Blur’s token is up 33% given that rival NFT marketplace OpenSea announced massive layoffs.

BLUR considerably improved its cost just as rival OpenSea ran into problems. Photo: medium

BLUR considerably improved its cost just as rival OpenSea ran into problems. Photo: medium

News that OpenSea is “tightening its belt” has developed sturdy momentum for rival marketplace Blur. This is plainly demonstrated by the cost fluctuations of the platform’s tokens.

Initially, BLUR improved by 80%, from USD .15 to USD .27, in just three weeks. After OpenSea announced it would reduce its workforce in half, Blur’s token continued to skyrocket by 33%.

1h chart of the BLUR/USDT pair on the OKX exchange, screenshot from TradingView on the morning of November seven, 2023

1h chart of the BLUR/USDT pair on the OKX exchange, screenshot from TradingView on the morning of November seven, 2023

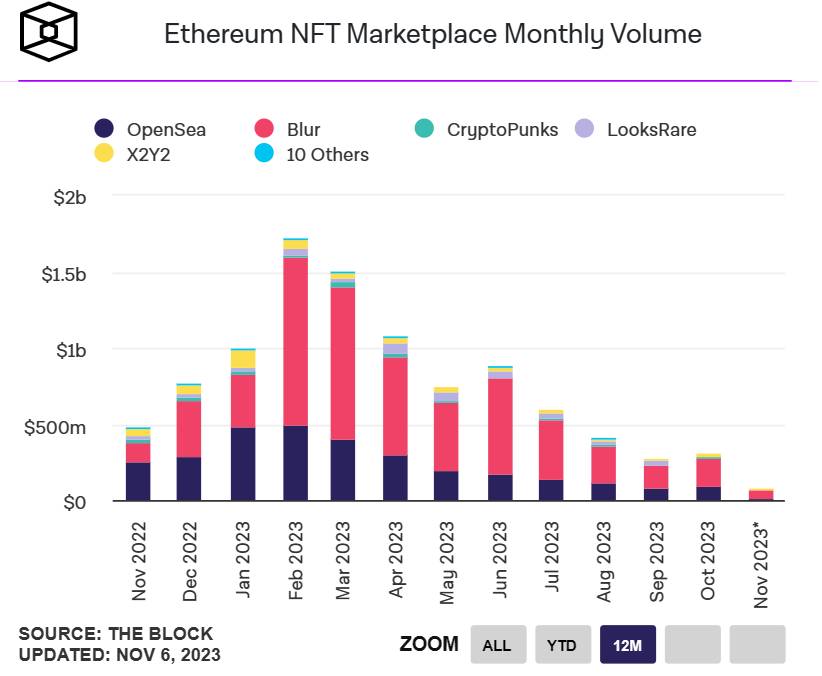

The over displays OpenSea’s plight following becoming usurped by Blur in NFT trading volume. According to the examination of Brad Kay, a researcher The block, Blur is thriving thanks to its various enterprise model. Kay mentioned:

“It is difficult for OpenSea to compete, because Blur has the advantage of a low royalty of 0.5%, an attractive airdrop program and incentives for NFT bidders.”

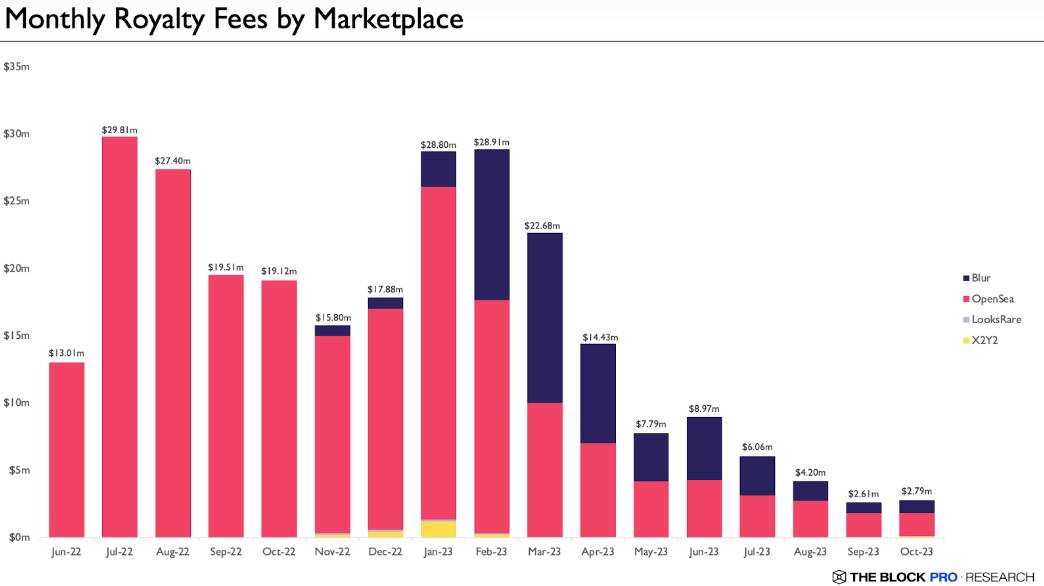

Royalty commissions on the four significant marketplace platforms. Source: The Bloc

Royalty commissions on the four significant marketplace platforms. Source: The Bloc

In contrast, OpenSea’s enterprise model is based mostly on collecting royalties and support costs on the platform. OpenSea has been making an attempt to cut down costs to compete and entice new consumers. However, all the efforts have been not ample and the Blur fell even more and even more behind.

>> Find out extra: Blur suggests that creators block OpenSea if they want to acquire complete NFT royalties

Blur does not revenue from commissions, Kay clarified. Instead, they chose to problem tokens. Normally, the project’s founding group will retain a sure preliminary percentage of tokens. The firm allocates 51% to the local community, 29% to the group that actively contributes to the undertaking, 19% to traders and one% to the advisory group.

Since April this yr, even however the NFT field has cooled down a bit, Blur nonetheless handles a bigger transaction volume than OpenSea.

Transaction volume statistics of significant market place platforms from November 2022 to these days. Source: The Bloc

Transaction volume statistics of significant market place platforms from November 2022 to these days. Source: The Bloc

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!