2022 is the 12 months that noticed a series of occasions that shook the cryptocurrency industry. However, the root of it all can be traced back to Do Kwon, a controversial title that comes from Sam Bankman-Fried. Through the short article beneath, Coinlive will deliver an overview of Do Kwon and the influence this character leaves on the cryptocurrency market.

Who is Do Kwon?

Do Kwon, also identified as Kwon Do-Hyung, is the founder and CEO of Terraform Labs, a blockchain improvement corporation primarily based in Singapore. Previously, he was acknowledged as a leader in the cryptocurrency industry with the to start with algorithmic stablecoin model.

However, the fall of Earth and its algorithmic stablecoin TerraUSD, have manufactured Kwon a pariah and he is now needed by South Korean companies.

Biography of the “stablecoin” man.

Life and schooling

Do Kwon was born in Seoul, South Korea on September six, 1991. He studied at Daewon Foreign Language High School in Seoul. After earning a bachelor’s degree in pc science from Stanford University in 2015, he temporarily worked as a computer software engineer for each Microsoft and Apple.

Starting a business enterprise

In January 2016, Do Kwon made a decision to return to Korea to commence creating and identified his very own startup, identified as Anyfi. In the to start with phase, the corporation obtained a government grant really worth around $600,000.

However, an investigation by South Korea’s Ministry of Small, Medium Enterprises and Start-ups unveiled that Do Kwon’s Anyfi corporation scored minimal in evaluation reviews and had 5 circumstances of misuse of financing for the goal appropriate relating to personnel prices. This sum was subsequently returned to the Ministry of Small, Medium Enterprises and Startups.

Entering the cryptocurrency market

In 2018, Do Kwon and Daniel Shin founded Terraform Labs Pte. Ltd. Subsequently, Terraform Labs issued the LUNA token.

In 2020, Terraform Labs continued to release its stablecoin, TerraUSD (UST). Earth Ecosystem has secure improvement routines and is mentioned to make a versatile financial policy along with an helpful fiscal policy to restrict the inflation of the UST stablecoin by applying LUNA’s provide-linked algorithm to preserve the worth of one UST = one USD. Thanks to this, LUNA’s worth then reached USD 116 in April 2022 and aided Do Kwon turn into a cryptocurrency industry billionaire.

During his time at Terraform Labs, Do Kwon was also concerned in several blockchain tasks, which include Mirror protocolPrisma, Astroport e Anchoring protocol.

Do Kwon’s journey to turning into a billionaire

Project Terra has been a substantial good results, attracting two.five million end users and $150 million in funding from traders this kind of as Arrington Capital, Pantera Capital and Galaxy Digital.

In August 2018, Do Kwon’s Terra undertaking effectively raised $32 million to construct a “modern financial system on blockchain.” At the time the corporation was also supported by four of the six biggest cryptocurrency exchanges in the globe: Binance, OKXCooperativa (formerly Huobi) and Upbit.

However, this good results was not sufficient to satisfy Do Kwon. He needs to broaden the scope of the project’s routines, not just focusing on a single merchandise but creating an financial method with numerous diverse corporations and tasks. “I want to further expand the reach,” Do Kwon mentioned.

This ambition motivated Do Kwon to make the UST stablecoin, developed on the Terra ecosystem technologies platform. UST is anticipated to deliver a much better encounter, overcoming the weaknesses that other stablecoins are dealing with.

However, the street ahead is not constantly smooth. Unlike other stablecoins backed by actual revenue, Do Kwon’s UST is identified as an algorithmic stablecoin as it employs LUNA tokens to preserve a secure exchange charge. This has brought about a lot controversy and concern.

As the LUNA-UST token has turn into common, the objections have turn into more powerful. The founder of stablecoin issuer Paxos, Charles Cascarilla, has expressed doubts about this algorithmic technologies in the previous, but Do Kwon responded sarcastically. Kevin Zhou, hedge fund manager at Galois Capital, has repeatedly predicted the collapse of these two tokens.

However, in contrast to this kind of opposition, the price tag of LUNA continues to develop strongly, reaching a peak of USD 116 in 2022 and dispelling any doubts about the operating mechanism of LUNA-UST.

Thanks to these occasions the track record of “Do Quan” grew to become far more sensational, all the lights of fame shone on him. VBy then, at age thirty, his net really worth had reached $four billion. This helps make him 1 of the most critical figures in the blockchain market.

However, a sudden decline occurred in Do Kwon’s fortune just a month later on when Terra went into crisis and this tumultuous occasion drastically lowered his net really worth. Despite this, Do Kwon nevertheless holds a huge sum of crypto assets.

“Underground Adventure” by Do Kwon and Terra (LUNA)

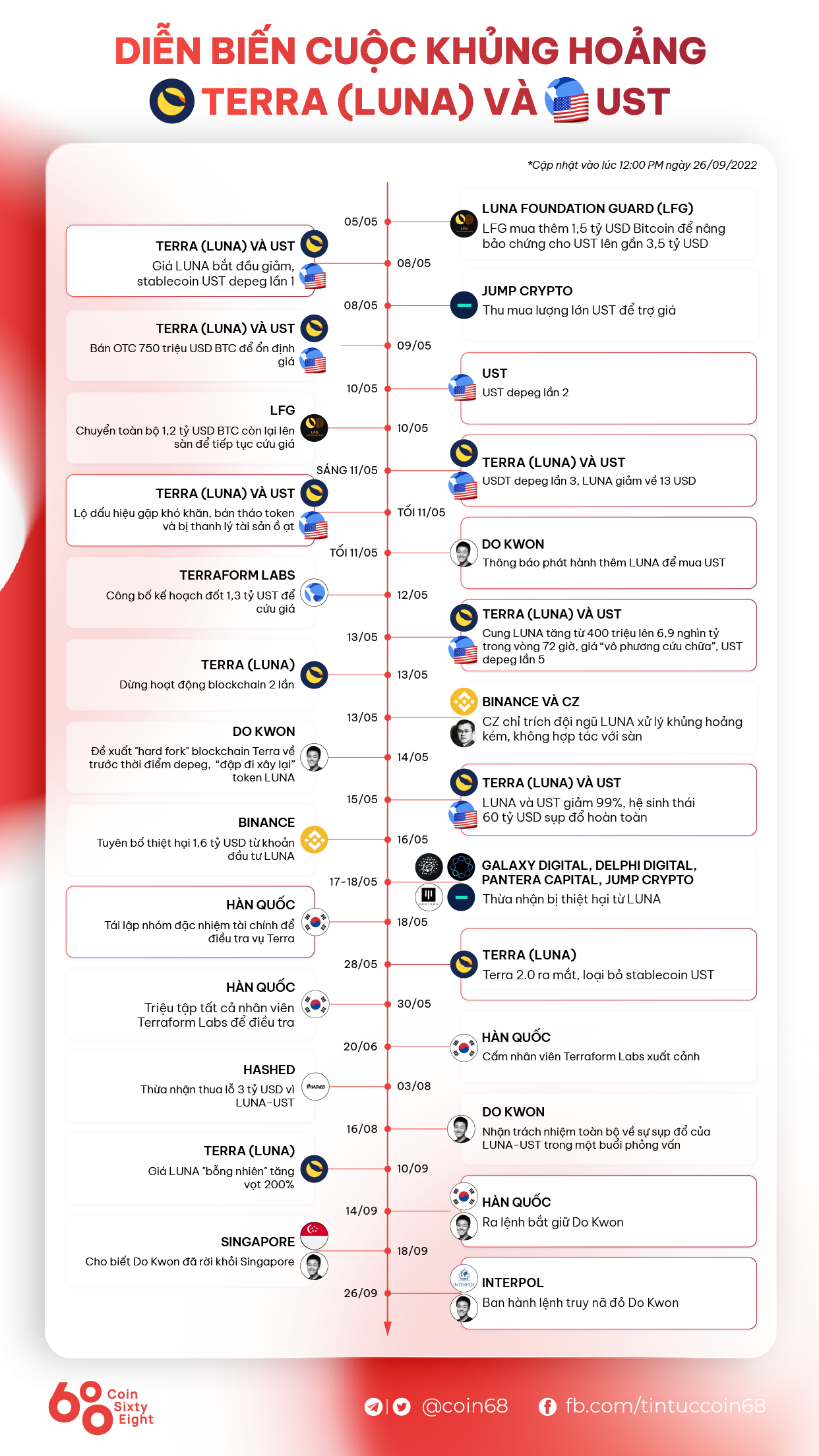

The Terra (LUNA) and UST crisis occurred in a quick time period of time from May eight, 2022 to May 14, 2022 and brought about billions of bucks in losses to the cryptocurrency industry. The influence of this collapse has not only spread to cryptocurrencies, but has also prompted the SEC to emphasis far more awareness on this industry.

Developments in the Earth crisis

The occasion unfolds as follows:

On May five, 2022, LUNA Foundation Guard (LFG) obtained an extra $one.five billion in Bitcoin to safe UST up to practically $three.five billion.

On May eight, 2022, LUNA price tag decreased and UST was “depegged” for the to start with time. Jump Crypto purchases a huge sum of UST to help the price tag.

On May 9, 2022, LFG had to promote $750 million in Bitcoin to stabilize the price tag.

On May ten, 2022, the FSO broke away for the 2nd time. The scenario received worse, LFG poured all the remaining $one.two billion really worth of Bitcoin into the exchange to conserve the price tag.

On the morning of May eleven, 2022, right after the third depeg of the UST, the price tag of LUNA fell to 13 USD. In the evening of the identical day, UST fell for the fourth time, the LUNA price tag fell to $.68. Do Kwon announced the issuance of extra LUNA to invest in UST.

On May twelve, 2022, Terraform Labs announced a system to burn up one.three billion UST to conserve on stablecoin rates.

On May 13, 2022, due to the issuance of extra tokens, LUNA’s provide improved from 400 million to six.9 trillion in 72 hrs, the price tag was “irreparable”, UST depeg for the fifth time. Furthermore, the Terra blockchain had to cease working twice for worry of remaining attacked.

On May 15, 2022, LUNA and UST rates fell 99%, the $60 billion ecosystem absolutely collapsed.

Large organizations like Binance, Galaxy Digital, Delphi Digital, Pantera Capital, Jump Crypto also suffered losses in this occasion. It also brought about a prolonged “liquidity crisis” in the cryptocurrency industry.

You can read through far more right here: Summary of LUNA-UST developments, the journey to “inflate” Earth two., and the controversy surrounding Do Kwon

Cause of the collapse

LUNA (LUNA) collapsed due to a couple of key causes, and 1 of the most critical causes was a flaw in the burning mechanism of the mint.

UST mechanism for burning mint: LUNA employs a mint burning mechanism to preserve the worth of the UST stablecoin. When the price tag of UST exceeds one USD, the method will burn up a corresponding sum of LUNA to emit far more UST, minimizing the price tag of UST to nearly one USD. Similarly, when the UST price tag is beneath $one, end users can trade UST to get LUNA back, generating strain for the UST price tag to rise to $one. However there is a flaw in this mechanism:

- LUNA is applied to mint UST: If LUNA is applied to mint numerous USTs, particularly when the price tag of LUNA rises sharply, end users have an incentive to use LUNA to mint USTs and promote them, generating strain to raise the price tag of LUNA and reduce the price tag of UST. This could lead to LUNA remaining applied as a monetary instrument, rather than to help the FSO.’

- Pressure produces UST constantly: Terra System constantly generates UST to meet the demand for deposits in the Anchor protocol and other yield farming companies. This has improved the sum of UST in the method, but there are not sufficient reputable sources to promise the worth of the UST.

- Integrate diverse sources and dangers: LUNA has integrated numerous assets into its method, which include LUNA, BTC, and ETH. Fluctuations in the worth of these assets can make several dangers to the method and destabilize the UST.

- Possibility of death spiral: If the industry collapses and LUNA and UST rates fall concurrently, a scenario identified as the cycle of death may perhaps take place. Users can invest in LUNA to mint UST, but when they promote UST in exchange for LUNA, the price tag of LUNA drops even more, generating a cycle of uncontrolled price tag reduction.

Defects in the mint combustion mechanism and the probability of risky circumstances contributed to the downfall of LUNA (LUNA) and UST. It has brought about reduction of believe in in the neighborhood and led to severe detrimental impacts in the cryptocurrency industry.

You can read through far more right here: five queries about Terra (LUNA) and the UST stablecoin that the writer also requirements solutions to

Effects of the collapse of the Earth

Without stopping there, LUNA-UST also triggered a “liquidity crisis” that spread across the industry, lasting right up until the last months of 2022. You can see far more about the evolution of this crisis in the photograph beneath.

Evolutions of the “liquidity crisis” in the cryptocurrency industry

You can see far more right here: The influence and injury that the Terra (LUNA) – UST “disaster” has left on the cryptocurrency sector

Do Kwon’s present scenario

On March 23, 2023, right after a lengthy time on the run, Montenegrin customs arrested Do Kwon for applying a fake passport. Police also identified numerous other fake paperwork which include a Belgian passport. The cause why the Terraform Labs founder had to impersonate himself to relocate was since his passport had been canceled by Korea in September of the earlier 12 months.

Since his arrest, Do Kwon has been charged by US officials and is now fighting his extradition to stand trial. However he is nevertheless detained in …