Near Procotol (Close to) has been a single of the brightest emerging names in the Layer-one race all through 2021 and early 2022. However, underneath the influence of the all round market place circumstance all through 2022 and with the developing competitors among Layer-one, Near Protocol tasks also encounter lots of complications and difficulties. Let’s consider a seem at the Near Protocol milestones, numbers and essential updates in 2022.

Ecosystem overview

About the quantity of tasks

Currently, the Near ecosystem has additional than 750 tasks and 125 DAOs created and managed.

Projects on the Near ecosystem are created rather in a different way, with all well-liked niches like DeFi, NFT, GameFi, DAO… so making very good help and complementarity.

One factor I value about Near is that they constructed Aurora, a remedy that is regarded a bridge for the productive blend of Near and Ethereum. Currently, Aurora itself has also created an ecosystem with additional than 200 substantial and smaller tasks.

Cash movement facts

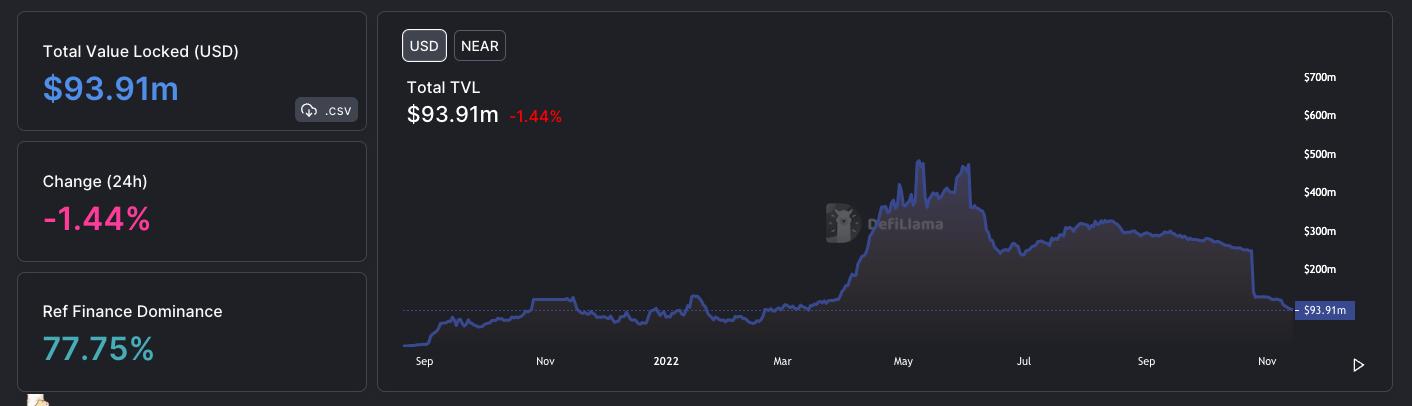

The quantity of tasks on Near is rather substantial, but are they carrying out nicely? Let’s analyze the money movement blocked on the Near ecosystem.

From June 2022 right up until now, TVL on Near has decreased from about $460 million to virtually $89.five million, equates to an 80% reduction.

So, is Near’s existing $89.five million TVL very good adequate? We will make a fast comparison table among ecosystems (information collected by CoinGecko – eleven/17/2022)

| TVL | Market Capitalization (MC) | Fully diluted cap (FDV) | MC/TVL | FDV/TVL | |

| Ethereum | 24.6b | 143.six b | 143.six b | five.eight | five.eight |

| Binance sensible chain | five.1B | 43.4b | 53.2b | eight.five | ten.four |

| Avalanche | 887.9 million | three.8B | 9.2B | four.three | ten.four |

| Polygon | one.1B | seven.7b | eight.7B | seven | seven.9 |

| Close | 89.five | one.5B | one.8B | sixteen.eight | twenty.one |

As you can see, evaluating Market Cap/TVL or FDV/TVL ratios demonstrates the very same end result, Near is overvalued (when we use TVL as a measure). Most other Layer-1s have this ratio a lot reduced than Near. Therefore, with only virtually 89.five million TVL of Near’s existing it truly is not very good at all.

Delving deeper into Near’s ecosystem, you see that out of virtually $89.five million TVL on Near, all… 77.75% belongs to just a single venture, Ref Finance. This prospects us to two conclusions:

- With the exception of Ref Finance, additional than 700 remaining tasks share only 22.25% of the TVL, equivalent to an sum of pretty much $twenty million. As this kind of, these tasks are totally ineffective in attracting customers and money movement.

- Near is also centered and vulnerable. As lengthy as Ref Finance will get hacked or crashes, the Near ecosystem can encounter major challenges.

Let’s consider a seem at the Top one Dominance on other ecosystems:

| Top one Domain | % domain | |

| Ethereum | Creator’s knife | 26.9% |

| Binance sensible chain | Exchange of pancakes | 50.9% |

| Avalanche | AVAVE | 46.seven% |

| Polygon | AVAVE | 25.five% |

| Close | Ref Finance | 77.75% |

Thus, other ecosystems retain the dominance percentage of the to start with one venture from 50% or significantly less, which will aid the ecosystem turn into additional decentralized, tougher to assault, and also distribute the money movement for improved remaining tasks.

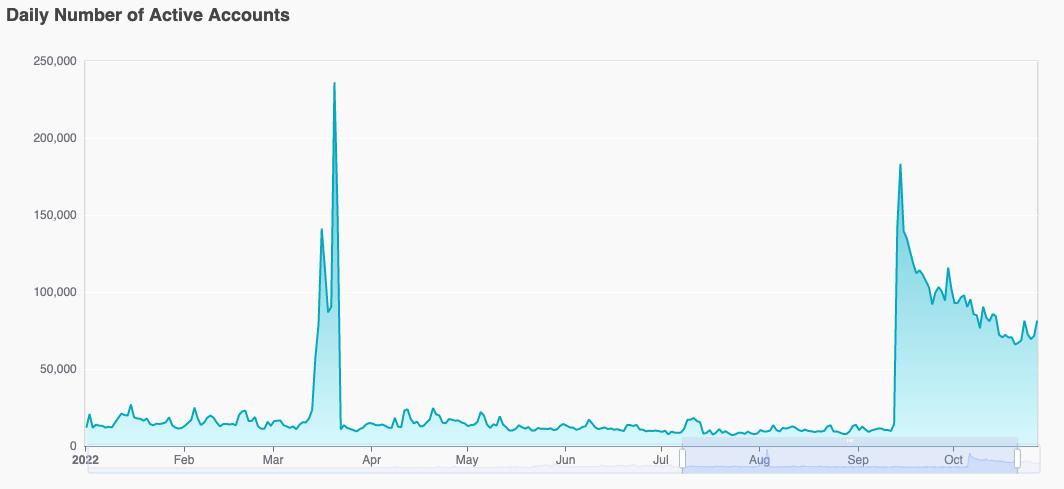

About customers

As you can see, the quantity of new accounts on Near has dropped substantially considering that May 2022. In my private view, this is primarily due to two factors:

- Close to himself can not build a “game” to entice customers and money flows.

- Affected by the sharp drop in the market place not too long ago => no new traders have entered the market place.

Except for intervals of peaks, the quantity of Near transactions is commonly rather steady. A plus stage in the final time period is that the quantity of transactions on Near has not decreased significantly, even larger than the time period July-September 2022. We can say that, in spite of not attracting new customers and money flows, Near continues to retain the outdated ones customers concerned in the ecosystem. This will be an benefit for Near.

Analysis of the pieces of the puzzle on Near

To improved comprehend the Near ecosystem, let us dive into the pieces that make up the ecosystem.

deFi

DEX

DEX on Near is rather diversified, between which Ref Finance, Orderly Network, Jumbo Exchange and Spin stand out, in which Ref Finance nonetheless occupies the absolute place. TVL on Ref Finance has reached in excess of USD 73 million, twelve instances larger than that of the leading two DEX exchanges, Orderly Network (TVL USD six.one million).

Due to its abundant liquidity, Ref Finance has turn into the exchange with the biggest trading volume on Near (common in excess of the previous thirty days, Ref Finance has accomplished a trading volume of about $four – five million USD/day.

Loan

The most notable representative in this section is Burrow with TVL reaching in excess of $sixteen million. However, Burrow nonetheless has lots of limitations, primarily the use of capital.

As you can see, even though Burrow has additional than $sixteen million usable, but only in excess of $two.five million is borrowed, this charge is only 15.9%. This is a really lower quantity and it is challenging to deliver a optimistic revenue for Burrow => curiosity paid to capital companies decreases => chance of TVL continuing to reduce.

Liquid staking

Liquid Stakings are answers that aid build synthetic assets of staking assets in a particular network (for illustration, stETH is a synthetic asset developed by staking ETH on Ethereum by the Lido remedy). Liquid Staking will aid customers each participate in staking and be certain liquidity of assets and create additional earnings.

Lido Finance is a single of the most prominent tasks in this niche when it is current and occupies a substantial TVL in the most well-liked chains this kind of as Ethereum, Solana, Polkadot. Unlike other ecosystems, Near was not affiliated with Lido but made a decision to produce its personal native goods this kind of as Metapool, LiNearProtocol or Stader.

In which, Metapool has TVL with in excess of $sixteen million, though LiNear and Stader have TVL with $five.one million and $one.9 million, respectively. Thus, the complete worth of liquid staking on the three biggest tasks on Near is only about $23 million.

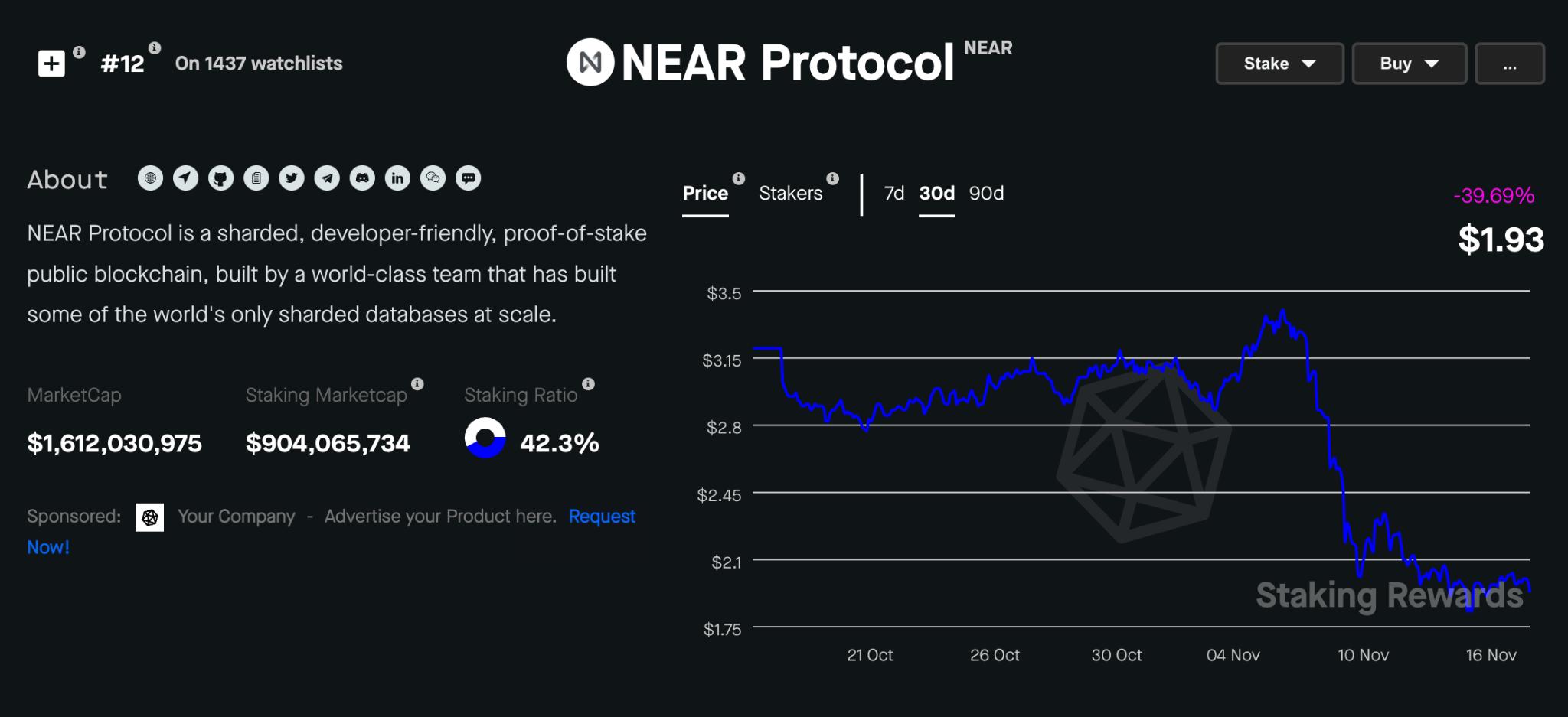

According to information on StakingRewards.com, the complete worth of Close to staking is really worth additional than $900 million. Thus, three substantial tasks on Liquid Staking on Near account for only about two.five% of the complete staking. It can be explained that the Liquid Staking array on Near is underperforming.

GameFi

With the strengths of transaction processing velocity and lower expense, Near Protocol is in which lots of game tasks pick out to produce. However, the good quality of video games on Near is not also substantial when there are only a number of tasks that seriously entice and retain gamers.

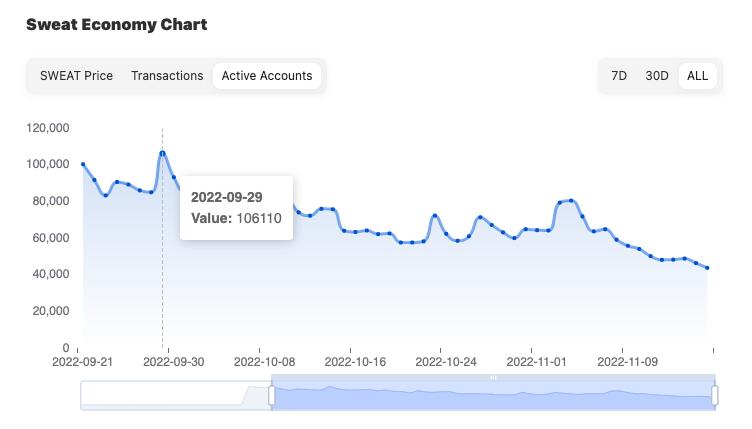

Sweat economic climate

This is a game created in the kind of Move-to-Earn, a trend that has produced a splash in the cryptocurrency neighborhood. Along with the slow growth of StepN – The to start with venture in this section, Sweat Economy is only at the upkeep degree of the venture.

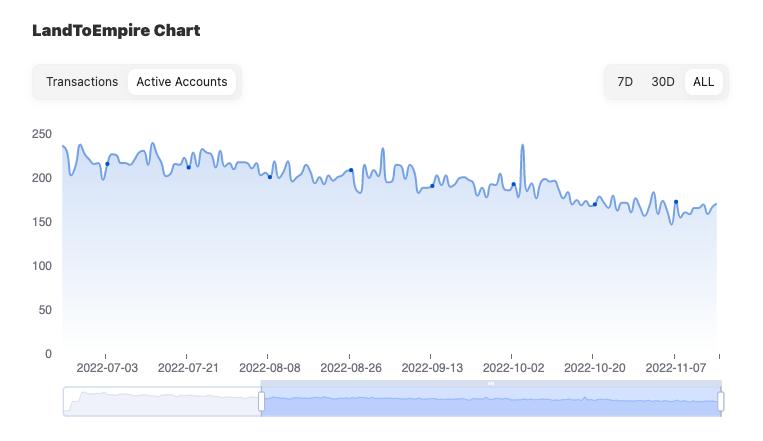

LandToEmpire

LandToEmpire is a approach game for dollars constructed on Near. In LandToEmpire, the player requires to improve his territory by creating and upgrading his personal territory or by attacking other players’ territories.

As a relatively main game on Near, having said that, LandToEmpire only maintains an common lively player count of in excess of 150 persons per day.

NFTs

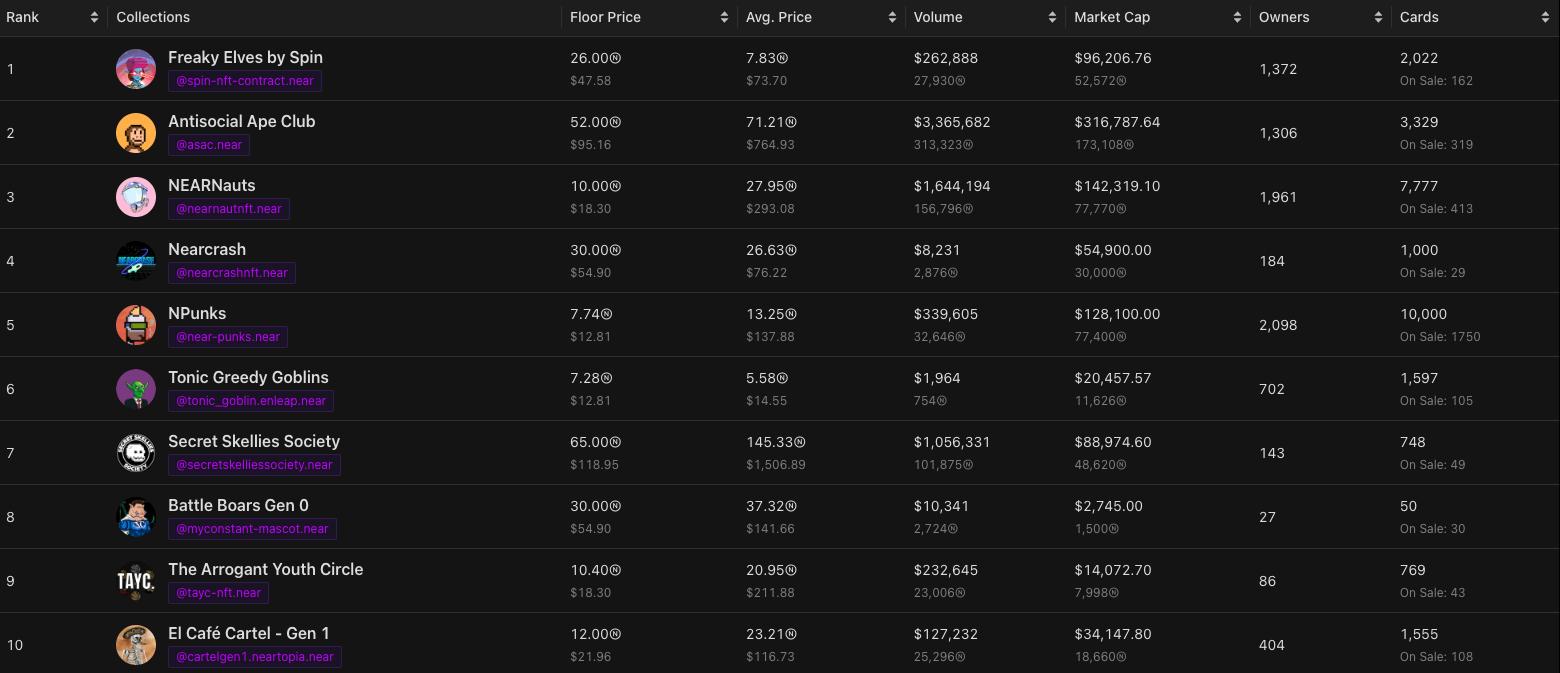

NFT is also a single of the niches that have exploded rather strongly on Near. There have been rather a number of NFT tasks immediately after mint has greater appreciably and accomplished very good trading volume on Paras (Near’s NFT Marketplace) this kind of as NearNauts, Antisocial Ape Club, Npunks and Spin’s Freaky Elves.

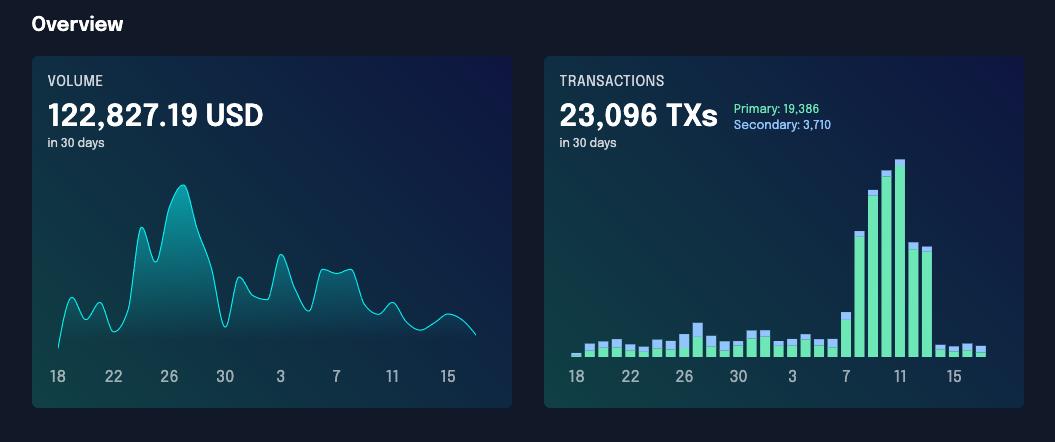

Paras – The foremost NFT market place on Near at this time maintains a complete trading volume in excess of the previous thirty days of in excess of USD 122,000 which is an common of in excess of USD four,000/day. Total transactions produced in the final thirty days are additional than 23,000 tx, equal to additional than 766 tx/day. This quantity has dropped rather a bit considering that earlier booms.

For a improved overview of Paras exercise, you can verify out this graph of consumer exercise on this Dappradar DApp:

steady coins

This is most likely Near’s most controversial piece. Mid April 2022, Near has announced the release USN – decentralized algorithmic stablecoin with a rate balancing mechanism related to the UST coin of the LUNA ecosystem (i.e. to mint one USN, one USD of Close to is demanded). USN was launched at a time when UST and LUNA had been really “successful”.

Unlike UST, Decentral Bank – the issuer of USN claimed to have totally enough securitization resources and answers to preserve a “high + sustainable” APY degree for its stablecoin, which has turn into a deadly weakness for persons of MOON and UST.

In June 2022, Decentral Bank announced it was discontinuing the securitization of USN with Close to due to worries that this cryptocurrency would slip, affecting the capacity of USN to preserve the USD one rate. The stablecoin has considering that been backed by USDT.

Even so, the remaining Close to five.seven million in USN reserves have continued to plummet, creating the spread among Close to and USN issued positions to now attain the $21 million mark.

Due to supplying copycat model but lower APY, USN was not adequate to entice customers. Also, with the collapse of the UST and LUNA model, customers no longer have adequate faith in tasks with related versions. In October 2022, the USN was declared completely deactivated.

It can be explained that the issuance of USN stablecoins is a reckless phase by the Near workforce when they just want to “follow…