Algorand [ALGO]a blockchain primarily based on the Proof-of-Stake (PoS) algorithm, recorded a decline in income in the third quarter of 2023, in accordance to a report new from Messari.

In a report titled “Algorand Q3 2023 Brief,” on-chain information supplier Messari identified that Algorand’s everyday income in US USD ended the quarter at its lowest degree in the previous 12 months, down 23%. % in contrast to the past quarter.

According to Messari, this income drop is due to the steady reduce in the typical everyday worth of the protocol’s native token, ALGO. According to information from CoinMarketCapthe altcoin’s worth plunged about twenty% amongst July one and September thirty.

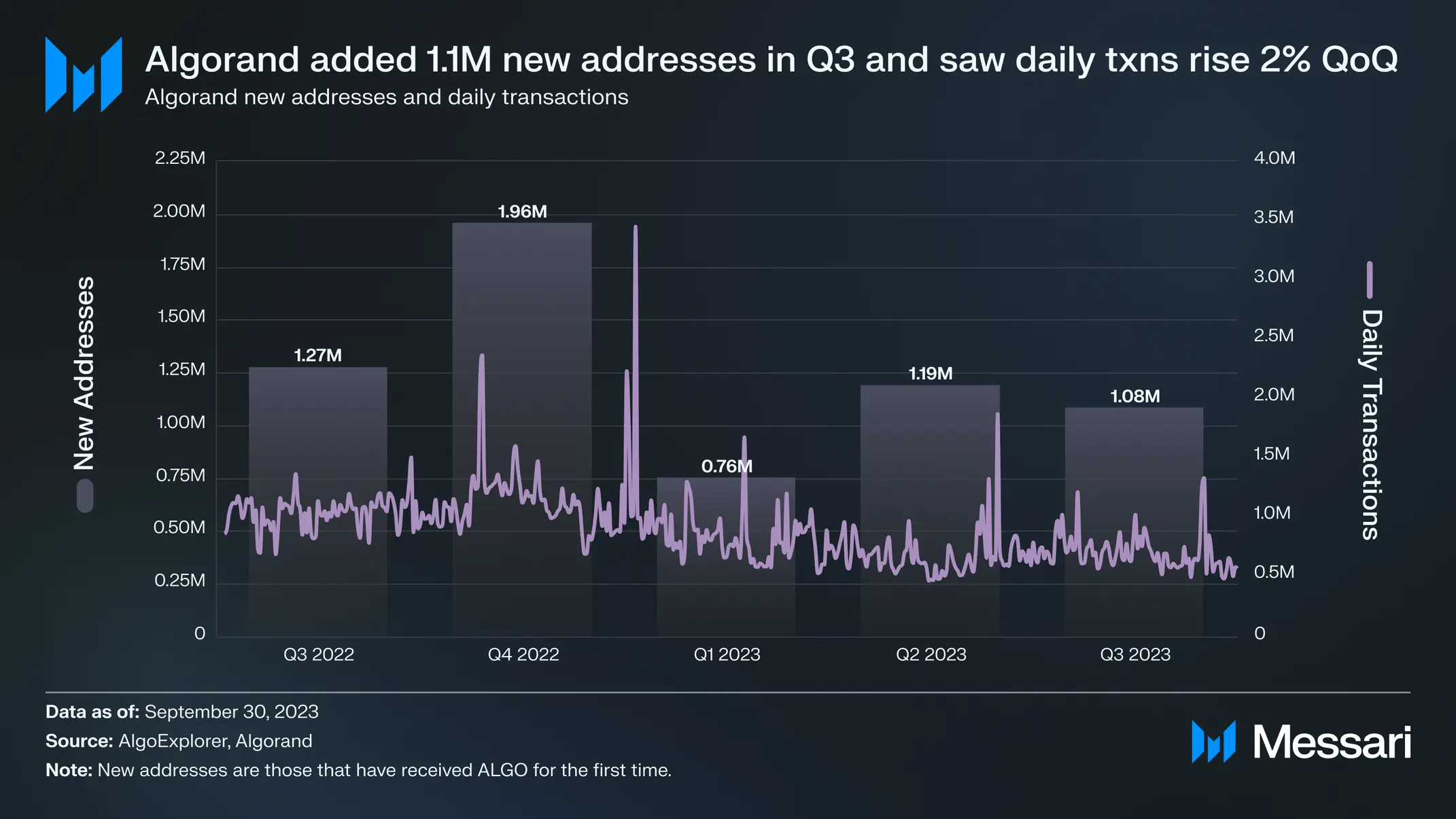

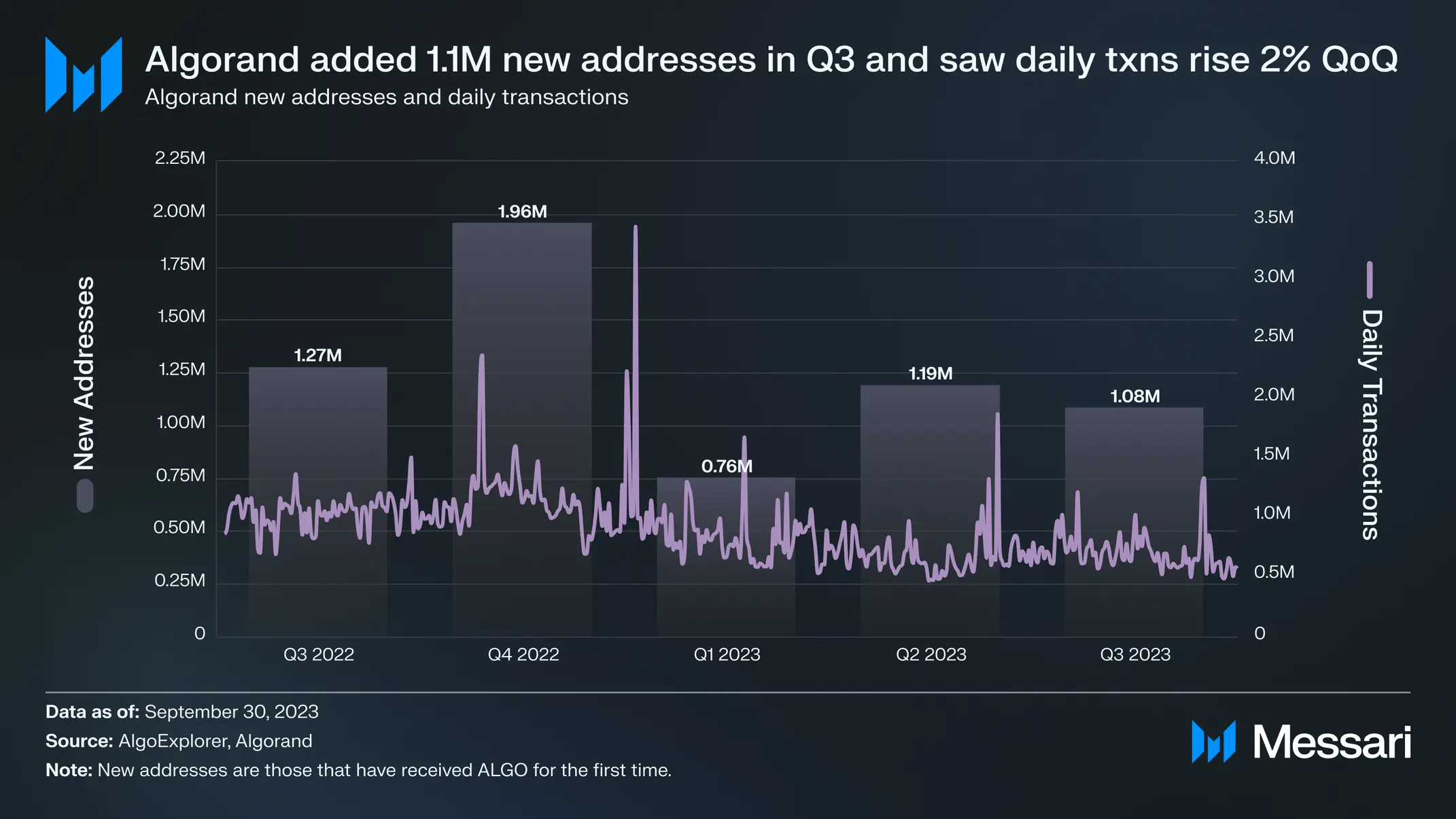

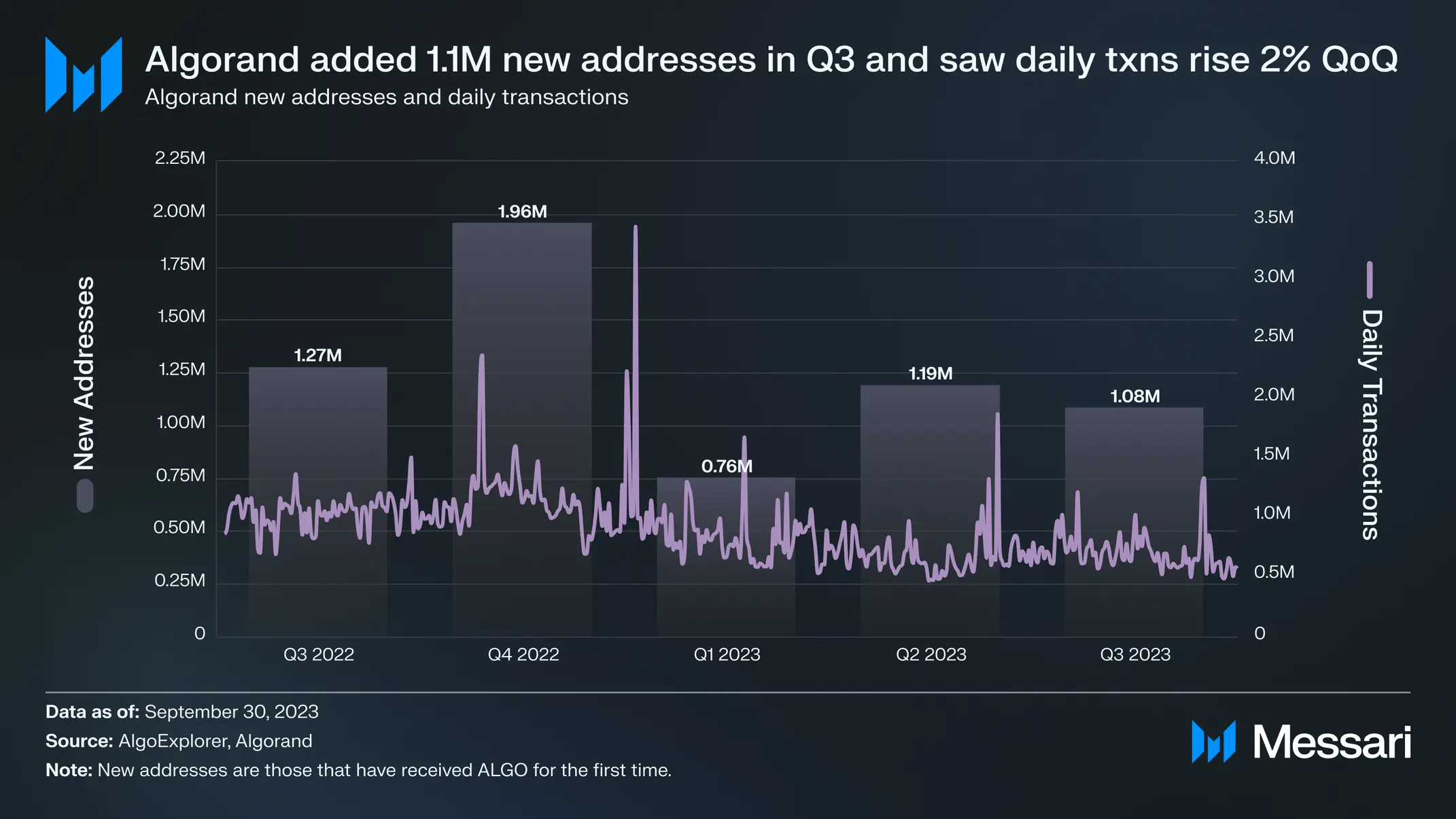

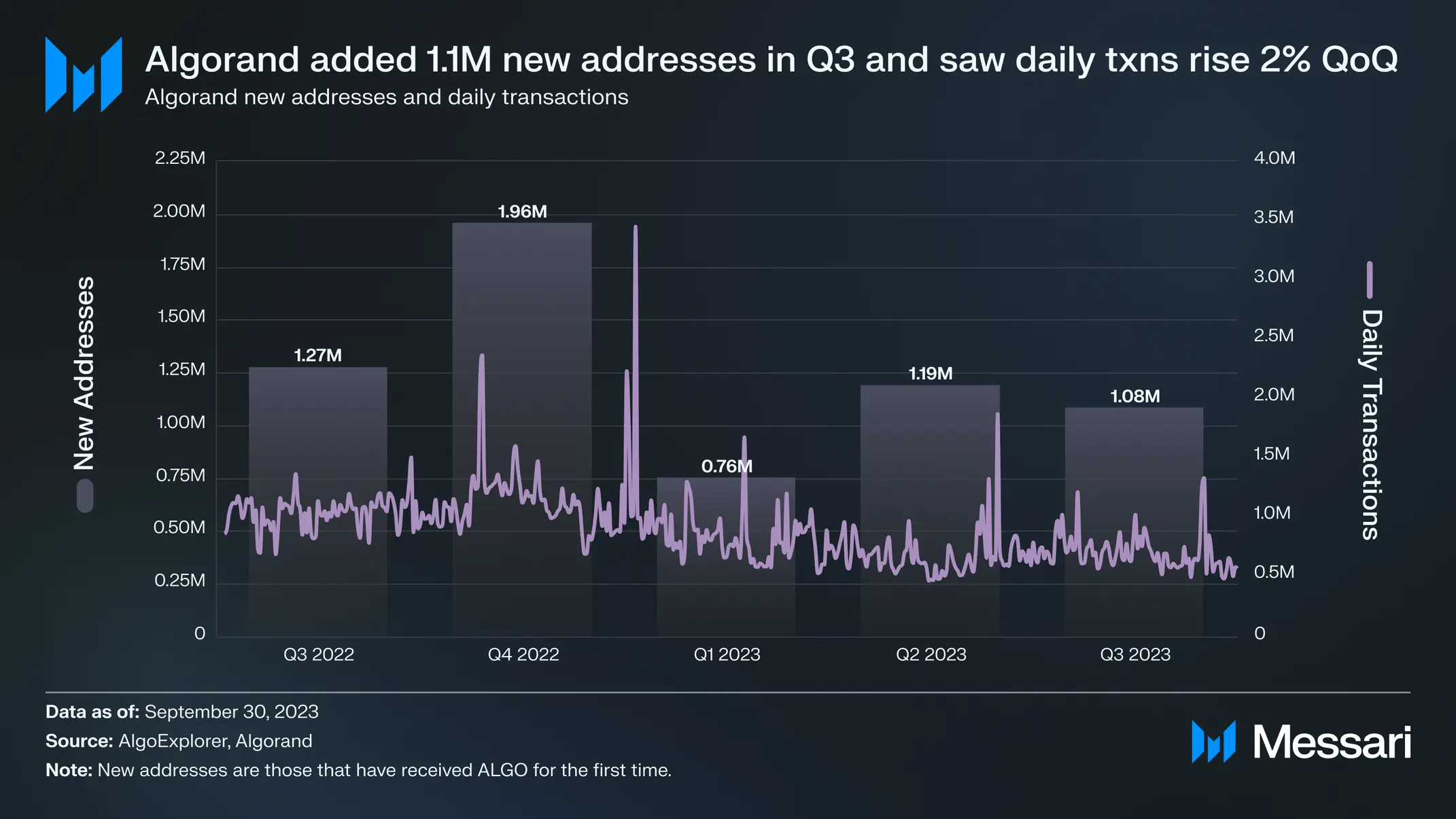

The income decline occurred in spite of development in new demand for Algorand in the quarter below overview. Messari identified that amongst July and September, Algorand “added 1.1 million new addresses in the third quarter, increasing the total number of addresses by 3% compared to the previous quarter.”

Furthermore, the PoS network has recorded a development in the typical variety of everyday transactions by two.two%. During the third quarter, the network recorded an typical everyday transaction volume of 713,000 transactions. In the 2nd quarter, this variety was 698,000. Messari extra:

“The increase in transaction numbers was likely stimulated by the number of transactions conducted by NFT activity on Algorand in the third quarter. This number increased by 321%, from 45,000 to 191,000 transactions.”

However, ALGO’s regular value decline all through the quarter impacted the sum of network costs paid to approach transactions on Algorand, main to a decline in USD-denominated income.

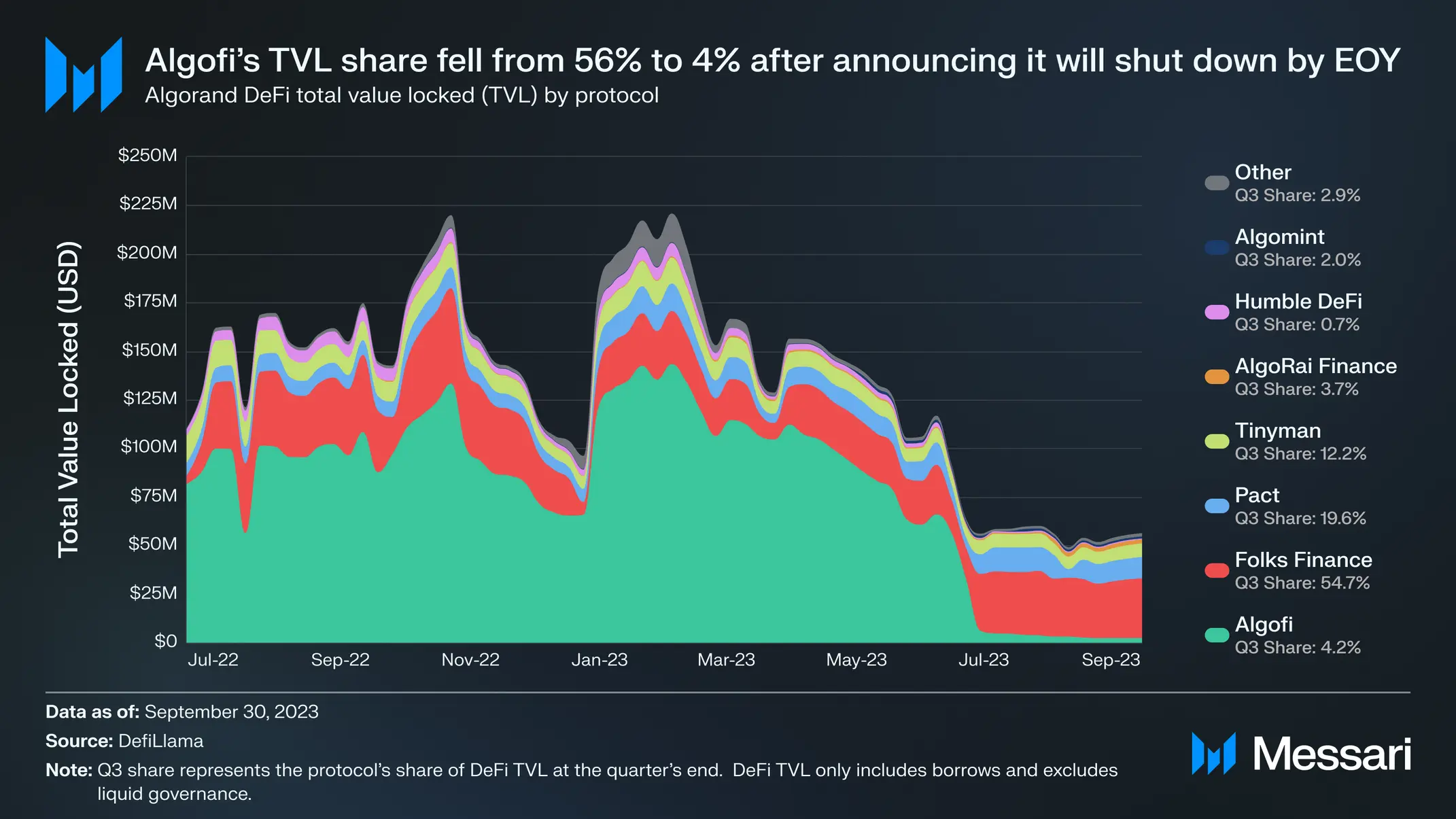

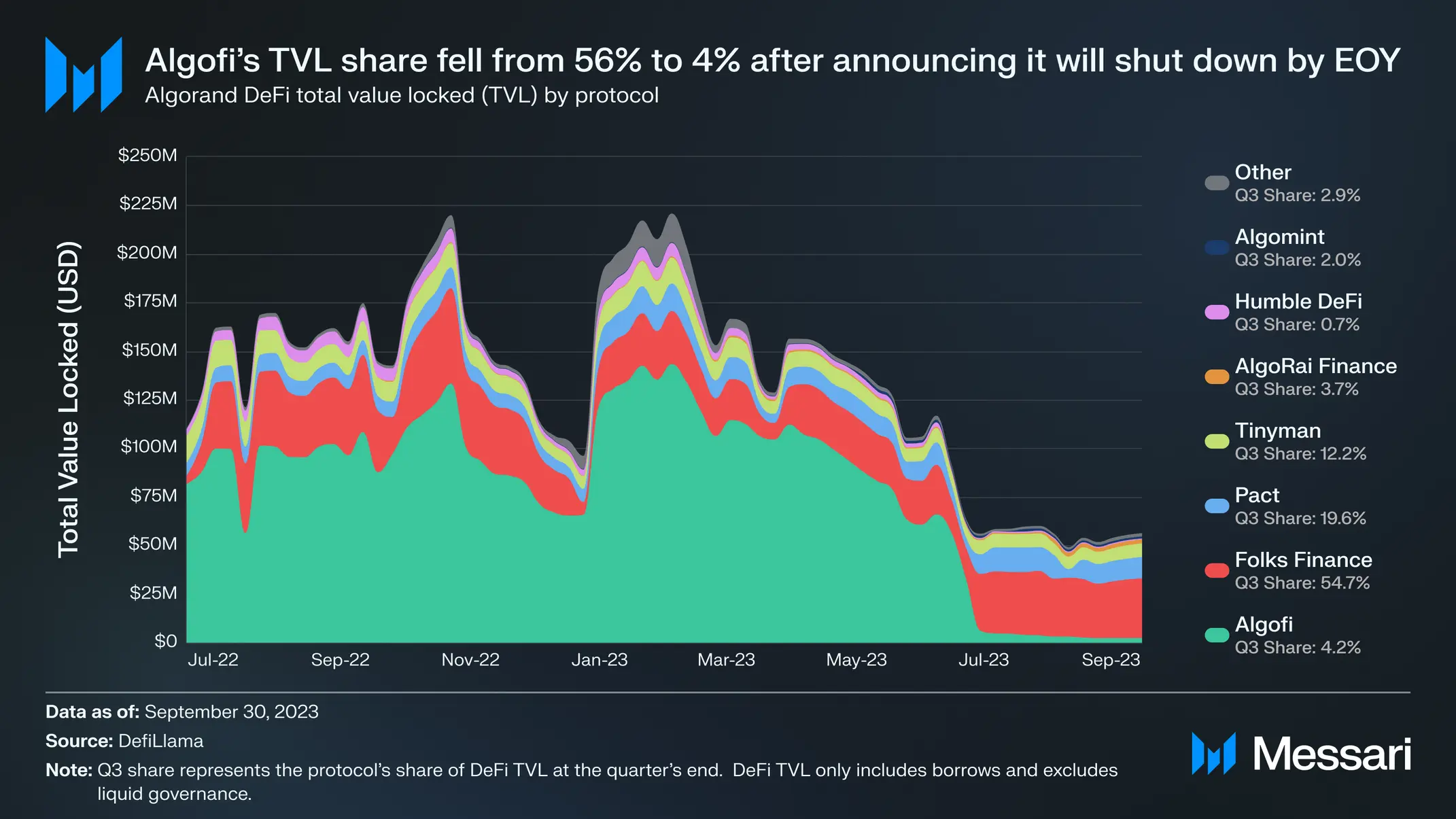

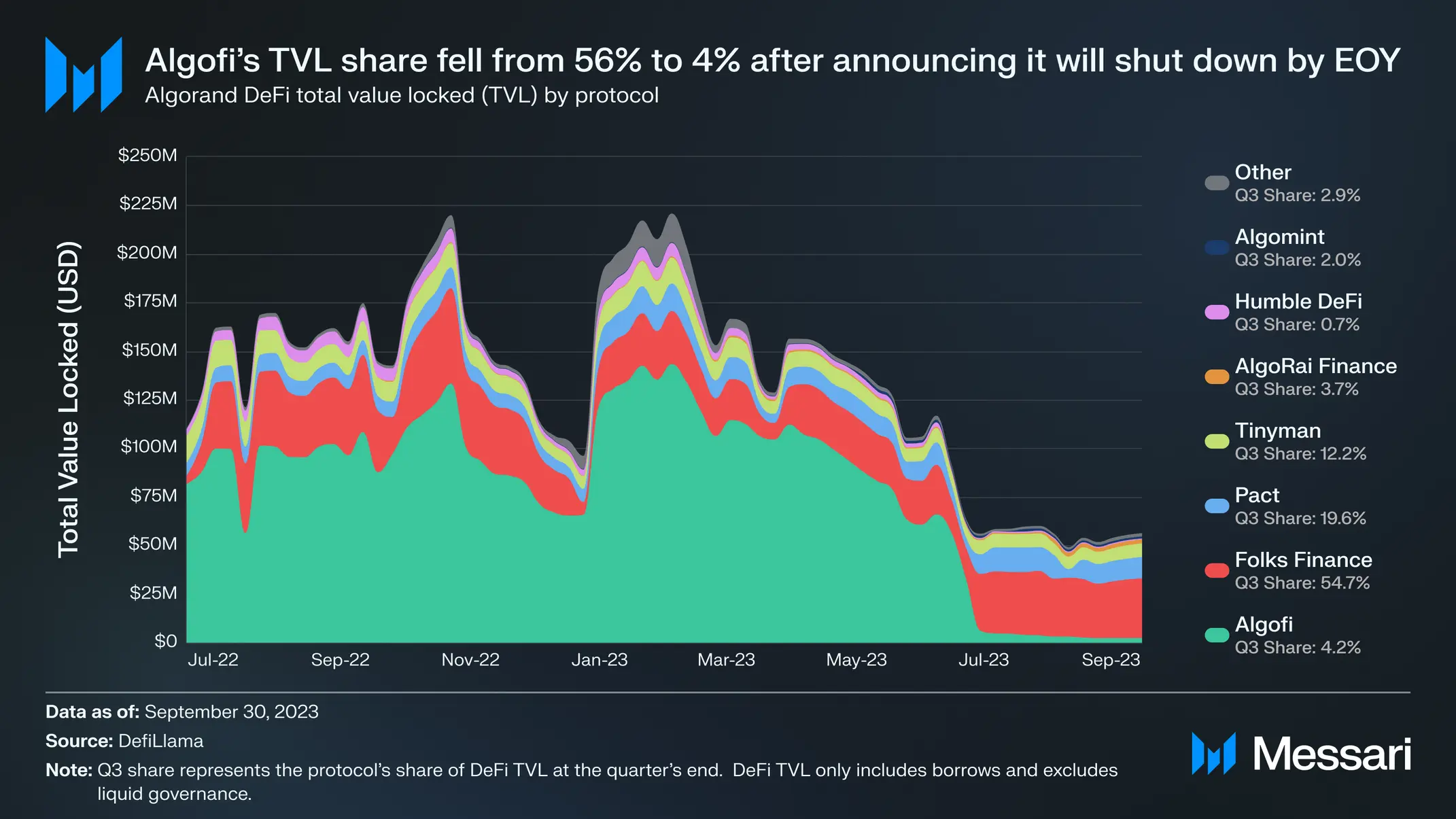

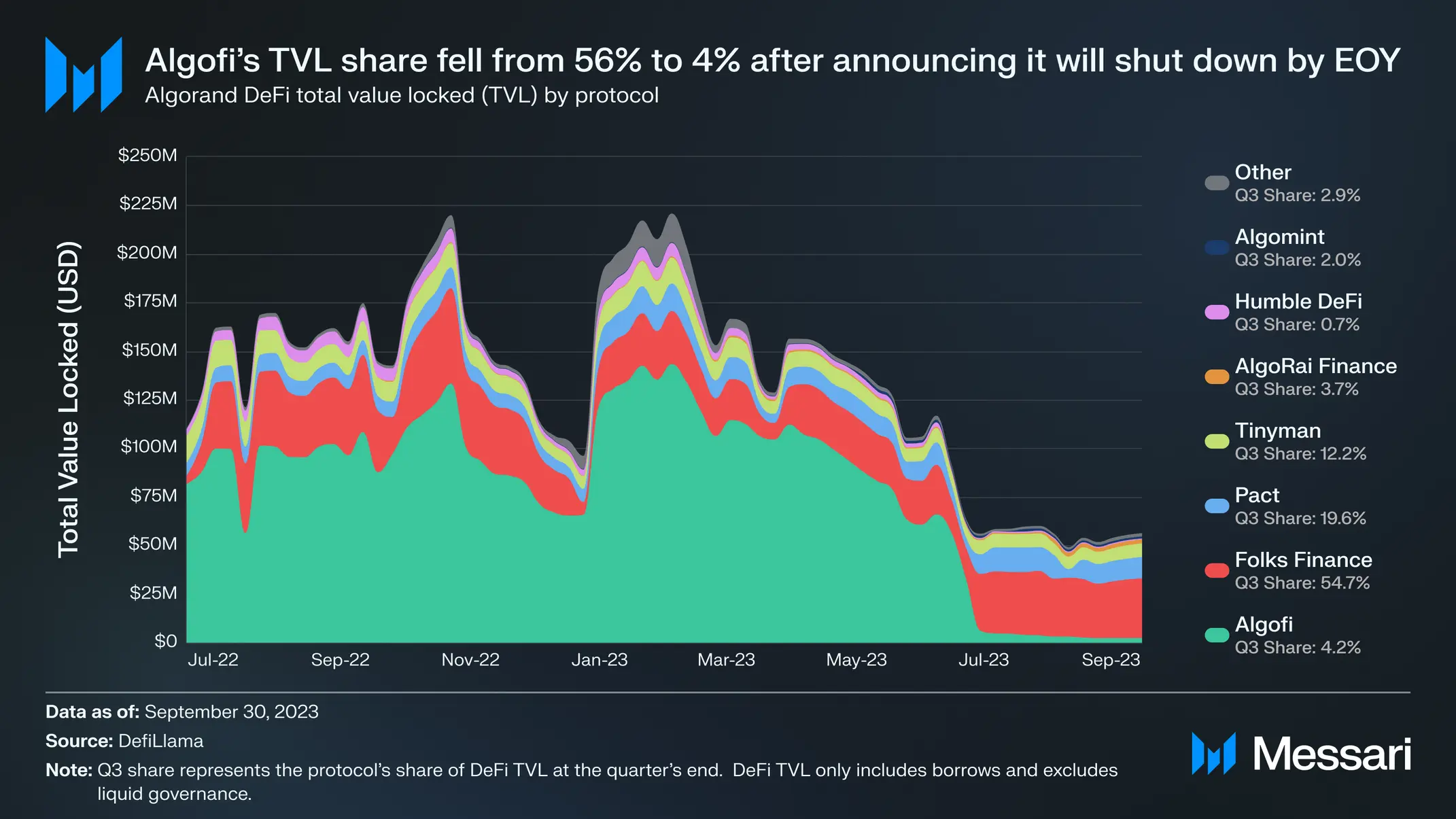

As for the decentralized finance (DeFi) sector, Algorand’s complete worth locked (TVL) has decreased by 48%. Messari attributes this to the protocol’s selection to shut down Algofi, which the study company describes as “its largest DeFi protocol ever to have a TVL.”

On July ten, Algofi Notification made a decision to near the platform due to “a combination of events”.

At press time, Algorand’s TVL reached $80.31 million, up 35% considering that the starting of October, in accordance to information from DefiLlama.

Status of Algorand (ALGO)

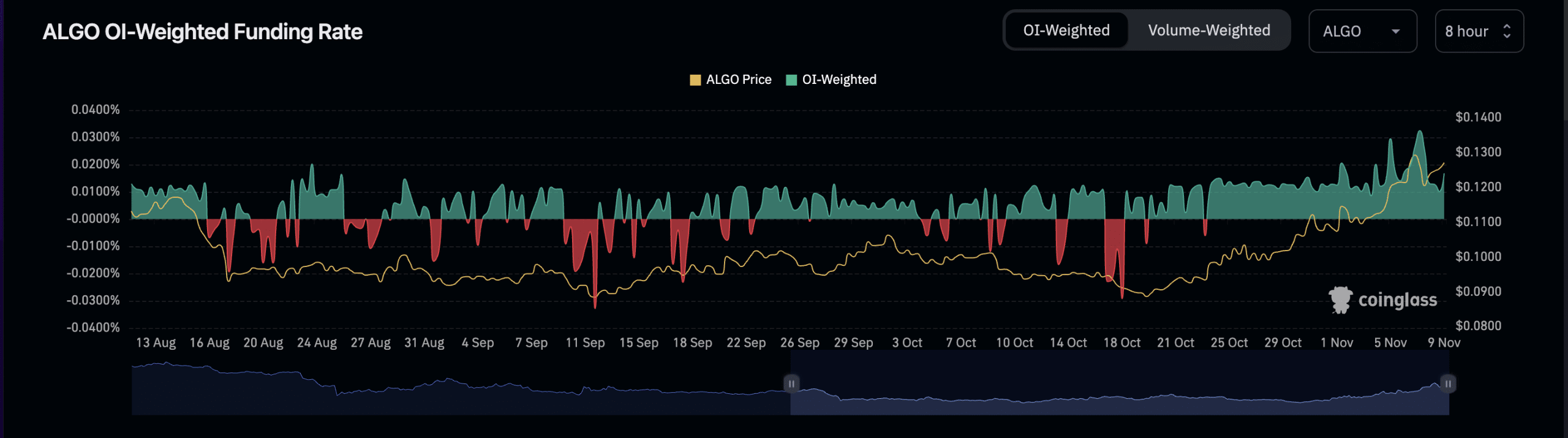

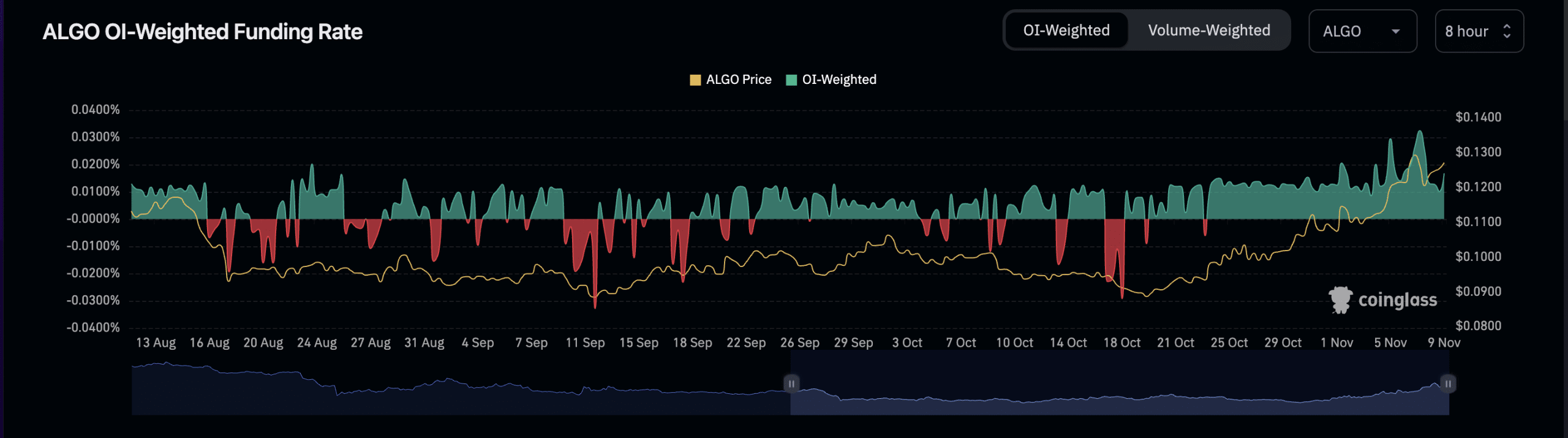

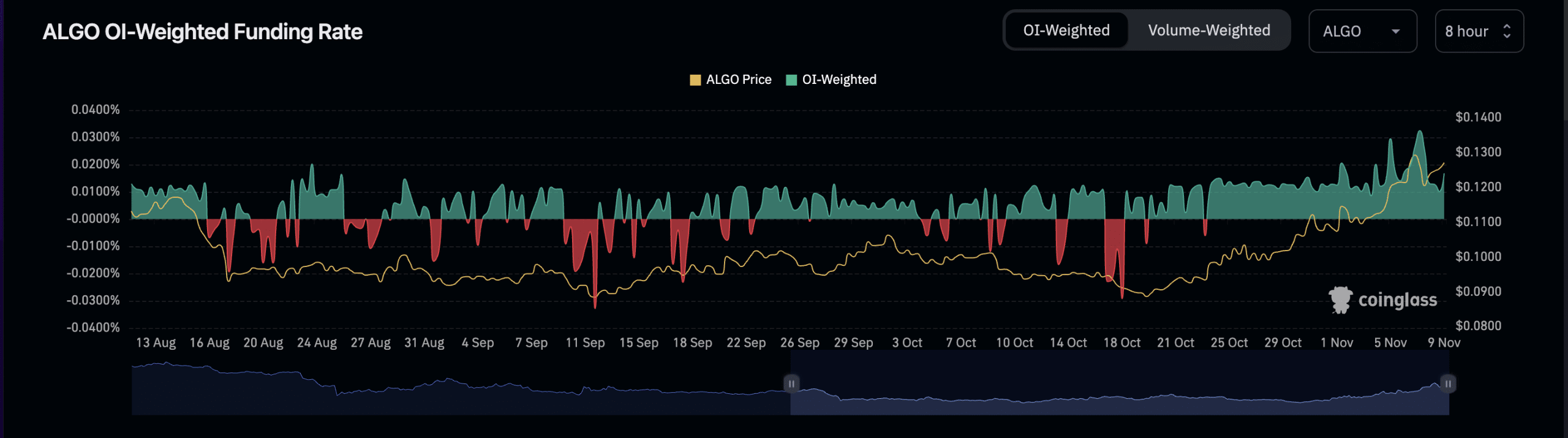

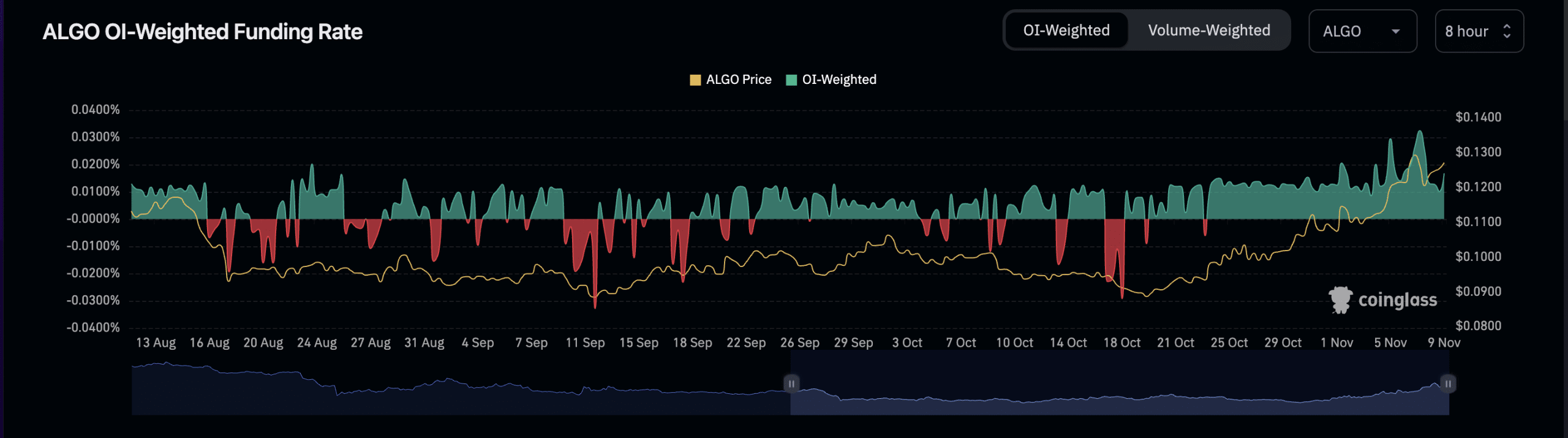

ALGO is at this time trading at $.1299, up 15% from final week. The current value improve has induced ALGO futures open to improve by 14%.

As of October 23, the market place has only had optimistic curiosity costs, as traders carry on to bet on an extended price hike.

This exhibits ALGO’s optimistic development and the market’s self confidence in its long term.

General Bitcoin News

Algorand [ALGO]a blockchain primarily based on the Proof-of-Stake (PoS) algorithm, recorded a decline in income in the third quarter of 2023, in accordance to a report new from Messari.

In a report titled “Algorand Q3 2023 Brief,” on-chain information supplier Messari identified that Algorand’s everyday income in US USD ended the quarter at its lowest degree in the previous 12 months, down 23%. % in contrast to the past quarter.

According to Messari, this income drop is due to the steady reduce in the typical everyday worth of the protocol’s native token, ALGO. According to information from CoinMarketCapthe altcoin’s worth plunged about twenty% amongst July one and September thirty.

The income decline occurred in spite of development in new demand for Algorand in the quarter below overview. Messari identified that amongst July and September, Algorand “added 1.1 million new addresses in the third quarter, increasing the total number of addresses by 3% compared to the previous quarter.”

Furthermore, the PoS network has recorded a development in the typical variety of everyday transactions by two.two%. During the third quarter, the network recorded an typical everyday transaction volume of 713,000 transactions. In the 2nd quarter, this variety was 698,000. Messari extra:

“The increase in transaction numbers was likely stimulated by the number of transactions conducted by NFT activity on Algorand in the third quarter. This number increased by 321%, from 45,000 to 191,000 transactions.”

However, ALGO’s regular value decline all through the quarter impacted the sum of network costs paid to approach transactions on Algorand, main to a decline in USD-denominated income.

As for the decentralized finance (DeFi) sector, Algorand’s complete worth locked (TVL) has decreased by 48%. Messari attributes this to the protocol’s selection to shut down Algofi, which the study company describes as “its largest DeFi protocol ever to have a TVL.”

On July ten, Algofi Notification made a decision to near the platform due to “a combination of events”.

At press time, Algorand’s TVL reached $80.31 million, up 35% considering that the starting of October, in accordance to information from DefiLlama.

Status of Algorand (ALGO)

ALGO is at this time trading at $.1299, up 15% from final week. The current value improve has induced ALGO futures open to improve by 14%.

As of October 23, the market place has only had optimistic curiosity costs, as traders carry on to bet on an extended price hike.

This exhibits ALGO’s optimistic development and the market’s self confidence in its long term.

General Bitcoin News