If you browse Twitter currently, you will possible see the Synthetix key phrase and SNX token seem dense. So what is going on? Why has Synthetix attracted so a great deal consideration from the DeFi local community?

Bull-situation for Synthetix

In the context of cryptocurrencies going by really complicated instances, even the DeFi section no longer receives the similar consideration as in 2020, 2021. But not for this, high-quality tasks, builder halt creating your very own protocol.

“The results speak for themselves”. Today, the cryptocurrency local community has viewed an amazing milestone from 1 of the key tasks in the DeFi area: Synthetix Network (SNX).

Notably, the Synthetix protocol was at first acknowledged one million bucks charge paid to SNX stakers on June 19, 2022.

According to information from CryptoFees.informationSynthetix is currently the 3rd DeFi undertaking in terms of complete compensation in one day.

That is, consumers have basically made use of, traded, traded on Synthetix numerous instances to get this kind of a commission, proving that this is an significant and handy DeFi undertaking.

Currently Synthetix is behind only two pretty renowned tasks in the area, Uniswap and Ethereum, which rise over the AAVE protocol.

Just one day earlier, the undertaking itself enthusiastically published its exceptional parameters:

$ SNX stakers get roughly $ 300-500,000 per day in commissions from transactions flowing by our ecosystem:@kwenta_io – Futures and Spots@CurveFinance – Atomic Marshes@ 1 inch – Atomic Marshes@lirafinanza – Options@PolynomialFi – Options

Bull or bear ️

Thank you @CryptoFeesInfo pic.twitter.com/ATqi3XhTRg

– Synthetix ⚔️ (✨🔴_🔴✨) (@syntetix_io) June 18, 2022

“SNX stakers get $ 300,000 – $ 500,000 a day. Here is the volume of the commission of the transactions that circulate in our ecosystem:

– Trade Spot and Futures on Kwenta

– Atomic Swap on Curve and one inch

– Trading possibilities on Lyra Finance and Polynomial Protocol

Do you consider Taurus or Bear is this?

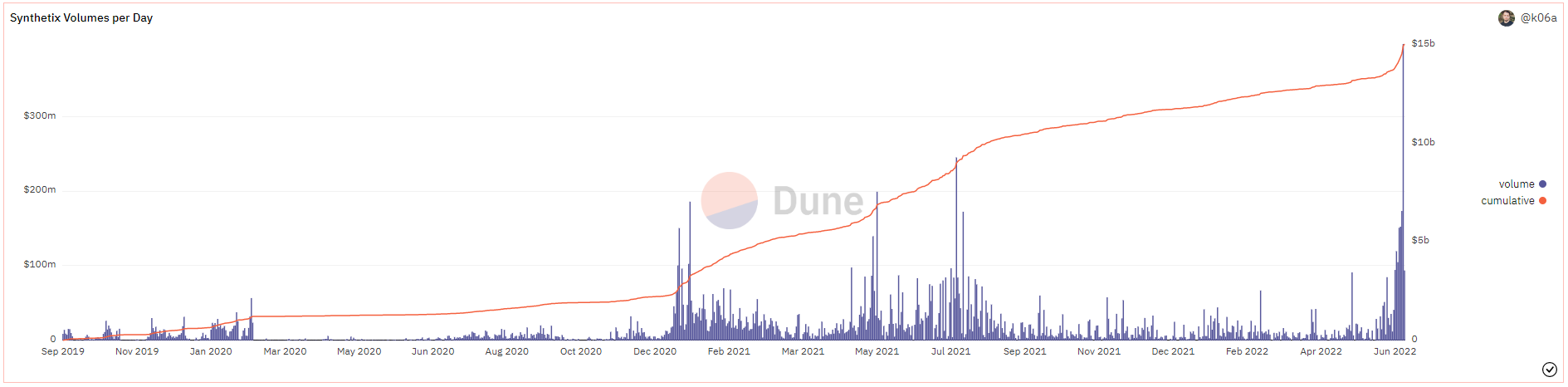

The trading volume of SNX has also grown tremendously in the previous couple of days, now sustaining a larger volume one hundred million bucks/day.

Is SNX going to have a brief compression?

With the beneficial metrics, and the reality that KOL Twitter is fairly FOMO, it is understandable that the SNX token rate begins pump loud.

As of Coinlive press time, SNX’s rate has risen 77% in the previous 24 hrs, peaking at $ three,395 on Binance.

Obviously, when the rate rises also strongly, numerous traders opt for to “take short” in anticipation of the rate starting up to reverse.

According to the information obtained, there are up to 18 million SNX tokens in brief positions on exchanges, along with SNX funding charges are all damaging, exhibiting that the quantity of brief positions is a great deal larger than it is extended.

And far more notably, there are now only all around twenty million liquid SNX tokens on exchanges.

15m $ snx now it truly is brief.

there are only 20m on switches

this point could finish up in dust up to $ ten +$ sirino / $ unfi type pic.twitter.com/b0LM8zs5x5– napgener 0xDONE (@napgener) June 20, 2022

“15 million SNX tokens are in a brief place.

Meanwhile, there are only twenty million tokens on the exchange.

This will most possible push SNX’s rate to all around USD ten, as was the situation with SIRIN, UNFI earlier. “

With only about two million SNX tokens left on the exchange, orderbook, even though funding charges are so damaging, in accordance to veteran analysts, it truly is possible brief squeeze to occur.

At that time, the SNX rate continued to have sudden green candles, foremost to the liquidation of a series of brief orders.

Giovanna

Maybe you are interested: