Wintermute, a nicely-acknowledged market place maker in the cryptocurrency market place, claims to have repaid a good deal of dollars to creditors in the previous couple of weeks.

Wintermute, a nicely-acknowledged market place maker in the cryptocurrency market place, was a short while ago embroiled in controversy more than “losing” twenty million Optimism OP tokens. Fortunately, all through subsequent negotiations, Wintermute convinced the hacker to return the dollars.

Answer the interview Wall Street newspaper On July seven, Marina Gurevich, Head of Wintermute’s operations, mentioned:

“When Three Arrows Capital was clearly insolvent, Wintermute and several other institutional traders were waiting for him to be asked to repay. In recent weeks we have repaid hundreds of millions of dollars of debt to many lenders ”.

Cryptocurrency trading company Alameda Research has presented emergency credit score lines to the now-failed cryptocurrency loan company Voyager Digital, in which it owned a minority stake. Filing for bankruptcy demonstrates that Alameda was also a buyer. https://t.co/QFYBhISq5C

– The Wall Street Journal (@WSJ) July 7, 2022

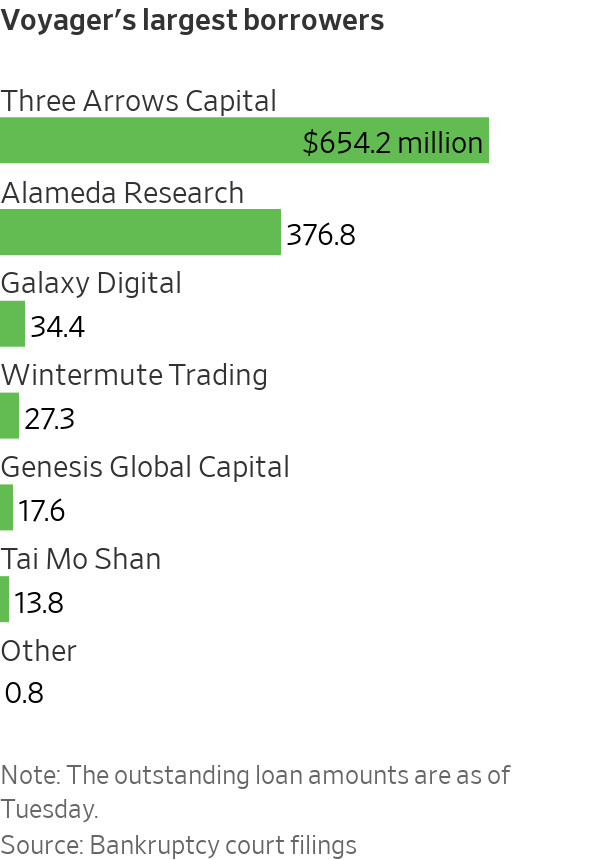

Wintermute’s statement comes as a cryptocurrency lending / investment platform that Voyager has filed for bankruptcy due to the “liquidity crisis” spreading across the cryptocurrency market place. Voyager is right influenced by the Three Arrows Capital investment fund, which also filed for bankruptcy on July two and is confirmed by Voyager that it owes them extra than $ 650 million in cryptocurrency.

In addition to Three Arrows Capital, other institutions that owe dollars to Voyager incorporate Alameda Research (practically $ 377 million), Galaxy Digital ($ 34.four million), Wintermute ($ 27.three million), Genesis Trading (17.six million). USD), USD), Tai Mo Shan ($ 17.six million), …

In the checklist over, Genesis Trading is the title that is also the creditor of Three Arrows Capital, with losses that can attain hundreds of hundreds of thousands of bucks.

Another noteworthy institution is Alameda Research, a crypto investment fund affiliated with the FTX exchange and billionaire Sam Bankman-Fried. As reported by Coinlive, Alameda Research was observed to be “both a creditor, a debtor and a shareholder” of Voyager. The hedge fund, which owes Voyager $ 377 million, loaned practically $ 500 million to Voyager at the finish of June and also owns about 9-ten% of the organization.

On July eight, Alameda Research tweeted for the initial time that it would be prepared to reimburse Voyager and withdraw its ensure.

Synthetic currency 68

Maybe you are interested: