To comply with last announcement from Coinbase, the exchange’s third-quarter industrial income fell 44% yr-above-yr.

Cryptocurrency exchange Coinbase lower that in half misplaced up to $ 545 million from $ one.one billion in the 2nd quarter, amid price cuts, downsizing and two-yr lows in trading volume on cryptocurrency exchanges.

Our third quarter fiscal final results 22 have arrived.

Check out our letter to shareholders:https://t.co/JmThnye15x

– Coinbase (@coinbase) November 3, 2022

However, the exchange’s trading income continues to be drastically impacted by thethe headwinds of the macroeconomy and the international cryptocurrency industry. Coinbase expects this problem to carry on until eventually 2023, the enterprise explained in a statement letter to shareholders.

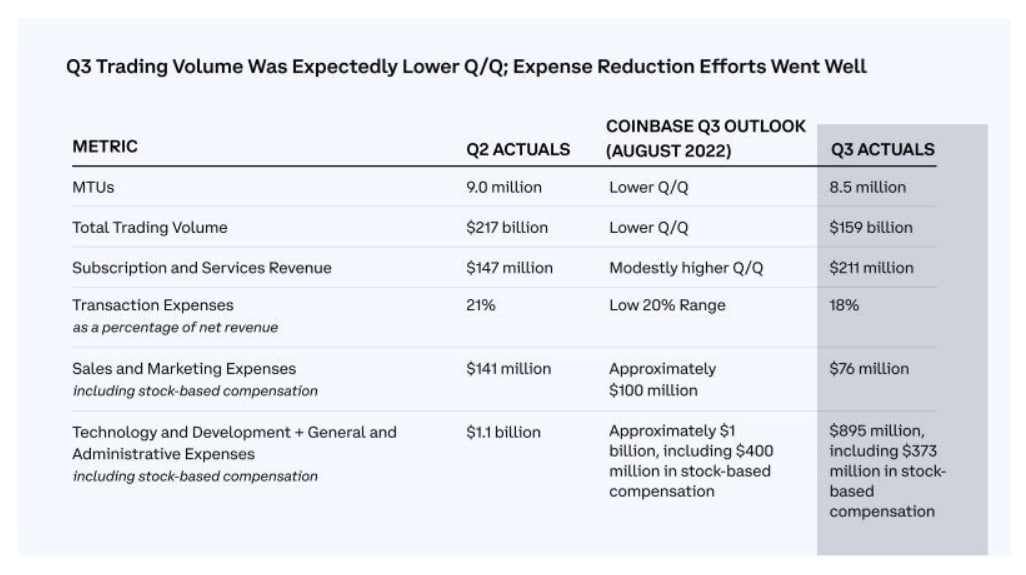

Total net product sales get $ 576 million, additional modest than the estimate of $ 646 million and far beneath the figure of $ 803 million in the 2nd quarter.

Transaction income in the 2nd quarter, it reached $ 366 million, down 44% above the exact same time period due to reduced trading volume. Meanwhile, subscriptions and support revenues elevated by 43% to 211 million bucks, due to the eye-catching curiosity charge provided by the floor. Some professionals get in touch with it highlights of the report.

Total working fees was $ one.one billion, down 38% from the 2nd quarter.

From thirty September complete assets on the platform elevated four%, from $ 96 billion to $ 101 billion. Coinbase has somewhere around $ five.six billion in money and money equivalents plus $ 483 million in cryptocurrencies.

Monthly Transactional Users (MTU) reached eight.five million, reduced than the forecast of seven.seven million. In it, it seems that “users have fled the United States, which is our main business market.” The cause for this action is partly due to hesitation above the approaching US crypto regulatory framework.

The exchange explained it stays “cautiously optimistic” in the previously shared EBITDA (earnings in advance of tax, curiosity and depreciation) array, primarily based on the assumption that the cryptocurrency industry is not terrible and consumer conduct is continuous.

After “Fasten seat belt” warning.CEO Brian Armstrong extra:

“In a falling industry, you can emphasis on developing. Innovation is even now ongoing and several organizations carry on to enter this room and put together for a time when the macroeconomy will strengthen. “

Additionally, Mr. Armstrong expects the USDC to be the de facto CBDC in the United States. They benefited from joining the USDC ecosystem in the third quarter.

As reported by Coinlive, Coinbase lower about one,a hundred jobs in Junethe most recent workers renovation is The departure of Product Manager Surojit Chatterjee and price handle.

Overall, the third quarter was a rather unhappy time for Coinbase, partly due to the fact the industry has not noticed significantly volatility and partly due to the fact trading exercise has been insignificant and seems to have stabilized.

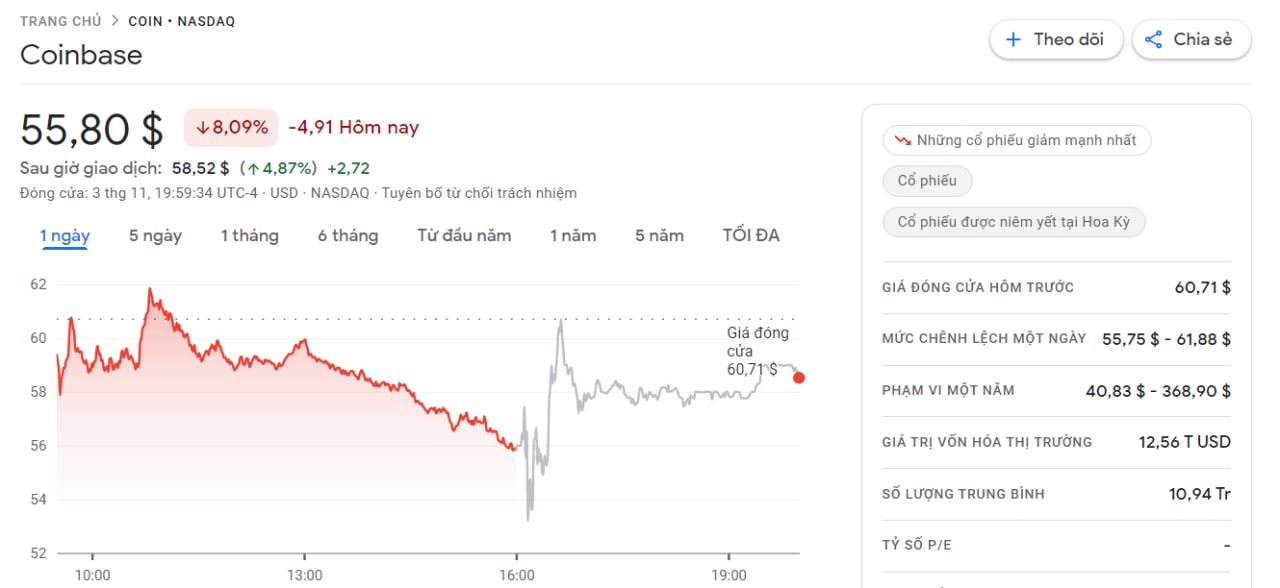

Shares of Coinbase (COIN) jumped approximately three.eight% to $ 57.90 in soon after-hour exchanges on November one Over the previous yr, the COIN rate has misplaced additional than 75%, even additional than 56% of Bitcoin.

Synthetic currency 68

Maybe you are interested: