Smilee Finance is a derivatives platform that employs Impermanent Loss to “turn options” into revenue-making items. Smilee Finance produces decentralized volatility items (DVPs) with several unique revenue methods to flip impermanent reduction threat into a “smile” for LPs. Let’s find out about Smilee Finance with Coinlive by way of the report beneath!

What is Smilee Finance? The task transforms the hazards of Impermanent Loss into “smiles”

What is Smilee Finance?

Smilee Finance is a derivatives platform that employs Impermanent Loss to “turn options” into revenue-making items. Smilee Finance requires inspiration from asset volatility-based mostly items in conventional money markets to develop decentralized volatility items (DVP) with several unique revenue methods.

What is Smilee Finance?

Smilee Finance employs many methods in DVP deposits to flip impermanent reduction threat into smiles for LPs supplying liquidity. It is significant that Smilee Finance generally ensures liquidity in every single deposit and totally covers all DVP-linked payments to boost the stability of the platform.

What trouble does Smilee Finance fix?

When supplying liquidity by means of AMM DEX this kind of as Uniswap, an quantity of LP place tokens are misplaced due to asset fee fluctuations and is referred to as impermanent reduction. Impermanent reduction takes place in liquidity pools that have a typical ratio for liquidity provision, for instance 50/50 ETH/USDC. When a consumer deposits one token and withdraws one more token, the asset ratio in the pool will naturally deviate from the 50/50 ratio if there are several transactions.

Consider supplying liquidity as if you had been promoting an solution. As described over with impermanent reduction, the way LPs revenue is with lower volatility in their positions. In solutions terminology, an LP who produces a liquid place is taking a Short Gamma (quick volatility) place. They consider on this threat in the hope that the transaction charges will be sufficient to offset above time and signify a Long Theta place.

The mixture of Short Gamma and Long Theta produces the LP solutions return. So who will purchase these solutions? Smilee Finance solved this trouble by decomposing the selection of impermanent losses into solutions and organizing them in a way that attracts end users to develop volatility returns referred to as Decentralized Volatility Product (DVP).

Smilee Finance items

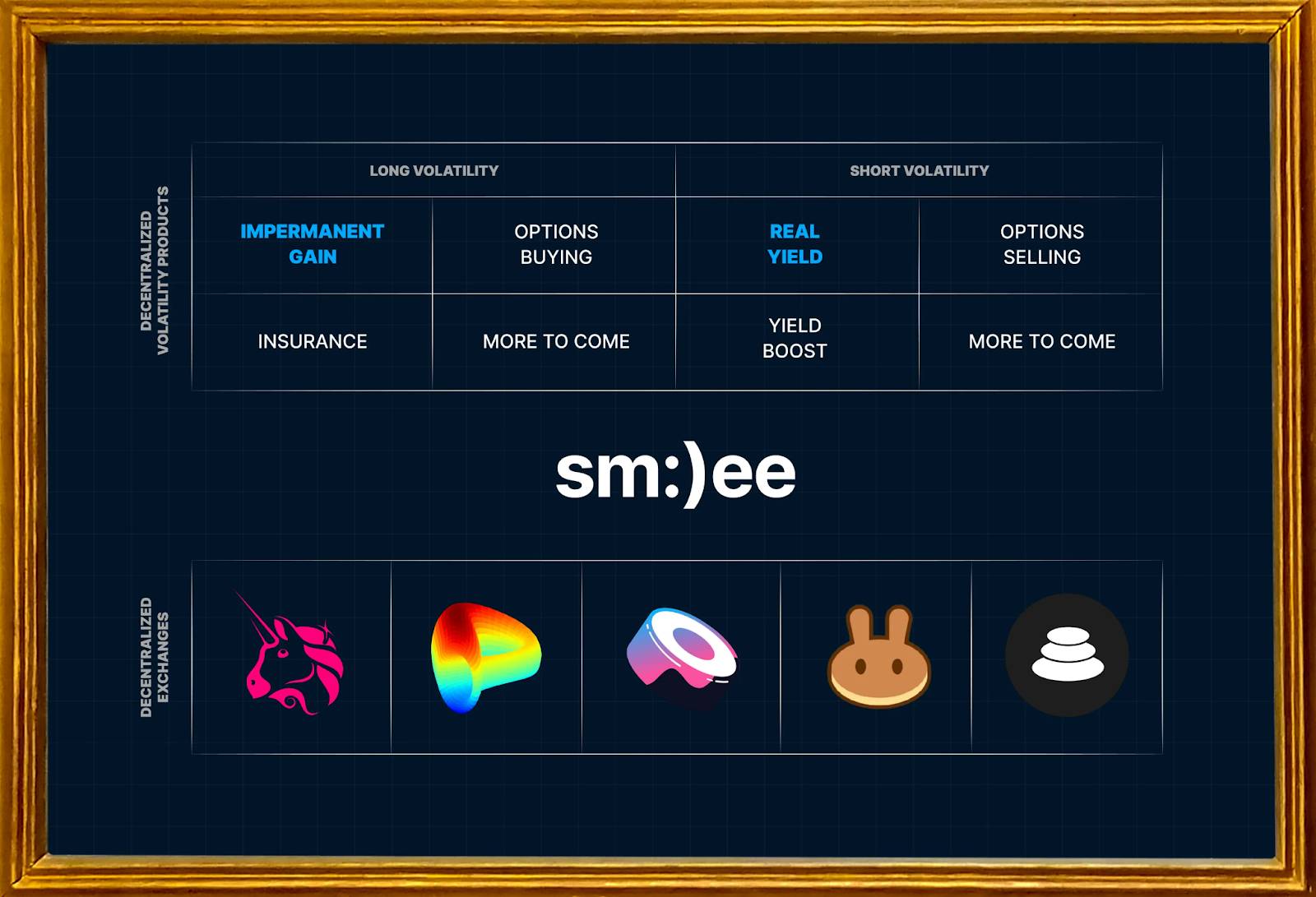

In essence, Smilee Finance is developing a committed volatility principle from items referred to as Decentralized Volatility Product (DVP). The framework of the DVP involves:

-

Type of volatility threat: prolonged volatility and quick volatility.

-

A pair of tokens: ETH/USDT, ETH/USDC,…

-

The effectiveness formula exactly defines the system underlying the DVPs.

-

Refund time.

-

Auction time.

These DVPs are deposits based mostly on several unique investment methods and have two key kinds:

-

DVP (quick-phrase volatility item) of quick volatility: This is a item for persons who are ready to presume Impermanent Loss or component of it in exchange for a Premium fee (insurance coverage commission). If end users are in the DVP Short Volatility vault, they will make revenue as prolonged as industry disorders are secure.

-

Long-Term Volatility DVP (Long-Term Volatility Product): This is a item for persons who pay out Premium to “earn” Impermanent Loss or a portion of it. If a consumer is in the DVP Short Volatility vault, he will make revenue irrespective of industry disorders.

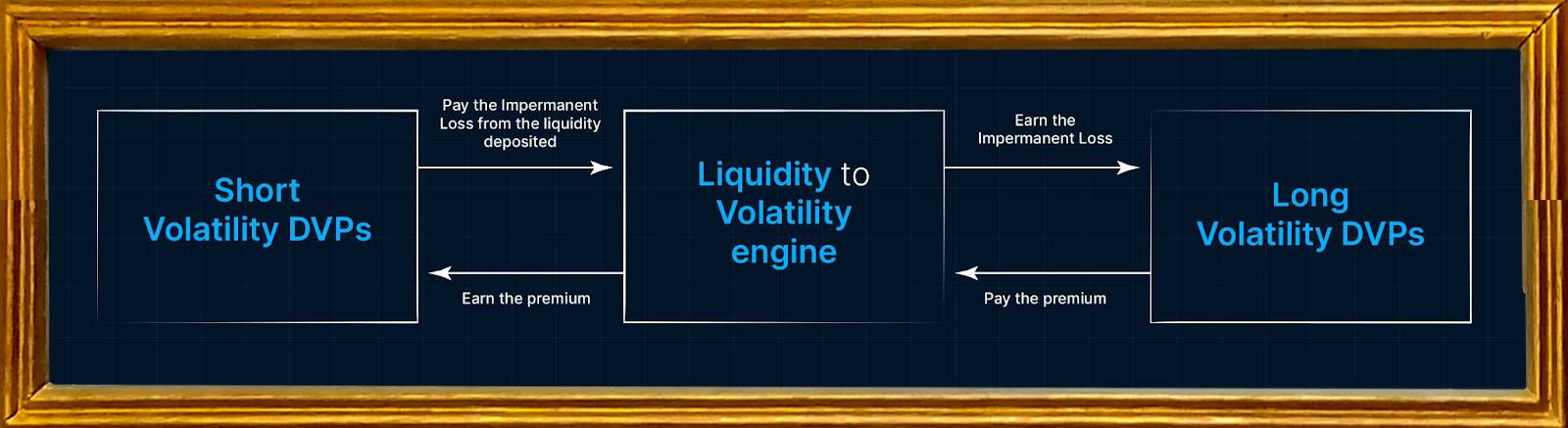

The Liquidity-Volatility engine is the place the Short Volatility DVP and Long Volatility DVP get the job done to convert Impermanent Loss into returns. This reaches the equilibrium the place the revenue earned by one DVP is paid by one more DVP in all probable industry conditions.

DVP operational model

Furthermore, Smilee Finance guarantees that the all round return of the Volatility DVP Shorts is equal to the return of the LP token place on AMM DEX. As for the all round return of prolonged volatility DVPs, it is equal to impermanent attain, the opposite of impermanent reduction. From right here, Smilee Finance only requirements to make certain that every vault has satisfactory liquidity so that all DVP payments are totally covered.

Smilee’s architecture is so versatile that it enables end users to develop customizable DVPs for sophisticated use instances from protocols, DAOs or organizations (MM, hedge money,…). This requires the idea of “LEGO money” to a new degree. Some DVPs are made based mostly on volatility this kind of as:

-

Options (contact, place,…).

-

Impermanent attain (as opposed to impermanent reduction).

-

Certificates and Structured Products.

-

Variance exchange.

-

Insurance (long lasting reduction, Depeg safety,…).

DVPs can be made by way of Smilee Finance

Real yield

Real Yield is a item aimed at the requirements of LPs when they are not compensated for the threat of supplying liquidity on AMM DEXs like Uniswap. Smilee Finance employs impermanent reduction to develop new items that boost the all round utility and worth of liquidity provision without having introducing more threat. Simply place, Smilee Finance will allocate capital additional properly, accruing larger and additional predictable returns for LPs.

Each Real Yield Vault will have the following framework:

-

A pair of tokens: ETH/USDT, ETH/USDC,…

-

APY

-

Profit methods (Real Yield, Delta Neutral,…).

-

Refund time.

-

Auction time.

During the auction, LP deposits liquidity into the vault in the type of one or each tokens. At the similar time, end users who deposit cash into the impermanent attain vault will pay out premium charges in USDC. Upon maturity, the complete premium paid minus the impermanent reduction will be transferred to the LP in the type of APY. Initially, the APY of vaults will be derived from the complete premium charges paid by Impermanent Gain Vault end users, but in the potential the APY will be calculated from the complete premium charges of prolonged volatility DVPs.

Real Yield Vault is anticipated to have the following methods:

-

Yield boost deposit: This is the place end users can immediately deposit LP tokens to earn APY revenue and premium charges. This expands the composability of the protocol and guarantees that the system generally will work superior when supplying liquidity on the DEX.

-

Vault Delta-neutral: This is the place end users can deliver liquidity without having direct publicity to the industry.

-

Vault with IL cover: This is the place impermanent reduction is restricted to the optimum to decrease the degree of threat in adverse industry conditions.

Impermanent attain

Impermanent attain is the opposite of impermanent reduction and is also a system that enables end users to trade when the industry fluctuates. Users can use impermanent attain for unique ranges this kind of as:

-

Opening a place just before a industry-impacting occasion, this kind of as a Fed curiosity fee boost or lessen meeting, Bitcoin Halving,…

-

Risk hedging for investment portfolios

-

Buy insurance coverage for stablecoin failure or worse

-

Trade arbitrage (cost distinction) to make revenue.

-

DAO and MM cover the threat of supplying liquidity to the DEX with their personal tokens or tokens they help.

Each Impermanent Gain Deposit will have the following framework:

-

A pair of tokens: ETH/USDT, ETH/USDC,…

-

Premium commission in USDC.

-

Profit system (only upside, only downside,…).

-

Refund time.

-

Auction time.

During the auction phase, end users participate in the Impermanent Gain Vault by having to pay a USDC premium that pays the APY of the Real Yield Vault. Additionally, the premium commission is also applied to identify the leverage the consumer can use up to x500 in APY:

Despite the significant leverage, no liquidation is probable mainly because no matter how significant the IL is, LPs will hardly ever be capable to get rid of additional than the deposited quantity. Therefore, the purchaser of Impermanent Gain will not encounter any threat of liquidation, irrespective of no matter if the leverage of the Impermanent Gain Vault is incredibly large.

When end users obtain one DVP Impermanent Gain it does not suggest they are forced to hold that place until finally expiration. If the consumer wishes to shut their place earlier, the refund will be equal to the impermanent revenue up to that stage, but all rewards paid will be forfeited.

Impermanent Gain Vault is anticipated to have two methods:

Basic details about tokens

Smilee Finance presently has no unique details on the launch of the token. Coinlive will update as quickly as there is the newest details on the task.

Roadmap for growth

Currently, Smilee Finance has not announced details on the growth roadmap. Coinlive will update as quickly as there is the newest details on the task.

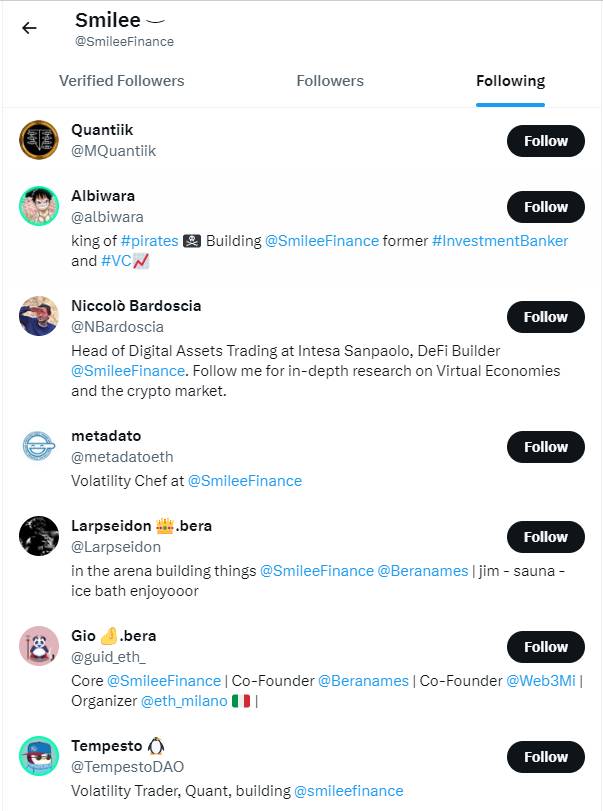

Development staff

Smilee Finance has not presently announced details about its growth staff members. However, Smilee Finance’s X (formerly Twitter) is following many accounts regarded to be the growth staff of the task.

These accounts are mentioned to be the growth staff of Smilee Finance

Investors

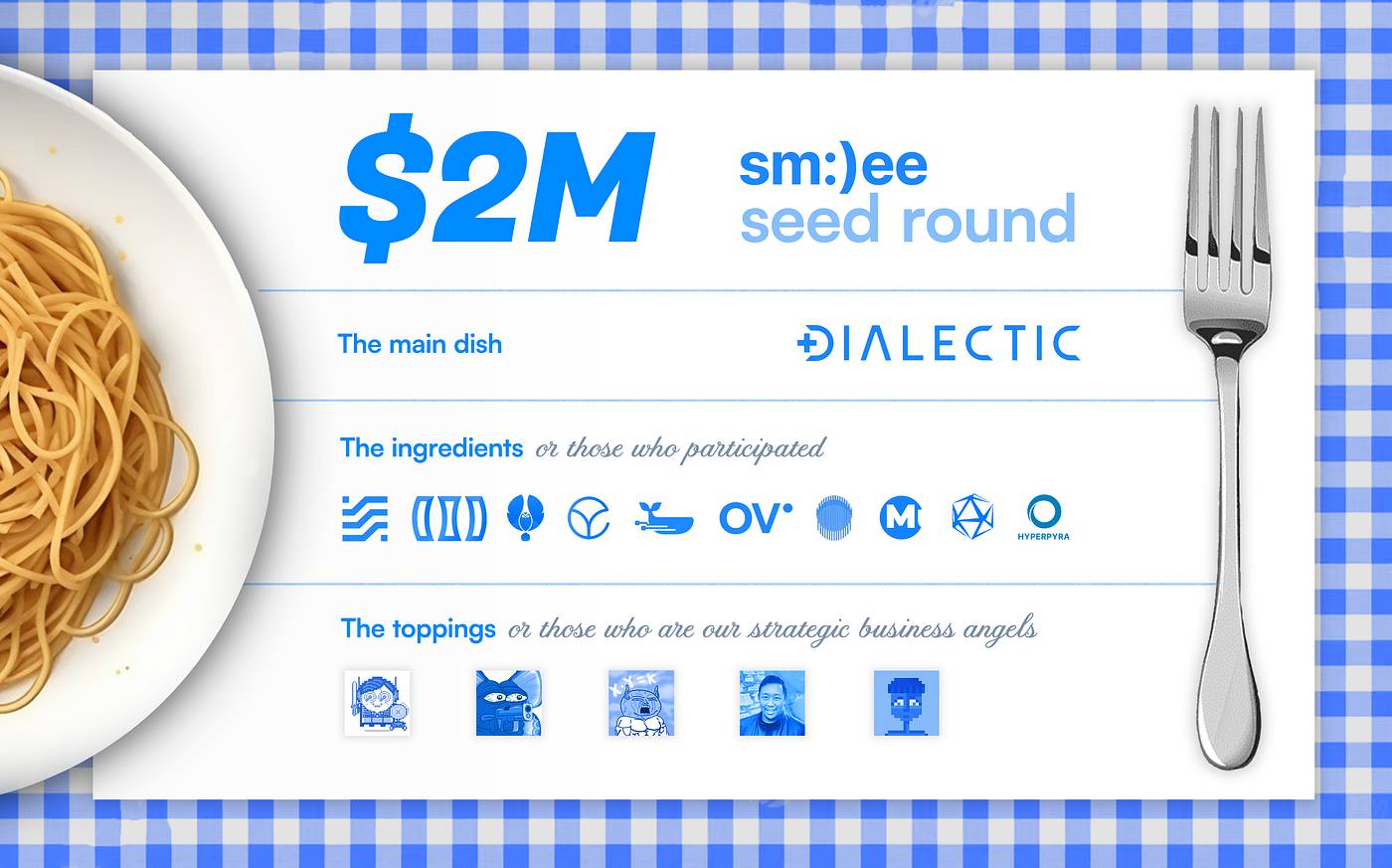

Smilee Finance efficiently raised $two million in Seed round with participation from investment money this kind of as Dialectic Capital, Synergis Capital, Concave Ventures,…

Smilee Finance traders

Company

Smilee Finance is collaborating with a quantity of tasks on Arbitrum this kind of as Y2K Finance, LEXER Markets, New Order,…

summary

Smilee Finance is a derivatives trading platform that employs Impermanent Loss to “turn options” into revenue-making items. While the plan and implementation may possibly be fantastic, there are hazards to trading solutions. Limitless is also in the item growth phase and we will have to wait for the official launch of the task to assess the feasibility of solving the impermanent reduction trouble for LP.

Through this report, you will possibly have some fundamental details about the Smilee Finance task to make your investment choice.

Note: Coinlive is not accountable for any investment choices…