Cryptocurrency industry analyst PlanB features a range of evaluation and commentary on the Bitcoin cost above the subsequent two months.

Prepare for the undesirable situation in July

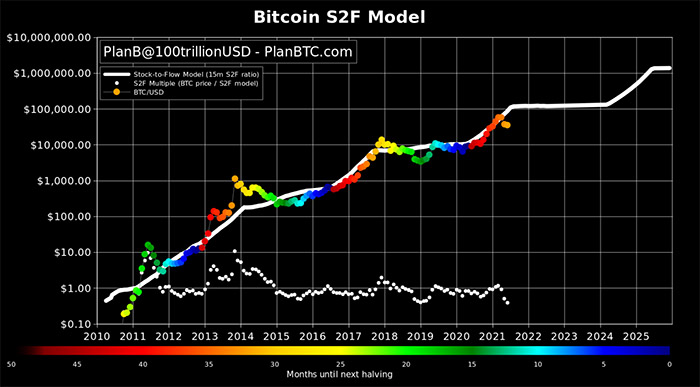

PlanB, the writer of the Stock to Flow (S2F) model, a short while ago presented a not-so-good condition for Bitcoin this month.

“The BTC price closed June at $35,037, much lower than the S2F model in January 2019. Over the next 6 months, Bitcoin price could break the S2F pattern (again),” PlanB explained.

Giving Bitcoin cost prediction in July, the analyst is very pessimistic.

“The closing price for July will be $28,000,” PlanB explained.

August will be quite fascinating

As of August, PlanB predicts that the industry will choose up and Bitcoin can regain momentum.

PlanB explained:

“During August, Bitcoin price will recover to over $47,000 and start moving towards resistance levels. The road ahead in the next few months will be very interesting.”

He predicts the Bitcoin cost could enhance by far more than forty% by the finish of August.

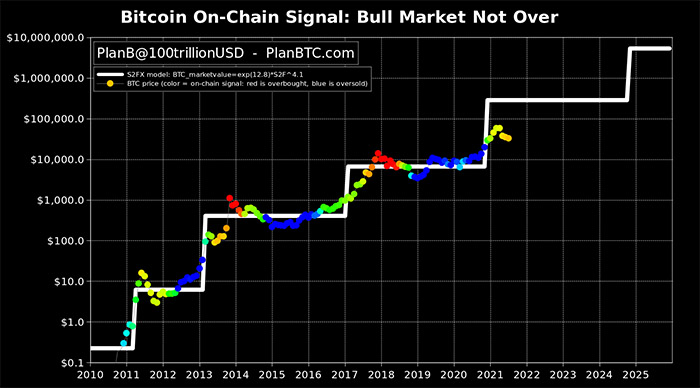

“My on-chain data says Bitcoin’s momentum is not over yet and $64,000 is not the peak. According to the S2F model, Bitcoin will have other rallies,” PlanB explained.

PlanB asserts that the closing cost in August will not be much less than $47,000.

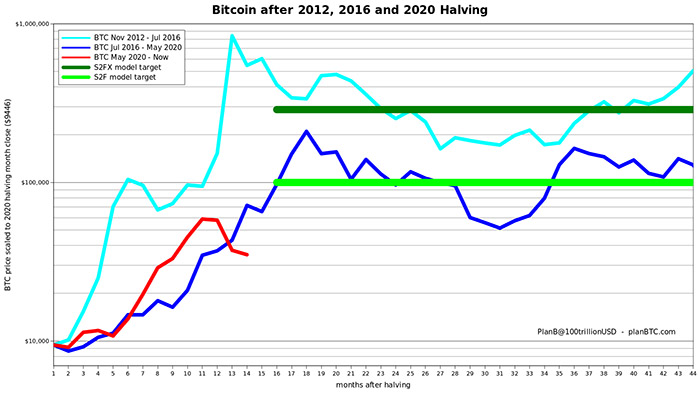

Returning to the query of irrespective of whether the Bitcoin cost will behave in the subsequent couple of months, set off a rally or proceed to accurate, PlanB explained that following every bull cycle, the Bitcoin cost will be much less volatile.

As proven in the chart under:

Bitcoin cost movements above the subsequent 6 months will be vital and fascinating in contrast to the Bitcoin cost predictions based mostly on the S2F model.

As issues settle, PlanB says there are only two situations for Bitcoin:

- $64,000 will be the peak this 12 months, and Bitcoin cost will hover all-around $25,000-$50,000 among now and the finish of the 12 months.

- The $64,000 degree is broken, Bitcoin continues its upward momentum in the direction of the target of $one hundred,000 and even $288,000 based mostly on the S2F model.

“I’m betting on the second outcome,” PlanB explained.

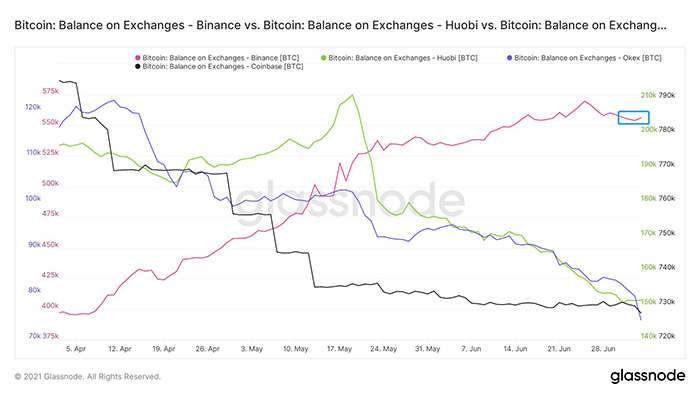

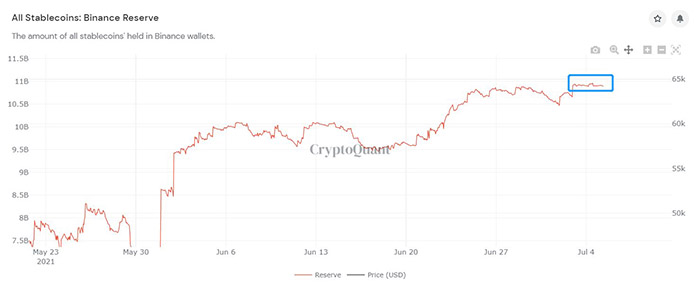

Meanwhile, in spite of the latest legal troubles, information displays that the reserves of Bitcoin and stablecoins on the Binance exchange have remained mainly stationary. This is great data that supports the cost.

CryptoQuant commented:

“The crypto market is not really bewildered about Binance being warned by countries.

In contrast, when the Chinese government implemented a policy of suppressing cryptocurrencies, a large amount of money escaped from the Huobi exchange. This shows the panic of the market.”

Bitcoin’s normal leverage on exchanges has returned to pre-May 19 amounts. Binance, the exchange with the biggest contract volume, hit a 3-month substantial. As a consequence, the potential volatility of the cryptocurrency industry is possible to be even more powerful.

Maybe you are interested:

Join our channel to update the most helpful information and awareness at:

According to Blogtienao

Compiled by ToiYeuBitcoin

.