Surely many Futures merchants don’t perceive what the funding fee is and why the funding charges are so excessive. In this text, I’ll merely introduce and clarify the funding fee for freshmen to grasp the gist of it.

What is the funding fee?

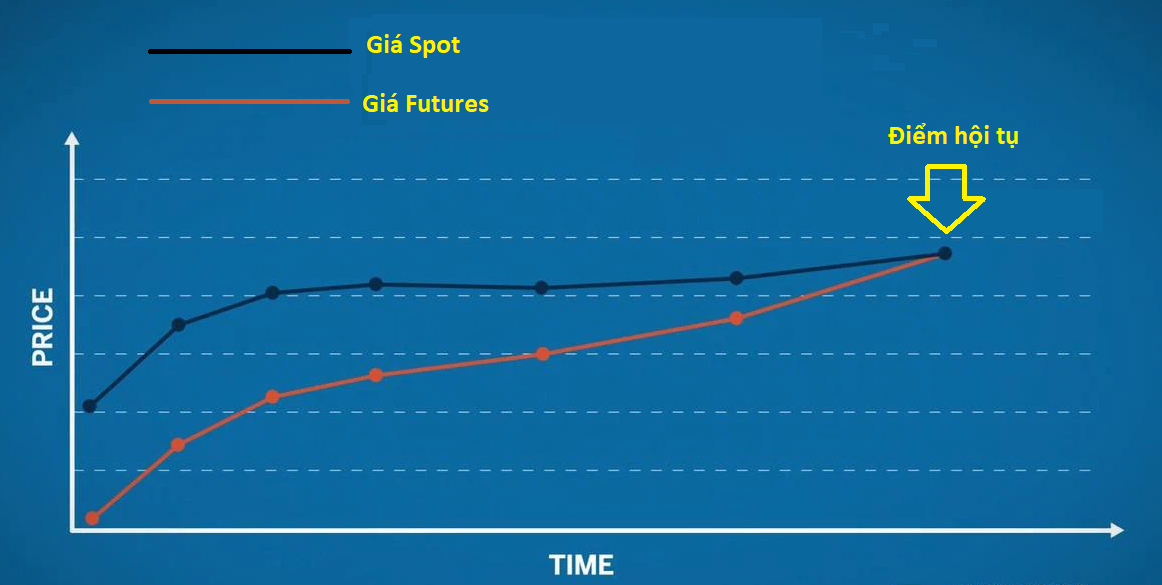

The funding fee is the ratio of the quantity to be paid when the costs between the Futures market and the Spot market differ. When the worth within the futures market is larger than the worth within the spot market, the financing fee is constructive, the occasion putting the lengthy order should pay the occasion putting the quick order. Conversely, when the worth of the cash within the Futures market is decrease than the Spot market, the occasion putting the quick order should pay the occasion putting the lengthy order. This is to make sure that the costs of the Futures and Spot markets are usually not too far aside. Many new merchants misunderstand the Futures and Spot markets as the identical, however they’re really totally different, and trading on margin, though utilizing the identical leverage mechanism as Futures, is definitely the identical market as Spot trading.

Why is there a funding fee?

Futures trading means futures trading, this can be a kind of trading that lets you purchase a leveraged asset at a recognized predetermined worth, often futures trading with a interval of round 1 month, 6 months or one 12 months and 6 compelled to liquidate your place no matter whether or not you make a revenue or a loss.

Unlike the common Futures market, Eternal Futures do not need a convergence level, so the worth might differ from the Spot market.

However, with perpetual futures trading, you can not shut the order perpetually, which can trigger the futures trading worth to fluctuate in another way from the precise worth. The financing fee will create a driving power for costs within the futures market to method the worth of the Spot market to safe the pursuits of merchants.

Although the chart is nearly the identical, there’s some distinction in worth between the Spot and Futures markets

The picture above is a comparability of the Bitcoin worth chart within the Spot market and the Futures market on the time of writing. You can see they’re fairly comparable however nonetheless have some distinction. The Bitcoin Spot worth is 34363.35 whereas the Bitcoin Futures worth is 34334.80. The undeniable fact that the worth within the Futures market is decrease than the worth within the Spot market causes the financing fee to be equal to -0.01%. This implies that the quick facet has to pay the lengthy facet 0.01% of the overall quantity during which its place is open.

How to calculate the funding fee when trading futures

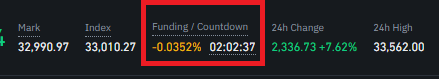

The option to calculate funding charges is kind of easy. Every 8 hours, the trade will calculate a financing payment as soon as, relying on the place you’re in, it is possible for you to to determine whether or not to obtain cash or lose cash, in the event you shut the order earlier than the financing payment is calculated, not you’ll have to pay the quantity of this tax (in any other case you’ll not obtain it). The method for calculating the funding fee is:

- Value of the place you’re opening x funding fee = funding payment.

For instance you’ve got 10 USD, you open a trading place with a leverage of 10, your place is 100 USD, if the funding fee is -0.035% then you’ll have to pay an quantity of 100 * -0.035% = – 0.035 USD. This implies that you’ll obtain $ 0.035 on the quick facet.

Note the countdown subsequent to Financing, which is the countdown to the subsequent financing payment.

For Binance Exchange, the utmost funding fee is 0.5% whatever the market unfold. The underlying funding fee is 0.01% and can rise or fall if the Futures and Spot markets differ considerably. You need to pay the financing payment 3 instances a day (8 hours at a time)

Impact of funding charges on merchants

Due to the existence of financing charges, the worth within the Futures market can be near the Spot worth, not too far-off. This prevents merchants’ forecasts from being skewed by market variations.

Many folks do not just like the funding payment, however its existence is important for the futures market.

However, when the market is simply too excited or scared, the stress to pay financing charges is kind of excessive, so you want to think about when creating your place. The existence of funding charges will even create some funding payment trading methods that assist in incomes important income.

What does the funding fee say?

The funding fee is extremely correlated with the sentiment of merchants. When the market is optimistic, the funding fee is usually constructive and the upper the speed, the extra excited the market. The reverse can also be true, when the funding fee begins to show detrimental, it implies that most merchants suppose the market will go down. However that is solely a reference indicator, the group just isn’t all the time proper.

Epilogue

Hopefully after this text you’ll perceive the funding fee to have a trading technique that fits you and not hate funding charges. After all, this can be a payment to guard the cryptocurrency market from extreme worth manipulation by sharks. See you in one other article.

.