zkLend is the main lending remedy on Starknet. So what is distinctive about this venture? Let’s discover out collectively with Coinlive as a result of this write-up!

What is zkLend (ZEND)? Leading lending remedy on Starknet

What is zkLend (ZEND)? Leading lending remedy on Starknet

What is zkLend (ZEND)?

zkLend is a lending platform designed on StarkNet, Layer two with scalability, substantial transaction velocity and safety inherited from Ethereum. zkLend has two key solutions which include:

What is zkLend (ZEND)?

Features of zkLend

Loan (lend)

Users will be in a position to deposit their assets into a reserve pool, which will deliver liquidity in the currency market place. In exchange, end users will obtain a yield token identified as zToken that displays the percentage of their deposits in the pool, the curiosity they obtain. Customers can deposit any sum they want into the pool with no time limits.

Loan

Users will be in a position to use their zTokens as collateral to borrow assets on several currency markets. The curiosity price model determines the borrower’s home loan price for every single residence. The highest loan sum depends on the abilities of the borrower. If a user’s complete loans exceed the loan restrict, their collateral may perhaps be liquidated to sustain the sustainability of the protocol.

Operational standing of zkLend

Since its launch, zkLend’s TVL has enhanced steadily and has now reached $five,216 million. This remedy has offered loans to end users for a complete worth of roughly two,241 million bucks.

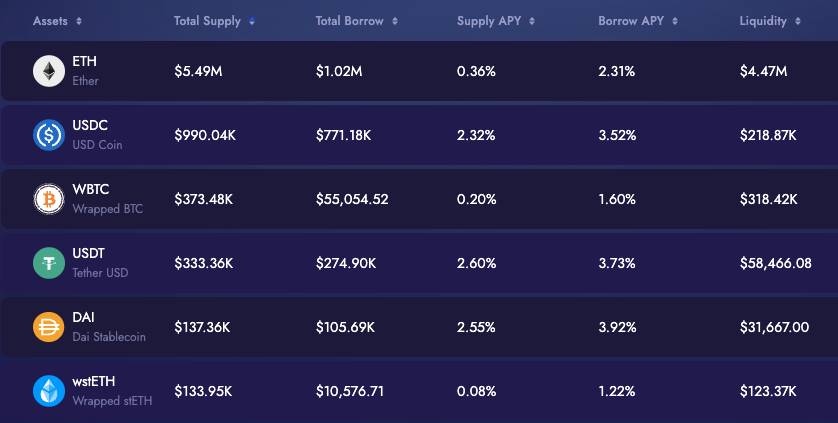

zkLend overall performance information. Source: app.zklend.com (November 13, 2023)

zkLend at the moment supports six asset forms, which include: ETH, USDC, WBTC, USDT, DAI, wstETH. Among them, ETH and USDC are the two assets that end users borrow and lend the most.

Specifications of supported asset forms on zkLend. Source: app.zklend.com (November 13, 2023)

Specifications of supported asset forms on zkLend. Source: app.zklend.com (November 13, 2023)

Basic facts about the ZEND token

|

Token title |

zkLend |

|

Ticker |

ZEND |

|

Blockchain |

Starknet |

|

Token rule |

CER-twenty |

|

To contract |

Updating… |

|

Token style |

Utility, governance |

|

Total provide |

one hundred,000,000 |

|

Circulating provide |

Updating… |

Assignment of tokens

Private and public revenue: 17%

Teams and consultants: 15%

Ecosystem 33%

Betting Yield: 35%

Token release system

Updating…

What is the ZEND token for?

Wallet to retail outlet ZEND tokens

You can retail outlet this token on the following wallets: Argent, Braavos.

Roadmap for growth

Phase three

Artemis Core Network (Q4 2023): Launch Mainnet model with further TVL options and applications.

Phase four

Apollo MVP (Q1-Q2 2024): Launch of the Apollo testnet with spouse participation.

Development group

Development group

Development group

Brian Fu: Brian is the co-founder and lead of the zkLend venture. He studied at the University of British Columbia, specializing in technical physics and small business scientific studies. He has far more than 15 many years of practical experience in classic finance, investment banking and personal equity at main monetary institutions this kind of as Bloomberg, Standard Chartered, Silk Road Finance and China Merchants Capital.

Jane Ma: Jane is the co-founder and venture manager of zkLend. She started her profession in revenue and trading at Credit Suisse ahead of joining Deliveroo in Hong Kong as Chief People Officer. She has intensive practical experience assisting startups scale their operations. Jane earned her bachelor’s degree in economics and background from Barnard College, Columbia University.

Zk Leung: Zk is the co-founder and chief engineering officer of zkLend. He is accountable for protocol growth and is based mostly in Cairo at zkLend. Zk has intensive practical experience in the blockchain business. Previously, he led several tasks in fields this kind of as: decentralized synthetic assets, CEX, DEX, and so forth. His most current contribution is “starknet-rs”, a developer instrument is a Rust consumer library for the Starknet network. Furthermore, Zk also obtained an honorary degree from the Hong Kong Polytechnic.

Emma Lee: Emma is the advertising director of zkLend. She started operating at a blockchain organization following graduating with honors from King’s College London in Politics, Philosophy and Law. To even more her abilities, she worked as a DeFi and NFT analyst at Crypto.com ahead of returning to the startup globe at zkLend.

Investors

zkLend has finished its seed funding round with up to $five million raised. This round of capital calls sees the participation of investment money and tasks this kind of as: Delphi Digital, Starkware, CMS,…

Investors

Company

The venture has partnerships with investment money and tasks this kind of as: Nethermind, ABDK, Pragma, HyperNative.

Company

summary

zkLend is the highest TVL lending protocol on Starknet. The venture has announced tokenomics but has not however launched tokens to the market place. Through this write-up, you will most likely have some essential facts about the venture to make your investment selection.

Note: The facts in this write-up should really not be regarded as investment tips. Coinlive is not accountable for any of your investment selections.