Bitcoin’s selling price motion is far from what traders want as BTC has moved away from its $ 69,000 to $ 23,000 ATH.

As of December twelve, information on the variety of Bitcoin addresses sending BTC to exchanges hit a 13-month reduced of four,197.9 per seven-day move acceptance.

? #Bitcoin $ BTC The variety of addresses sent to exchanges (7d MA) just hit a 13-month reduced of four,197,905

The former 13-month reduced of four,202,917 was observed on November 24, 2021

View metrics:https://t.co/sqthvgFboN pic.twitter.com/Rj0YwSWUIc

– glassnode alerts (@glassnodealerts) December 12, 2021

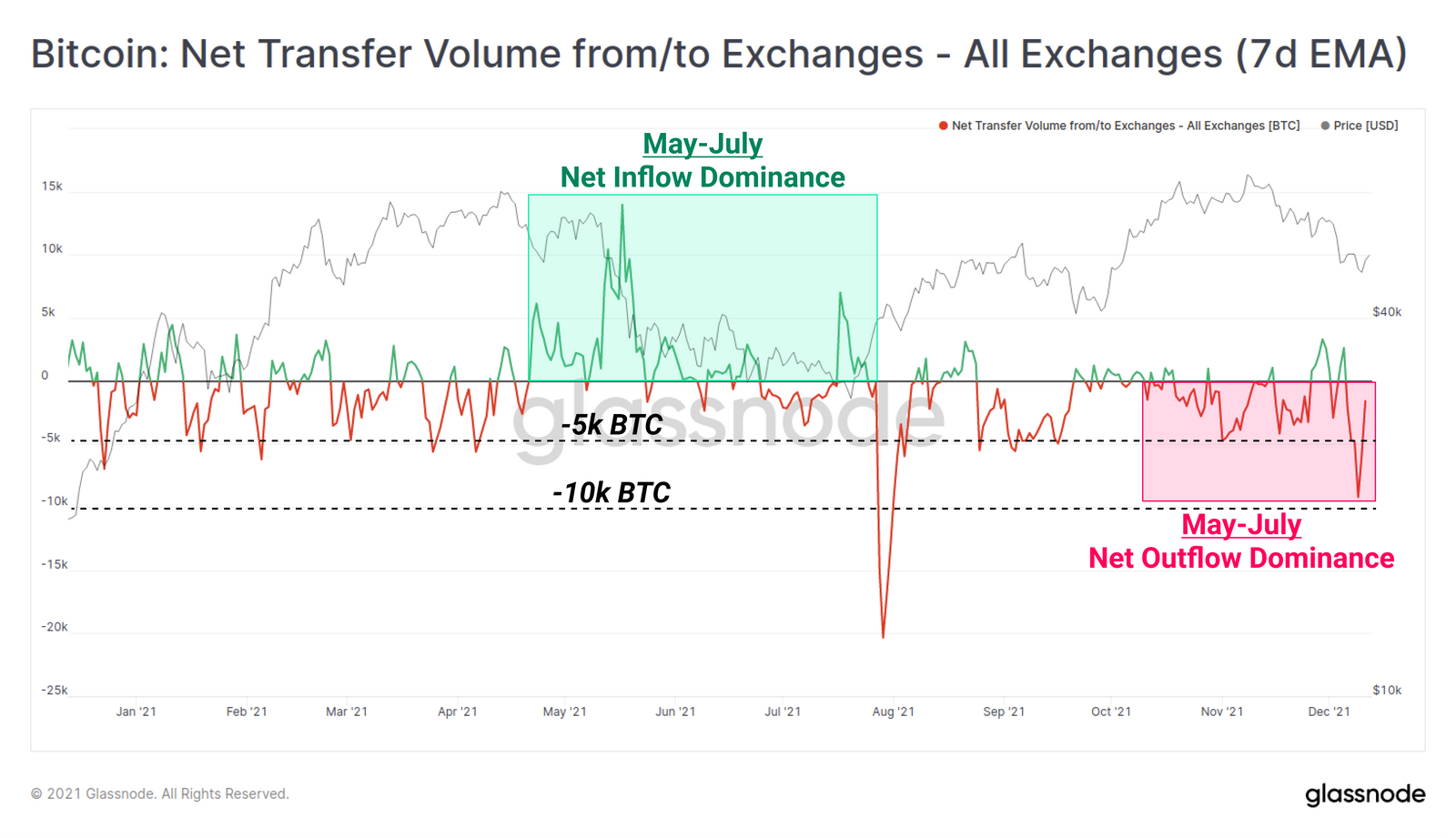

For a greater image, wanting at the net movement trading volume chart (based mostly on 7D EMA), we can see that the industry is at this time in accumulation mode, with ranges of three,000 to five,000 BTC remaining taken from the trades each day.

Therefore, the diversity of Bitcoin sending addresses suggests that traders are turning a lot more in direction of BTC holdings in anticipation of a new bullish cycle. Over the previous number of weeks, BTC has persistently proven extreme volatility, breaking under the $ 60,000 assistance and bottoming out at $ 42,000 incredibly immediately.

As of press time, Bitcoin (BTC) continues to decline regardless of a flurry of fantastic information, shedding $ five,000 in 24 hrs and trading close to $ 46,694.

However, the greater query is why Bitcoin is not still ready to bounce back, when the quantity of BTC pushed on the exchange is not extreme, if not totally “disadvantaged” in front of customers, it is continually withdrawn to supplement extended-phrase holdings. The variety of Bitcoin reserves on the exchange has also “arrived” regardless of 90% of the BTC provide remaining mined.

According to the analytical viewpoint of Coinlive staffThe to start with motive the industry is in difficulty is the influence of the super mutant COVID Omicron, which pushed Bitcoin under $ fifty five,000 for the to start with time in late November. But, on December 13, the United kingdom recorded its to start with death due to Omicron, probably most retail traders had been truly frightened by this information and produced continued stacked marketing strain.

Next is the Fed barrier. There have been quite a few warnings from specialists that the Fed chairman could be lousy for the industry in the following phrase. In specific, the choice to increase curiosity charges earlier than initially planned in mid-2022 could be manufactured at the following Fed meeting on December 15 to make improvements to the inflation circumstance in the United States to attain a higher of almost forty many years. , along with the complex epidemic circumstance that has “paralyzed” the US economic climate more than the previous 12 months.

In common, from the two former details, marketing strain is creating up, generally from retail traders, who are very easily influenced by some skepticism and worries from macro elements. Conversely, the moves of important economic institutions just revolve close to the story of BTC accumulation every time there is a opportunity to drop in selling price.

On December 9, MicroStrategy purchased an more $ 82.four million in Bitcoin, bringing the company’s recent ownership to 122,477 BTC for an estimated $ five.9 billion. El Salvador also “finished” 150 BTC all through the extreme promote-off that occurred at the finish of final week. The Treasury of El Salvador holds one,370 BTC, with an regular selling price of $ 49,405.

Synthetic Currency 68

Maybe you are interested: