

Provide liquidity to the stablecoin pool

Provide liquidity to the pool with just 1 token

Providing liquidity in a pool with only 1 token is identified as Single-Asset Liquidity Provisions (SALP) in which LPs require to offer only a single form of token in the pool on AMM DEX. This is a device that simplifies the system of supplying liquidity and minimizes the impermanent reduction due to imbalance involving tokens.

Some DeFi platforms that help pools with just one token contain: Beefy Finance, Wombat Exchange, Gamma Strategies,…

Provide pooled liquidity with higher token spreads

LPs can offer liquidity in pools that do not call for a 50/50 token pair ratio on some platforms this kind of as Bancor and Balancer. Some liquidity pools call for various ratios this kind of as 80/twenty, 60/forty,…

For instance: The Website link/ETH liquidity pool with a ratio of 80/twenty will aid LPs reduce the threat of impermanent reduction as the worth of Website link increases as they are largely exposed to Website link with 80% of the pool. However, if ETH rises substantially relative to Website link, the impermanent reduction will be substantially higher. However, this is unlikely to come about in the lengthy phrase as ETH’s industry capitalization is substantially larger than that of Website link and it only holds a twenty% share in the pool.

Provide liquidity to DEX AMMs with the CLMM mechanism

CLMM (Centralized Liquidity) is an algorithm made use of by DEX AMMs that enables LPs to centralize liquidity at distinct selling price factors to boost the liquidity of token pairs. CLMM aids LPs reduce the impermanent reduction skilled and reduce selling price slippage for end users when exchanging tokens.

Some notable DEX AMMs utilizing CLMMs contain:

Uniswap: This is the oldest AMM DEX on Ethereum that enables end users to trade ERC-twenty tokens with no going by way of intermediaries. Uniswap V3 employs CLMM so that LPs offer liquidity only inside the distinct selling price array in which trading ordinarily takes place rather than the total worth of the asset in the industry.

Uniswap

Killer whale: This is the AMM DEX on Solana who have produced their very own CLMM technique identified as Whirlpools. The volume of liquidity on the Solana ecosystem has flowed substantially to Orca thanks to this CLMM mechanism and the platform has also surpassed Raydium to turn into the greatest AMM DEX platform on Solana.

killer whale

killer whale

Trader Joe: This is a well known AMM DEX on Avalanche that also employs the CLMM mechanism. Trader Joe is inspired and substantially enhanced by Uniswap V3’s CLMM and is the major DEX AMM in the Avalanche ecosystem.

Trader Joe’s

Trader Joe’s

Cetus Protocol: This is a DEX AMM utilizing the CLMM mechanism developed on the Sui and Aptos ecosystems. With the Cetus protocol, LPs can execute various Maker approaches even though maximizing earnings by way of liquidity pools and minimizing impermanent reduction.

Cetus Protocol

Cetus Protocol

Turbo Financing: This is a DEX AMM utilizing the CLMM mechanism developed on the Sui ecosystem. Turbos Finance employs the CLMM model to aid LPs earn far more revenue from transaction charges and reduce impermanent losses.

Turbo Finance

Turbo Finance

summary

Impermanent or short-term reduction is a type of threat that takes place when the Liquidity Provider (LP) offers liquidity to AMM DEX. Calculating impermanent reduction is vital if LPs want to offer liquidity with as tiny threat as attainable.

Through this write-up, you will in all probability have some fundamental details about Impermanent Loss if you want to turn into an LP in the DeFi industry.

Note: Coinlive is not accountable for any of your investment choices. I want you achievement and earn a good deal from this prospective industry!