Mining charges for 1 Bitcoin have dropped to a ten-month very low as BTC’s mining trouble has dropped six.seven% from the peak in May.

On July 14, JPMorgan strategists led by Nikolaos Panigirtzoglou stated in a exploration report that the price of making Bitcoin fell to about $ 13,000 from $ 24,000 in early June 2022. This is the lowest degree given that September. 2021.

This volatility stems from the reality that BTC’s mining trouble has dropped from its peak in May 2022, dropping from 31.25 trillion to 29.15 trillion, which is also when Bitcoin’s mining income for miners registered the worst decline in 2022.

The price of manufacturing Bitcoin has dropped from all over $ 24,000 in early June to all over $ 13,000 now, which could be viewed as a downside to pricing, in accordance to JPMorgan. https://t.co/Ud1VkS5ymI

– Bloomberg (@business enterprise) July 14, 2022

Reducing the price of making Bitcoin can lessen the promoting strain of miners and enhance profitability. However, JPMorgan strategists remained cautious, saying the drop in manufacturing charges could be viewed as detrimental for Bitcoin’s long term cost outlook. Because the price of manufacturing is viewed as the decrease bound on BTC’s cost array through the lengthy-phrase bear marketplace.

Indeed, the index peaked shortly immediately after Bitcoin’s cost reached an ATH of $ 64,000 in April 2021 and $ 69,000 in November 2021. Therefore, it is safe and sound to say that this information is hugely correlated with the cost motion. of Bitcoin. Therefore, JPMorgan analysts do not hesitate to make a prediction that BTC will possible proceed to right in the direction of the area of $ 13,000 as the price of making BTC.

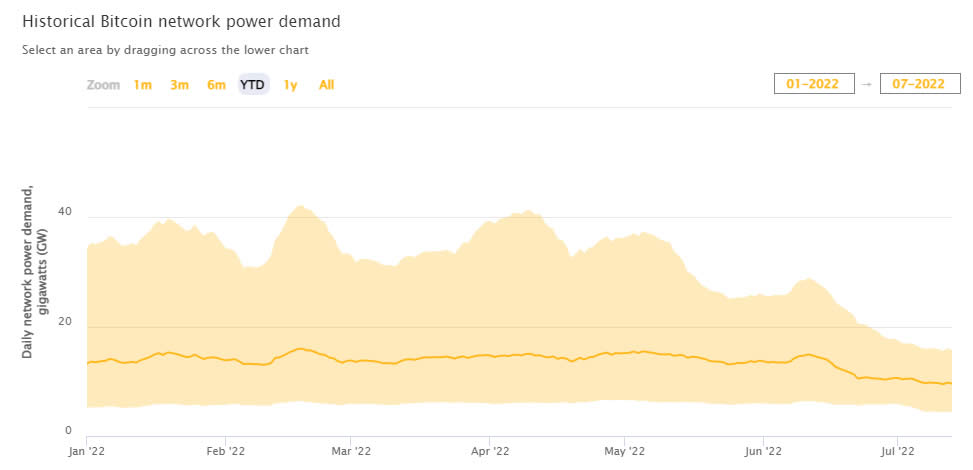

The lower in manufacturing charges is as a substitute linked to the reduction in electrical energy consumption. According to the published Cambridge University Bitcoin Energy Consumption Index, the grid’s estimated every day electrical energy demand is 9.59 Gigawatts. That’s a 33% drop in the previous month and forty% from 2022’s record demand of almost sixteen Gigawatts in February.

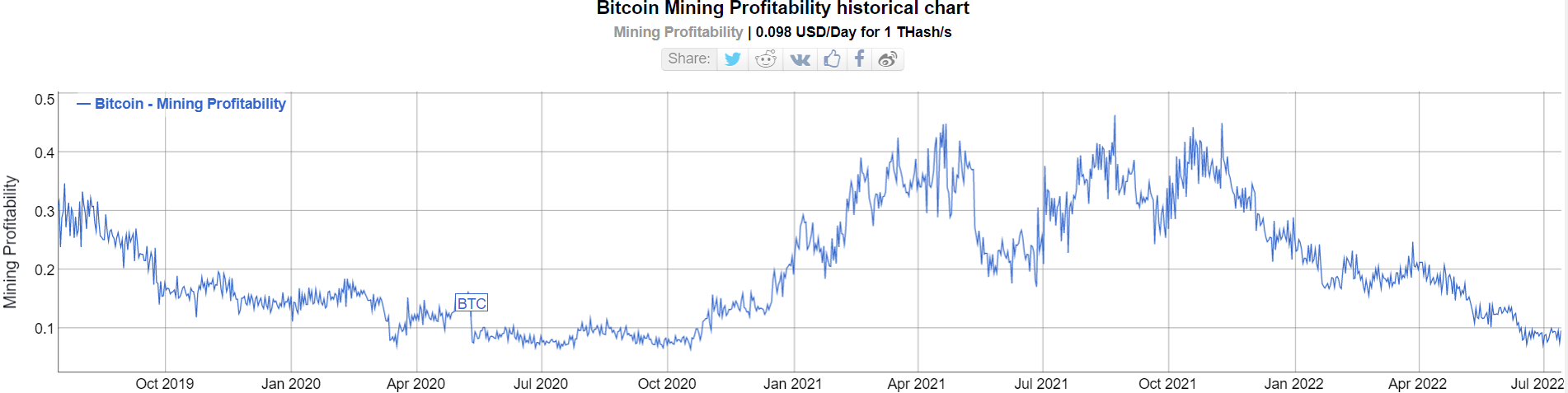

Additionally, a considerable quantity of miners have closed their older mining rigs due to inefficiency as they operate unprofitable due to increasing electrical energy charges and falling BTC rates. This has resulted in a 63% drop in mining profitability given that the commence of the 12 months.

Mining revenue is at present at its lowest degree given that October 2020 at $ .098 per day for one THash / s. However, there is also the probability of decreasing manufacturing charges which could avert mining income from continuing to decline and even reverse that trend in the coming months.

Synthetic currency 68

Maybe you are interested: