Tether’s USDT could win significant following Paxos stopped issuing BUSD and was threatened with prosecution by the best controller of US securities.

Market share of stablecoins in the new buy?

As Coinlive reported at dawn on Feb. 13, The SEC is about to sue Paxos claiming that BUSD is a disguised safety. In the afternoon of the very same day (Vietnam time), The New York Department of Financial Services has asked Paxos to halt issuing stablecoins connected with the Binance identify. These information consecutively developed panic in the neighborhood and the marketplace burned down quickly following.

Paxos’ choice to suspend new mints rocked the $136 billion stablecoin marketplace. In distinct, lots of men and women predict that marketplace share will quickly be in the hands of Tether’s USDT and Circle’s USDC – and the organization that refers Paxos to New York officials. Furthermore, MakerDAO’s DAI is also viewed as a very good candidate.

Binance, the world’s biggest cryptocurrency exchange by volume, has invested heavily in selling the use of BUSD on the platform.

Last September, Binance as well drastic abandonment of Circle’s USDC trading pairs and completely merged into BUSD to “promote” the stablecoin they “hold”. The move immediately created BUSD the third most well-liked stablecoin, with a marketplace cap of $35 billion and 35% of the large trading volume on Binance.

Binance CEO Changpeng Zhao posted a forum for that with With the issuance of new stablecoins suspended, the capitalization of BUSD can only lessen more than time and will carry on to help BUSD as normal. But it is also redundant that if BUSD is declared a safety, it will have big implications for the cryptocurrency business.

Now, crackdowns from New York, as properly as from the US Securities and Exchange Commission (SEC), are paving the way for rivals to regain marketplace share.

USDT is now the biggest stablecoin, with close to $69 billion in circulation. In 2nd area is USDC with $41 billion. On the other hand, the marketplace capitalization of DAI drops to close to $five billion.

Clara Medalie, director of exploration at digital asset analytics company Kaiko commented:

“Paxos’ decision will profoundly change the stablecoin space and disrupt Binance’s strategy for global cryptocurrency dominance.”

Leena ElDeeb, a representative of 21.co, explained in an e-mail:

“The headwind will lead to consolidation in the stablecoin marketplace for blue chips like USDT and USDC. The winner will most most likely be Tether, as we are seeing hundreds of thousands of USD pouring into USDT on Binance.”

Medalie additional that USDC is gaining a whole lot of momentum with out BUSD and it would be intriguing if Binance puts the stablecoin back for sale. But lots of men and women are concerned that Circle is the up coming target in the SEC’s sights.

What is the way for Binance?

Since Binance only aligns its branding with BUSD, Paxos’ choice could only restrict the exchange’s finances.

Conor Ryder, exploration analyst at Kaiko, explained of Binance:

“The other selections might not have as well a lot affect on their company. The primary harm is even now track record, in particular because the exchange eliminated USDC and other stablecoins.”

Furthermore, the current series of occasions is not the finish of Binance’s stablecoin aspirations.

“Binance might be seeking for yet another issuer for BUSD or a improved option. There are even now a whole lot of variables at perform, but for now we must hope traders never rush out of their BUSD.”

Users “give up” on BUSD following a series of complications

According to the announcement, traders can convert BUSD into USD or USDP funds till February 2024. Even so, there is even now no stopping the wave of large withdrawals on Binance. Over the previous 24 hrs, the neighborhood has began to move away from BUSD and other stablecoins.

The 24-hour spot trading volume of the BUSD/USDT trading pair hit $three.two billion, which is the biggest each day trading volume because the collapse of FTX exchange.

