The dedication resulting from the advancement team’s indicators and their contribution to the venture is an particularly crucial aspect to contemplate for traders ahead of providing the very best overview of the system on its investment.

The self confidence degree of the large boys

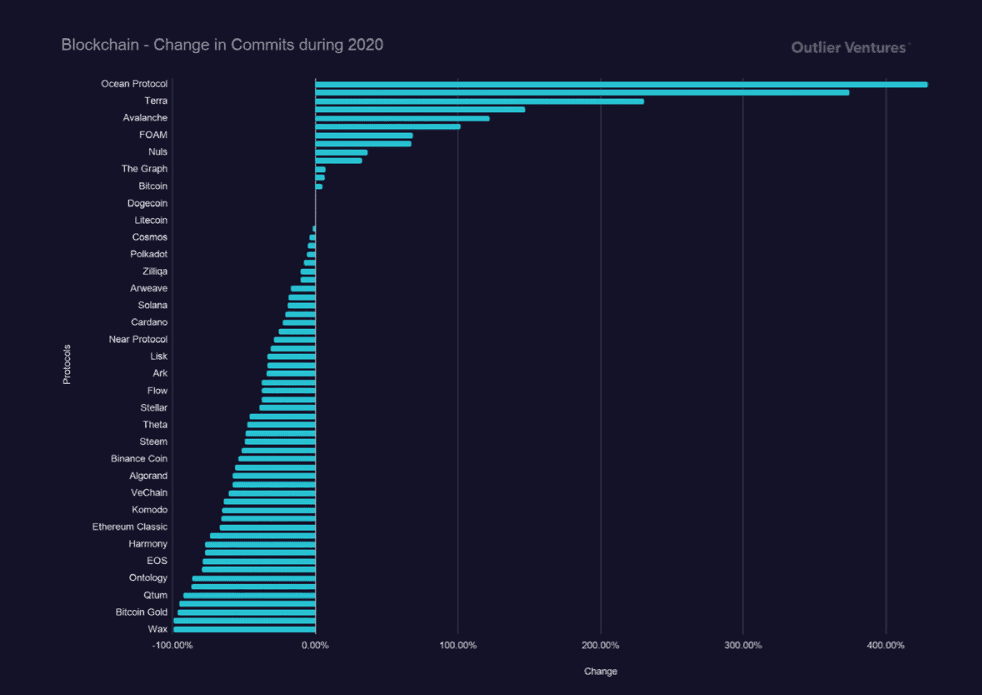

The month to month modify of lively commits and developers for the yr is calculated by averaging the calculated commits for the very first and final two months of the yr and calculating their percentage modify.

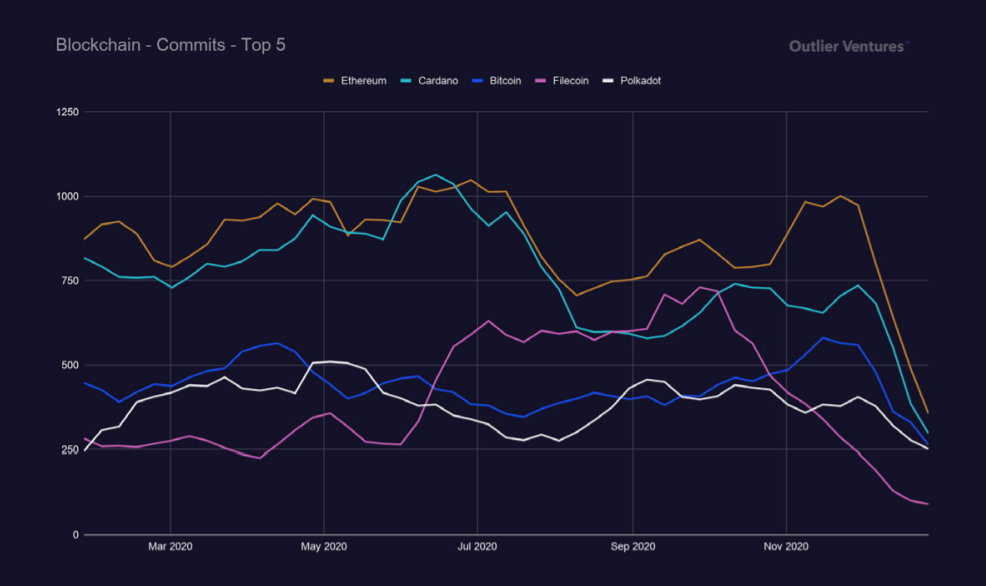

Outlier’s newest Blockchain Development Trends Report, which analyzes the major 50 blockchains primarily based on their industry worth of native assets from July 2020 to June 2021, displays that the protocols are underneath lively advancement, the most severe currently being Ethereum and Cardano, with committed weekly averages of 866 and 761.

Meanwhile, following up are many well-known names like Bitcoin (441), Filecoin (405), and Polkadot (385) which rounded out the major five at all around 50% of Ethereum and Cardano.

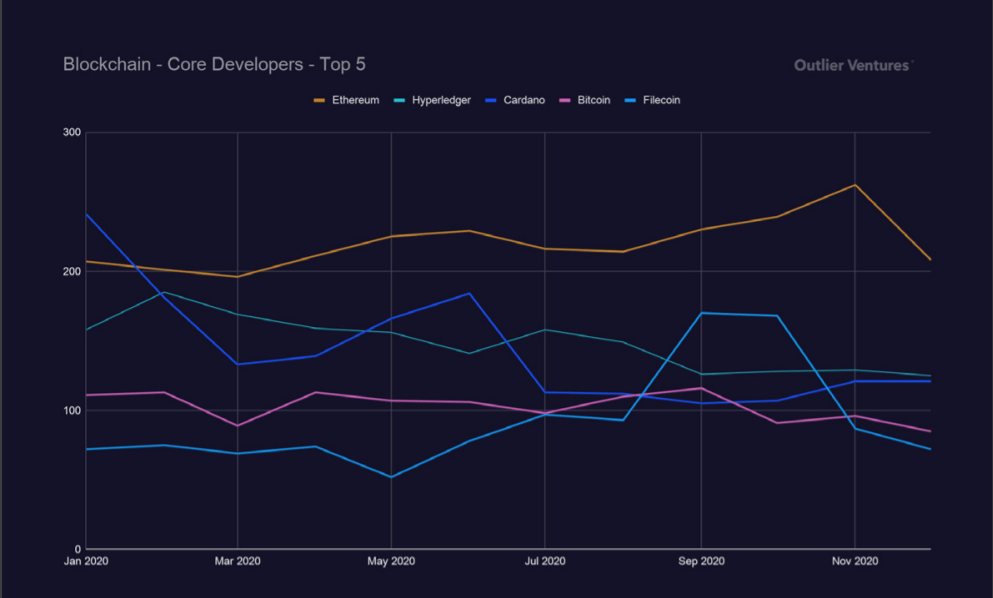

Looking at month to month lively developers, Ethereum prospects with 220 over normal month to month lively core developers, followed by Hyperledger (149), Cardano (144), Bitcoin (103) and Filecoin (92). ).

Impressive pace of new faces

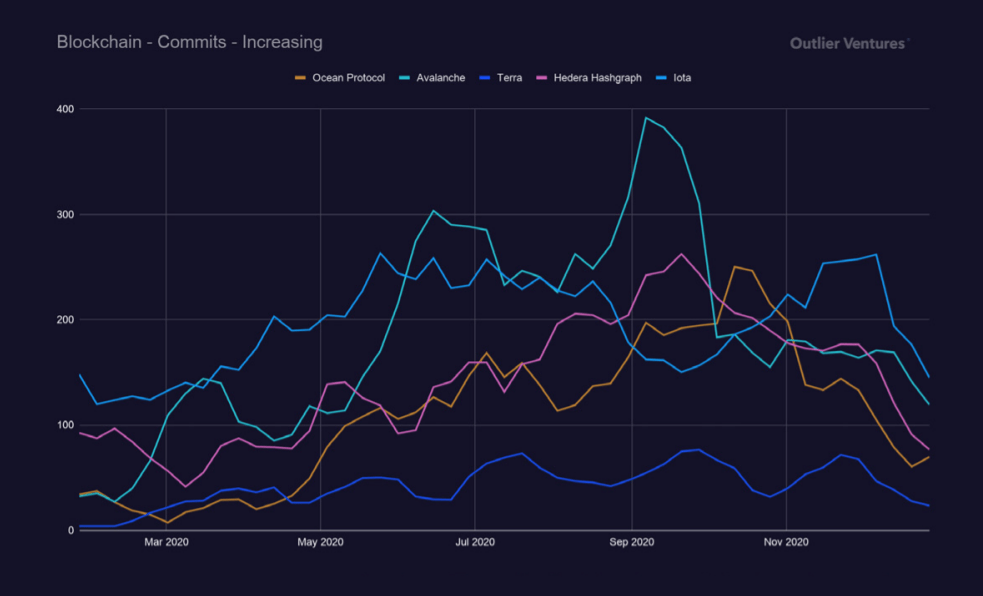

In addition to veteran names, new protocols this kind of as Avalanche (AVAX), Oceanic Protocol (OCEAN) And Earth (MOON) has noticed substantial effects in core advancement. Avalanche’s commitments quadrupled by the finish of the yr, even greater than they peaked all around mid-September 2020, presumably in planning for their release to the principal network on 21 September.

– See extra: three factors that pushed the value of Avalanche (AVAX) to rise by 200% in the final thirty days

Terra noticed a almost five-fold boost in engagement in excess of the very same quantity of time, very likely due to the improve of the public core network, Columbus-four in early October, and the Houston advancement framework for CosmWasm wise contracts at the finish. September. .

– See extra: What is the cause why Terra (LUNA) delayed the Columbus-five update? – What influence does this determination have?

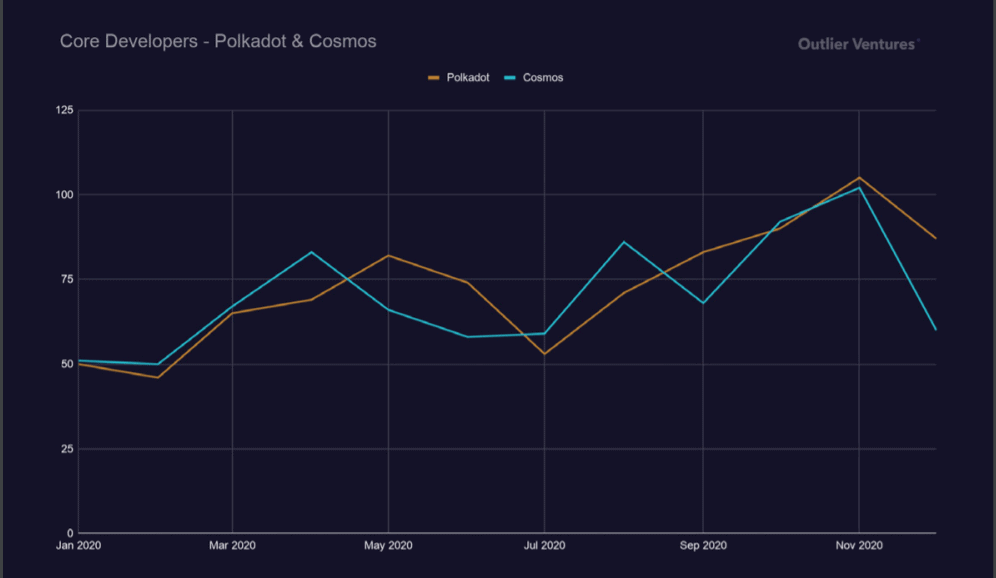

On major of that, Polkadot (DOT) and Cosmos (ATOM) noticed a relatively related pattern in the developer contribution count, with Polkadot doubling the variety of month to month lively core developers and Cosmos expanding by 60%.

The value action development of the two platforms is gradually taking form at the second. Cosmos (ATOM) tripled “silently” in the 2nd half of August. Given the correlation among contributing information and accessible momentum, it is very very likely that Polkadot (DOT) will carry on to turn out to be the target of the cryptocurrency industry in the fourth quarter of 2021.

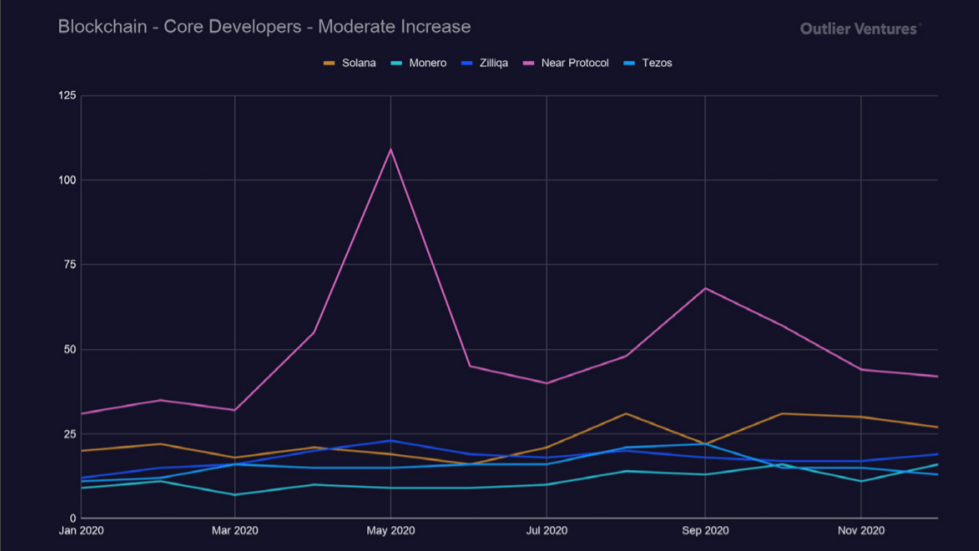

At the very same time, Solana (36%), Monero (35%), Zilliqa (33%), Tezos (thirty%) and Near Protocol (22%) noticed a substantial boost in developer contributions. Close to recorded a rather sturdy information spike all around the core network launched at the finish of April 2020, which had a large influence on NEAR’s recent effects, as the platform rallied strongly and established ATH ahead of the collapse of the complete cryptocurrency industry. a handful of days in the past.

What does DeFi display?

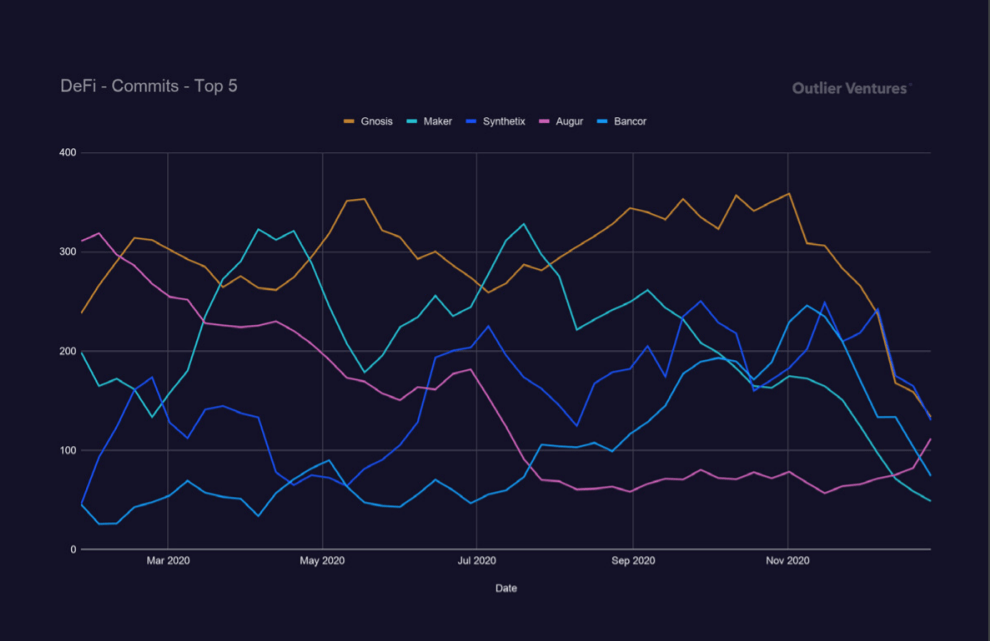

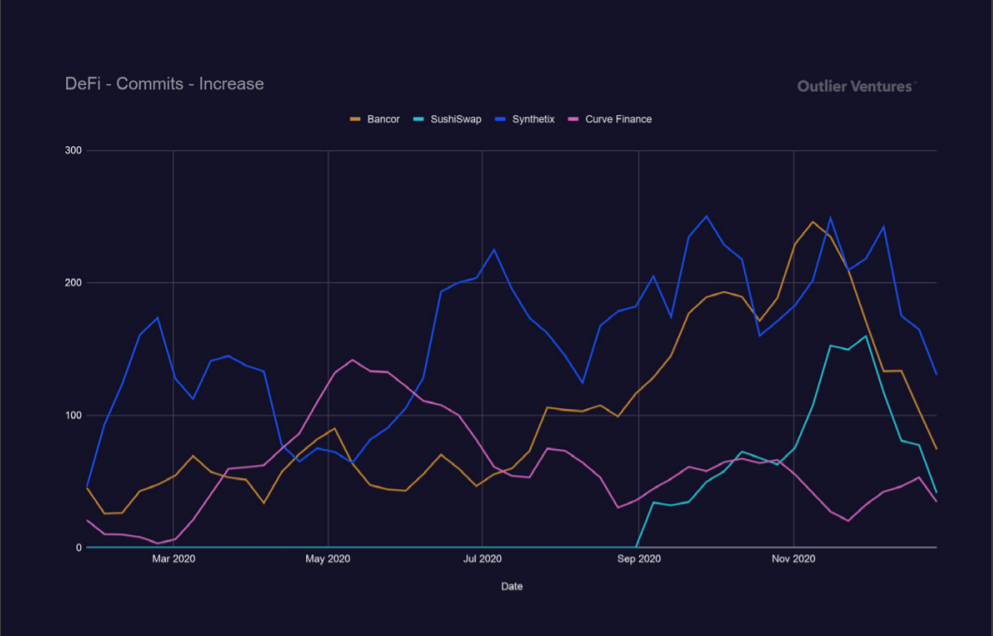

On the DeFi front, the most lively tasks in this area in terms of engagement are Gnosis, Maker, Synthetix, Augur and Bancor. Of these, Gnosis displays the highest degree of advancement and is the most secure in operation with an normal of 276 commits per week, even though Synthetix has the highest development, with a 58% boost in weekly commits. Notably, all of these tasks had been launched in 2018 or earlier.

Some of the extra current tasks that manufactured a good deal of information in 2020 this kind of as Yearn Finance (YFI), SushiSwap (SUSHI) and Curve Finance (CRV) have a superior degree of core advancement action, but have not nevertheless proved viable. – Term tolerance for local community advancement or action is not sturdy sufficient.

However, in terms of the largest boost in engagement of the yr, it was the very well-identified faces Aave (763%), Bancor (264%), Set Protocol (161%) and mStable (153%). SushiSwap and yearn.finance, the two tasks launched in 2020, also showed substantial development, followed by Curve Finance, PieDAO and Synthetix.

summary

Ethereum with a complete of 42457 commits, stays the most actively designed blockchain protocol, followed by Cardano (37327) and Bitcoin (21614). Polkadot (DOT) and Cosmos (ATOM) with a complete of 18879 and 17854 commits are progressively proving their place to not get as well far behind in advancement.

Synthetic currency 68

Maybe you are interested: