Bitcoin had a robust begin to 2021, peaking close to $65,000 in April, however has since misplaced about 47% of its all-time excessive. The world’s hottest cryptocurrency is dealing with nice dangers.

While backers seem like persevering with to carry onto Bitcoin, different traders are cautious of the extreme volatility available in the market and anxious concerning the threat to their portfolios.

CNBC has compiled 5 of the most important dangers dealing with the world’s largest cryptocurrency as we enter the second half of 2021.

Strict laws

One of the highest dangers dealing with Bitcoin proper now’s regulation.

In current weeks, China has stepped up its crackdown on the crypto trade. The authorities shut down energy-intensive cryptocurrency mining operations and requested banks and fee firms like Alipay to not present digital forex providers.

Last week, the crackdown on the cryptocurrency market unfold to the UK. British authorities have banned the world’s largest cryptocurrency change Binance from working throughout the nation’s territory, in accordance with CNBC.

Simon Yu, CEO of cryptocurrency startup StormX, mentioned traders ought to see China’s transfer as a “positive” for bitcoin and different cash like ethereum, because the market will turn out to be more and more decentralized. .

However, Mr. Yu warned that if the administration of President Joe Biden tightened regulation an excessive amount of, massive issues might come up. “The US has too many agencies that can regulate cryptocurrencies from many angles. Bitcoin could be a security threat, or it could be a commodity, or an asset class in the US,” Yu defined.

“Currently, the US government has not found a way to properly control the virtual currency market, which may hinder the virtual currency business in the future,” Yu mentioned.

Recently, US Treasury Secretary Janet Yellen and different officers have warned that digital currencies are getting used for unlawful transactions.

Last 12 months, the administration of former President Donald Trump proposed an anti-money laundering regulation, requiring traders holding bitcoins in digital wallets to confirm their identities in the event that they make transactions of $3,000 or extra.

Bitcoin Volatility

Another threat is that the value of bitcoin and different digital currencies is commonly unstable and extended.

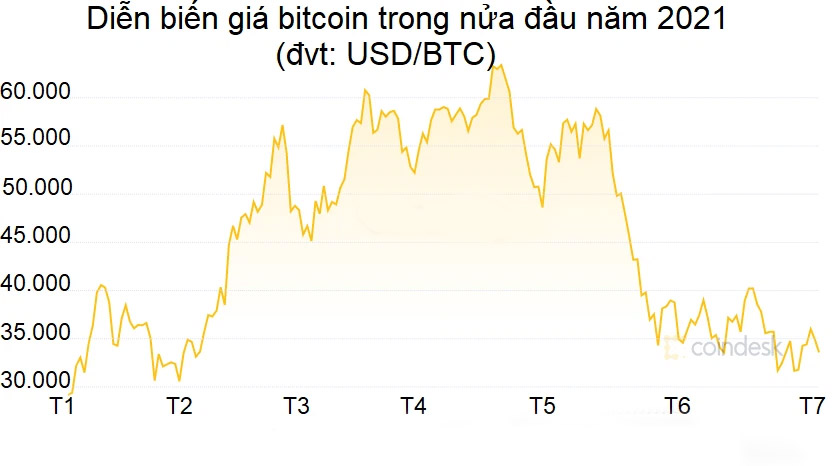

In April of this 12 months, the bitcoin worth hit an all-time excessive of round $64,829 per BTC on the day the cryptocurrency change Coinbase launched on Nasdaq.

After that, the value of the world’s largest digital forex plunged to $28,911/BTC on the finish of June, virtually the entire good points this 12 months evaporated. Currently, the bitcoin worth is again above $34,000/BTC.

Pro-bitcoin traders see the coin as digital gold, a protected haven in occasions of financial uncertainty. However, whereas volatility could be useful when the value of an asset goes up, bitcoin’s volatility is bidirectional.

UBS financial institution notes: “Limited supply of cryptocurrencies can increase volatility. Bitcoin has not been widely used in real life and the price fluctuates wildly, both of which show that many people are speculating to make a profit.”

While bitcoin’s continued volatility could frustrate some, CFO Ross Middleton of decentralized finance platform DeversiFi thinks that this specificity in itself might enchantment to institutional traders. market share.

Speaking to CNBC, Mr Middleton mentioned: “Volatilization can actually be an attraction, as a result of with bitcoin’s potential for large worth volatility, funds could make a revenue in the event that they make investments available in the market with an allocation. small capital relative to the general portfolio measurement.

Environmental considerations môi

Questions surrounding bitcoin’s affect on the atmosphere might be one other headwind for the digital forex.

Buffalo plow requires a number of power to function. In parallel with the value motion, the power consumption of bitcoin has elevated considerably over time. Critics have lengthy warned about bitcoin’s large carbon footprint, however Tesla CEO Elon Musk was the closest to bringing the matter to mild.

Earlier this 12 months, Musk’s electrical automobile firm surprised the market when it introduced a $1.5 billion funding in bitcoin and began accepting funds within the digital forex. However, then Elon Musk shook the market when he reversed his earlier resolution attributable to considerations concerning the affect of bitcoin mining on the atmosphere.

According to CNBC, the environmental affect of bitcoin places asset managers in a troublesome place, as public stress grows to power them to chorus from investing in ethically dangerous property.

Stablecoins below surveillance

Stablecoins are additionally dealing with growing scrutiny from regulators. Stablecoins are fixed-price digital currencies which might be pegged to real-world property just like the US greenback.

Last week, Eric Rosengren, Chairman of the US Federal Reserve (Fed) Boston department, mentioned that tether, the stablecoin among the many world’s largest digital currencies, is a threat to stability. of the monetary system.

Investors usually use tether to purchase different cryptocurrencies as an alternative choice to the buck. However, some are involved that the issuer of tether doesn’t have sufficient USD reserves to take care of the USD peg mechanism of the digital forex.

Back in May, the corporate behind tether launched its monetary statements. About 76% of the corporate’s reserves are money and money equivalents, however lower than 4% are precise money, whereas about 65% are business paper (a type of short-term debt).

Critics have lengthy been involved that tether is getting used to control the bitcoin worth. In 2018, analysis by professor John Griffin (University of Texas) and colleagues confirmed that tether was used to inflate the value of bitcoin because the world’s largest digital forex fell amid the frenzy of 2017.

“Meme coins” and scams

The rampant hypothesis within the cryptocurrency market might be one other threat for bitcoin.

Dogecoin, the “Shiba Inu” digital forex that was created as a joke, skyrocketed earlier this 12 months, repeatedly hitting new information, as increasingly more retail traders flocked to it. digital property to make massive earnings.

At one level, dogecoin’s market cap was greater than that of Ford and different main US firms, thanks partly to Elon Musk’s tweet storms. However, the digital forex has misplaced a number of worth since then.

“The risk is that scams and scams appear more and more throughout the past year. In certain coin memes, we have seen a lot of price pumping and dumping causing retail investors to suffer great losses,” mentioned Mr. Yu of StormX.

“Whenever retail investors are harmed, the government steps in. If things are regulated too strictly, the virtual currency industry may be negatively affected,” Yu emphasised.

Maybe you have an interest:

Join our channel to replace essentially the most helpful information and information at:

According to Vietnambiz

Compiled by ToiYeuBitcoin

.