The MUX Protocol is 1 of the primary futures exchanges on Arbitrum. So, what is so terrific about this venture? Let’s come across out with Coinlive via this post!

What is the MUX (MCB) protocol? Decentralized trading platform with perpetual contract

What is the MUX (MCB) protocol? Decentralized trading platform with perpetual contract

What is the MUX (MCB) protocol?

The MUX protocol is a perpetual contract trading platform that features deep liquidity, optimized trading charges, 100x leverage, varied marketplace possibilities, and exclusive summary functions this kind of as intelligent place routing.

What is the MUX (MCB) protocol?

What is the MUX (MCB) protocol?

The MUX protocol has two key elements:

-

MUX Leveraged Trading Protocol: Decentralized leveraged trading protocol supplying selling price neutral trading, leverage up to above 100x.

-

MUX Leveraged Trading Aggregator: Sub-protocol of the MUX protocol with the performance to instantly choose the most appropriate liquidity path to support reduce aggregate charges for traders though satisfying the require to open positions. This device can also deliver further margin for traders to enhance leverage up to 100x.

Operational model of the MUX protocol

The MUX protocol performs primarily based on three key mechanisms, which include: Universal liquidity, Multi-asset pool e Dark Oracle.

Universal liquidity

Protocols that operate across various blockchains generally practical experience liquidity fragmentation. The MUX protocol solves this dilemma by unifying liquidity across diverse chains working with the broker module, which is a liquidity monitoring bot especially for margin trading. After a trader locations an purchase, the broker module calculates the accessible liquidity on distributed chains and executes the purchase if it can match the place dimension. The universal liquidity mechanism presents higher capital efficiency across all deployed networks with out the require to move assets in between diverse chains.

Let’s say the venture has four pools: Arbitrum, Avalanche, BNB Smart Chain and Fantom, each and every pool has ten ETH and five ETH is at this time reserved for lively positions. When the broker module seems to be at all the distributed networks, it determines that the complete liquidity will be forty ETH and the accessible liquidity will be 35 ETH. If a trader locations a lengthy purchase of twenty ETH on Arbitrum, the following procedure takes place:

After the command is sent on the chain, the broker module will procedure the command.

-

The Broker module will examine if the all round liquidity meets the purchase dimension prerequisites.

-

The complete liquidity of the pool is forty ETH (ten + ten + ten + ten) and the accessible liquidity of the pool is 35 ETH (forty – five)

-

35 ETH is increased than the purchase necessity of twenty ETH and for that reason the broker module will execute the purchase.

Multi-asset pool

The Multi-Asset Pool is normally absolutely backed by a portfolio of blue-chip assets and stablecoins. When traders open leveraged positions, the pool reserves the demanded assets till the place is closed. If the trader’s place is rewarding, on closing the purchase the trader can withdraw the collateral and revenue from the reserve. If the trader’s place is at a reduction, on closing the place the trader will shell out the reduction with a assure.

To control possibility, lengthy and brief positions in each and every marketplace will have open curiosity limits. The restrict will not exceed gross liquidity, so the pool normally has the potential to shell out earnings to traders.

Dark Oracle

The MUX protocol makes use of a dark oracle to aggregate numerous selling price feeds to make sure selling price accuracy and stability. Dark Oracle is a personal selling price oracle that does not publicly show the selling price of assets in the pool and its key function is to avoid front-operating trades. Furthermore, dark oracles also get rid of arbitrage options, making it possible for transactions that do not impact the selling price. When traders location orders, the broker module will take the selling price from the dark oracle and executes the orders with out affecting the selling price.

Operational standing of the MUX protocol

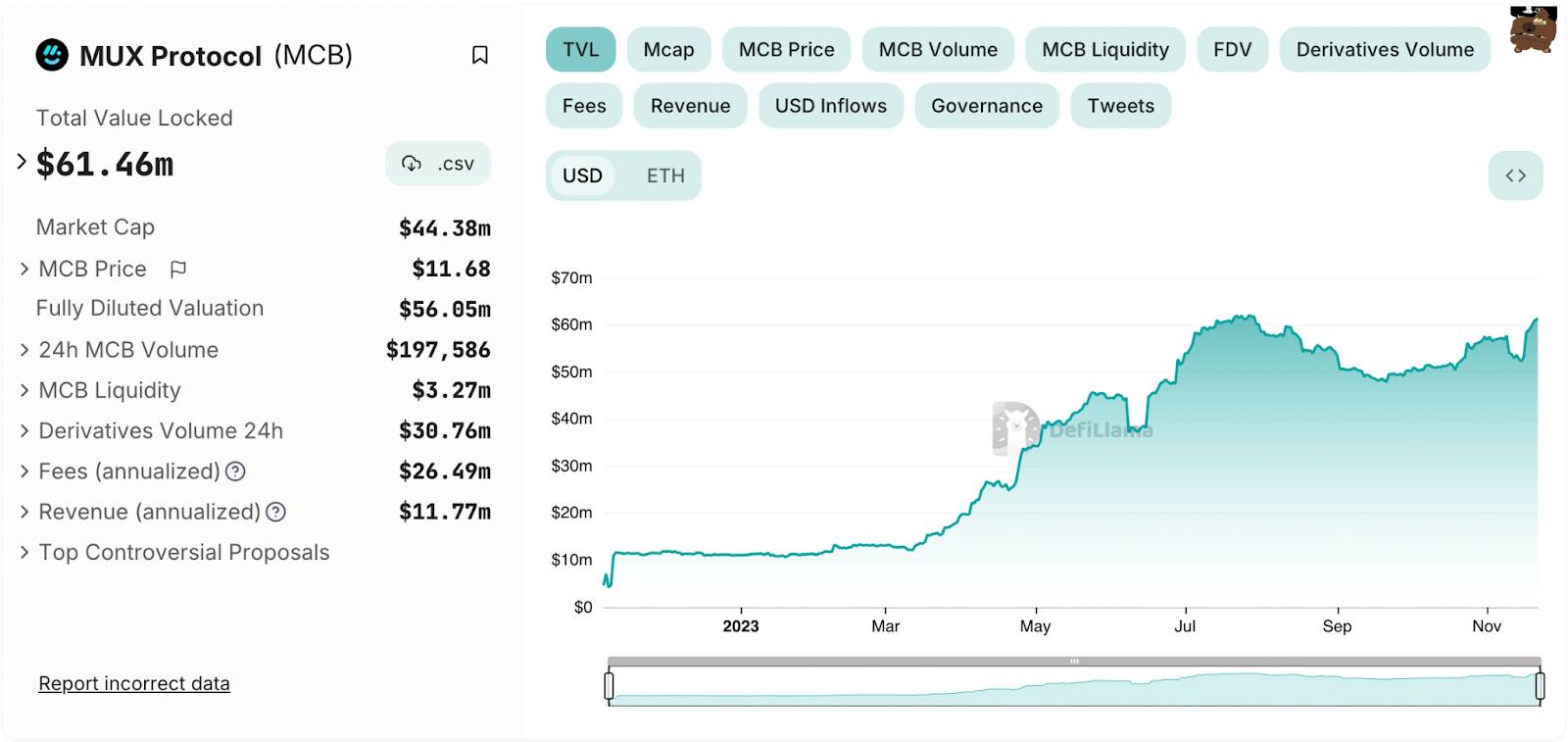

MUX Protocol’s TVL has proven constant development and has now reached the $61.46 million mark.

TVL of the MUX protocol. Source: DefiLlama (November 23, 2023)

TVL of the MUX protocol. Source: DefiLlama (November 23, 2023)

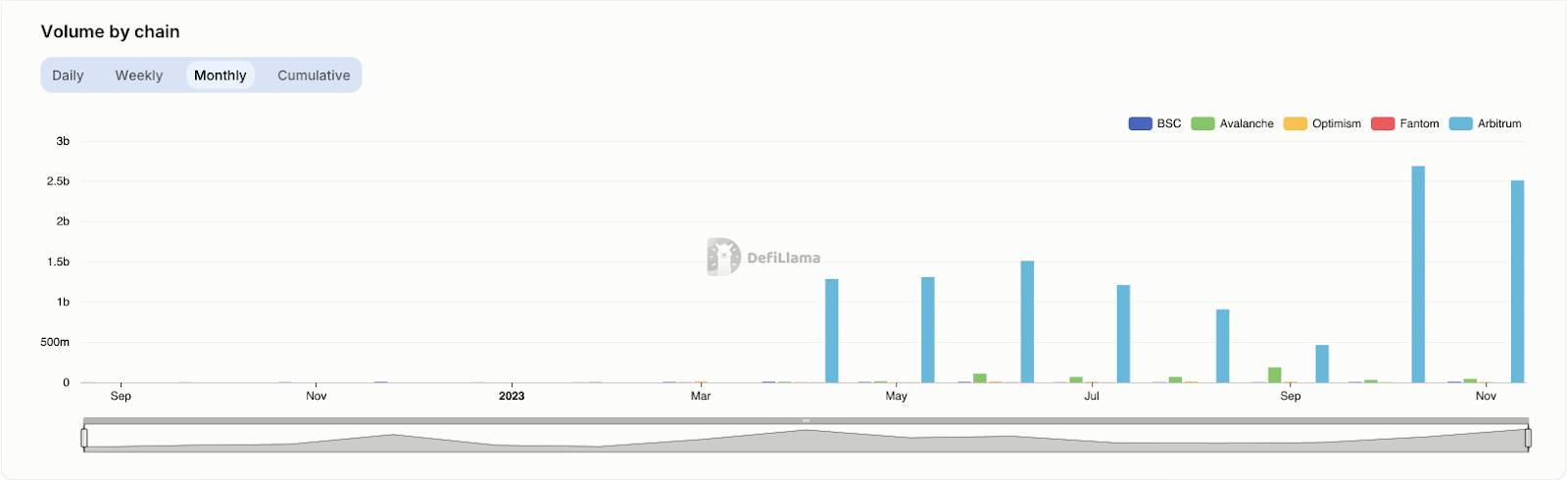

The MUX protocol operates largely on Arbitrum, the trading volume of this platform from April to now on Arbitrum has constantly demonstrated superiority above other blockchains this kind of as: BNB Smart Chain, Avalanche, Fantom, Optimism.

Transaction volume on diverse blockchains of the MUX protocol. Source: DefiLlama (November 23, 2023)

Transaction volume on diverse blockchains of the MUX protocol. Source: DefiLlama (November 23, 2023)

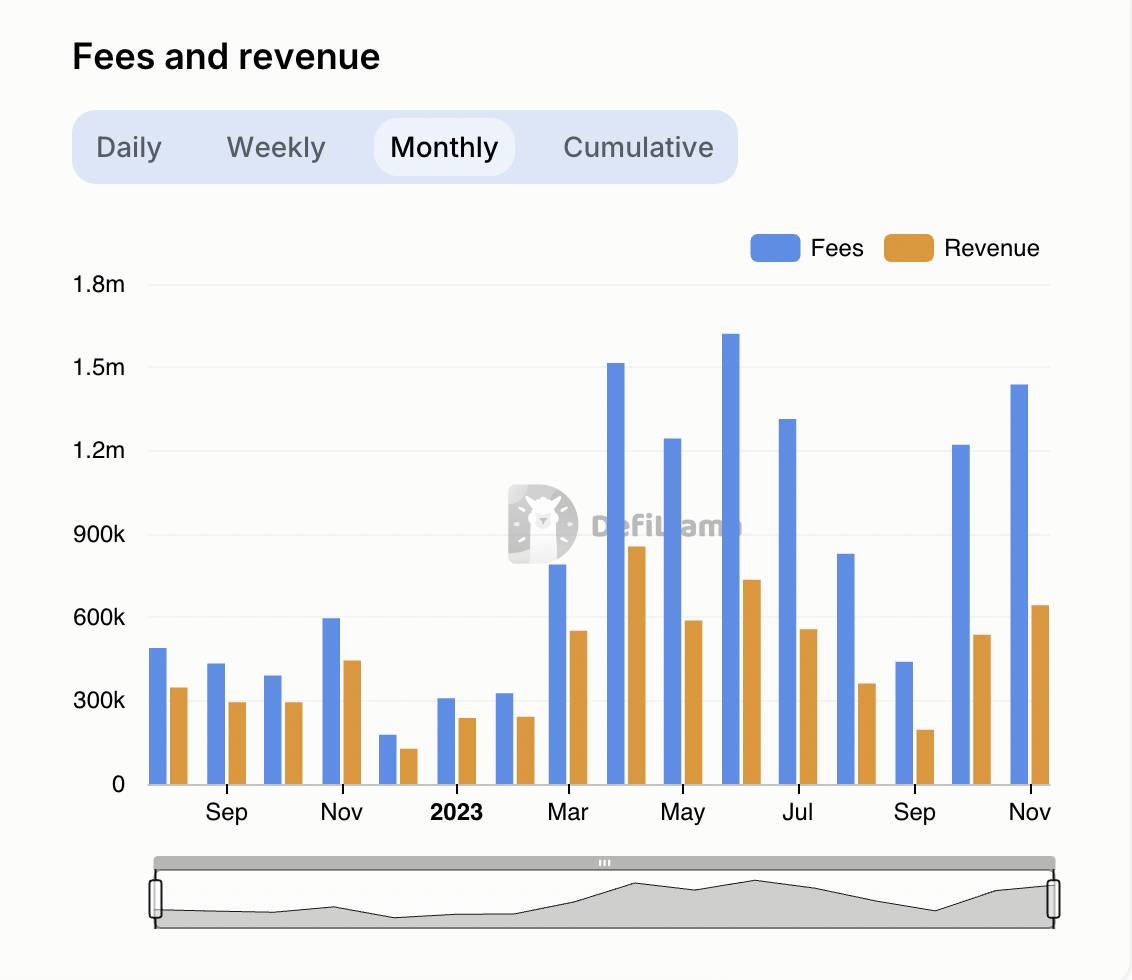

From April 2023 to now, the normal transaction charge that the protocol collects each and every month has normally been over $one million. Furthermore, the normal income for the duration of this identical time period is normally far more than 400 thousand bucks per month.

MUX protocol transaction costs and income. Source: DefiLlama (November 23, 2023)

MUX protocol transaction costs and income. Source: DefiLlama (November 23, 2023)

Tokenomics of the MUX protocol

MUX protocol token sorts

MUX protocol token sorts

The MUX protocol has four sorts of tokens: MCB. MUX, MUX e MUXLP.

MCB

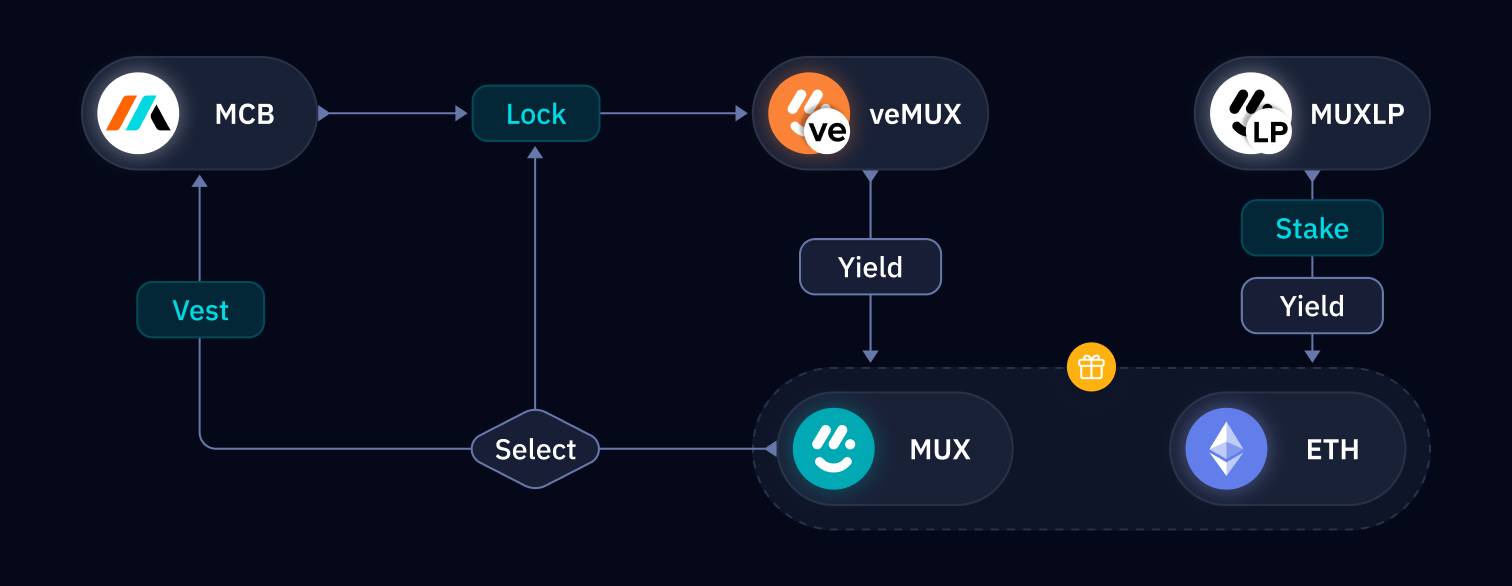

MCB is the key token of the protocol. Users can lock MCB to acquire veMUX, which will allow them to acquire income and rewards from the protocol in the type of MUX tokens.

MCB Token Supply:

MUX

MUX is the reward token of the MUX protocol, this token is not transferable. Users can acquire MUX tokens by holding veMUX or staking MUXLP.

The present provide restrict for the MUX token is one,000,000 and the day by day issuance is one,000.

veMUX

veMUX is the governance token of the protocol, this token is not transferable. Users can lock MCB token or MUX token to acquire veMUX. Holding veMUX will let customers to acquire further income from the protocol and rewards in the type of MUX tokens.

Transaction costs collected on the protocol will be allotted to veMUX holders.

MUXLP

MUXLP is the protocol’s LP token. Users can stake this token to earn income and rewards from the protocol in the type of MUX tokens. Transaction costs collected on the protocol will be allotted to MUXLP stakers.

Basic information and facts about the MCB token

|

Token title |

MUX protocol |

|

Ticker |

MCB |

|

Blockchain |

Ethereum, BNB Smart Chain, Arbitrum One |

|

Token rule |

ERC-twenty, BEP-twenty |

|

To contract |

Ethereum: 0x4e352cf164e64adcbad318c3a1e222e9eba4ce42 BNB sensible chain: 0x5fe80d2cd054645b9419657d3d10d26391780a7b Arbitrum One: 0x4e352cf164e64adcbad318c3a1e222e9eba4ce42 |

|

Token form |

Utility, governance |

|

Total provide |

four,803,143 |

|

Circulating provide |

three,803,143 |

MCB Token Storage Wallet

You can retail outlet this token on the following wallets: Exchange Wallet, MetaMask, Coin98 Wallet, Trust Wallet.

Where to obtain and promote MCB tokens?

MCB is at this time traded on numerous diverse exchanges with a complete day by day trading volume of somewhere around $193 thousand. Exchanges listing this token include things like: Uniswap, PancakeSwap, MEXC, BingX, CoinEx, Balancer,…

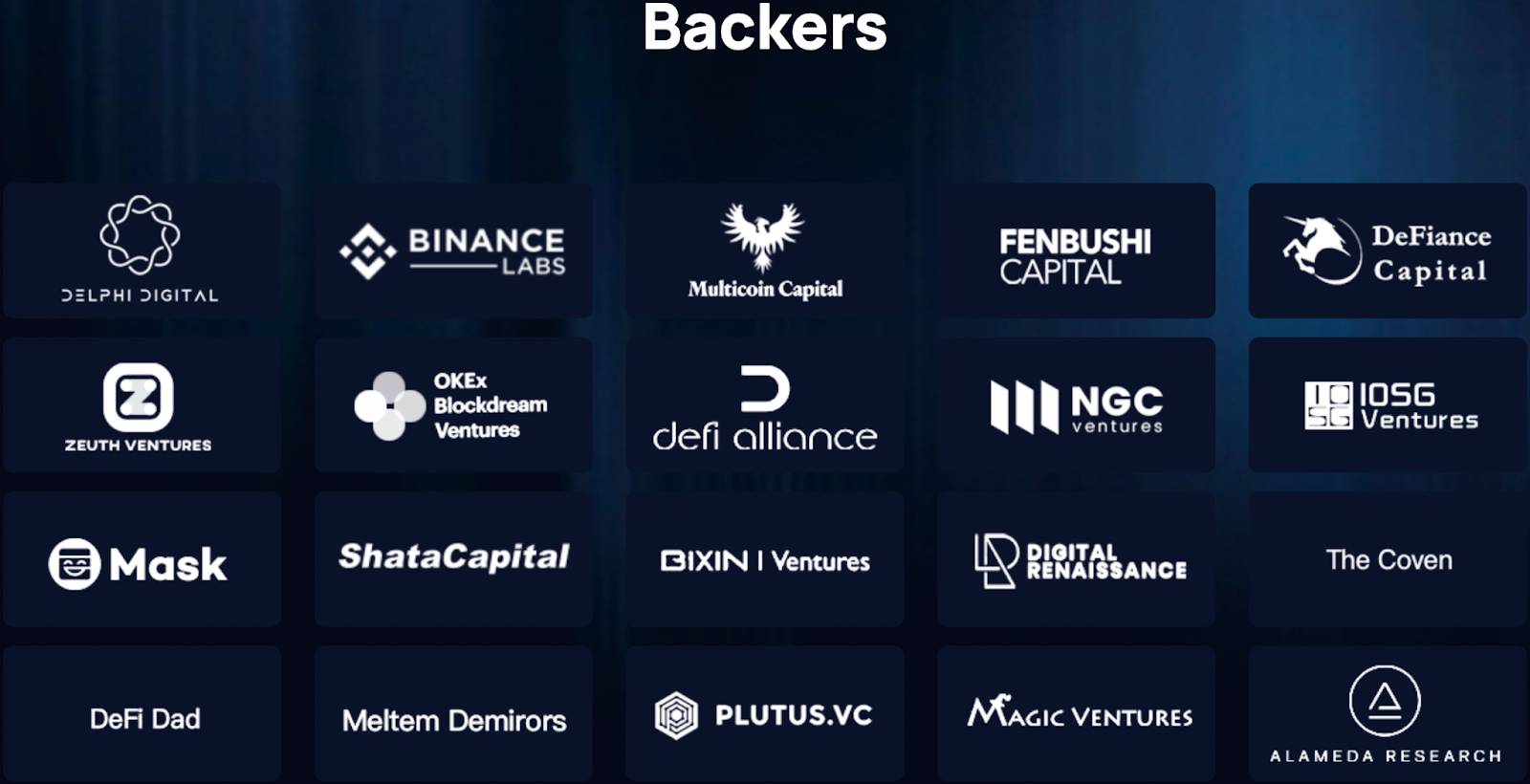

Investors

In the initial capital round in May 2021, MUX protocol obtained investments from numerous primary money in the cryptocurrency marketplace this kind of as: Delphi Digital, Binance Labs, Multicoin Capital, IOSG Ventures,…

Investors

Investors

Most lately, in October 2023, this venture obtained $four.93 million in funding from the Arbitrum Foundation.

summary

The MUX protocol is a futures contract trading protocol launched in 2021. Although it is current on five diverse blockchains, the trading volume of this venture is largely on Arbitrum. Through this post, you will most likely have some fundamental information and facts about the venture to make your investment selection.

Note: The information and facts in this post really should not be regarded investment tips. Coinlive is not accountable for any of your investment selections.