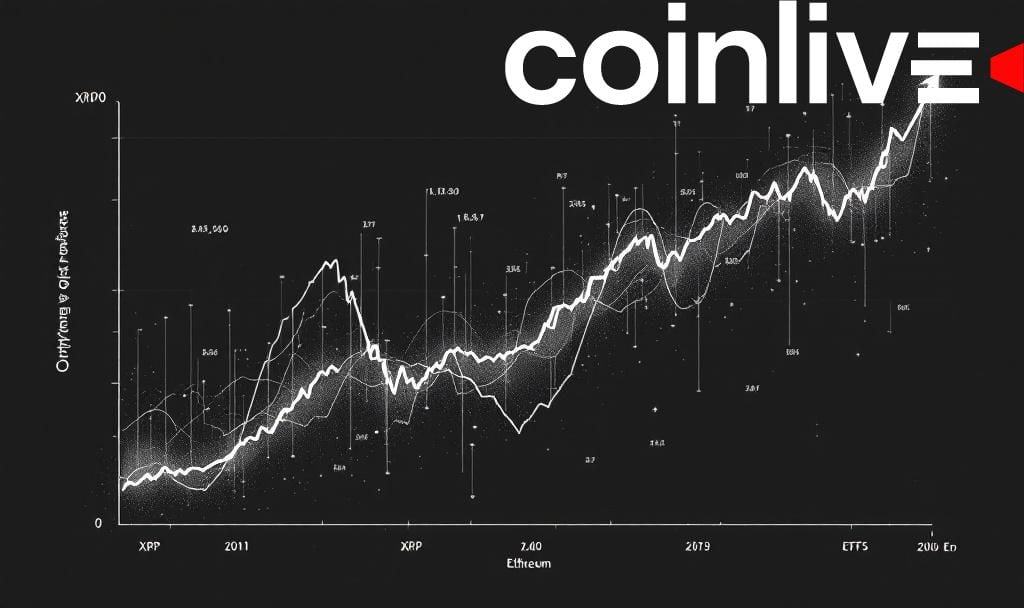

- XRP and Solana ETFs attract significant institutional inflows.

- Bitcoin and Ethereum witness substantial outflows.

- Altcoin ETFs reshape investment dynamics significantly in 2025.

XRP and Solana ETFs attracted over $500 million in institutional inflows during November 2025, contrasting with $4 billion exiting Bitcoin and Ethereum investments.

This shift in capital reflects a changing focus within the cryptocurrency market, influencing institutional strategies and potential growth for altcoin ETFs.

XRP and Solana ETFs witnessed record institutional inflows, with more than $500 million combined, marking a notable shift. Canary Capital’s XRP ETF, with its highest trading volume on launch day, reflects this evolving investment interest.

Major players, including Canary Capital, are central to these shifts. Their spot XRP ETF achieved $59 million on its first day. Grayscale and Bitwise also contributed over $382 million in Solana ETF inflows, highlighting growing altcoin interest.

The capital movement signifies a marked shift from Bitcoin and Ethereum investments to altcoin ETFs, causing Bitcoin and Ethereum ETFs to face over $4 billion in outflows. This evolution is influencing the broader cryptocurrency landscape profoundly in 2025.

Financial implications are apparent as altcoin ETFs become more central to investors. The myriad inflows suggest that institutional investors are reevaluating their crypto investment strategies, spurring potential long-term growth in altcoin markets.

The trends highlight changing investor perceptions, with a potential shift in crypto market focus. This movement, catalyzed by institutional interest, could drive broader adaptation and regulatory acceptance of alternative cryptocurrency products.

Financial, regulatory, and technological implications from these inflow patterns suggest further market expansion in altcoins, sustained by new financial products. Developer sentiment in the Solana ecosystem remains robust, despite temporary price decreases, supporting longer-term market prospects.

For the first time, institutional investors are being invited to consider Solana as a standalone macro asset. This represents a significant shift in perception. – Maria Carola, CEO, StealthEx