Bridges concerning layers of the blockchain perform an crucial function in connecting and converting assets. Currently, Orbiter Finance has verified to excel at doing this endeavor, offering a secure encounter to consumers as they participate in Layer two ecosystems on the Ethereum network. Join Coinlive to understand a lot more about Orbiter Finance by the write-up beneath!

What is Orbiter Finance? Bridge manual on the Orbiter Finance platform for a opportunity to acquire airdrops

What is Orbiter Finance?

Orbiter Finance is a decentralized cross-rollup bridge (rough translation: decentralized bridge utilizing cross-rollup technologies) to transfer assets to Ethereum and also Layer two infrastructure. The peculiarity is that it is optimized to minimize expenses and boost The velocity of asset conversion is nearly instantaneous.

To greater recognize Orbiter Finance, you can understand a lot more about bridge or a lot more particularly cross-chain right here: What is the cross chain bridge? How do blockchains connect to just about every other?

In a easier and a lot more understandable way, cryptocurrency bridge it is a technique that lets consumers to effortlessly exchange tokens concerning distinct blockchains or Layer two scaling answers so that consumers can use their tokens to join the ecosystem of the new blockchain.

For instance: You may possibly have tokens on Ethereum and want to join the ecosystem Starknet, zkSync, Referee,…so you can use a Dapp to transfer assets back and forth concerning two blockchains.

Orbiter Finance is a venture that solves this trouble by supporting cross-rollup asset migration concerning Ethereum, Starknet, zkSync, Loopring, Arbitrum, Arbitrum Nova, Optimism, Polygon, BNB Chain, ZKSpace, Immutable X, dYdX, Metis, and Boba.

Special options of the Orbiter

Safe: Orbiter Finance does not have the dangers typically observed in other cross-chain bridges primarily based on safe aggregation strategies.

Low expenses and immediate transactions: The transaction course of action concerning EOA (External Ownership Accounts) of Sender AND Creator all through the network Source AND Destination. Sender It does not interact with contractual addresses.

Support for Ethereum assets: The venture does not want to mint assets, so liquidity can be thoroughly supported in a decentralized method.

How Orbiter Finance performs

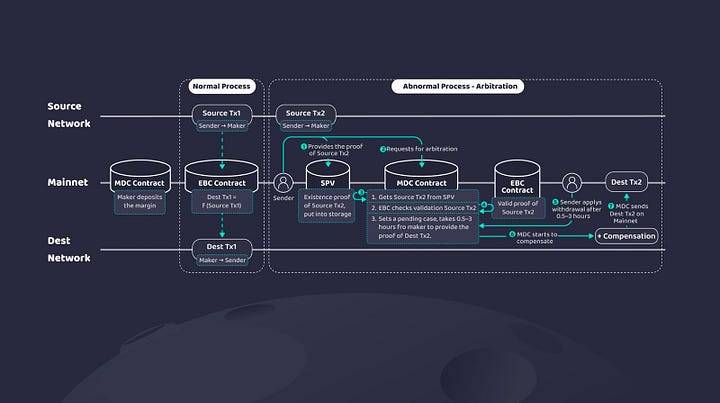

Orbit finances performs utilizing two roles: Sender AND Creator.

- Sender: Deposit tokens from the network Source (unique network) Next Creator.

- Creator: Upon receipt of the sent token, Creator will send you tokens Sender on line Destination (location network).

Creator have to enter a reserve sum in the Orbiter contract prior to operating the cross-rollup support Sender. This sum acts as collateral to be certain this Sender they will be compensated if they do not acquire their dollars immediately Creator. This promotes dependability and protection in transactions. At the identical time, the Creator you can earn by acquiring commissions for just about every profitable transaction.

Operating model of the venture

The transition concerning Sender AND EOA belongs to Marker (External Owned Address) takes place across the network Source AND Destination. Sender it does not interact immediately with the contract handle.

Obiter is a Layer two answer that evolves in direction of Optimistic Rollups, capable of processing transactions at higher frequencies, so it can be price-efficient and rapidly ample to help a lot more consumer instances in the extended phrase.

Orbiter Finance advancement roadmap

Orbiter advancement roadmap

Creator technique it is an crucial component for Orbiter as it is not only the most important supply of protection, but also contributes to the completeness of the Orbiter ecosystem. In addition to the acquainted Maker contract, OrbiterAPI and OrbiterSDK also fall into the Maker System class, offering a full set of developer resources.

Orbiter X is a brand innovation that permits cross-handle and cross-currency bridging concerning addresses and cross currencies. This lets consumers to trade their assets seamlessly without the need of the want for complicated and high priced intermediary processes.

The public launch date for the Maker System and Orbiter Coinlive will update the details as quickly as achievable.

Potential launch of Orbiter Finance

Orbit finances it is by far a single of the most effective bridges in the Layer two ecosystem utilizing EVM. Also, the project’s token has not been launched however, but in accordance to the way substantial decentralized exchanges function, most tasks will distribute a substantial sum of tokens to consumers to acquire industry share.

Orbit finances it will assistance consumers conserve most of the time desired to move assets from Ethereum to any of its layer 2s with acceptable transaction charges. Therefore, higher-capability consumers will steadily be a lot more probable to transfer assets utilizing Orbiter Finance.

Instructions for operating Testnet for a opportunity to get airdrops to Orbiter Finance

Step one: Join the Orbiter Finance Guild as an Arbitrum as over right here: https://guild.xyz/orbiter-finance

Guild Orbiter finances

Step two: Configure zkSync and Arbitrum as follows utilizing MetaMask with the following framework:

zkSync

Referee

Step three: Make some transactions as needed on Orbiter Finance.

There are five amounts on Guild.xyz:

- Trainee pilot: Perform three-9 trades.

- Pilot: Perform ten to 49 operations.

- Elite pilot: Make 50 to 99 transactions.

- Experienced pilot: Make a hundred to 99 transactions.

- Pilot Ace: Perform in excess of 500 operations.

Additionally, you can interact with the Galxe platform to acquire Orbiter Finance NFTs: https://galxe.com/OrbiterFinance/campaign/GCUcTUiTut

Orbiter exercise interface on Galxe

Here, you want to full the following duties to acquire the Orbiter Finance NFT.

Issues to maintain in thoughts when participating in Airdrop Orbiter Finance

Although utilizing Orbiter routinely will boost your probabilities of airdropping, the chance price must constantly be regarded as, i.e. the transaction charge. However, Orbiters i will modify my charge in accordance to the gwei of the network Destination to maintain charges beneath common, but that will not occur usually due to the volatile nature of fuel tariffs. Shippers can see latest costs on Orbiter’s site.

However, in accordance to personalized encounter, the transaction expenses on this platform are fairly higher, so you will have to determine how several transactions to make in accordance to your requirements.

Additionally, when thinking of and predicting the Orbiter Airdrop occasion, we must take into consideration a handful of things:

- The chance that the venture will Airdrop prior to participating.

- Token allocation charge for the Airdrop occasion.

- The issues of participating in the Airdrop.

- Calculate the usefulness and objective of utilizing tokens in the venture.

- Calculate the energy when the venture decides the Airdrop occasion.

summary

Orbiter Finance applies cross rollup along with the Ethereum information layer, and this largely limits vulnerability to attacks by 51% naturally. Due to this kind of performance, compatibility with most Ethereum Layer two, and appreciably diminished asset transfer transaction velocity concerning Ethereum Layer one and Layer two. Through this write-up, you have to have partly understood the details of base on the venture to make your investment selections.

Note: Coinlive is not accountable for any of your investment selections. I want you good results and earn a whole lot from this probable industry.