What is the request network (REQ)?

Request is a decentralized network that enables safe funds between the requester and the payer. All data is saved in a sound decentralized ledger. This results in cheaper, simpler and safer funds and permits for lots of automation.

To grow to be the spine of world trade, Request integrates a typical register with the next traits:

– Popular as a result of it’s designed to help 100% of world transactions, no matter forex, legislation or language.

– Smart as a result of not like the prevailing commonplace ledger. The request is the supply of the exchanges and enhances the computerized business code, in addition to dealing with a large number of cost phrases.

The request could be thought-about as a stage greater than Ethereum 2.0, which permits cost requests to fulfill the authorized framework, additionally seeing the forex as a instrument to finish request transactions. In this sense, Request is extra world than any forex.

How does the demand network work?

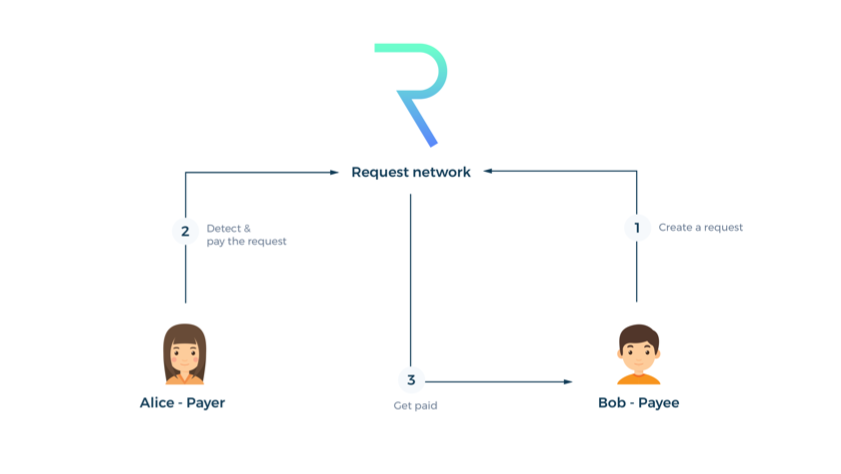

Anyone can write to the request register and make cost requests. The request could be detected by the recipient monitoring the network (through a pockets or through a monetary utility). If the request is authorised by the person, it may be paid with one click on. The request is then accomplished and up to date on the network.

For instance:

Bob asks Alice to pay, then creates a request (bill) and passes it to the blockchain; Alice’s pockets detects the request and processes the cost.

In case Bob is on Amazon and Alice is making a purchase order, Amazon makes a request on the blockchain, Alice’s telephone scans the blockchain and detects the request, sends a notification and he or she agrees to pay.

The requests embody:

- Confidentiality, as there isn’t any have to share banking data

- Simple, since you simply have to click on a button

- Savings, as the acquisition doesn’t require third events (eg Paypal)

In which circumstances is the request used?

B2B invoicing (B2B bill)

Billions of invoices are shared yearly between firms, most of that are nonetheless despatched in paper kind and electronic mail, which should be copied. This results in some severe errors, particularly when making use of tax or prepayment guidelines.

With Request, firms can share these invoices straight by way of the register; there shall be no duplication, because the accounting system shall be put in and up to date instantly.

The firm awaiting cost will be capable to instantly detect the delay, which shall be much less seemingly as a result of evolution of the invoice cost system. The Company has the flexibility to pay on the optimum date upon receipt of the request.

Online funds

For instance: Shopping on Amazon requires cost by credit score / debit card, thus exposing delicate data. Furthermore, by selecting the cost possibility through Request, your knowledge remains to be protected. Amazon will ship a request to the network, the person’s account will detect and request affirmation of cost from the person. This will set off a switch on the lowest value with out revealing your cost data.

You can keep away from surprising credit score / debit card funds that companies cost covertly, because it gives a option to authenticate funds earlier than they occur.

Advantages of the request, in comparison with present methods, they’re:

- Safety: Payment data isn’t shared, there isn’t any threat that somebody will intercept and reuse your banking data.

- Simplicity: One click on to checkout and no guide entry errors.

- Cost: There aren’t any third events similar to Paypal, Bitpay or Stripe, they’re all suppliers that cost between 1% and seven% of the quantity despatched. The request reduces prices.

Basic details about the REQ token

- Token identify: Request

- Ticker: REQ

- Blockchain: Ethereum

- Token commonplace: ERC-20

- To contract: 0x8f8221afbb33998d8584a2b05749ba73c37a938a

- Token sort: Utility

- Total provide: 999.881.816 REQUEST

- Circulating provide: 771.800.862 REQUEST

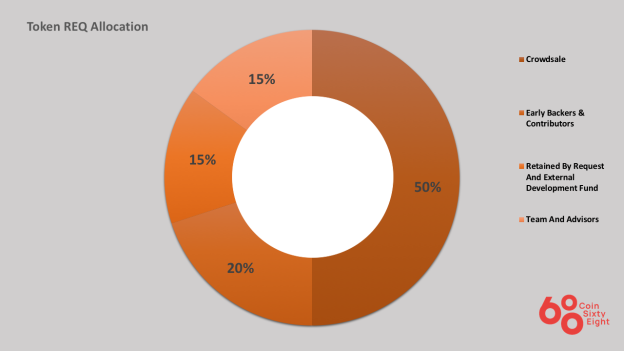

- Mass sale: 50%

- Early stage funding fund and contributors to the undertaking: 20%

- Reserve Fund and External Development Fund: 15%

- Team and mentor: 15%

What is the REQ token for?

- Grant entry to cost requests

- Stake out to make the nodes work.

- Administration.

REQ Token Storage Wallet

REQ is an ERC20 token, so you should have many pockets choices to retailer this token. You can select from the next wallets:

- Floor pockets

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 pockets

- Cool wallets: Ledger, Trezor

How to earn and personal REQ tokens

Buy straight on the inventory alternate.

Where to purchase and promote REQ tokens?

Currently, REQ is traded on many various exchanges with a complete each day trading quantity of roughly USD 840,000. Exchanges itemizing this token embody: Binance, Uniswap, Huobi, Bitfinex, Kucoin, Gate.io, …

What is the way forward for the Request Network undertaking, ought to I spend money on REQ tokens or not?

Request Network is an answer that enables customers to simplify the cost course of. This network could be utilized to actual cost circumstances similar to: B2B invoicing, on-line cost. Through this text, you need to have by some means grasped the essential details about the undertaking to make your funding selections. Coinlive shouldn’t be liable for any of your funding selections. I want you success and earn quite a bit from this potential market.

.