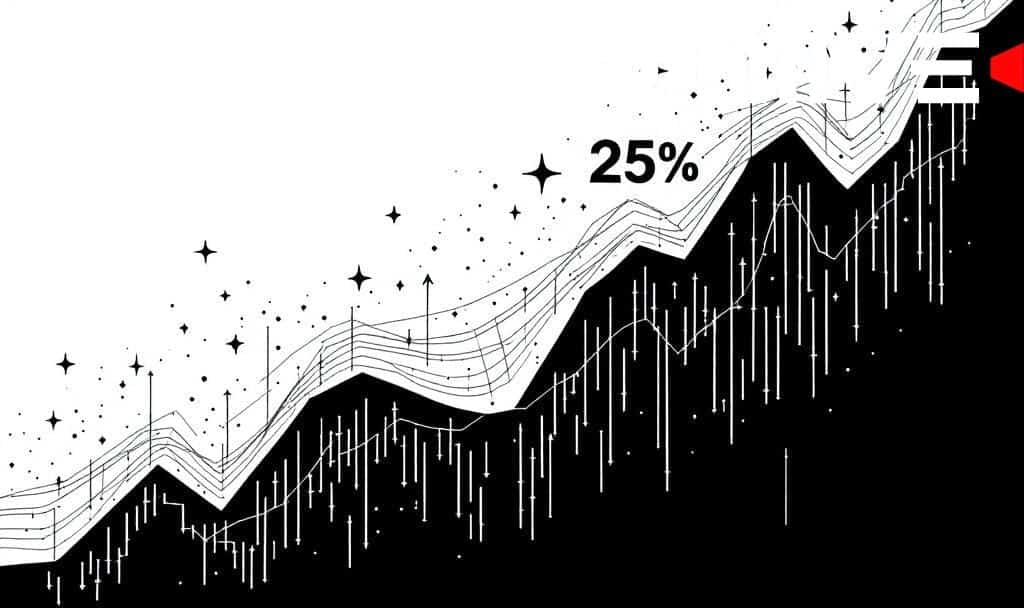

- XRP rebounds 25%, led by ETF inflows boosting price.

- Analysts highlight key resistance and market potential.

- ETF trends mirror historical Bitcoin dynamics, impacting supply.

Ripple’s XRP surged 25% in two weeks, hitting $2.34 due to ETF inflows, reversing a two-month downtrend and boosting investor confidence.

The rally indicates market optimism despite recent declines, with ETF dynamics echoing Bitcoin’s success, hinting at potential XRP scarcity and price escalation.

Main Content

XRP Price Rally Insights

XRP experienced a 25% price increase in two weeks, climbing to $2.34 due to significant ETF inflows.

Ripple’s leadership has not made public statements regarding the price movement, though precise data confirms increased ETF participation. For more details, you can explore the CryptoDotNews Partner Page.

Impact of ETF Launches

ETFs launched, capturing $1.3 billion in assets, have seen continual positive inflows over 43 consecutive days. This reflects increased investor interest.

XRP’s rise contrasts with negative flows from Bitcoin and Ethereum ETFs, underlining market shifts. For further highlights from analysts, you can check out the following tweet:

Market Dynamics and Projections

The ETF-driven scarcity in XRP has reminiscent elements of Bitcoin’s previous ETF expansions. Experts project further price increases if these dynamics persist.

According to Dark Defender, breaking above $2.22 is crucial for XRP. The analyst also suggested the token could be approaching a larger upside move, likening the setup to silver, and flagged targets such as $6 and even $20 further out. Source

Market analyst Dark Defender notes XRP’s bullish trajectory, particularly highlighting a crucial resistance level. To gain more insights into market band discussions, refer to: