What is Total Value Lock (TLV)?

Local Value Lock (TLV) is the complete sum of assets locked in a DeFi good contract. It represents the sum of assets at present held in a certain protocol.

“Many DeFi monitoring websites use Total Blocked Value (TVL) as a benchmark. Simply place, TVL represents the amount of assets at present in perform in a certain protocol. This worth is not meant to signify the residual stability, but rather the complete sum of the underlying liquidity provide assured by a certain application and / or by DeFi in basic. “.

- From Kyber Network on December 14, 2019:

“One metric in the DeFi area he is notably fond of measuring when evaluating DeFi dapps is Total Value Locked (TVL). TVL measures the complete worth of tokens locked in these dapps, arguing that the larger the TLV worth in the dapp, the much better the dapp.

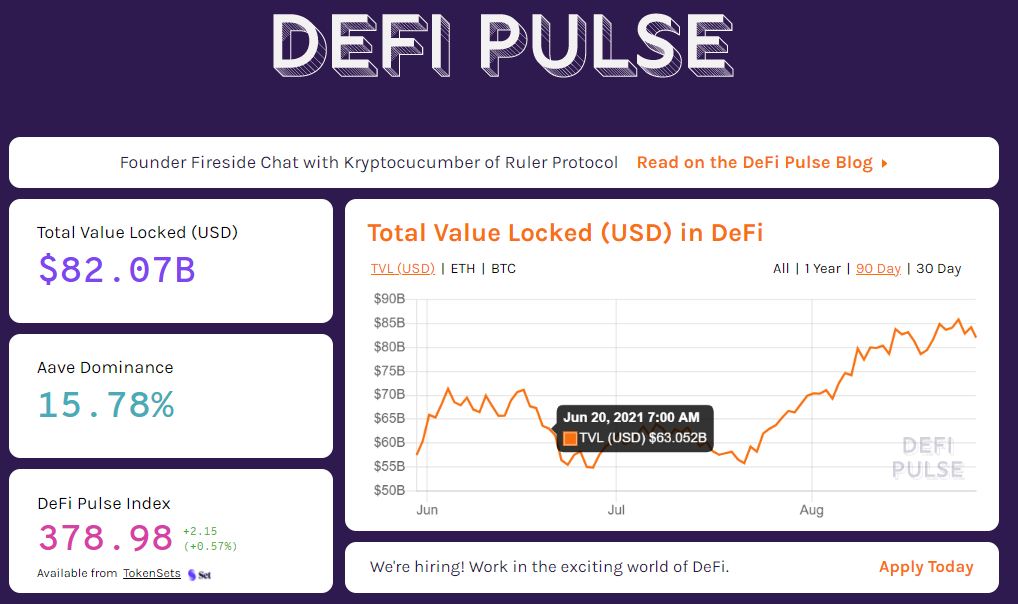

Overall TLV is a metric employed to measure the total health and fitness of the DeFi and the Yield Farm market place. You can track complete blocked worth (TLV) across several companies.

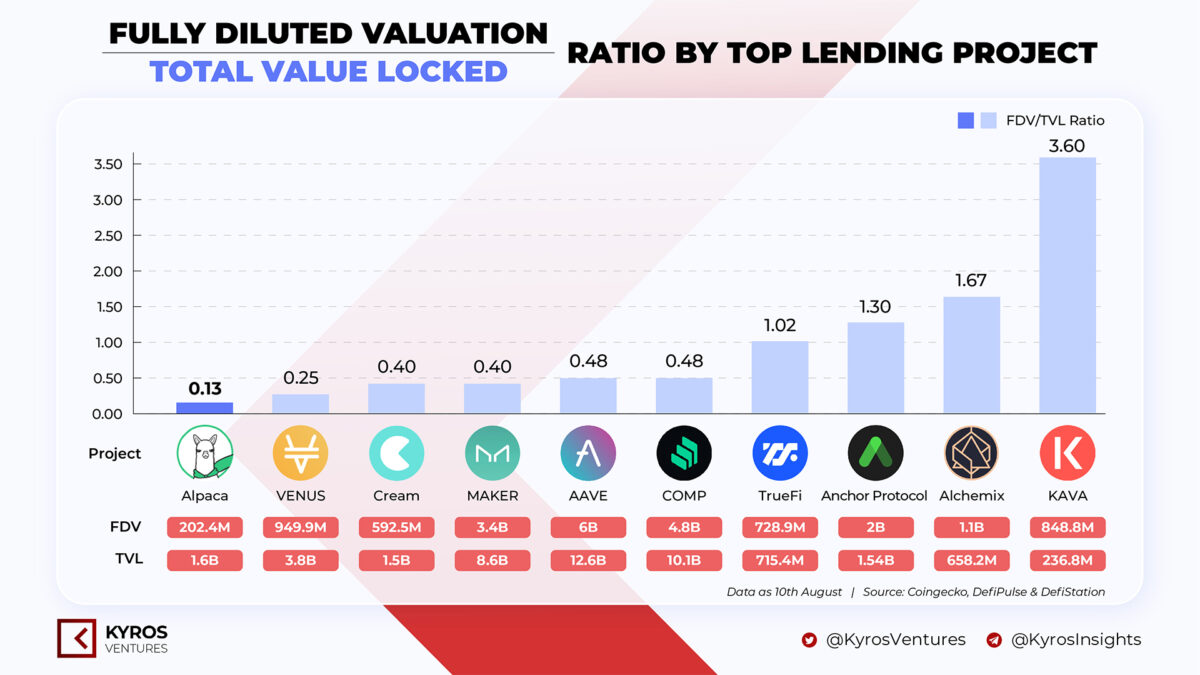

Typically to assess the likely of a DeFi task, we generally determine and think about the market place capitalization of decentralized fiscal companies towards its TLV based mostly on 3 parameters like: calculation: circulating token provide, optimum token provide as effectively as the existing rate .

To get the existing market place capitalization, it is important to multiply the existing provide by the existing rate. However, it depends on the author’s level of see that the total capitalization is entirely diluted.

Total market place capitalization = existing provide * existing rate

Inside:

- Total market place capitalization is the complete market place capitalization

- Circulating provide is the estimated complete amount of tokens in circulation

- Current rate is the existing or market place worth of the token

Calculate the TLV worth for the complete sum of blocked tokens multiplied by the market place worth of the blocked token.

Total Value Block (TLV) = Total Token Block * Current Price

The bodyweight or ratio of the market place capitalization of the DeFi support to the TLV worth. Or the TLV ratio is calculated as follows:

TLV ratio = complete market place capitalization / TLV

From a theoretical level of see, the larger the TVL Ratio, the decrease the worth of the home having said that, this is not often genuine when we seem at actuality. One of the easiest strategies to apply TVL scaling is to assist figure out if DeFi material is undervalued or overrated, and this can be finished by on the lookout at the ratio. If it is much less than one, the task is underestimated in most situations.

In an August ten examination by Kyros Ventures, the TLV report requires the complete market place worth of the underlying protocol. Based on the ratios over, Alpaca’s TVL ratio is .13 and it is feasible that the market place worth of the task is undervalued than it in fact is. And KAVA’s TLV ratio of three.six could be overestimated at the second.

Also, TLV on each and every protocol has its very own mechanism. So it depends on the dapp application. Analysts have various ratings and generally examine apps with comparable performance.

Example: One level of see is that TLV does not accurately reflect which dapp is greatest based mostly on TLV. The situation is among Uniswap and Kyber. In the Uniswap protocol, when a consumer presents liquidity for an asset pair this kind of as UNI / ETH. Due to Uniswap’s design and style, each and every liquidity pool is person, so each and every ETH provide unit can only be employed for 1 unit for a offered asset pair. While on Kyber Network or Bancor Protocol, when a consumer presents liquidity for a UNI / ETH pair, this ETH can also be employed to give liquidity for an additional asset pair, be it KNC / ETH or other comparable pairs. The explanation is the design and style of pools in Kyber or Bancor which connect and lead to an boost in the use of liquidity per unit of ETH in applications this kind of as Kyber or Bancor. Hence, in terms of efficiency, Kyber or Bancor are effective in making use of capital and have much better mechanisms.

However, because Kyber’s protocol is created to have larger slippage than Uniswap, customers even now desire to pick out Uniswap to transact. Currently, Uniswap’s TLV is more than $ six billion and Kyber’s is only $ 379 million. Therefore, TLV numbers can also be somewhat precise parameters. However, the truth that a project’s TLV worth is substantial displays substantial dependability for customers.

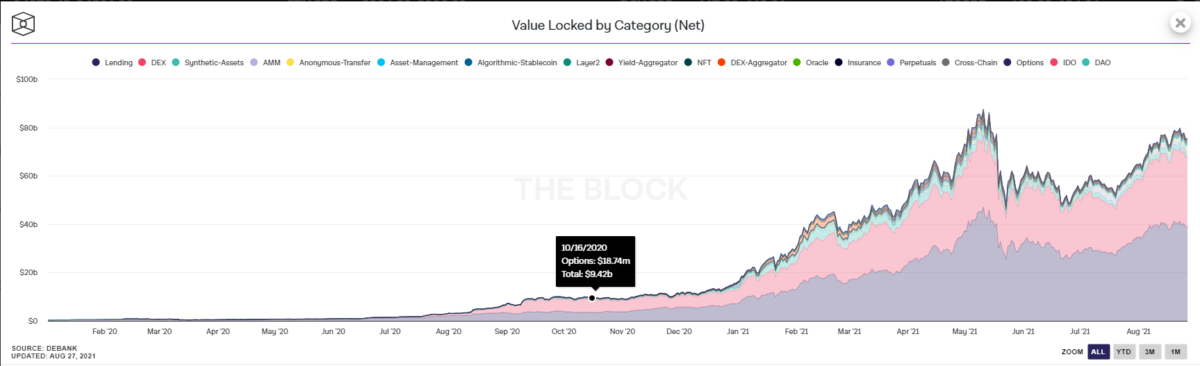

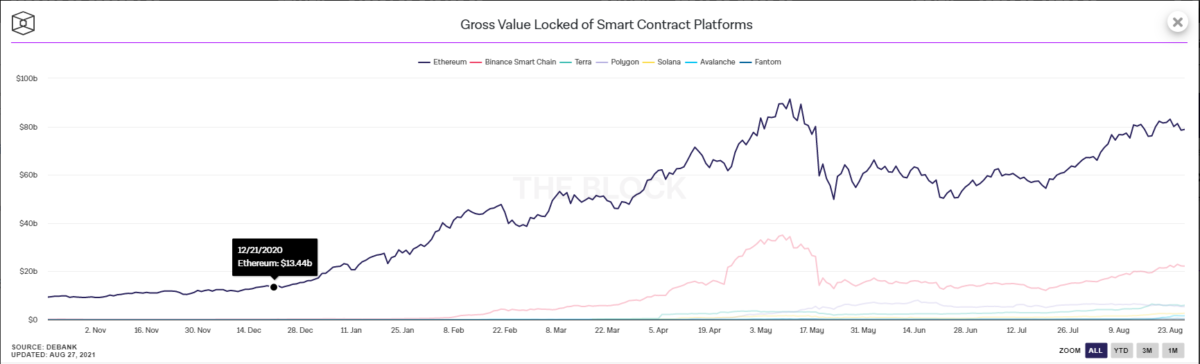

Currently, we can promptly classify TLVs into DeFi protocols this kind of as Lending, DEX, Synthetic-Asset, AMM, Payment, … and some other platforms.

The TLV purchase in the DeFi sector from prime to bottom is the loan array with the highest proportion, followed by DEX in basic, synthetic-asset (or derivative), AMM, and the rest of the protocols.

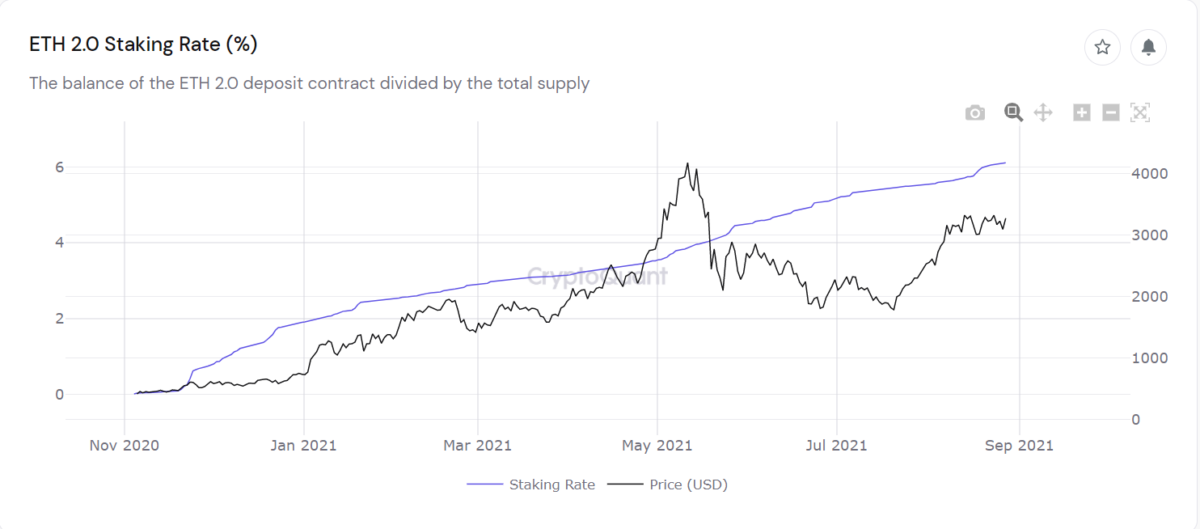

Not only TLV on DeFi, but we can also determine TLV on Proof of stake blockchain or a unique situation of Ethereum staking ETH to participate in the conversion to Ethereum two..

Distinguish among TLV on Proof of Stake Validator and TLV on dApp

As talked about over, TLV is generally referred to as the complete worth of the tokens blocked in the DeFi protocol. However, the idea of TLV is also acknowledged in blockchain networks with the Proof of Stake consensus protocol.

The summary of the Proof of Stake blockchain is as follows: in the Proof of Stake blockchain network, the Validators or operators of the Network Node are accountable for retaining the working of the network by validating transactions on the Blockchain. For the Proof of Stake network, each and every Validator is generally necessary to aim a minimal sum of native tokens of that Blockchain in purchase to commit to launch Node. It demands staking a sure sum of native tokens for safety and to steer clear of fraudulent transactions. Because when anything goes incorrect, the staked tokens locked in the good contract will be reduce or burned in accordance to the technique guidelines if fraud is detected. At the exact same time, the amount of tokens in perform is the amount of shares or votes that Validators have all through the technique when participating in the governance of the network by way of voting proposals. The reward for retaining the validation of the network will be returned to the Validator divided in accordance to the amount of shares that each and every Validator commits.

Therefore, the TLV worth displays the safety and confidentiality of the blockchain network. Or the degree of believe in customers have when they stake and delegate their tokens to Validators.

The ETH two. Staking Rate chart displays the correlation among the ETH staking worth in contrast to the complete provide. This parameter increases more than time, the existing staking charge is six which displays that most of the ETH provide is blocked. And there is some correlation with the development in the worth of ETH in accordance to the Staking Rate.

However, for some blockchains that are not still remarkably decentralized like Binance Smart Chain, the worth of TLV on the network is pretty much meaningless. Currently, Binance Smart Chain only has 21 Validators. And we generally only examine the estimated circulating provide with the complete provide.

Relationship among complete blocked worth and estimated circulation provide

When we are interested in TLV for a task, we can’t steer clear of confusion among TLV and Circulating Supply Estimate. TLV determines the complete worth of all tokens locked in that DeFi protocol. This contains the protocol’s native token and other assets locked into the protocol.

Example: when a consumer presents liquidity on Uniswap, for UNI / ETH pairs, the complete TLV contains UNI + ETH.

However, for Uniswap’s Circulating Supply, it displays the sum of UNI circulating in the market place and it is feasible for customers to carry UNI shares.

A task even though issuing tokens generally only enables a sure sum of tokens to circulate. This is to make certain a stability among provide and demand in purchase to preserve the rate of the token. Create regular development by decreasing circulating provide by burning tokens or producing Pool Farm to cut down token circulation and assist customers earn additional.

In analyzing a DeFi task, if we analyze the sum of tokens concerned in relation to the estimated circulating provide, we can effortlessly estimate the real provide that has circulated on the market place. This is the on-chain information that analysts generally pick out to recognize the accumulation or sale trend of a task.

summary

Total Value Lock (TLV) is an critical parameter that displays the user’s believe in in the task, dependent on each and every DeFi protocol, the sum of TLV displays various amounts of use. In all situations, a substantial TLV represents the likely power of liquidity, and at the exact same time the TLV also displays the degree of provide and demand in the native token market place. Each protocol will have a various rating for each and every task and the parameters are approximate mainly because the essential framework of the protocol does not reflect the tokenomic state of a task. All facts in this short article is researched by Coinlive and does not constitute investment tips. Coinlive is not accountable for any direct and indirect dangers. Good luck!