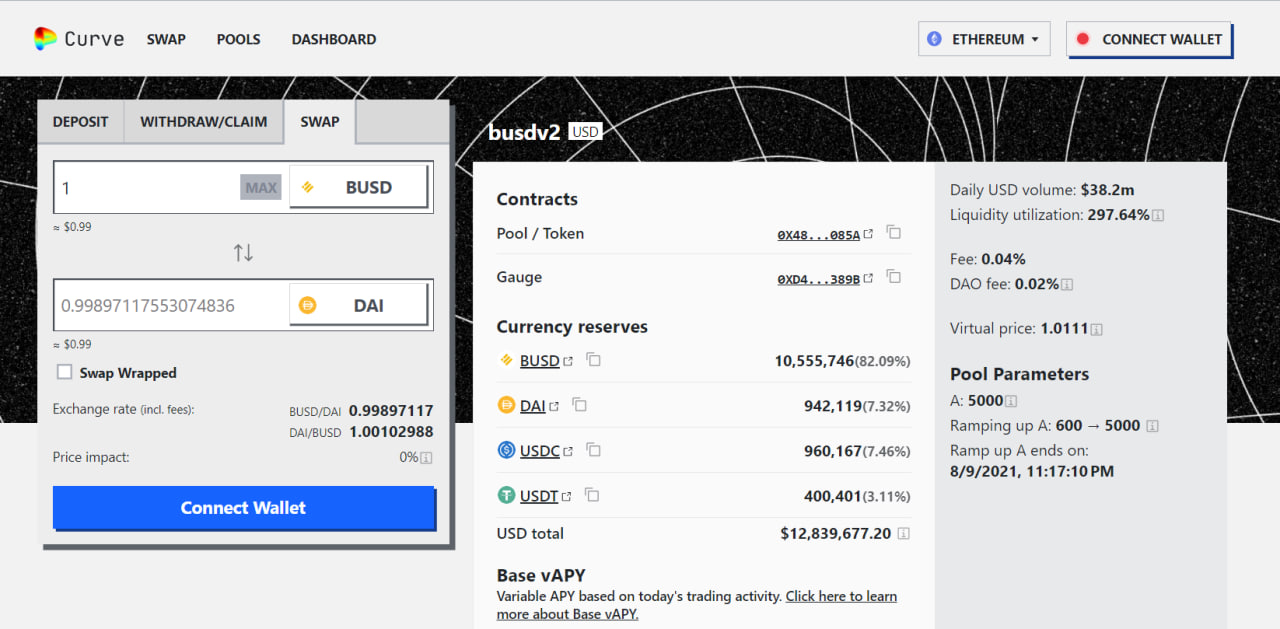

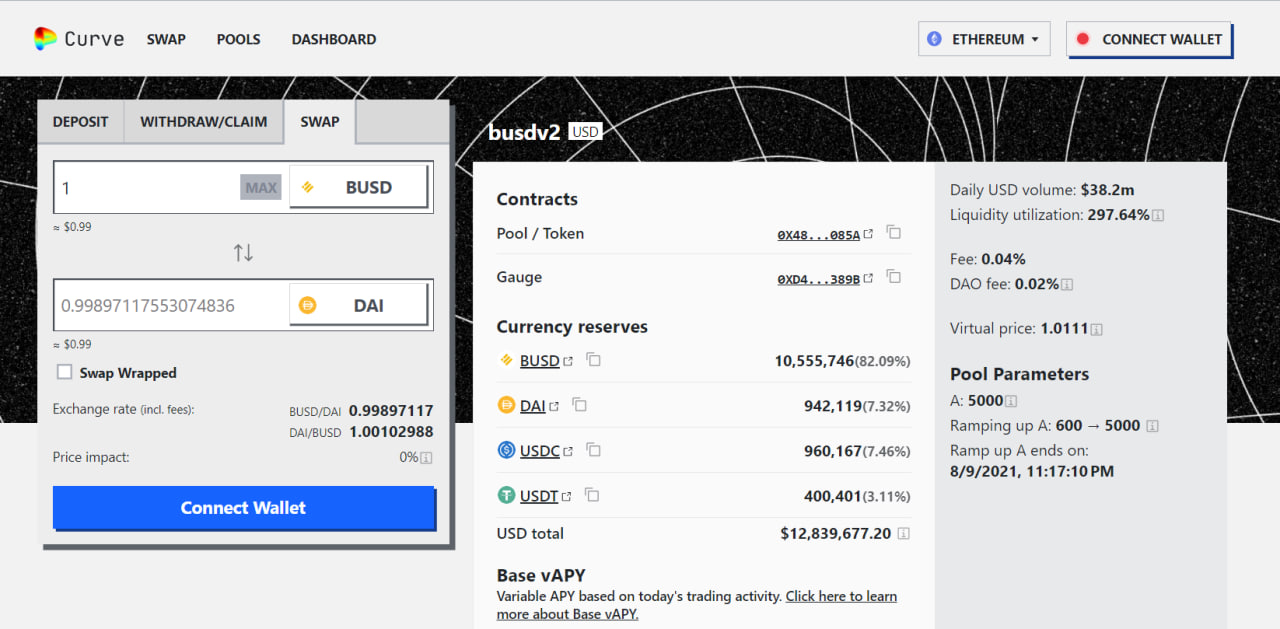

The biggest pool of BUSD on Curve is almost out of USDT, USDC and DAI. 82% of the liquidity in the pool is BUSD. At the present exchange fee, ten,000 BUSD can only be exchanged for 9,982 USDT.

Active blockchain information nansen demonstrates that the Paxos treasury has transferred roughly 275 million BUSD to a burned handle, taking people tokens out of circulation.

Synthetic currency68

Maybe you are interested:

Tether’s USDT could win significant following Paxos stopped issuing BUSD and was threatened with prosecution by the best controller of US securities.

Market share of stablecoins in the new buy?

As Coinlive reported at dawn on Feb. 13, The SEC is about to sue Paxos claiming that BUSD is a disguised safety. In the afternoon of the very same day (Vietnam time), The New York Department of Financial Services has asked Paxos to halt issuing stablecoins connected with the Binance identify. These information consecutively developed panic in the neighborhood and the marketplace burned down quickly following.

Paxos’ choice to suspend new mints rocked the $136 billion stablecoin marketplace. In distinct, lots of men and women predict that marketplace share will quickly be in the hands of Tether’s USDT and Circle’s USDC – and the organization that refers Paxos to New York officials. Furthermore, MakerDAO’s DAI is also viewed as a very good candidate.

Binance, the world’s biggest cryptocurrency exchange by volume, has invested heavily in selling the use of BUSD on the platform.

Last September, Binance as well drastic abandonment of Circle’s USDC trading pairs and completely merged into BUSD to “promote” the stablecoin they “hold”. The move immediately created BUSD the third most well-liked stablecoin, with a marketplace cap of $35 billion and 35% of the large trading volume on Binance.

Binance CEO Changpeng Zhao posted a forum for that with With the issuance of new stablecoins suspended, the capitalization of BUSD can only lessen more than time and will carry on to help BUSD as normal. But it is also redundant that if BUSD is declared a safety, it will have big implications for the cryptocurrency business.

Now, crackdowns from New York, as properly as from the US Securities and Exchange Commission (SEC), are paving the way for rivals to regain marketplace share.

USDT is now the biggest stablecoin, with close to $69 billion in circulation. In 2nd area is USDC with $41 billion. On the other hand, the marketplace capitalization of DAI drops to close to $five billion.

Clara Medalie, director of exploration at digital asset analytics company Kaiko commented:

“Paxos’ decision will profoundly change the stablecoin space and disrupt Binance’s strategy for global cryptocurrency dominance.”

Leena ElDeeb, a representative of 21.co, explained in an e-mail:

“The headwind will lead to consolidation in the stablecoin marketplace for blue chips like USDT and USDC. The winner will most most likely be Tether, as we are seeing hundreds of thousands of USD pouring into USDT on Binance.”

Medalie additional that USDC is gaining a whole lot of momentum with out BUSD and it would be intriguing if Binance puts the stablecoin back for sale. But lots of men and women are concerned that Circle is the up coming target in the SEC’s sights.

What is the way for Binance?

Since Binance only aligns its branding with BUSD, Paxos’ choice could only restrict the exchange’s finances.

Conor Ryder, exploration analyst at Kaiko, explained of Binance:

“The other selections might not have as well a lot affect on their company. The primary harm is even now track record, in particular because the exchange eliminated USDC and other stablecoins.”

Furthermore, the current series of occasions is not the finish of Binance’s stablecoin aspirations.

“Binance might be seeking for yet another issuer for BUSD or a improved option. There are even now a whole lot of variables at perform, but for now we must hope traders never rush out of their BUSD.”

Users “give up” on BUSD following a series of complications

According to the announcement, traders can convert BUSD into USD or USDP funds till February 2024. Even so, there is even now no stopping the wave of large withdrawals on Binance. Over the previous 24 hrs, the neighborhood has began to move away from BUSD and other stablecoins.

The 24-hour spot trading volume of the BUSD/USDT trading pair hit $three.two billion, which is the biggest each day trading volume because the collapse of FTX exchange.

The biggest pool of BUSD on Curve is almost out of USDT, USDC and DAI. 82% of the liquidity in the pool is BUSD. At the present exchange fee, ten,000 BUSD can only be exchanged for 9,982 USDT.

Active blockchain information nansen demonstrates that the Paxos treasury has transferred roughly 275 million BUSD to a burned handle, taking people tokens out of circulation.

Synthetic currency68

Maybe you are interested: