US President Joe Biden’s to start with executive buy on artificial intelligence has sparked considerably debate and mixed reactions.

AI tokens “struggle” following the White House decree. Photo: CNBC

AI tokens “struggle” following the White House decree. Photo: CNBC

On October thirty, the White House issued a new executive buy to make sure nationwide protection towards the probable hazards of artificial intelligence (AI) technologies.

One point is clear: to know the guarantee of artificial intelligence and prevent its hazards, we have to govern this technologies. There’s no other way about it.

Yesterday I signed an executive buy that represents the most important action any government has ever taken on security, protection, and believe in in AI. pic.twitter.com/9sRE8tcUne

— Joe Biden (@JoeBiden) October 31, 2023

Accordingly, President Biden’s administration necessitates AI advancement providers to notify the US government below the Defense Production Act (DPA) if the system below advancement poses a nationwide protection threat, the regional economic system or influences the wellbeing of end users.

The executive buy necessitates developers to obtain options to reduce the harm that AI can induce to employees, this kind of as unpleasant occupation losses or the substitute of human jobs with AI.

White House deputy chief of personnel Bruce Reed described the buy as “the strongest action” ever taken by any government in the planet to make sure cybersecurity.

However, the over move sparked a good deal of damaging reactions from the public. The CEO of Tusk Ventures, a fund that invests in technologies and artificial intelligence, mentioned that technologies providers will not want to share proprietary information about the artificial intelligence programs they are developing with the government for worry of info leaks and fraud in the hands of opponents.

Not just the tech planet, several cryptocurrency providers have also expressed their discontent. Jeff Amico, a former companion at a16z and present CEO of Gensyn Network, criticized the edict as horrible mainly because it harms US innovation. He stressed that the new guidelines make startups and providers creating state-of-the-art technologies tasks topic to the very same compliance and reporting as significant publicly traded organizations.

Biden’s AI executive buy is out, and it truly is horrible for American innovation.

Here are some of the new obligations, which only significant historical operators will be ready to comply with 👇 pic.twitter.com/R3Mum6NCq5

— Jeff Amico (@_jamico) October 31, 2023

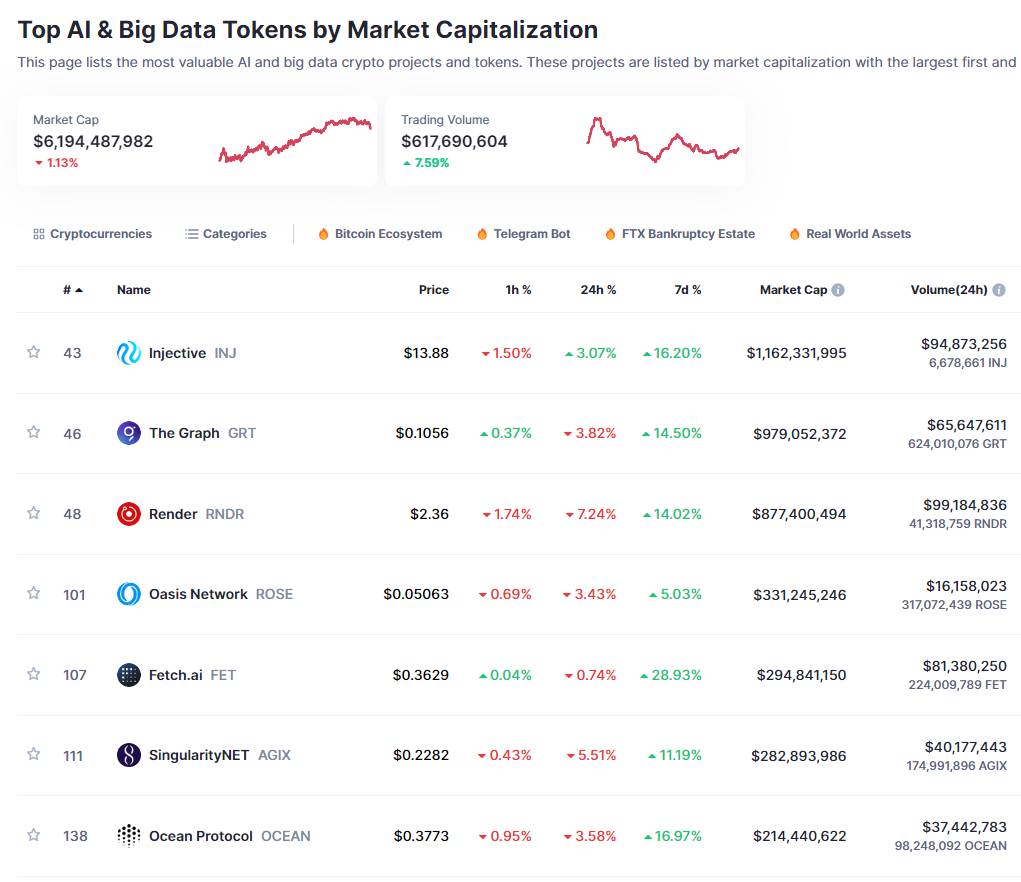

While the vast majority of the crypto sector has grown properly in excess of the previous 24 hrs, the AI token section has been drastically impacted by the decree. Typical tokens like The Graph (GRT), Fetch.AI’s (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) all fell deeply by five-ten%.

Price fluctuations of some big AI tokens in excess of the final 24 hrs. Source: CoinMarketCap

Price fluctuations of some big AI tokens in excess of the final 24 hrs. Source: CoinMarketCap

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!