The Anchor Protocol (ANC) lending task on Earth just lately accredited the proposal to concern veANC tokens, paving the way for the “Anchor Wars”.

Anchor overview

Anchor Protocol (ANC) is the “core” lending protocol of the Earth ecosystem (LUNA) mainly because it presents an curiosity charge of 18% for the UST stablecoin, which has been the driving force behind LUNA-UST’s development in latest months. UST also grew to become the third greatest stablecoin in the cryptocurrency field in April with a market place capitalization of above $ 18 billion. UST’s results has led several other ecosystems to make their personal algorithmic stablecoins this kind of as USN on Close to Protocol or USDD on TRON, all of which have exceptionally interesting APY earnings.

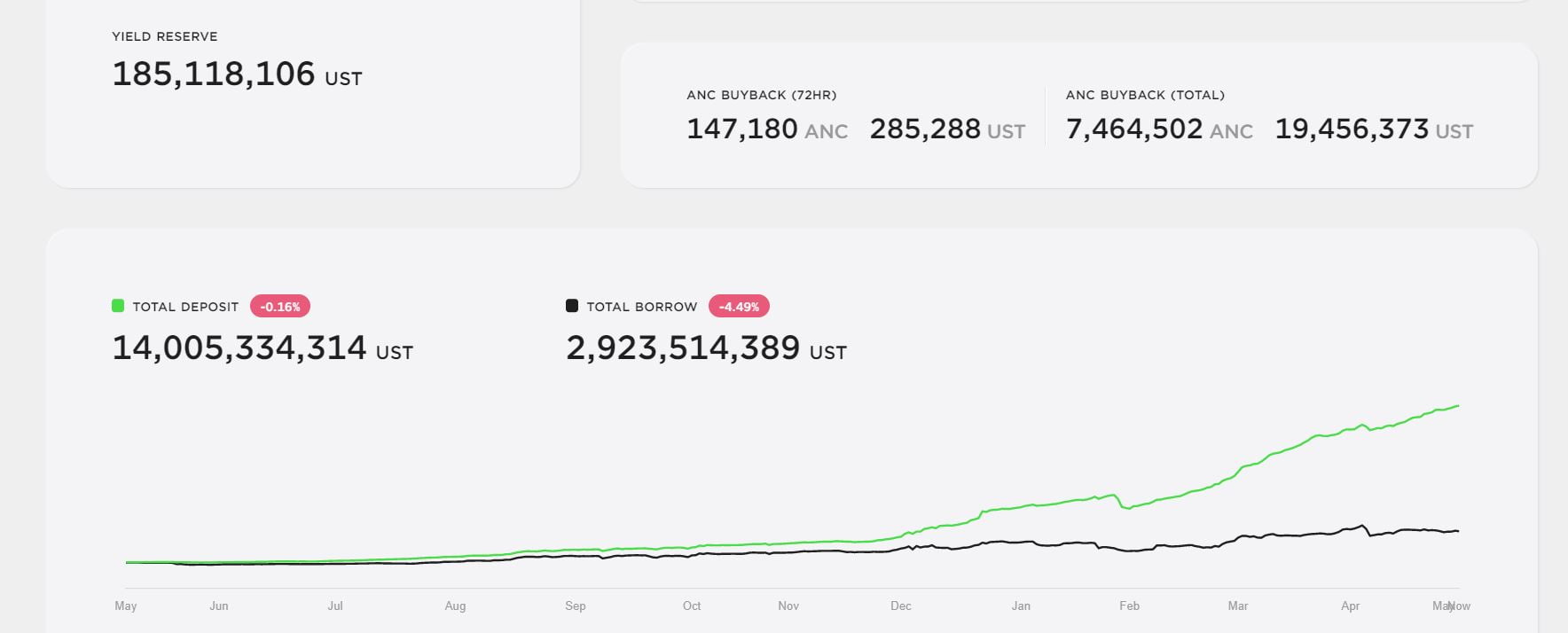

However, there are nevertheless several criticisms directed at the romance involving LUNA and UST, arguing that it is all just a “ponzi game”. Where, the “drop of water” that will make it all fall is the truth that Anchor Protocol runs out of money to shell out for UST shippers’ rewards. The purpose is that the sum of UST deposits on Anchor nevertheless exceeds the loan sum, forcing the task to have to shell out out of its personal pocket to shell out 18% curiosity.

In individual, the sum of dollars that FSO has deposited in Anchor is at this time UST 14 billion, although the sum borrowed is only almost UST three billion.

In February 2022, Anchor when ran out of dollars and had to inquire Terra to “save” UST 450 million. So far, the over sum is only $ 184 million and it is estimated that it will be employed in the up coming 34 days.

Proposal 26 and veANC token

Therefore, the Anchor Protocol local community from March 2022 started discussing developing new makes use of for the project’s ANC token to take out the aforementioned node. The consequence of this procedure is Proposal 26, which was voted on May six.

one / With the approval of Prop 26, $ ANC tokennomics is obtaining an update!

Let’s get a seem at what it moves from $ ANC good $ veANC will seem and how it will have an impact on the voting, prize staking and collateral indicators that could lead to the brief-phrase #Anchor Wars️ pic.twitter.com/6hzlTmKQyy

– Anchor protocol (@anchor_protocol) May 6, 2022

Proposition 26 will carry a significant improve to ANC tokenomics, with the arrival of veANC – the token represents the sum of ANC blocked and will now be employed in Anchor governance and voting. As a consequence, ANC holders can opt for to lock their tokens from one week to four many years to improve the excess weight of their votes, up to a greatest of two.five instances.

The sum of blocked ANC is immediately unlocked every single week and lowers the user’s capability to vote, so if you want to hold the vote ratio, the consumer desires to consistently check and convert the unlocked ANC back to veANC.

five / For instance, if a consumer has blocked one hundred $ ANC for four many years (offering a greatest rating improve of two.5x), their voting electrical power would commence at two.five * one hundred = 250. This 250 $ veANC thus it would “decay” linearly, or it would unlock every single week, at the charge of:

❇️ four many years * 52 weeks = 208 weeks

❇️ 250/208 = one.two $ ANC/ week– Anchor protocol (@anchor_protocol) May 6, 2022

“For example, a user blocks 100 ANCs for 4 years (to get 2.5 times more votes), the initial vote count will be 2.5 * 100 = 250. These 250 veANCs will” lapse “above time, unlocking each and every week at a specified pace of:

four many years * 52 weeks = 208 weeks

250/208 = one.two ANC / week. “

Anchor also mentioned that ANC tokens that participate in staking will no longer have governance rights, but will nevertheless give holders the proper to acquire ANC rewards. Those who want to participate in the vote ought to cancel staking and transfer ANC to veANC.

In addition, 50% of the reward for ANC staking will henceforth be awarded to holders of veANC tokens.

The blockade of the ANC will also minimize the ANC provide circulating in the market place, triggering the rate of the token to rise. The ANC rate had risen somewhat on the adoption of Proposition 21, but is back in line with the basic retracement of the cryptocurrency field at press time.

How veANC designed “Anchor Wars”

veANC will be employed to build inspiration to borrow UST on Anchor Protocol, solving the trouble of “oversupply, lack of demand” that this platform is dealing with.

With the new model, Anchor consumers will will need to safe assets this kind of as LUNA, ETH, AVAX or ATOM to borrow UST dollars. This collateral sum, for instance LUNA, will be swapped by Anchor into derivative assets this kind of as bLUNA, stLUNA or LUNAx, issued by significant DeFi protocols such as Lido Finance, Stader or Benqi.

13 / For instance, for $ LUNA there may perhaps be a basket of $ bMOON, $ stLUNA& $ LUNAx from which the protocol performs the exchange $ LUNA anytime anyone presents $ LUNA as a ensure on Anchor.

– Anchor protocol (@anchor_protocol) May 6, 2022

Holders of veANC will have the proper to vote on how the sum of LUNA collateral will be traded in the over derivatives, as a result affecting the rewards derived from the creation of this kind of derivative tokens.

Anchor Protocol hopes that making use of veANC to establish collateral costs will type an “Anchor War” involving DeFi protocols, which will consider to gather ANC, block veANC, and the incremental voting ratio of collateral you build, therefore obtaining even further rewards. . Regular consumers of ANC can also join this battle by delegating veANC to tasks.

15 / This LSD minting competitors (which protocols this kind of as @LidoFinanza, @staderlabs, @BenqiFinance and other people earn sizeable commissions) is what could give rise to #Anchor Wars⚔️.

– Anchor protocol (@anchor_protocol) May 6, 2022

This is a related pattern to “Curve Wars” on Ethereum when tasks like Convex compete to hold veCRV to vote for CRV awards for themselves. However, it is nevertheless also early to say with certainty that Anchor Wars on Earth can build the very same result as Ethereum’s Curve Wars.

The model of “waging war” involving DeFi tasks is also employed by several ecosystems this kind of as Solidly Wars on Fantom or Platypus Wars on Avalanche.

Synthetic currency 68

Maybe you are interested: