As the cryptocurrency market has grown so quick and even dizzying previously 1 yr, certainly what many traders are thinking about, particularly those that have an interest within the DeFi market, would be the article. Which math drawback would be the drawback to be solved, leading to a collection of potential tasks. Today, let’s check out a number of the present notable points, and could also be fertile floor for DeFi tasks.

Note, the article beneath is the writer’s private opinion, and shouldn’t be thought of funding recommendation. And now, let’s go to the primary drawback. Enjoy!!!

Bitcoin continues to be the “boggart” of the market

It is straightforward to see that the Bitcoin Dominance index (Bitcoin’s market capitalization charge) has at all times fluctuated round 60-70% previously 1 yr (the interval witnessed the “boom” of DeFi. dropped to 40% within the newest volatility of the market, however that is nonetheless fairly a big proportion.

In addition, the correlation index (correlation) between BTC and altcoins typically (and DeFi particularly) is commonly very excessive, about 0.7 to 0.8. The nice affect of Bitcoin is just not solely mirrored in numbers but additionally within the normal sentiment of the market, when anybody who buys altcoins is at all times nervous about Bit, as a result of when Bit falls 1, alt can crash to 10.

When the KING falls, the entire kingdom follows .#Bitcoin‘s drop in value pulls down a number of the strongest gamers within the #crypto sport as nicely, together with $ETH $XRP $LTC $BCH ONLY $ADA $DOT

As the market is slowly recovering, will $BTC be capable to pull the prepare up once more? 🙏 pic.twitter.com/sWcyCPkxR0

— Kyros Ventures (@KyrosVentures) January 12, 2021

The closest answer to this drawback is pool farms, which give liquidity with BTC pegged to an altcoin. For instance, the BTC-ETH pool farm requires customers to lock BTC and ETH. This, about principle, can assist altcoins not dump too deeply when BTC is fluctuating. When altcoins fall too deeply in opposition to BTC, the arbitrageur (one who takes benefit of arbitrage alternatives) will purchase low-cost altcoins to drop into the pool, and on the similar time create traction to assist altcoins not slide too far in opposition to BTC.

However, this answer has not but unfold, and The quantity of those swimming pools is just too low in comparison with the scale of Bitcoin. Even the very fluctuations of BTC additionally has the alternative impact psychologically additionally LPs (who present liquidity within the pool), inflicting them to hurry to withdraw liquidity and exacerbate value fluctuations.

If you compromise down, you’ll be able to lose your profession, and if the DeFi market actually desires to develop stably, it’s crucial to reduce the affect of BTC, or… anticipate that BTC doesn’t fluctuate strongly.

Cross-chain

The undeniable fact that too many blockchains develop in parallel is inadvertently creating an issue, that’s synchronization. Each blockchain could have its personal token normal, so the bridges from ecosystem A to ecosystem B are extraordinarily necessary.

This fragmentation creates for customers a really uncomfortable and inconvenient expertise when collaborating in a blockchain ecosystem.

On the blockchain undertaking facet, they want a easy gateway to draw cash, in any other case each product layer they construct within the ecosystem will go to waste. If supported by a centralized trade with the identical plentiful cash as BSC or SOL, this isn’t an issue.

For instance, if a person has USDT in TRC-20 format, transferring this quantity to CEX is not going to price a lot. From CEX, proceed to purchase BSC’s BEP20 and Solana’s SPL tokens, then switch to the DEX system of those two ecosystems. Thus, the cash withdrawal course of will likely be tremendously supported.

But with these ecosystems with out this aggressive benefit, they must be very targeted on the cross-chain array, merely to have the ability to entice cash from different ecosystems.

Security – Reputation of the undertaking

Easy to see, BSC blooms but additionally exposes a darkish facet of “decentralized”, that are rip-off tasks and lack of high quality.

The current hacks on BSC are Technical error, not a uncommon incidence or a black swan accident. You can study extra particulars by means of the articles beneath:

Therefore, the problem of status and safety of tasks, which is never talked about, has now obtained the eye of the group.

Certik can also be a undertaking that has applied an audit system for a very long time. However, evidently the final psychology of the group nonetheless doesn’t consider a lot in a undertaking labeled “audited”. Spartan Protocol was once censored by certik however was additionally hacked as soon as earlier this yr whereas performing an improve to V2.

Therefore, that is nonetheless a problem that wants extra radical options, apart from the investor group itself should always monitor and enhance their very own data.

Liquidation

When capital is concentrated in liquidity swimming pools, stake swimming pools, a bottleneck for line cash unintentionally appeared. This briefly time period is useful to the token value, as the whole circulating provide will lower. However, long run, the token is not going to carry out its important position in an ecosystem, that’s worth switch. And by not being secured by an exercise within the ecosystem (for instance, trading, trade, …), the token itself will obtain unfavourable results.

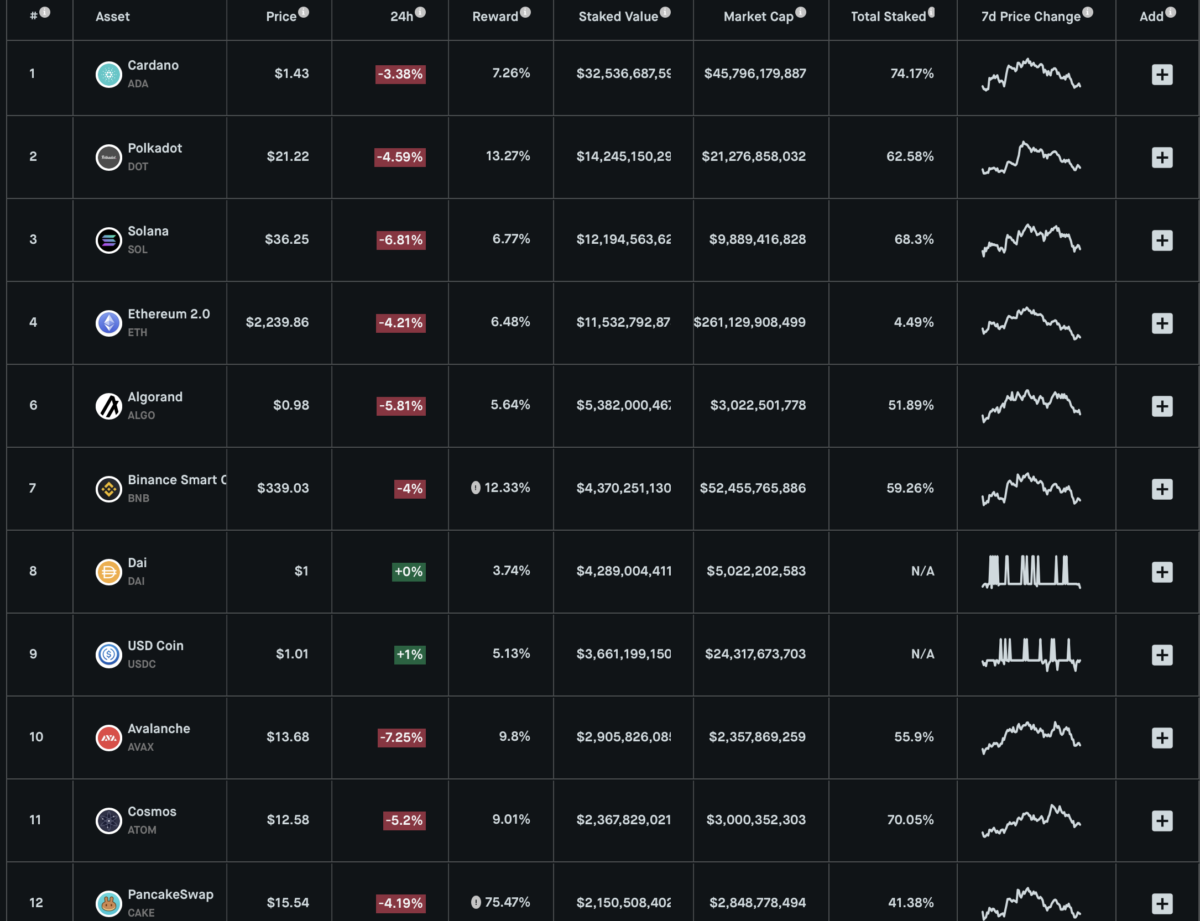

Undeniably, the truth that many tokens are staked on the network is an effective level, because it helps to make sure safety (particularly with PoS – Proof of Stake methods). However, stake worth ratio / complete market cap It’s additionally one thing to concentrate to. If a token has too excessive a stake, it exhibits little circulation within the ecosystem and is a foul signal for the long-term well being of a undertaking.

The present “Liquidization” answer has a couple of new instructions as follows:

- Valuation of LP tokens: permitting customers to mortgage LP tokens, and on the similar time generate a brand new spherical of cash making.

- Create extra curiosity paying swimming pools for LP tokens or certificates tokens with collateral (e.g. cToken, yToken, aToken,..)

- Liquidation of farming earnings: This is the course Pendle is taking, however it nonetheless wants extra time to show efficient.

If the liquidity drawback is solved, the money circulate from exterior the DeFi market could have extra impetus to pour in. Because merely, nobody desires to place capital in a spot the place the cash might be caught, not persevering with to rotate to make a revenue.

“Legalize” the demand for NFT

Personally, I see, NFT presently exists as a separate market in DeFi ecosystems. More particularly, let’s take the lending, aggregator, and Transaction – AMM arrays for instance. These arrays have a detailed relationship with one another, this product takes assets (eg liquidity, person set, ..) from different array merchandise to collectively improve the whole worth, serving to to extend the whole worth. 1 + 1 will most likely be higher than 2.

While, NFT presently being impartial as a marketplace for shopping for and promoting photos. There have been a couple of options for NFT collateral to mint stablecoins, with the intention to proceed to re-establish money circulate, nevertheless, as talked about above, these options should not full.

Another drawback is that liquidity of the NFT, when shopping for and promoting NFT will likely be very troublesome. Some tasks have proposed to fragment the NFT into small items to make it simpler to promote, however in fact its impression is just not too noticeable. Binance’s NFT Marketplace might be the answer everybody hoped for.

In addition to liquidity, will want a “cultural” push in order that NFT will likely be extra widely known, as a substitute of simply being seen as a sport of “rice and clothes” as it’s now. It also needs to be added that accumulating within the West might be thought of a tradition, a passion (in fact, this assertion is just not biased in the direction of optimistic or unfavourable), whereas within the East, NFT might be thought of is a monetary sport the place the primary comer “sells the vision” to the latter.

And this sense of mine is stronger, particularly after Binance (an trade that has a powerful affect on Asia’s fomo) joined the NFT sport.

Ending

The above 5 points are my private views on the DeFi market. Hopefully the above article offers you a unique and extra fascinating perspective on the present DeFi market.

Note, this text is for informational functions solely and is the writer’s private opinion. All of the above shouldn’t be thought of funding recommendation.

Synthetic

Maybe you have an interest: