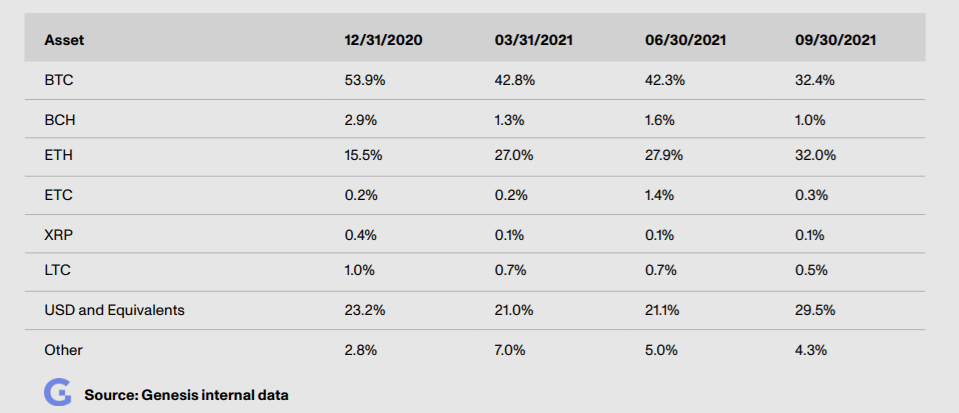

Cryptocurrency company Genesis lately launched its third quarter 2021 marketplace observation report and highlights some of the essential marketplace trends. This time about, statistics display Bitcoin demand is dropping as institutions are exploring DeFi platforms and other altcoins.

According to the report, demand for Bitcoin tended to decline in the third quarter due to the lack of options for traders to revenue from the spread in between BTC rates in the spot and futures markets.

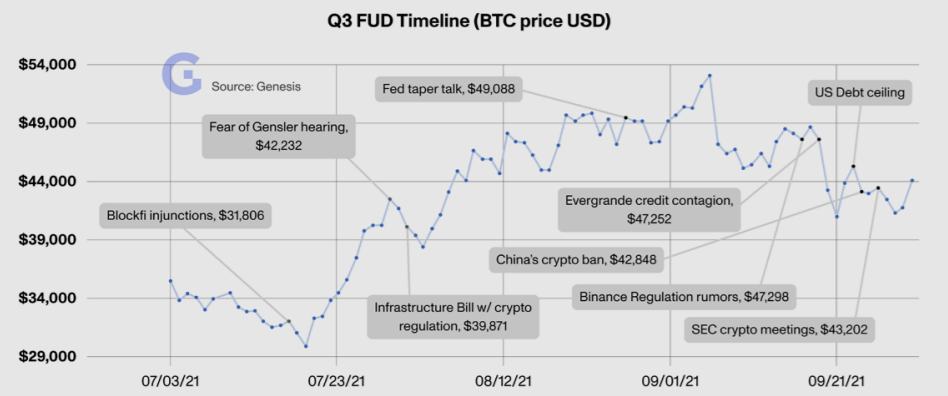

Combined with the Chinese crackdown all through the 12 months, it has led to a shift in sentiment in the marketplace, as a result generating Bitcoin significantly less interesting.

The third quarter noticed BTC and ETH out of “danger” across a broad selection of trading ranges. Because the marketplace has grow to be far more mature and absorbs chance a lot quicker than ahead of. Hence, there will be lots of retracements that will present the bulls with the restoration of a new bullish trend.

Investors who have persistently purchased BTC have stabilized on the FUD-led dips which have aided stabilize the marketplace. But in the long run, it is the quantity of prospective customers for Bitcoin that obviously marks the subsequent move in the bullish cycle and sets the stage for BTC’s return to dominance.

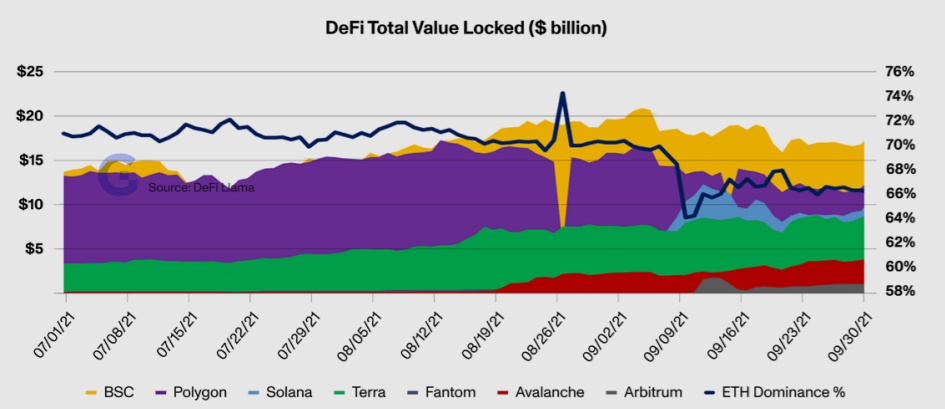

Genesis highlights that as far more institutions are coming to the DeFi area, there is a better “desire” in ETH on the component of institutions to borrow and lend on a selection of decentralized applications. Throughout the third quarter, the choices continued to appeal to far more developers and capital. Many institutions are exploring return options on Layer one protocols, which usually supply interesting pricing for stablecoin, ETH and BTC pairs.

While Layer one vied in velocity and protection of transactions, the incentives from ecosystem advancement money plans catalyzed a enormous storm, foremost to a reduce in ETH’s marketplace share in favor of Layer one platforms such as Solana. (SOL), Terra (LUNA), Avalanche (AVAX), Fantom (FTM) and Close to. One of the finest bulls is Solana (SOL), which overtook Cardano (ADA) and Tether (USDT), getting the fourth biggest coin by marketplace.

– See far more: The marketplace is incredibly enthusiastic: Altcoins are racing to make new ATHs, who are they?

Despite the lack of curiosity in Bitcoin, the prediction of the U.S.’s very first Bitcoin futures ETF has revived the marketplace from common fiscal institutions, this kind of as investment banking institutions and giant wealth managers. With a trading volume of $ one billion on the very first day of launch, which gave BTC a huge enhance to set up a new ATH, there has been powerful curiosity in this solution.

Synthetic currency 68

Maybe you are interested: