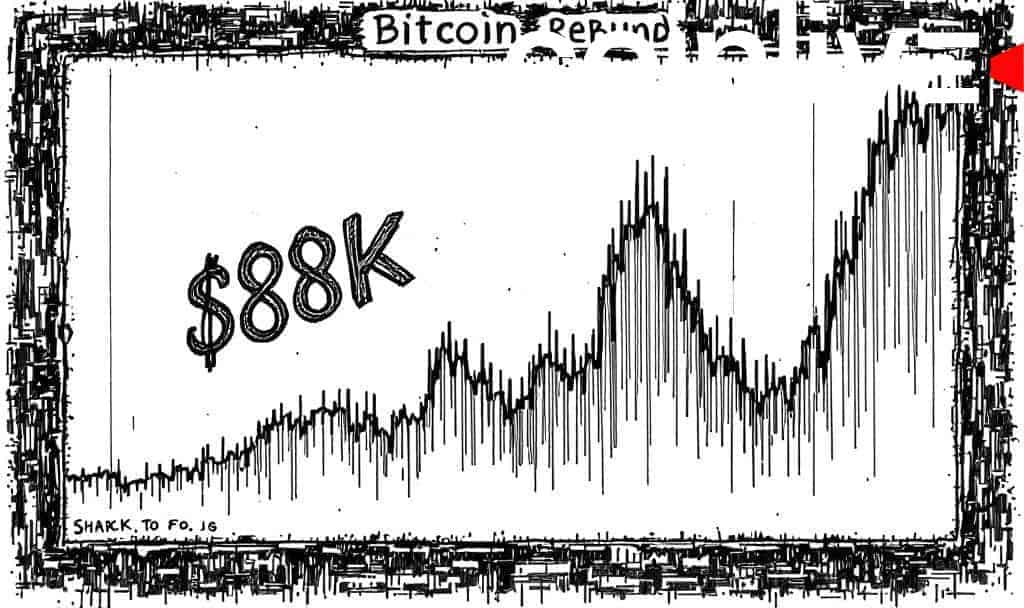

- Bitcoin rebounds to $88K after sharp decline.

- Market influenced by macroeconomic factors.

- Liquidation zone impacts trading activities.

Bitcoin experienced a sharp drop early this week before rebounding to $88,000, triggering significant liquidation in the crypto market.

This fluctuation underscores sensitivity to macroeconomic factors, impacting market stability and trading dynamics.

Section 1

Bitcoin experienced a sharp drop early this week before rebounding to $88K, marking a crucial level recently associated with liquidation. The rebound follows a volatile period marked by shifts in macroeconomic conditions observed at various levels.

Key players in the market have not directly commented on the price movements. The fluctuations are attributed to macroeconomic factors, including decisions by the Federal Reserve, with a noted absence of specific leadership actions influencing the rebound.

Section 2

The price fluctuations had immediate effects on various industries. Cryptocurrencies such as Ether and Solana also experienced turbulence, reflecting broader market volatility. The total crypto market cap has slightly decreased, showing the broader market’s reaction to Bitcoin’s price changes.

Financial implications include over $150 million in liquidations within a short period, impacting particularly Bitcoin and Ether. Analysts point to macroeconomic factors like Fed rate decisions as significant influences. These factors demonstrate the intertwined nature of economic policies and market movements.

Section 3

The market’s reaction to these events did not elicit notable statements from leading figures in the crypto community. Exchange analyses, however, underscore a potential link between fiscal decisions and liquidity conditions affecting Bitcoin’s trajectory.

“The recent Bitcoin price movements can largely be attributed to macroeconomic factors including Federal Reserve decisions and impending fiscal deadlines, rather than specific leadership actions.”Potential outcomes include increased market sensitivity to fiscal policies, with analyses suggesting ongoing impacts on liquidity. Historical trends indicate Bitcoin’s movement around $88K serves as a key pivot, highlighting the significance of macroeconomic influences on cryptocurrency valuations.