If the League of Legends game has a Baron Nashor with far more than six,400 well being factors, the economic industry also has a Ron Baron with assets of above five billion bucks. Not only that, the investment fund he founded and managed has beaten the Nasdaq for 15 consecutive many years, so assisting numerous traders get wealthy speedily. So who is Ron Baron? Let’s locate out with Coinlive by the report under.

Who is Ron Barone? Biography of the fund manager who beat the Nasdaq for 15 consecutive many years

Who is Ron Barone?

Ronald Stephen Baron (born 1943) is an American mutual fund manager and investor. He is the founder of Baron Capital, an investment management company primarily based in New York City. This enterprise was generally made by Ron Baron to control around $45 billion in Baron fund assets. As of November 2022, Ron Baron’s complete assets are really worth around $five billion and is continuously rising thanks to the shares he holds.

Baron grew up in Asbury Park, New Jersey, in a Jewish loved ones the two of his mothers and fathers have been ordinary staff and did not have considerably knowledge in the company globe. After attending school, Ron Baron majored in chemistry at Bucknell University and concurrently earned a double law degree at George Washington University.

Portrait of Ron Barone

During his time at university, Ron Baron started investing in the stock industry with capital earned by guide labor that all college students did at the time, this kind of as shoveling snow, waiting tables, operating as a lifeguard on the seaside and promoting ice cream. . And thankfully, with only a smaller capital of USD one,000, he turned it into USD four,000 by mindful observation and examination of the stock market’s developing momentum. From 1970 to 1982, Ron Baron worked as an Introduction Broker at securities companies and grew to become nicely identified between business gamers for his effective investments in smaller organizations.

Ron Baron’s job

In 1982 Ron Baron founded Baron Capital Management, a enterprise working primarily in the discipline of fund and asset management. The investment principle of this fund is to invest in lengthy-phrase development worth, the shortest time period that Ron Baron’s enterprise holds shares is four-five many years, and the longest time period is 15 many years. But the vital to building this investment approach efficient is not its lengthy-phrase nature, but rather the success of in-depth generation study. More particularly, the emphasis of specials in which Ron Baron invests are typically organizations with the favored customer items of the Baby Boomer generation.

A very little side details about the Baby Boomer generation, this is a phrase utilized to refer to men and women born in between 1946 and 1964. The proportion of this group tends to make up the bulk of the population age table. In the United States alone, Baby Boomers signify far more than twenty% of the population (about 76 million men and women), and the bulk are retirees, CEOs and entrepreneurs. This generation was the outcome of submit-World War II financial reconstruction and the GI Bill, which permitted American soldiers to invest in suburban houses at preferential charges. Thanks to this, Baby Boomers have been born in perfect problems and grew up in an open economic system with abundant jobs and desirable wages. Thus, industries ranging from customer products to technologies and healthcare flourished all through this time period. This is why Ron Baron, a individual with a sharp investment mindset, has grasped the trends of this generation and opened a streak of far more than 15 many years of consecutive victories on the Nasdaq a hundred.

In 2011-2012, Baron Capital managed practically $twenty billion in assets across all fields, which include football. According to Bloomberg sources, in addition to the Glazer loved ones, Baron Capital is the 2nd identify to personal a important stake in this workforce. In 2012, Baron Capital obtained far more than 24% of the complete excellent provide of MANU (Manchester United) shares, equivalent to five.eight% of the team’s shares. Subsequently, in 2014, this percentage was elevated by Baron Capital to 37.eight% of MANU shares excellent on the industry (equal to 9.two%).

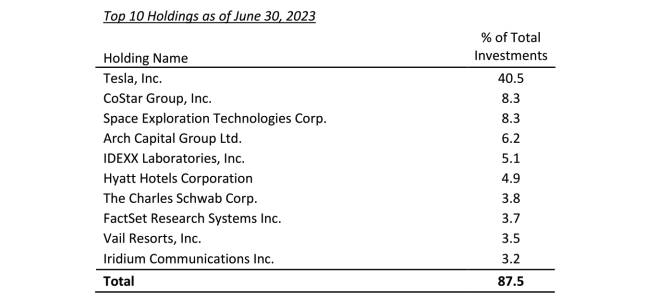

In addition to the “passion” for the business, technologies regarded as revolutionary for humanity are also a single of Baron Capital’s highly-priced passions. In 2014, Ron Baron invested far more than $380 million to purchase Tesla shares at $43.07. To date, revenue from this deal have tripled from its place when Tesla shares have been trading close to $260. As of 2023, Tesla shares signify forty% of the complete portfolio held by Baron Capital.

Baron Capital investment portfolio as of March 2023

summary

Above is details about Ron Baron and his successes all through the formation and improvement of Baron Capital. Through the report, we hope that Coinlive has offered readers a far more standard point of view on Ron Baron and his achievements as a fund manager.