Morpho is a answer designed to boost capital efficiency for significant lending platforms like Aave. So what is particular about this task? Let’s come across out collectively with Coinlive by means of this short article!

What is the Morpho Protocol (MORPHO)? Loan functionality optimization platform

What is the Morpho Protocol (MORPHO)? Loan functionality optimization platform

What is the Morpho Protocol (MORPHO)?

Morpho is a peer-to-peer lending platform designed on the basis of Compound and Aave. Morpho serves as an optimization device for loan pool options, assisting to strengthen capital efficiency on loan pools by seamlessly connecting borrowers and lenders.

Morpho Protocol

Morpho aids strengthen curiosity prices (lending and borrowing) by preserving liquidity, settlement ensures and equivalent danger parameters linked with the underlying protocol.

The Morpho protocol has undergone protection checks by 9 distinct corporations to make certain that it supplies a protected solution to customers.

Entities that complete protection checks for the Morpho protocol

Entities that complete protection checks for the Morpho protocol

Since its inception, Morpho has attracted almost $one billion in processed deposits and loans with a complete worth of far more than $500 million.

Total quantity borrowed and lent on the Morpho protocol

What issue was the Morpho protocol made for?

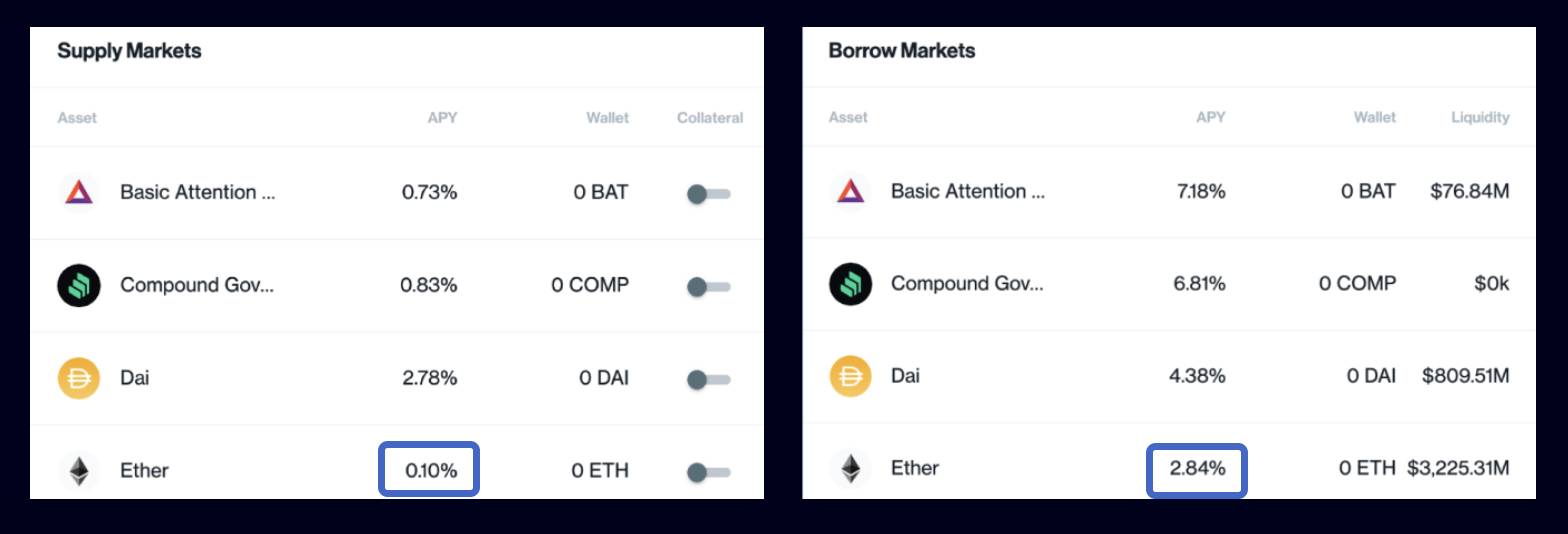

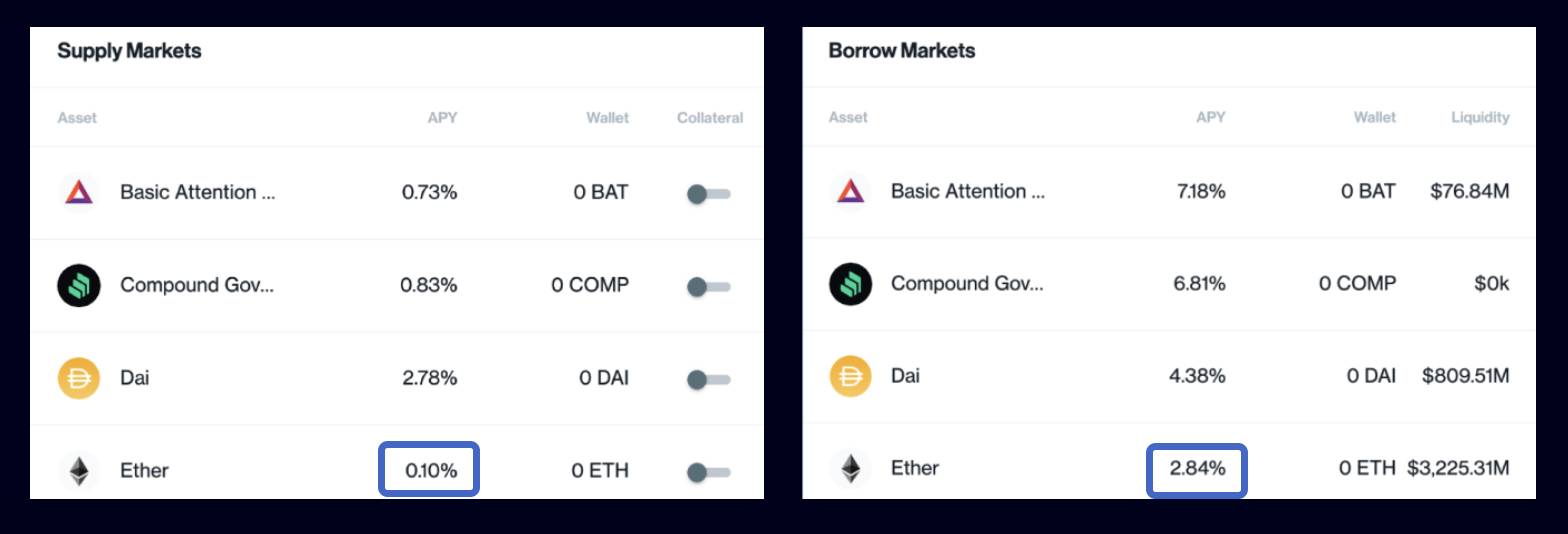

On lending protocols like Aave and Compound, the curiosity prices on loans and borrowings will usually be incredibly distinct. You can see an illustration from the picture under.

Compare curiosity prices on loans and borrowings

Compare curiosity prices on loans and borrowings

This big difference largely comes from loan pools that use a liquidity pool mechanism. In most situations, the amount of lenders will be greater than the amount of borrowers, which lowers the efficiency of capital utilization.

In liquidity pools, curiosity prices will be socialized, that means that several lenders will have to share the interests of a restricted amount of borrowers. Therefore, lenders will earn significantly less dollars whilst borrowers will have to shell out greater curiosity to compensate for the very low capital efficiency. The big difference in between energetic and passive curiosity prices is the consequence of this mechanism.

With Morpho, curiosity prices will not operate in accordance to a socialized mechanism, but as an alternative liquidity will be offered flexibly and seamlessly with a peer-to-peer network mechanism. Both borrowers and lenders get much better curiosity prices. The curiosity fee offered by Morpho will be in between the lending and borrowing curiosity prices as proven under.

Morpho curiosity fee calculation mechanism

Mechanism of action

Morpho acts as a proxy in between customers and the lending pool. After a loan company deposits dollars into Morpho, the protocol areas that asset into the lending pool to get an curiosity-bearing token (ibToken). ibToken is a token that represents the assets that customers have deposited into the lending pool. ibToken will immediately produce earnings above time.

When an individual desires to borrow dollars from Morpho. The protocol will use ibToken for lending.

From this level on, each the loan company and the borrower advantage from a one hundred% utilization fee, resulting in enhanced curiosity prices for each events.

Morpho’s mechanism for connecting borrowers and lenders

The Morpho protocol employs a priority queuing mechanism to connect customers, sorting customers based mostly on the quantity they want to lend or borrow. When a new loan company supplies liquidity to the protocol, its liquidity will to start with be matched with that of the greater borrower. Then comes the 2nd, the third,…until the liquidity offered is absolutely matched or no far more borrowers are matched.

As a consequence, let us presume a borrower is new to Morpho. In this situation their wants are met to start with by the biggest loan company, then by the 2nd, until eventually the loan liquidity is totally pleased or no ideal lenders continue to be.

Basic details about the MORPHO token

|

Token identify |

Morpho |

|

Ticker |

MORPHO |

|

Blockchain |

Ethereum |

|

Token rule |

CER-twenty |

|

To contract |

0x9994e35db50125e0df82e4c2dde62496ce330999 |

|

Token style |

Government |

|

Total provide |

Updating |

|

Circulating provide |

Updating |

Assignment of tokens

The complete provide of MORPHO tokens is one,000,000,000, of which DAO will mint 80% of the tokens and the Association will mint twenty% of the tokens and promote 19% of them to traders by means of two funding rounds in 2021 and 2022.

In the to start with token distribution (MIP1), DAO distributed MORPHO tokens to the founders, Morpho Labs, and other independent contributors, researchers, and consultants.

The preliminary distribution happens by means of a vesting agreement. The minimal lock-in time period is six months, followed by thirty month installments, commencing from 25 December 2022.

Initial allocation fee of MORPHO tokens

Token release system

Updating…

What is the MORPHO token for?

The MORPHO token is made use of to vote on governance choices this kind of as:

-

Deploy Morpho core intelligent contracts across many blockchain protocols and networks

-

Manage the record of listed markets and other vital parameters

-

Store protocol and governance information in a decentralized method

-

Treasury management

Wallet to shop MORPHO tokens

You can shop this token on the following wallets: MetaMask, Coin98 wallet, Trusted wallet.

Where to purchase and promote MORPHO tokens?

Updating…

Investors

Morpho Protocol has finished two rounds of funding with the quantity obtained up to $19.35 million. These capital calls have the participation of investment money this kind of as: a16z, Coinbase Ventures, Variant, Standard Crypto, Spark Capital,…

Investors

Investors

summary

Morpho is a answer that aids strengthen capital efficiency for lending platforms. Through this short article, Coinlive hopes that you have grasped the primary details about this task.

Note: The details in this short article ought to not be thought of investment tips. Coinlive will not be accountable for any of your investment choices.

Morpho is a answer designed to boost capital efficiency for significant lending platforms like Aave. So what is particular about this task? Let’s come across out collectively with Coinlive by means of this short article!

What is the Morpho Protocol (MORPHO)? Loan functionality optimization platform

What is the Morpho Protocol (MORPHO)? Loan functionality optimization platform

What is the Morpho Protocol (MORPHO)?

Morpho is a peer-to-peer lending platform designed on the basis of Compound and Aave. Morpho serves as an optimization device for loan pool options, assisting to strengthen capital efficiency on loan pools by seamlessly connecting borrowers and lenders.

Morpho Protocol

Morpho aids strengthen curiosity prices (lending and borrowing) by preserving liquidity, settlement ensures and equivalent danger parameters linked with the underlying protocol.

The Morpho protocol has undergone protection checks by 9 distinct corporations to make certain that it supplies a protected solution to customers.

Entities that complete protection checks for the Morpho protocol

Entities that complete protection checks for the Morpho protocol

Since its inception, Morpho has attracted almost $one billion in processed deposits and loans with a complete worth of far more than $500 million.

Total quantity borrowed and lent on the Morpho protocol

What issue was the Morpho protocol made for?

On lending protocols like Aave and Compound, the curiosity prices on loans and borrowings will usually be incredibly distinct. You can see an illustration from the picture under.

Compare curiosity prices on loans and borrowings

Compare curiosity prices on loans and borrowings

This big difference largely comes from loan pools that use a liquidity pool mechanism. In most situations, the amount of lenders will be greater than the amount of borrowers, which lowers the efficiency of capital utilization.

In liquidity pools, curiosity prices will be socialized, that means that several lenders will have to share the interests of a restricted amount of borrowers. Therefore, lenders will earn significantly less dollars whilst borrowers will have to shell out greater curiosity to compensate for the very low capital efficiency. The big difference in between energetic and passive curiosity prices is the consequence of this mechanism.

With Morpho, curiosity prices will not operate in accordance to a socialized mechanism, but as an alternative liquidity will be offered flexibly and seamlessly with a peer-to-peer network mechanism. Both borrowers and lenders get much better curiosity prices. The curiosity fee offered by Morpho will be in between the lending and borrowing curiosity prices as proven under.

Morpho curiosity fee calculation mechanism

Mechanism of action

Morpho acts as a proxy in between customers and the lending pool. After a loan company deposits dollars into Morpho, the protocol areas that asset into the lending pool to get an curiosity-bearing token (ibToken). ibToken is a token that represents the assets that customers have deposited into the lending pool. ibToken will immediately produce earnings above time.

When an individual desires to borrow dollars from Morpho. The protocol will use ibToken for lending.

From this level on, each the loan company and the borrower advantage from a one hundred% utilization fee, resulting in enhanced curiosity prices for each events.

Morpho’s mechanism for connecting borrowers and lenders

The Morpho protocol employs a priority queuing mechanism to connect customers, sorting customers based mostly on the quantity they want to lend or borrow. When a new loan company supplies liquidity to the protocol, its liquidity will to start with be matched with that of the greater borrower. Then comes the 2nd, the third,…until the liquidity offered is absolutely matched or no far more borrowers are matched.

As a consequence, let us presume a borrower is new to Morpho. In this situation their wants are met to start with by the biggest loan company, then by the 2nd, until eventually the loan liquidity is totally pleased or no ideal lenders continue to be.

Basic details about the MORPHO token

|

Token identify |

Morpho |

|

Ticker |

MORPHO |

|

Blockchain |

Ethereum |

|

Token rule |

CER-twenty |

|

To contract |

0x9994e35db50125e0df82e4c2dde62496ce330999 |

|

Token style |

Government |

|

Total provide |

Updating |

|

Circulating provide |

Updating |

Assignment of tokens

The complete provide of MORPHO tokens is one,000,000,000, of which DAO will mint 80% of the tokens and the Association will mint twenty% of the tokens and promote 19% of them to traders by means of two funding rounds in 2021 and 2022.

In the to start with token distribution (MIP1), DAO distributed MORPHO tokens to the founders, Morpho Labs, and other independent contributors, researchers, and consultants.

The preliminary distribution happens by means of a vesting agreement. The minimal lock-in time period is six months, followed by thirty month installments, commencing from 25 December 2022.

Initial allocation fee of MORPHO tokens

Token release system

Updating…

What is the MORPHO token for?

The MORPHO token is made use of to vote on governance choices this kind of as:

-

Deploy Morpho core intelligent contracts across many blockchain protocols and networks

-

Manage the record of listed markets and other vital parameters

-

Store protocol and governance information in a decentralized method

-

Treasury management

Wallet to shop MORPHO tokens

You can shop this token on the following wallets: MetaMask, Coin98 wallet, Trusted wallet.

Where to purchase and promote MORPHO tokens?

Updating…

Investors

Morpho Protocol has finished two rounds of funding with the quantity obtained up to $19.35 million. These capital calls have the participation of investment money this kind of as: a16z, Coinbase Ventures, Variant, Standard Crypto, Spark Capital,…

Investors

Investors

summary

Morpho is a answer that aids strengthen capital efficiency for lending platforms. Through this short article, Coinlive hopes that you have grasped the primary details about this task.

Note: The details in this short article ought to not be thought of investment tips. Coinlive will not be accountable for any of your investment choices.