2022 will be a quite memorable yr for the cryptocurrency market place as a total. Although the general trend was down, the market place was exceptionally energetic with a series of occasions. The influence of these developments will final for numerous many years to come, shaping a colorful crypto planet.

The market place has ups and downs, occasions have very good and terrible. But all in all it really is been a yr. Let’s consider a seem at the milestone occasions of 2022 with Coinlive!

one. The 0xSifu scandal has been “exposed”

Wonderland (TIME) is a task to “copy” the Olympus DAO (OHM) model and operate on Avalanche. The task was founded by Daniel Sestagalli – The “rising star” of the DeFi sector at the time simply because he was the founder of Abracadabra, Popsicle Finance and the “Frog Nation” alliance, even at one particular level proposed to purchase the the moment common DEX SushiSwap. This new group of tasks was the moment recognized as “DeFi 2.0”.

The 2nd crucial figure of Wonderland is the “CFO” whose Twitter account is 0xSifu. Anonymity is frequent in the cryptocurrency market place. This will not be newsworthy until eventually 0xSifu is “peeled” by a member of the crypto local community, ZachXBT. Michael Patrick – co-founder of Canadian cryptocurrency exchange QuadrigaCX.

QuadrigaCX is an exceptionally infamous exchange right after stealing $190 million from end users underneath the guise of the CEO’s sudden death, and the FBI has also been implicated in the investigation. The title Michael Patryn also has a “rogue” background with a criminal record. The QuadrigaCX situation was so common that Netflix even produced a quick documentary about the story of the exchange’s collapse.

Whether a prominent task of the DeFi two. motion has this kind of a “scam” member will naturally influence a whole lot, building traders query Wonderland’s dependability. The scandal speedily swept the section, pushing the selling price of most coins in the DeFi two. pool to a “slump”.

By the time 2022 ended, the “DeFi 2.0 trend” has all but sunk into oblivion. Projects that had been the moment labeled “potential” are now ignored.

two. Andre Cronje is leaving the cryptocurrency sector

If 2020 and 2021 assistance construct Andre Cronje’s picture of “The Godfather of DeFi” with a amount of primary tasks in the discipline of decentralized finance, a series of occasions will consider area in the quick very first three months of 2022 that canceled every thing.

It all began with Solidly, the AMM on Fantom launched by Cronje following the “advanced” ve(three,three) model. And as typical, any DeFi task “involved” with Andre is especially observed by the local community. Solidly speedily acquired a big sum of cash poured into the protocol, triggering Fantom’s TVL from December 2021 (when Solidly was announced) to March 2022 (when Solidly launched) to raise from $three billion to $eight billions of bucks.

But then, the local community identified a…pretty silly bug in the code. According to the code comment, the Base Emission Rate (approximately understood as the original emission degree of the Reliable token) is two%. However, it really is feasible that the crew forgot to subtract one from this worth, triggering the real amount to roll down to 98%.

This is basically a blunder that should not have took place. If the programmer had been a lot more mindful, the bug may well not have occurred.

And who is the programmer right here? It’s André Cronje!

With so numerous difficulties arising, Andre Cronje is the one particular to criticize. The task leader then produced the move… “stop playing Twitter”, leaving the local community wanting to know in which path to proceed accompanying Solidly. Then, a number of days later on, Andre produced the choice to rock the total market place when he announced that he was “leaving the industry” DeFi, pausing to concentrate on 25 tasks.

Immediately, the symbolic selling price of the tasks Andre Cronje participated in the growth of had plummeted, when numerous folks criticized the sudden departure of the “DeFi godfather” as no unique from the “rug pull”, i.e. the fraud of the local community when they place a a whole lot of faith in Solidly and the ve(three,three) model in the previous.

Fast forward to the finish of the yr, Andre sometimes seems on Twitter, remarks a number of lines, writes a number of blog site posts, and a number of instances “hint” will come back. These actions, when building the local community fairly “bored”, are nevertheless welcomed by a aspect of “avid fans”. After all, Andre Cronje is nevertheless one particular of the most potent and contributing characters still.

The nascent cryptocurrency market place are unable to be excluded from the influence of worldwide financial and political developments in 2022.

three. FBI arrests couple in connection with 2016 Bitfinex hack

On February 9, 2022, the US Department of Justice announced this $three.six billion really worth of Bitcoin seized (94,000 BTC) was stolen in the Bitfinex exchange hack in 2016, and also arrested two relevant suspects, couple Ilya Lichtenstein – tech entrepreneur and Heather Morgan – businessman, safety specialist.

However, in accordance to the indictment, the pair are accused of getting “conspiracy to launder money,” but it is unclear no matter whether the hacker immediately attacked the Bitfinex exchange.

The over information has the moment once more produced the picture of the cryptocurrency market place even a lot more detrimental in the public eye. The two primary characters are currently being held by US authorities when awaiting trial in court.

four. Crypto and the Russia-Ukraine conflict

This yr the planet has witnessed the Russia-Ukraine conflict it has an effect on all facets of daily life. And cryptocurrencies are no exception.

When the Russia-Ukraine conflict broke out, the selling price of BTC was severely hit, “flying” past the typical forecasts. The volatility of BTC through this time period has been likened to a “roller coaster”, primary to numerous enormous liquidations on exchanges.

More importantly, the cryptocurrency has been picked by the Ukrainian authorities as a around the world donation process. Since Ukraine set up an official internet site for donating cryptocurrencies, numerous folks within and outdoors the local community have sent every single coin to assistance the nation. Vitalik Buterin also “silently” donated $five million to Ukraine. Subsequently, Ukraine launched the “war museum” NFT assortment with Russia, demonstrating the usefulness and practicality of this discipline.

five. Tornado funds verdict

In the previous, there have been numerous circumstances of crypto tasks currently being addressed by regulators, this kind of as Ripple currently being sued by the SEC or the New York government towards Bitfinex-Tether.

However, the situation of US web page Tornado Cash currently being listed on the sanctions checklist is the very first instance in which we see the fierce confrontation concerning government manage of a nation with the spirit of decentralization and the privacy of cryptocurrencies.

Therefore, Tornado Cash’s verdict is not just a matter of style and design, but represents the common state of cryptocurrencies these days:

six. Elon Musk and Twitter

If in preceding many years Elon Musk has proven his “more acceptance” of Bitcoin and crypto, this yr it really is Twitter’s flip.

In 2022, Elon Musk took the total planet on a roller coaster trip as he often announced he was in the system of acquiring the Twitter business, then out of the blue “cancelled”, criticized and then established to purchase it. So far, getting only been ushered in as CEO of Twitter for much less than a month, Elon Musk has expressed his intent to come across a new executive for Twitter.

These occasions would in all probability only influence the conventional money markets… had been it not for Twitter. This is a social network that is pretty much the “home” of the worldwide crypto local community, so developments with the host business are mentioned. Also, Elon Musk has an “ambiguous history” with cryptocurrencies, so this M&A deal naturally has an effect on the total sector.

seven. American legal historical past

The legality of cryptocurrencies in the US has usually been the most common subject in the local community. Because, as the very first planet electrical power, the guidelines that the United States applies to cryptocurrencies will be mentioned and consulted by other nations.

Luckily, US officials do not intend to outright ban it like China, but alternatively want to deliver cryptocurrencies into the suitable regulatory framework. Especially in 2022, the United States demonstrates excellent determination when a series of expenses and laws relevant to the sector stick to one particular one more.

As it stands, it is complicated to synthesize clear legal regulation simply because US officials themselves are nevertheless devising and learning answers. Some of the crucial developments are as follows:

– On March 9, 2022, the White House internet site published an report summarizing President Biden’s digital asset executive purchase. The purchase directs federal companies to accelerate investigation into facets of the cryptocurrency sector with the eventual target of building a in depth regulatory framework.

– September 2022, the US government issued new pointers on the regulation of cryptocurrencies. This is thought of to be the very first in depth regulation guidebook for the cryptocurrency sector with quite a few crucial factors this kind of as:

– Many draft laws on the regulation of cryptocurrencies have been presented to the National Assembly, this kind of as the draft laws to regulate the total cryptocurrency sector, the bill to grant management rights of cryptocurrencies to the CFTC and restrict the growth of DeFi by former advisor to FTX CEO Sam Bankman-Fried. There is also a proposal to tax cryptocurrency “brokers” pending clarification from the US Treasury Department.

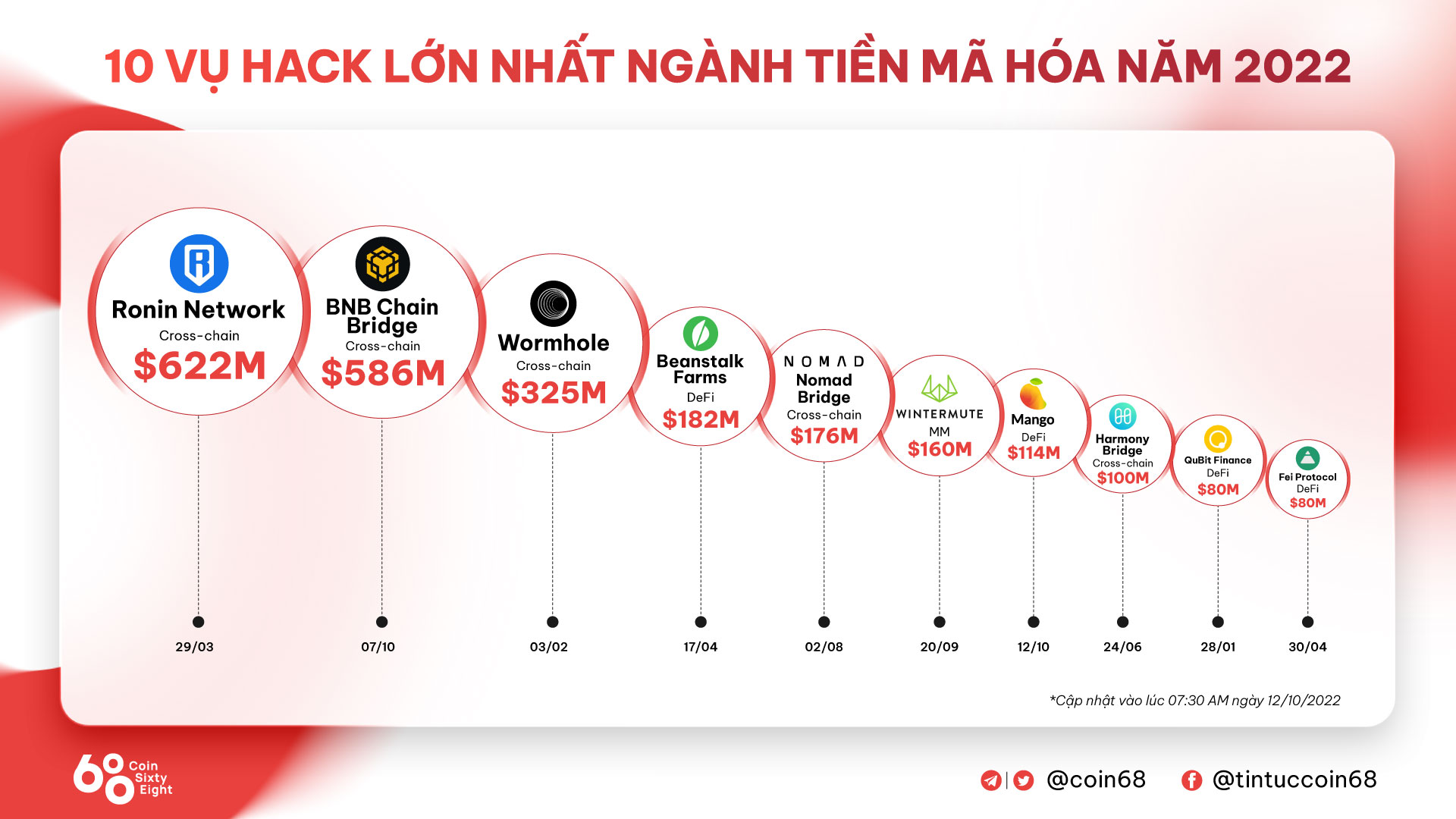

eight. The yr of hackers

Cryptocurrency markets enter a downtrend in 2022, but are nevertheless a rewarding “money machine” for hackers.

According to the statistics of Chain examinationat least three billion bucks suffered losses in cryptocurrencies all through the yr and produced 2022 the record for the complete worth of losses due to cryptocurrency attacks.

The most usually targeted target is DeFi’s cross-chain array, which is thought of a “long loop” of transfers concerning blockchains but is also a key vulnerability. With three tasks connected in October, virtually $600 million was misplaced, or 64% of the complete reduction for the yr.

Learn a lot more about the top rated crypto hacks of 2022: