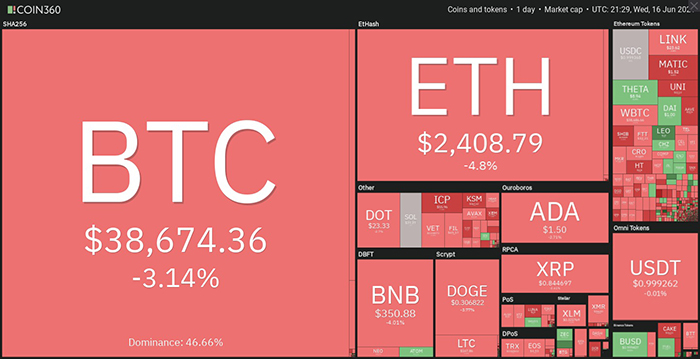

Bitcoin selling price and stock industry corrected somewhat just after the US Federal Reserve (Fed) announced programs to increase curiosity costs twice by 2023.

Bitcoin (BTC) extended its decline just after Fed Chairman Jerome Powell announced that his company is rescheduled and intends to increase curiosity costs twice by 2023.

Bitcoin commenced to weaken in the early hrs of trading on Wednesday (US time) just after shedding assistance at $forty,000 to hit an intraday minimal of $38,300. The Dow and S&P 500 also fell .77% and .54%, respectively.

The choice came amid issues between economists about increasing inflation in the United States, and Powell stated that the Fed raised inflation expectations from two.four% to three.four%. While Powell described the present spike in inflation as “temporary,” shopper costs are at a 13-yr higher and analysts are concerned that increasing inflation will weigh on the recovery. publish-Covid-19 economic system.

The Fed chair did not immediately deal with no matter if the Fed would get started shrinking $120 billion in month-to-month bond purchases, but his choice to increase costs in 2023 suggests that the program will lower in advance of 2023 to correctly performed.

Can Bitcoin keep its present assortment?

On June 15, Bitcoin selling price efficiently finished a bullish inverse head and shoulders pattern (four-hour chart), but failed to method the $45,500 target degree just after hitting resistance at $41,350.

While BTC selling price has dipped beneath $forty,000 and failed to flip it to assistance, analysts are viewing the present selling price action as a assortment-bound trade and at the time of creating, $38,300 has seems to be like a retest of decrease assistance.

With significantly less than three hrs left till the shut of the everyday candle, traders will possible be waiting for BTC to hold over the twenty-day moving regular close to the $37,000 degree, in which it is anticipated to act as assistance.

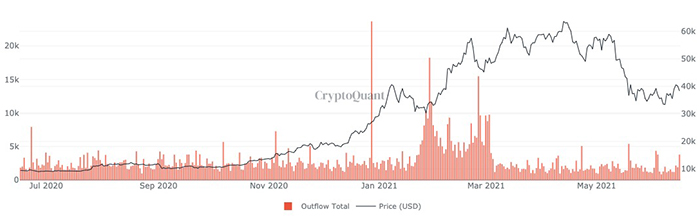

One point to note is that BTC inflows to significant exchanges (inflows) have remained regular and miner product sales have enhanced more than the previous couple of days, as information from CryptoQuant demonstrates that Bitcoin inflows are main. low cost prospect.

The 50 and 200-day moving averages are also on the way to converging, potentially forming a bearish “death crossover,” but each are backward indicators, which means they are not totally reflective. selling price action in the spot industry. However, each of these moving averages can generate important resistance for the bulls.

A drop beneath the $37,000 to $36,000 assortment, in which quite a few traders on Twitter declare to spot extended positions, will possible push BTC selling price to the decrease finish of the present assortment in the $35,000 to $31,000 area.

Readers can stick to the Bitcoin exchange charge and additional than two,000+ other cryptocurrencies right here.

Maybe you are interested:

Join our channel to update the most valuable information and information at:

According to CoinTelegraph

Compiled by ToiYeuBitcoin