[ad_1]

What is Q DeFi Rating (QDR)?

Q DeFi Rating is a multi-chain & aggregate analytics platform for all DeFi industries.

Q DeFi Rating provides accurate and reliable real-time data on a variety of information such as yield farming, liquidity pools, upcoming token sales and indices on Ethereum, BSC, HECO chain and Polkadot.

What are the highlights of Q DeFi Rating?

- Real-time on-chain data for all liquidity pools and yield farming across the entire DeFi ecosystem.

- A single dashboard for actual ROI/APY/APR from DeFiPulse, Coinmarketcap, etc.

- All major blockchains are supported (Ethereum, Binance Smart Chain, HECO chain,..).

- Take advantage of ROI’s and IL (impermanent loss) information through a personalized dashboard.

Functions of Q DeFi Rating

- Get all the information related to DeFi.

- Explore hundreds of DeFi projects through a single dashboard.

- Freedom to express personal opinions on DeFi projects without worrying about being locked out of your account.

- Choose the best pools, sort by coin and other parameters.

- Full details of the user’s portfolio allows to compare the ROI of pools and track investments.

Profit sharing mechanism and deflationary mechanism?

Q DeFi Rating protocols receive multiple payments (subscriptions, API services, …) into smart contracts, then all these funds go to Uniswap/Pancake

The funds are divided into three parts:

- 30% to cover platform costs

- 35% for ETH/BNB to support liquidity

- 35% for QDR to support liquidity

QDR is paired with ETH/BNB to form LP token

- 50% shared among liquidity providers QDR

- 50% LP tokens burned to prevent QDR token inflation

Basic information about QDR token

- Token Name: Q DeFi Rating

- Ticker: QDR

- Blockchain: Updating

- Token Standard: Updating

- Contract: Updating

- Token Type: Utility, Governance

- Total Supply: 200,000,000 QDR

- Circulating Supply: Updating

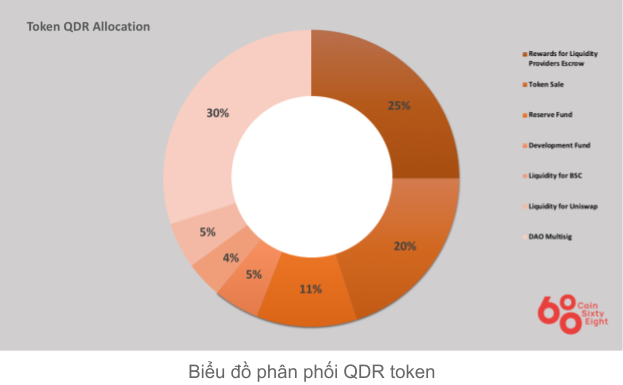

Token Allocation

- Liquidity Provider Rewards: 25%

- Token sale: 20%

- Reserves: 11%

- Development Fund: 5%

- Liquidity for BSC: 4.5%

- Uniswap liquidity: 4.5%

- KNIFE: 30%

What is QDR token used for?

- Bar for API usage rights

- Pay for the right to use the PRO version, without ads

- Payment for Marketing activities on Q DeFi Rating platform

- Administration

- Earn money through DeFi

- Discounts, and other activities

QDR token storage wallet

Updating

How to earn and own QDR token

Updating

Where to buy and sell QDR tokens?

Updating

Roadmap

Q2 2021

- History page upgrade

- Tokensale page upgrade

- Instant fund buy/sell widget

- Synthetic information page of cross-chain bridges

Q3 2021

- Expand Solana data functionality, integrate farming projects

- Support Polkadot / Kusama parachain, integrate farming projects án

- Token swap page upgrade

- Lending information page to aggregate lending protocols

- Project rating upgrade

Q4 2021

- Support more protocols

- Mobile application

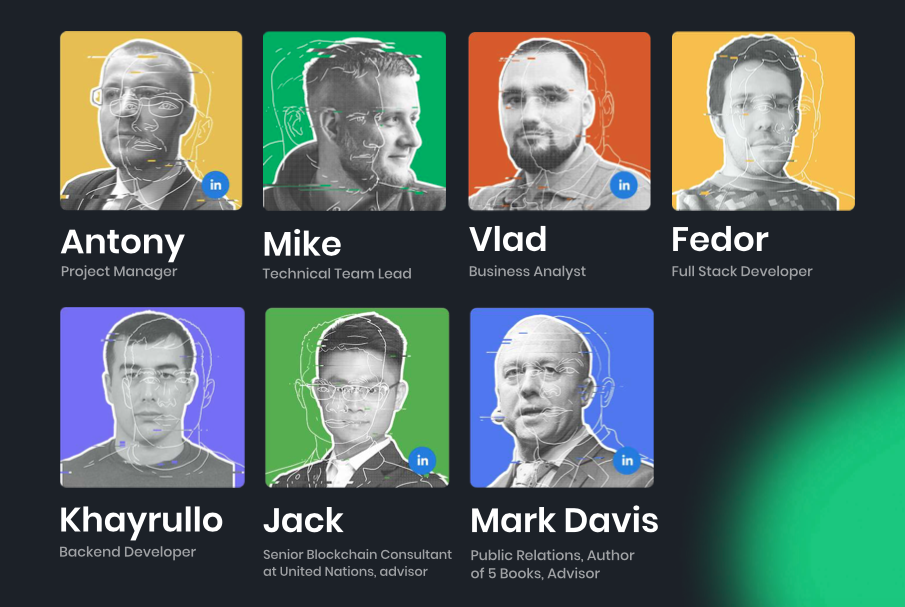

Project development team

What is the future of the Q DeFi Rating project, should I invest in QDR token or not?

Q DeFi Rating is a platform that aggregates many types of multi-chain information from different DeFi projects such as liquidity pool information, APY, yield farming. Through this article, you must have somewhat grasped the basic information about the project to make your own investment decisions. Coinlive is not responsible for any of your investment decisions. Wish you success and make a lot of profit from this potential market.

[ad_2]