The bankruptcy unit that took above the FTX exchange has presented a lot more information on the $five.five billion in assets it recovered in the previous month.

Exchange FTX positioned and recovered $five.five billion in assets, what new CEO John J. Ray III identified as an “extraordinary effort,” in accordance to court paperwork. This quantity is up somewhat from the $five billion recall discover issued by FTX’s lawyer a week in the past. The exchange is explained to owe the 50 biggest creditors $three.one billion.

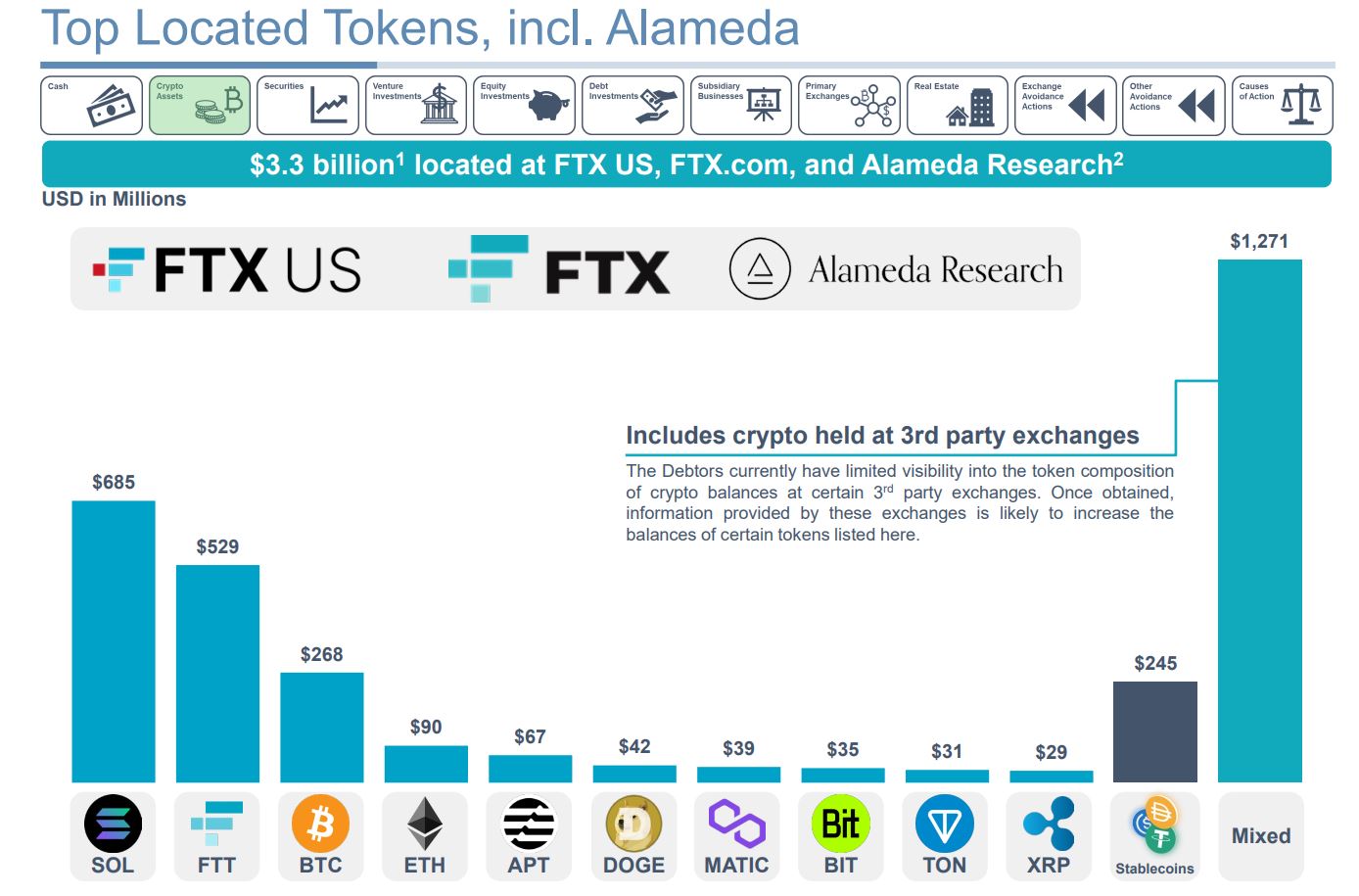

Notably, the bankruptcy unit that took above FTX had a hand of $one.seven billion in income, $three.five billion in liquid cryptocurrencies and $300 million in securities.

The checklist of cryptocurrencies owned by FTX consists of $685 million in SOL, $529 million in FTT, $268 million in BTC, $90 million in ETH, $245 million in stablecoins, and above $one.three billion in other cryptocurrencies. In this, FTT are unable to be viewed as “high liquidity”, due to the fact it is a token linked with FTX and there is just about no require to trade in the industry.

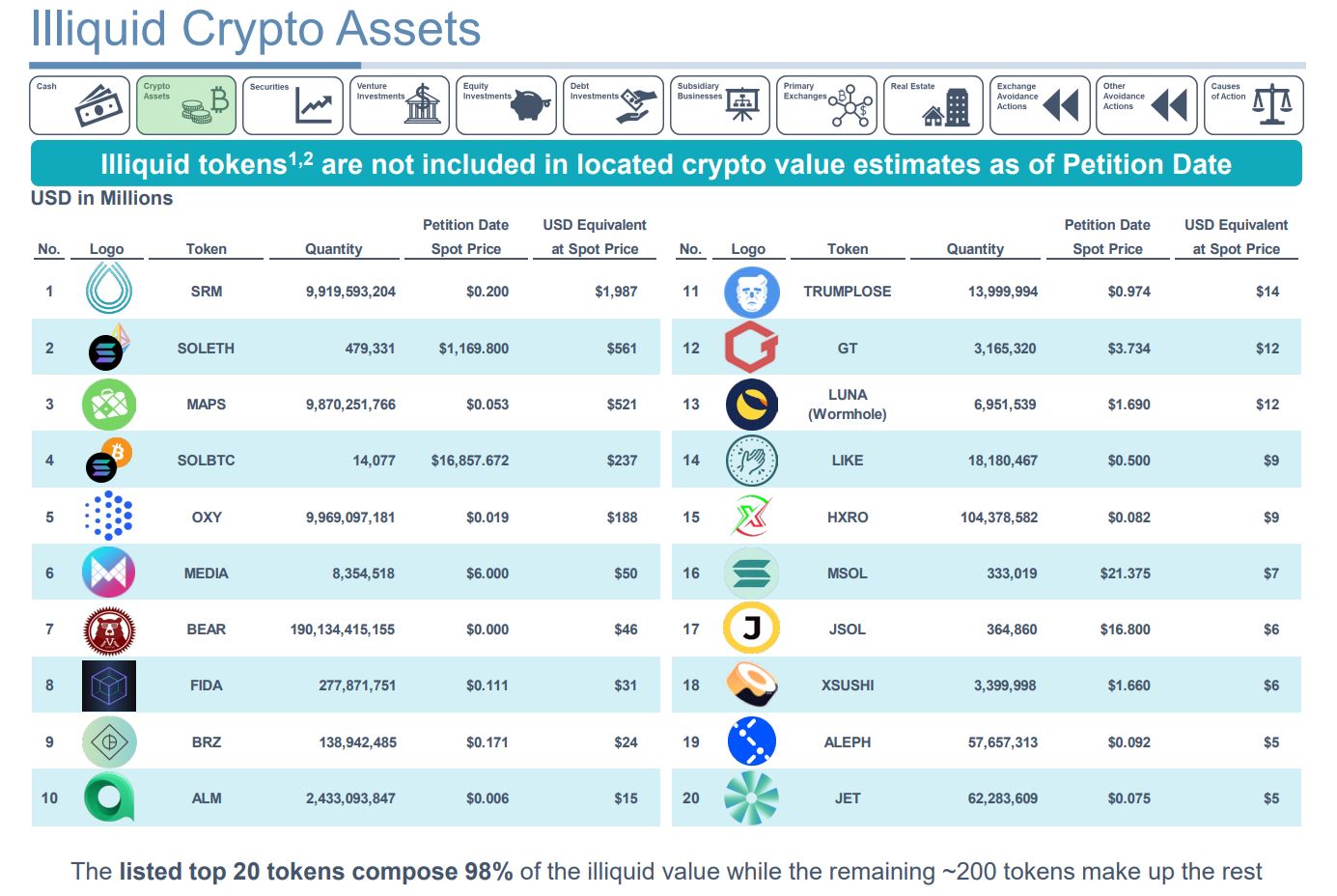

Additionally, the exchange has also recognized a massive variety of illiquid crypto tokens, as proven beneath, with negligible industry worth.

FTX’s management and advisors also met with the floor lender’s representative to existing the quantity of assets recovered. As a end result, each FTX.com (platform for worldwide end users) and FTX.US (platform for US end users) have been located to be reduced on assets.

Assets recognized as belonging to FTX.com are $one.six billion, with $742 million in cold wallets managed by the bankruptcy unit and an additional $121 million awaiting delivery. Additionally, the exchange suffered a $323 million shortfall, which was taken by an undisclosed third celebration in the FTX assault immediately after the exchange announced bankruptcy, when an additional $426 million was seized by the Bahamian government.

FTX.US is explained to have $181 million in cryptocurrencies, with $88 million below the bankruptcy unit’s management, $three million awaiting delivery, and $90 million stolen in the assault. .

FTX CEO John J. Ray III explained:

“We are producing excellent strides to maximize asset recovery and our crew has worked challenging to realize this. We would like to remind creditors that this facts is at the moment provisional and is topic to adjust.

In the close to potential, FTX will carry on to come across approaches to fetch a lot more assets for the exchange via the following strategies:

– Sale of 4 subsidiaries FTX, LedgerX, Embed, FTX Europe and FTX Japan.

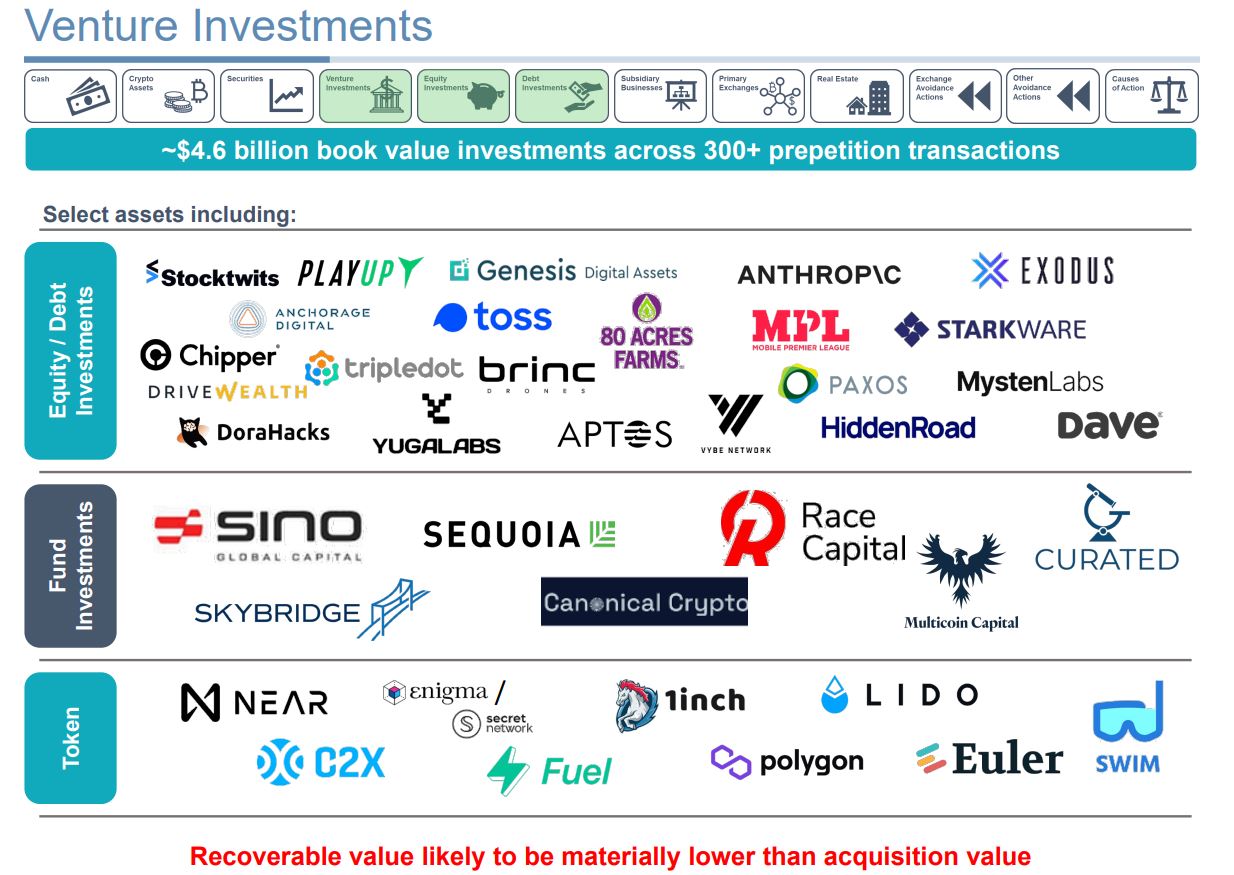

– Selling FTX investments with a guide worth of $four.six billion.

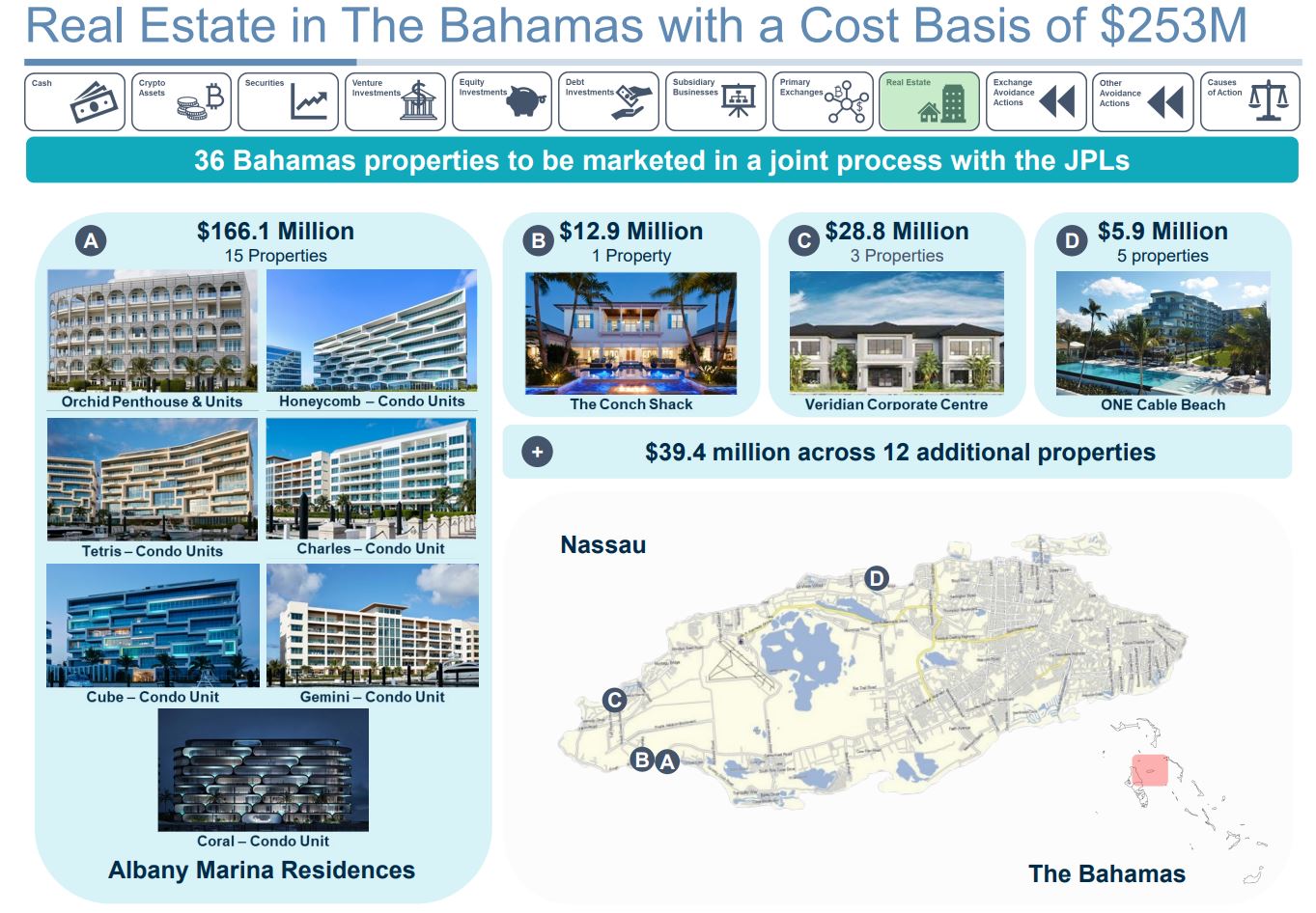

– Sale of FTX properties in the Bahamas, valued at an estimated $253 million.

– Investigate other transactions in historical past to gather a lot more income.

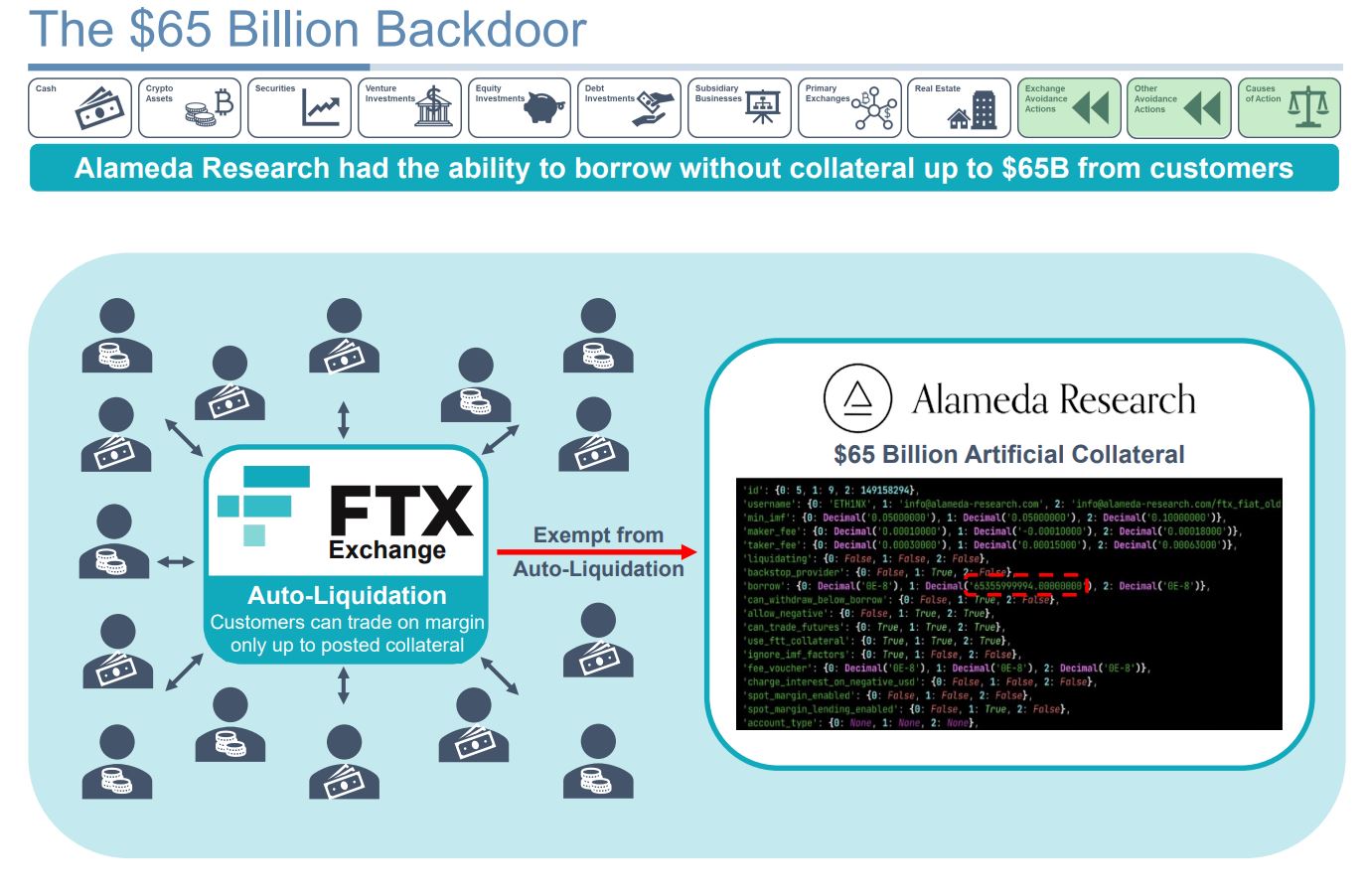

The FTX filing also delivers proof that the exchange has a fraudulent mechanism in location to enable Alameda Research to borrow $65 billion in consumer money, as properly as a lot of industry makers to retain “negative” accounts on the exchange with no getting charged for settlement.

Former FTX CEO Sam Bankman-Fried launched a statement on Twitter that the settlement unit misreported FTX.US assets, exclusively excluding $428 million in income in the financial institution account. He nevertheless maintains his view that FTX.US nevertheless has sufficient income to spend prospects.

FTX US is creditworthy, as it usually has been.https://t.co/XjcyYFsoU0 pic.twitter.com/kn9Wm9wxjl

— SBF (@SBF_FTX) January 18, 2023

Synthetic currency68

Maybe you are interested: