Coinbase ended Q3 2023 with above $five.five billion in extra funds, funds equivalents, USDC, and custody.

Coinbase Growth Exceeds Expectations in Q3 2023. Photo: Nasdaq

Coinbase Growth Exceeds Expectations in Q3 2023. Photo: Nasdaq

Beating analysts’ forecasts, Coinbase reported a solid third quarter in terms of income and revenue, but trading volume was not as anticipated.

Our Q3’23 update has arrived.

Read the complete letter to shareholders and tune into our earnings phone right here → https://t.co/fod43YZcAY pic.twitter.com/Iusjw1Uysx

— Coinbase 🛡️📞 (@coinbase) November 2, 2023

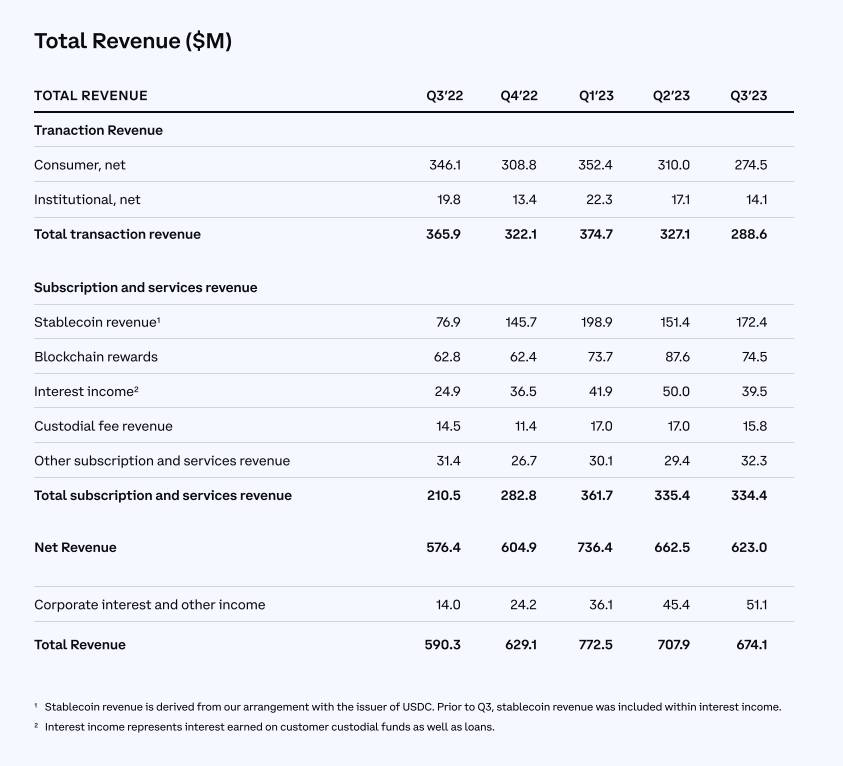

On the evening of November two (Vietnam time), cryptocurrency exchange Coinbase announced its economic report for the third quarter of 2023. As a end result, complete income in the quarter it reached $674.one million, exceeding analysts’ estimates ($650.9 million), but down five% in contrast to the earlier quarter.

TRevenue in the quarter reached $674.one million

TRevenue in the quarter reached $674.one million

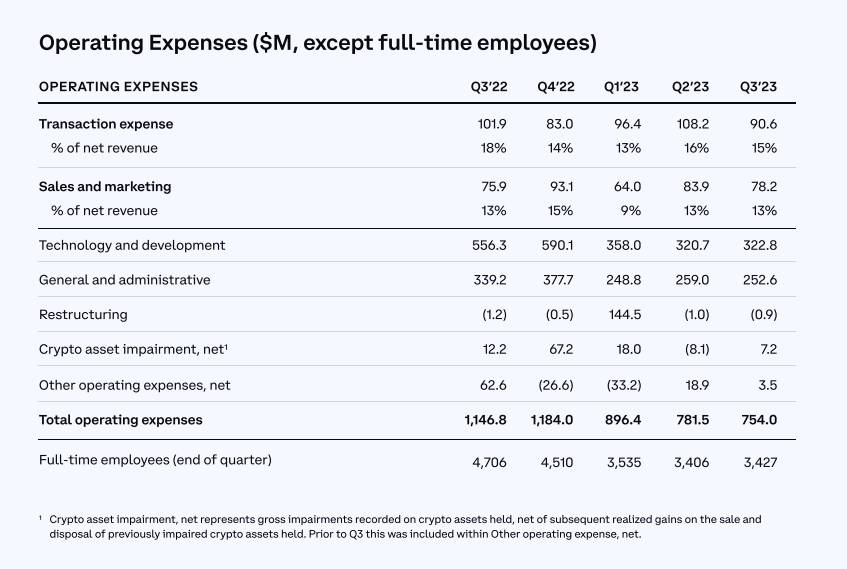

Total working expenditures was $754 million, reduce than the earlier quarter.

Total working costs have been reduce than the earlier quarter

Total working costs have been reduce than the earlier quarter

Loss per share revised to $.01, whilst FactSet’s estimate was $.fifty five, marking the third time in a row that Coinbase beat forecasts.

Supported by new markets and new goods, the business created $172 million revenue stablecoin USDC, up twelve% in contrast to the earlier quarter.

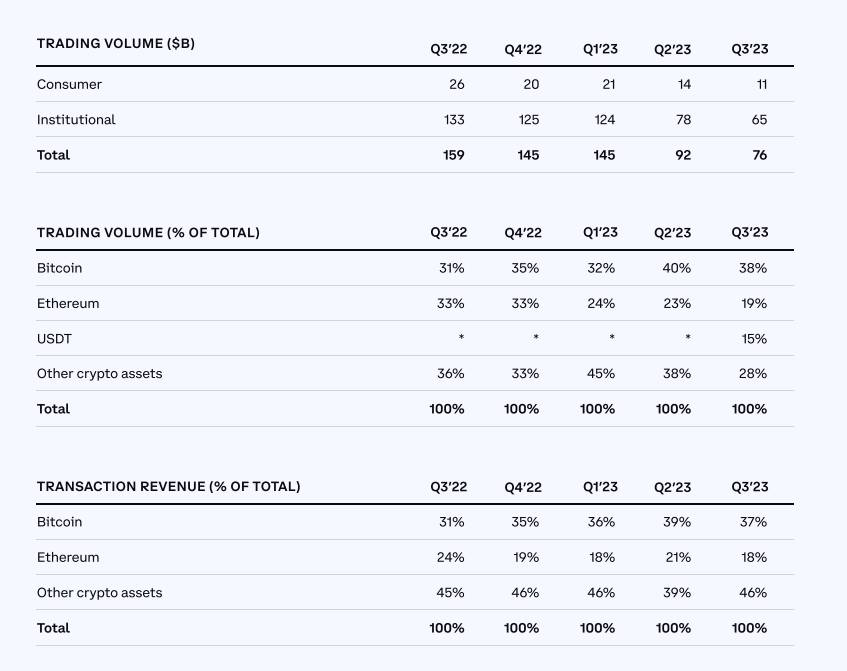

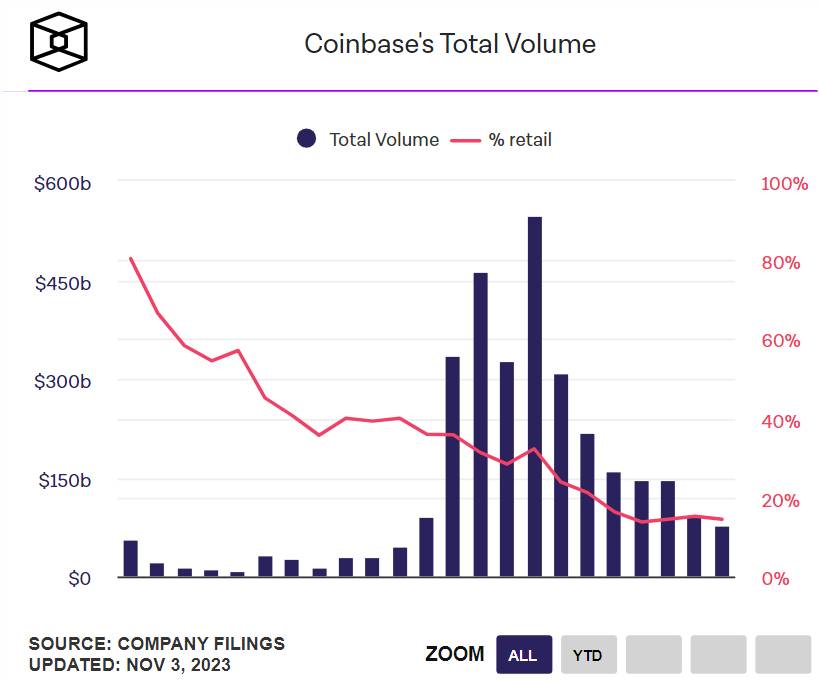

However, trading volume (trading volume) in the quarter reached only $76 billion, down 17% from the very same time period in the earlier quarter ($92 billion). Commercial income for the quarter was $288.six million, down twelve% on a like-for-like basis.

Compare trading volume with earlier quarters

Compare trading volume with earlier quarters

In a letter to shareholdersCoinbase believes the decline of the cryptocurrency marketplace is to blame for the decline in trading exercise.

As of the begin of the fourth quarter of 2023, Coinbase created around $105 million in trading income final October. The exchange expects subsequent quarter’s earnings prior to curiosity, taxes, depreciation and amortization (EBITDA) to be constructive.

Coinbase’s complete trading volume from Q1 2021 to date. Source: The Bloc

Coinbase’s complete trading volume from Q1 2021 to date. Source: The Bloc

Coinbase’s stock ticker, COIN, rose sharply following the release of its economic reviews. The stock is up 131% this yr, whilst the rate of Bitcoin (BTC) has observed approximately the very same enhance.

1D chart of COIN on the Nasdaq, screenshot from TradingView on the morning of November three, 2023

1D chart of COIN on the Nasdaq, screenshot from TradingView on the morning of November three, 2023

On the other hand, America’s biggest cryptocurrency exchange is nonetheless locked in a legal battle with the US Securities Commission (SEC). In June this yr, the regulator filed a lawsuit, accusing Coinbase of not staying registered as an exchange, broker or clearinghouse. As a short while ago as final month, the exchange was asking the court to dismiss the lawsuit. However, Coinbase is nonetheless selected by Wall Street giants asking to open a spot Bitcoin ETF as a custodian of BTC for their goods.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!