While many cryptocurrencies have been in the grip of a bear market over the past week, Arbitrum (ARB) has been showing signs of a slight uptick. However, the story doesn’t end there, as ARB appears to be on the verge of breaking out of a bullish pattern that could lead to double-digit price gains in the coming days.

Will Arbitrum Turn Uptrend?

Data from CoinMarketCap shows that ARB investors have been gaining strength over the past 24 hours, pushing the token price up slightly. At the time of writing, ARB is trading at $0.5019 with a market capitalization of over $1.75 billion.

The bad news is, according to IntoTheBlock0% of ARB investors are profitable. However, this trend may change in the coming days.

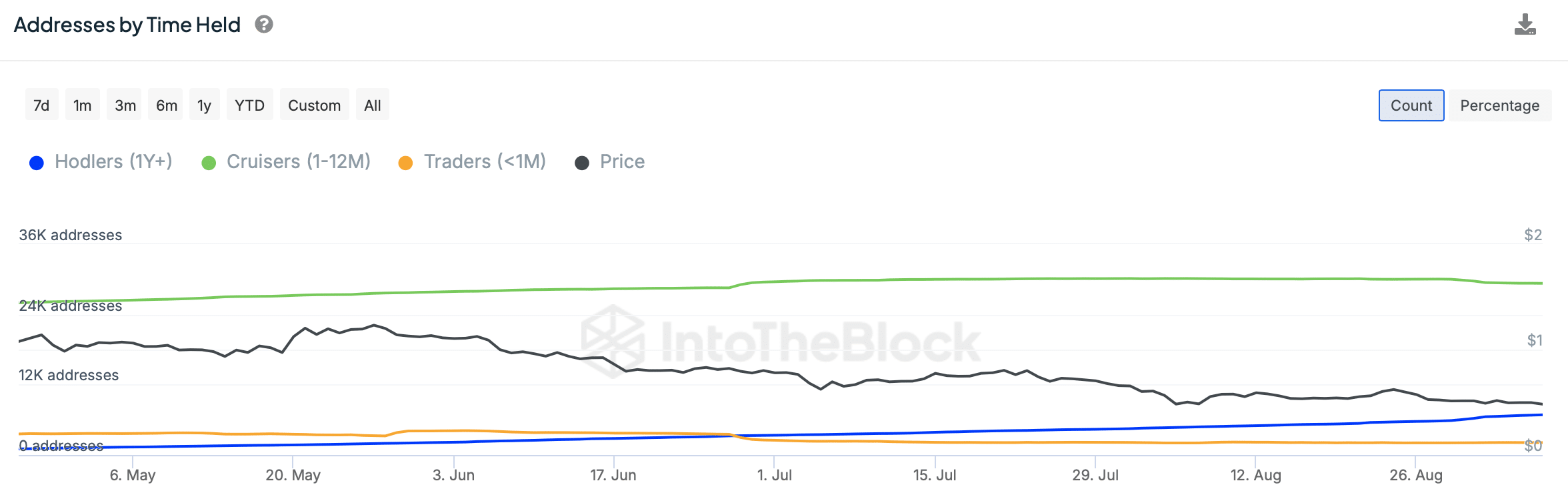

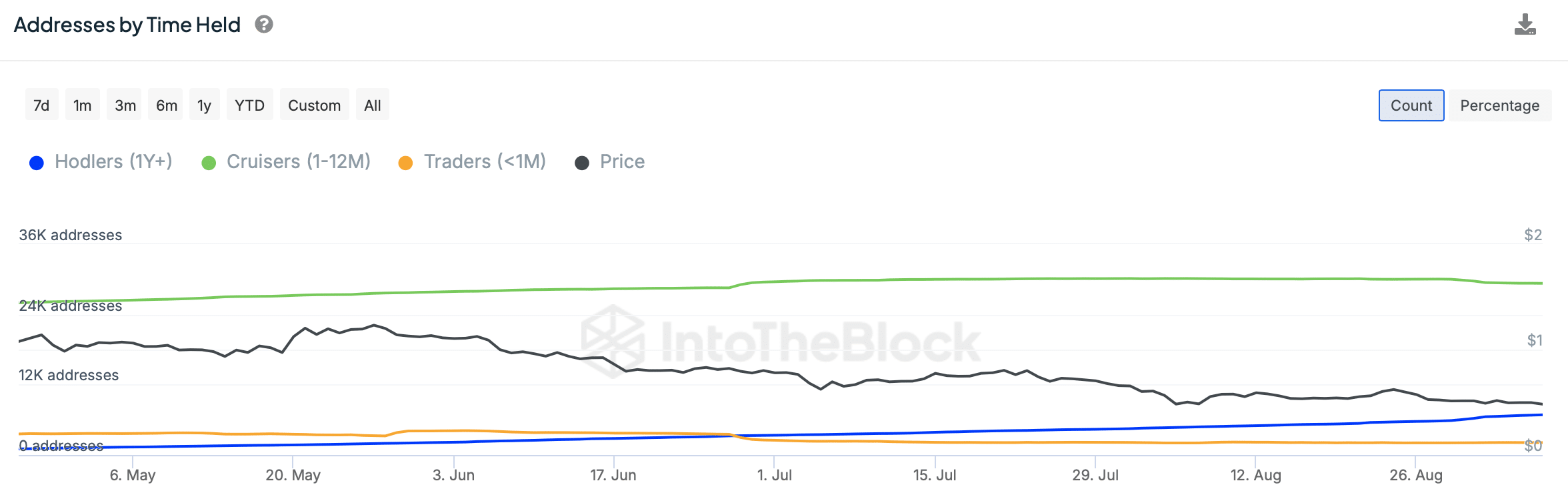

AMBCrypto’s analysis revealed that the number of long-term investors, those holding tokens for more than a year, has increased slightly, demonstrating their confidence in future price increases.

The better news is that the token’s price is moving in a bullish pattern. World Of Charts, a popular crypto analyst, shared on Twitter about the “bullish falling wedge” pattern.

At the time of writing, ARB is on the verge of a breakout, which could lead to a 25% increase in price. In fact, a bullish divergence has also appeared on the chart of one of the technical indicators, further confirming the possibility of a breakout.

ARB’s Next Move

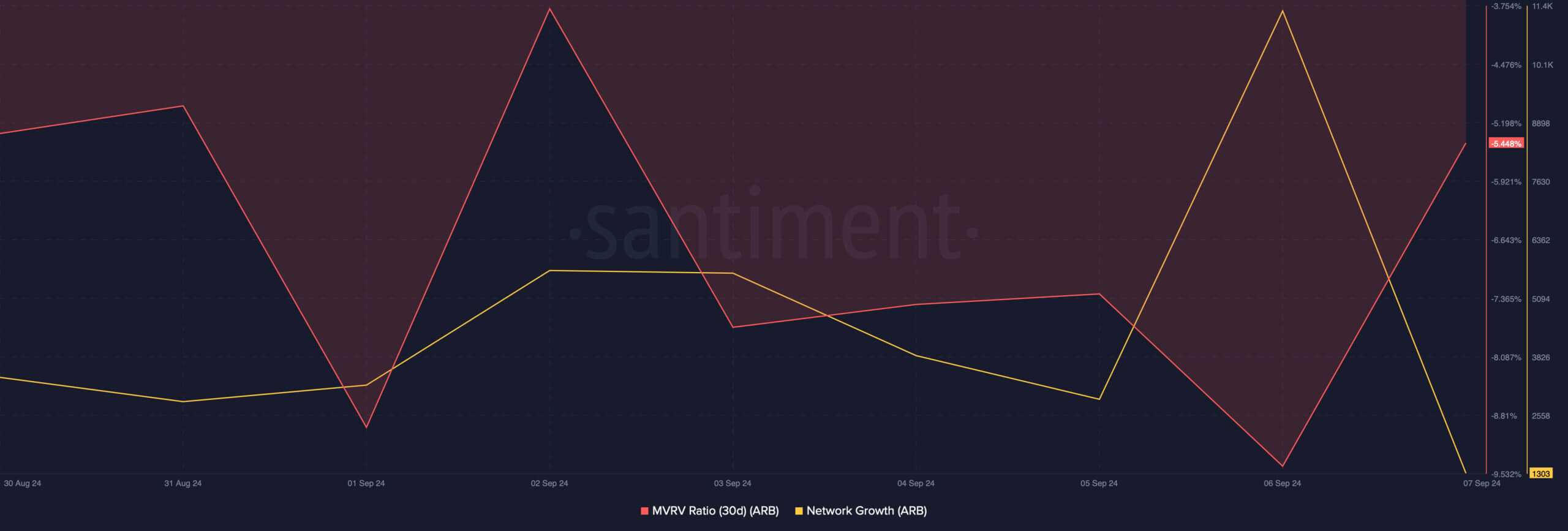

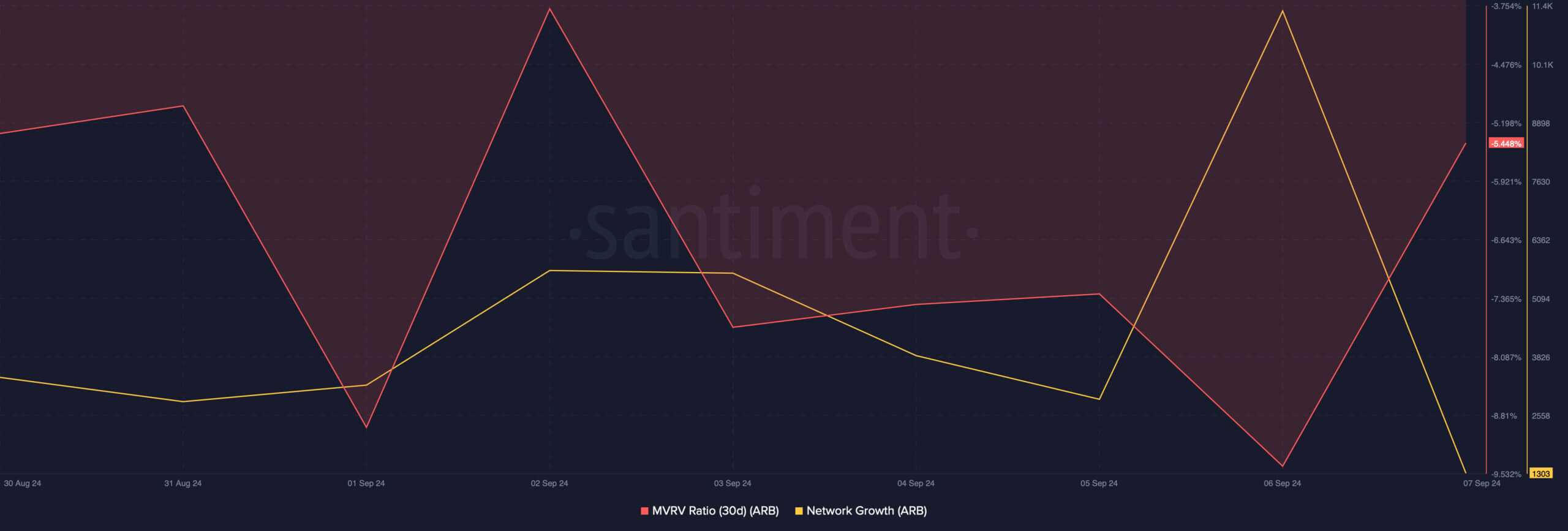

We checked the token’s on-chain data to see what the metrics say about the potential breakout. According to data from Santiment, Arbitrum’s MVRV has improved.

Additionally, the token network growth also increased sharply on September 6, which means that the number of new addresses created is increasing.

However, data from Coinglass again indicating a bearish signal. The Arbitrum long/short ratio has decreased, indicating that there are more short positions than longs in the market, which can be interpreted as a bearish signal.

Therefore, we examined the token’s daily chart to better understand whether a bullish breakout is possible.

Real or not, this is ARB’s market capitalization in BTC terms.

We notice that most market indicators are bullish for this token. For example, Arbitrum’s Chaikin Money Flow (CMF) has been increasing.

The Relative Strength Index (RSI) also shows a similar trend. These indicate that the possibility of a price increase and a bullish breakout is very high.