Crypto Lighthouse is a program organized by Coinlive with company to debate, analyze and supply the group with probably the most in-depth and up-to-date views on the cryptocurrency market. After 4 profitable sharing periods, Crypto Lighthouse # 5 is a vigorous dialogue on blockchain ecosystems hot-hit The present.

Crypto lighthouse # 5 honored to be accompanied by particular company, who’re representatives, buyers of famend cryptocurrency funding funds and communities in Vietnam, who’re:

- Sister Jenny Nguyen: COO Coinlive & Kyros Ventures – Coinlive representatives chat with program company

- Sister Riley Tran: Co-founder GFS, Country Director of the NEAR Protocol – representing the ecosystem CLOSE

- Brother Vinh the Nguyenn: Co-founder, CEO Coin98 Finance – represents the ecosystem Solana

- Brother Vu Tran: Community administrator Crypto Noodles – represents the ecosystem Polygon

Details on these company have been particularly shared by Coinlive Here.

Comments on the present sharp decline available in the market

Before we get into the DeFi ecosystem points, the livestream begins with the company’ perspective on the general context of the present market. According to company, 2 occasions The huge drop available in the market in a short while Was it the previous? dangerous signal, or just one adjustment wholesome after a interval of too quick progress?

Sister Riley

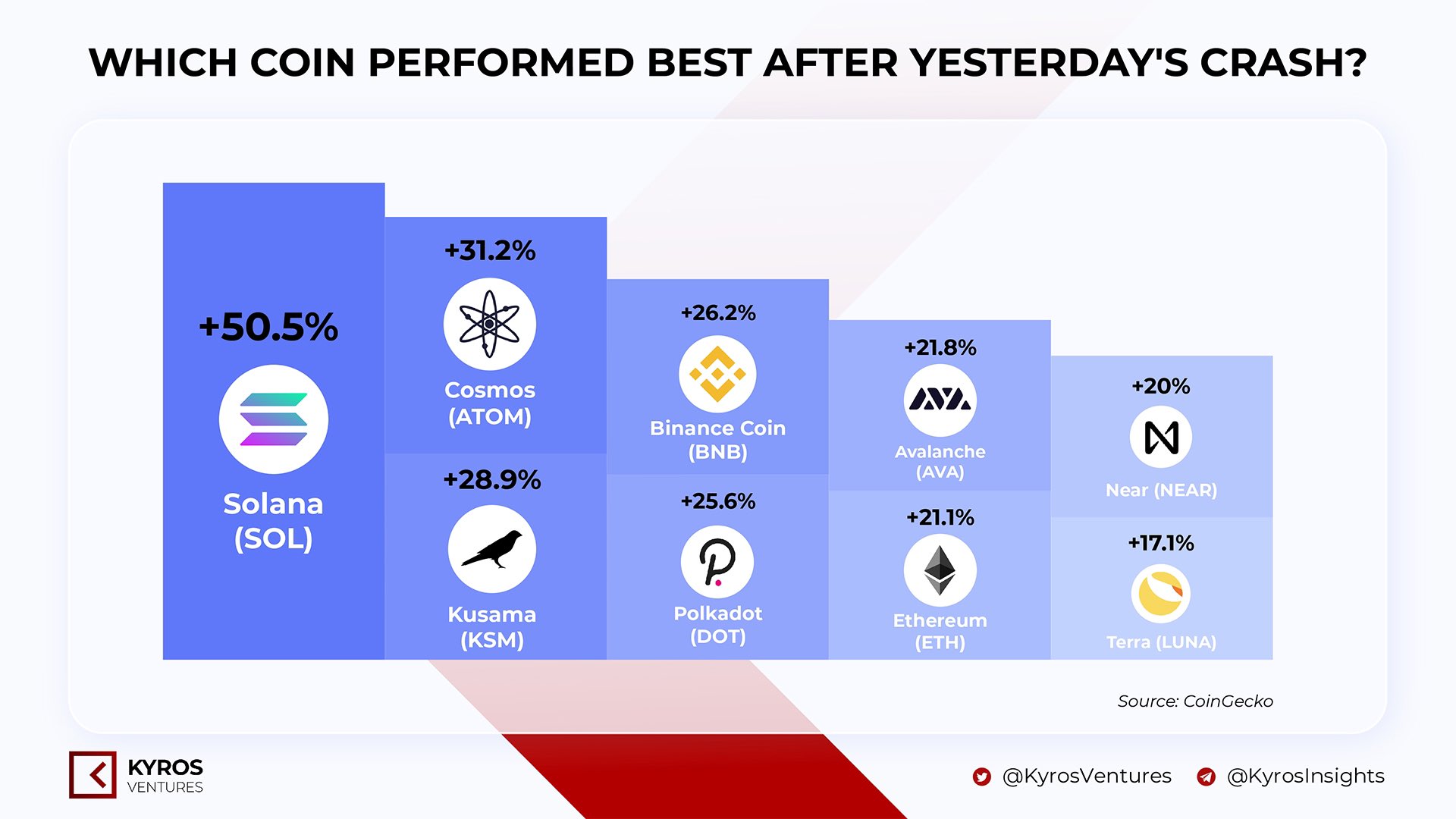

The cryptocurrency market has been rising for a very long time since March 2020 and not using a deep correction. Although many communities and analysts had warned prematurely of the mid-June decline, many buyers didn’t have time to “get out,” resulting in proprietor-reluctantly.

In addition, a collection of FUDs from China precipitated the market to falter.

However, if she displays the chain, Ms. Riley sees that the money circulate hasn’t escaped a lot and continues to pour into the market. He believes the market will proceed to develop sooner or later.

Therefore, it is just a short lived adjustment to organize for the following uptrend.

Mr. Vu

Short time period panic sale (clearance sale) is regular. But Mr. Vu had predicted subsequent 6 months the market might be “hot” once more, because of EIP-1559, because of Binance NFT, …

A variety of massive firms are pouring cash into the cryptocurrency market, there is no such thing as a purpose why the market will go down as deep as in 2018.

his glory

According to Vinh, Coin98 early warned of this case. With such a projection, in May I’ve money out (withdrawing cash from the market) and now beginning to put a reimbursement.

The finish of this 12 months (2021) or the start of 2022 is the height of this bull run.

Strengths and weaknesses of Near, Solana, Polygon ecosystems

Close to protocol (NEAR)

In your opinion Riley, GFS selected to grow to be Near Protocol’s strategic associate as a result of there enterprise mannequin (enterprise mannequin) of Near.

A component from that, mass adoption (extensively accepted) is what all blockchains are about. This can also be Near’s principal purpose. The Near system focuses on making the person expertise straightforward, with acquainted and pleasant merchandise like these of conventional finance (CEFi). From there, it lures the unknown crypto group to hitch the camp.

As for programmers (dev), Near attracts each skilled builders and a toolkit for builders not too specialised in blockchain. To entice extra builders, extra DApps are being developed and the ecosystem is increasing.

NEAR goes slowly however absolutely, solely after it’s accomplished publicly, it isn’t a “rolling” model like different methods. Therefore, NEAR will broaden extraordinarily quick thereafter.

Solana (SOL)

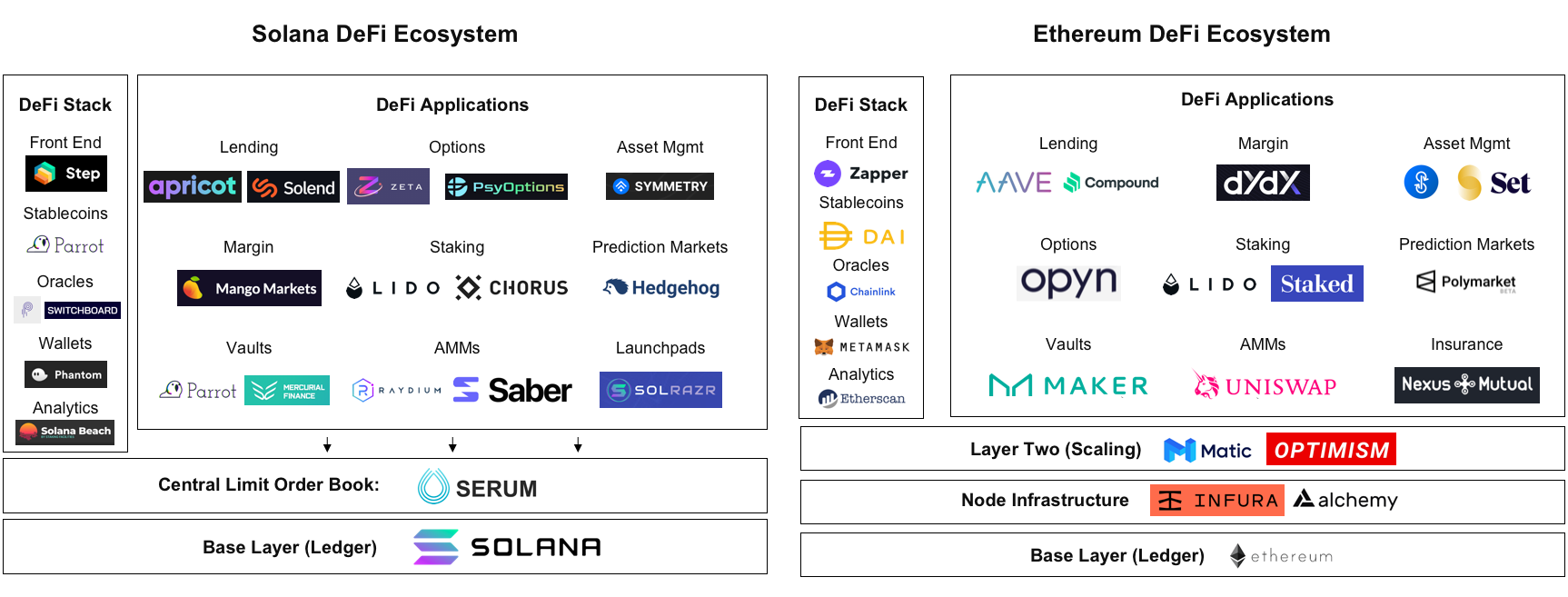

The purpose Coin98 Ventures arrange a $ 5 million funding fund to help tasks on Solana is as a result of Solana has a totally completely different blockchain structure than different blockchains, in contrast to Ethereum or Near, and so forth.

Comparing the 2 buildings between Solana and Ethereum, Coinlive defined it completely within the article DeFi 101 – All in regards to the decentralized finance ecosystem.

comply with me Vinh, the principle problem is that builders are aware of the outdated structure, they must examine from the start. Solana developer documentation is restricted. This is a big impediment, an enormous barrier that makes the Solana ecosystem unable to blow up with the identical pressure because the Binance Smart Chain (BSC).

Solana follows the technique of overlaying all facets of the ecosystem, however the high quality and amount of the tasks are usually not but corresponding to BSC.

The Solana structure has very excessive scalability, so it has nice potential within the close to future.

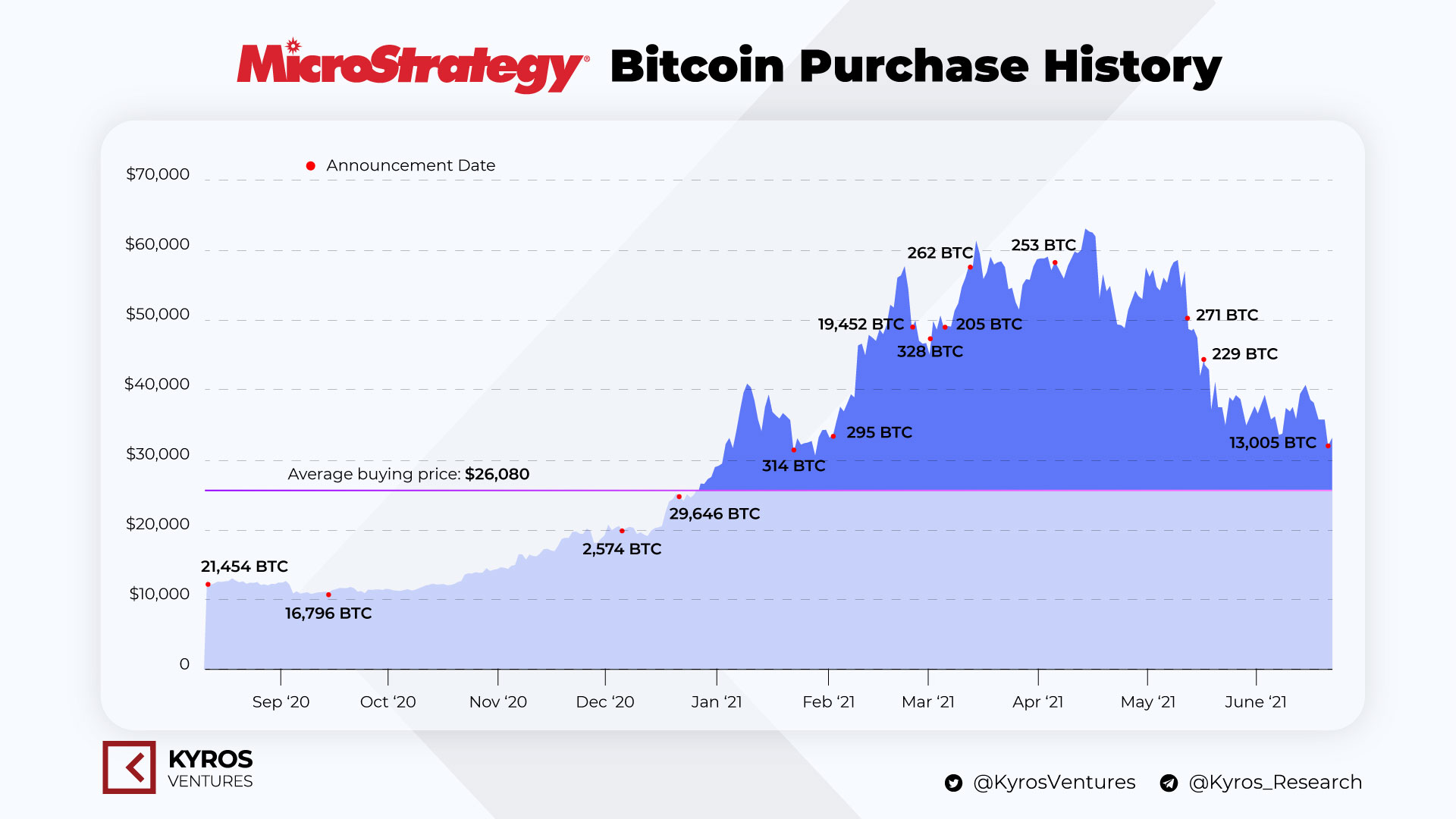

In phrases of funding, the SOL token has risen in worth from 1 USD to a peak of 60 USD. SOL additionally held the value very properly throughout this correction, climbing to all-time highs regardless of the subdued market.

Polygon (MATIC)

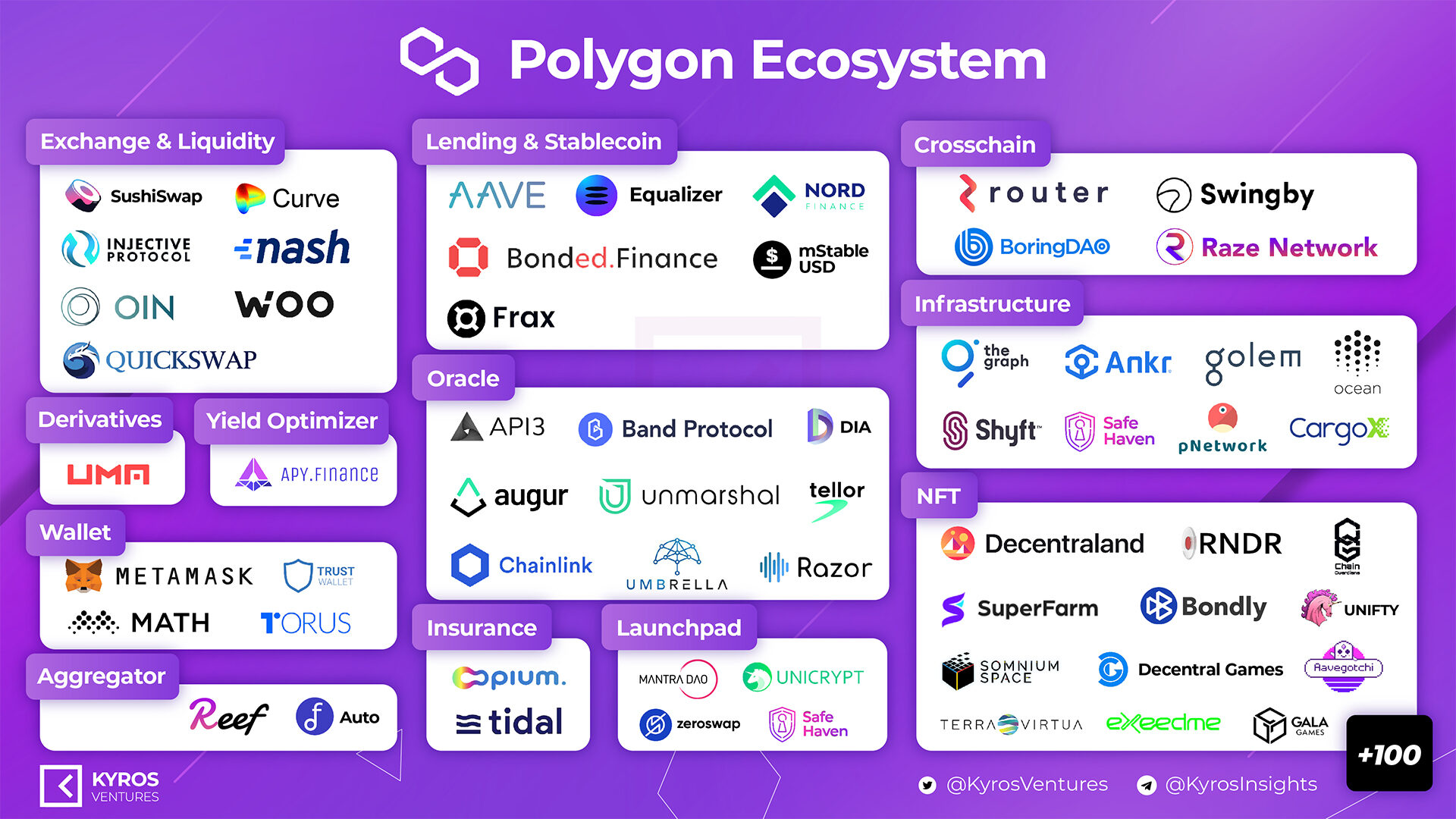

comply with me Vu, he and the Crypto Instant Noodles group are specializing in Polygon as a result of MATIC has handed the stage downward development of the market, has been creating for a very long time. In February 2021, Matic modified its technique from stage 2 answer to Level 2 aggregator – be part of stage 2 collectively.

Since then, Polygon has attracted many outstanding DeFi companions corresponding to AAVE, Compound, and so forth. Since then, the variety of Polygon (MATIC) customers has elevated to 75,000 as DeFi has continued to blow up on the platform.

Polygon as a satellite tv for pc metropolis of Thu Duc of Ho Chi Minh City. On Polygon there may be every thing that “people” want corresponding to infrastructure, lights, electrical energy, roads, bridges, markets, banks, and so forth.

Investment technique within the DeFi section

Which product traces and teams (Lending, AMM, Oracle, and so forth.) have the potential to “take off”?

In your opinion Riley, no product is extra vital than one other, no challenge is extra potential than one other. DeFi is healthier than CeFi as it’s clear, decentralized, with out permission.

Lending, AMM, Oracle, … are all indispensable items in DeFi.

Brother Vinh Further feedback are:

We, the customers, enter the marketplace for revenue. So is the challenge.

The piece of the puzzle that generates probably the most revenue might be developed first.

I nonetheless comply with you VuInvestors should not ignore any ecosystem. The strongly creating system is closely targeted, however continues to spend time observing and understanding different methods and tasks.

How to guage a challenge?

To consider the challenge, Ms Riley for instance NEAR,

- should first think about enterprise mannequin and growth group

- then market capitalization (market capital) as (greater market capital – much less potential)

- How is the financing of the challenge? Is the funding ample to make the challenge survive the crypto winter?

- Ecosystem, massive or small person?

- Next is the overview roadmap (itinerary), associate (associate), token mannequin

- The challenge group can also be an vital issue

- Finally, consider your opponents

What about your challenge analysis ideas? Vinh was:

- revenue to begin with

- rip-off group or actual?

- How scalable is the challenge?

- Token Growth ROI, Token Valuation?

How to allocate the capital?

Brother Vinh Suggested methods to allocate capital as follows:

- allotment small capital in tasks they’ve excessive danger

- allotment numerous capital in safer tasks, low danger

Anh Vu advises those that are watching Crypto Lighthouse # 5 livestream to solely use the income to spend money on the challenge. If unlucky challenge rugpull, hack, .. then what I lose is just a small revenue, not your entire capital.

Personal funding technique and mindset

comply with me Vinh, buyers ought to divide their eggs into many baskets: surf trading capital, IDO capital, catching waves, holding stablecoins to seize the underside, and so forth. Depending in your private monetary state of affairs, have an affordable technique.

With my sister RileyNo funding channel is 100% secure and risk-free. Our purpose has at all times been:

Maximize revenue + decrease danger

Finally, you Vu To share “Decisions in 2 words” which he at all times obeys, is:

- Read so much

- The market is consistently altering

From there he thought:

- be taught from profitable folks

- Invest in your self

Guests who participated within the Crypto Lighthouse # 5 livestream additionally answered many questions from the group that could not be coated within the article. Those can overview the sharing session Here.

Jane

Maybe you have an interest: