overview

Recently, CoinMarketCap, DappRadar and The Block Research concurrently launched up to date reviews on the GameFi industry problem and marketplace efficiency in the initially half of 2022 to readers. The reviews are published in the context of the GameFi industry. going as a result of a Bear Market phase, exactly where the DeFi and GameFi Total Market Cap indices noticed a drop of practically 60% to close to $ 25 billion and $ ten billion respectively.

Despite the gloomy macroeconomic situation, the recorded information demonstrates the resilience, innovation and extended-phrase development of the nascent GameFi marketplace in contrast to its predecessor, now a useful generation of a lot more than $ 300 billion Web2 video games. Investment flows and consumer exercise in blockchain video games have been recorded at a sustainable degree and have outperformed the DeFi sector, reinforcing the thesis of the approaching boom in the GameFi sector and Metaverse aids allow in excess of a hundred million citizens to accessibility the cryptographic area. With a strong basis of money assets and talent, the only piece left for a genuine boom is an impressive small business model that incorporates a sustainable extended-phrase token economic system.

Fortunately, there are in excess of one,500 and increasing candidates for this place.

GameFi’s investment flows are increasing in spite of the present macro problem

Against a backdrop of increasing US dollar worth, Russia’s war-connected power crisis in Ukraine, and a US Federal Reserve-led fiscal tightening to fight the century of higher 10-yr inflation, all of which have produced a macro bearish problem that does not has been viewed considering that the dawn of cryptocurrencies in 2009. All of these occasions have contributed to hedge fund (VC) dynamics and have had a significant effect on the cryptocurrency industry, wiping out practically $ two trillion from complete cryptocurrency industry capitalization considering that all-time. highest in November 2021.

Nonetheless, CoinMarketCap and Footprint Analytics have launched information that estimates a complete of practically $ two.five billion in capital that has been invested in the Web3 gaming marketplace considering that early 2022, a staggering enhance that surprises from the 874 million mark. bucks recorded in the identical final yr. According to DappRadar, the Web3 and Metaverse gaming tasks raised a lot more than $ 300 million in July alone, led by effectively-acknowledged marketplace gamers this kind of as Animoca Brands as a result of a selection of pursuits this kind of as obtaining, investing, utilizing IP and “promoting the Metaverse space “.

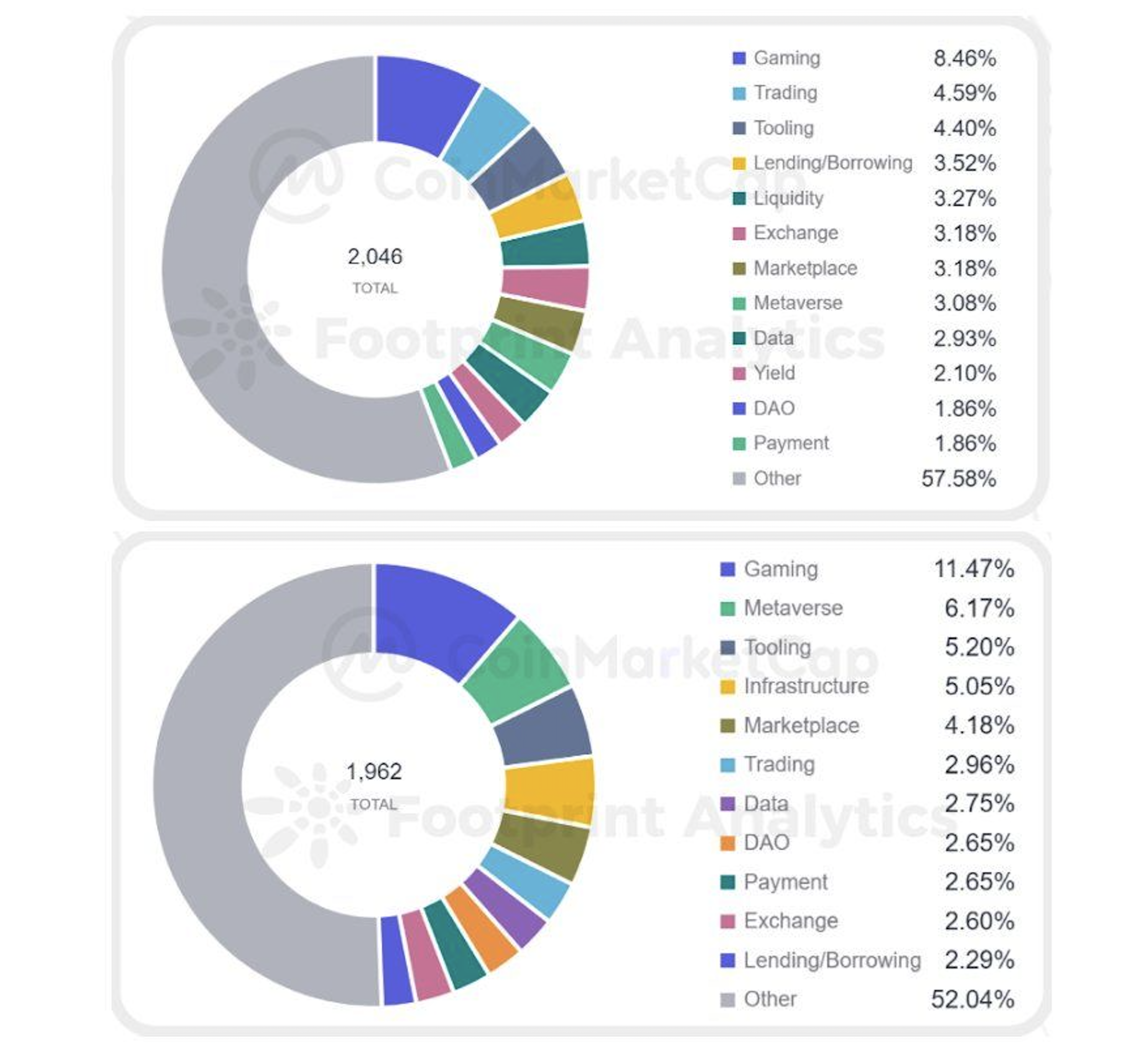

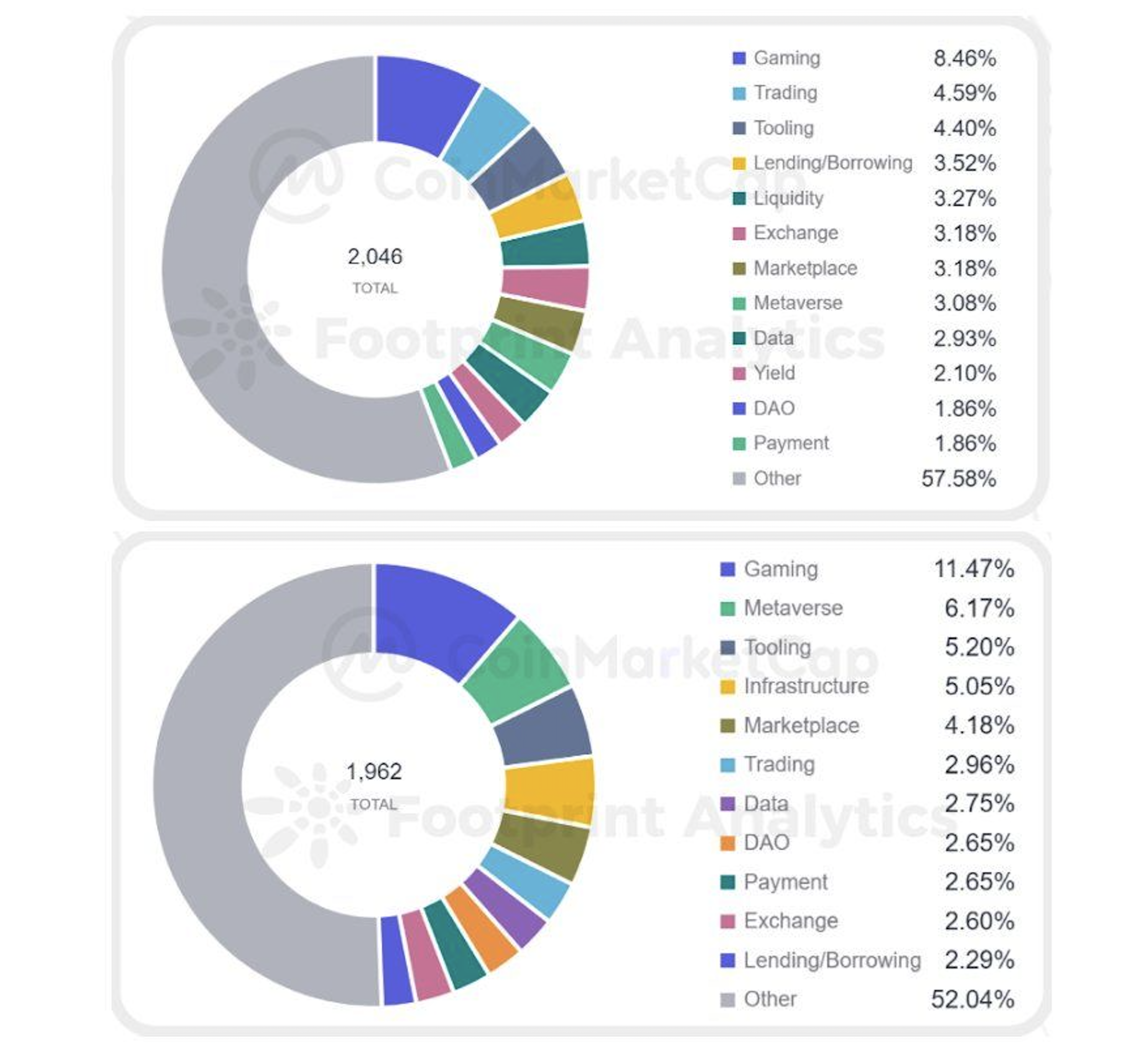

This yr, the GameFi and Metaverse & Gaming tasks acquired a increased degree of investment than prominent regions this kind of as blockchain resources, trading and lending. Notably, 48% of these investments have been created early on, an essential reminder of the industry’s nascent state and substantial possible for potential development. All of this funding produces fertile ground for the incubation of up coming-generation Web3 infrastructures and gaming tasks.

Blockchain Gaming is the most energetic sector in the crypto area

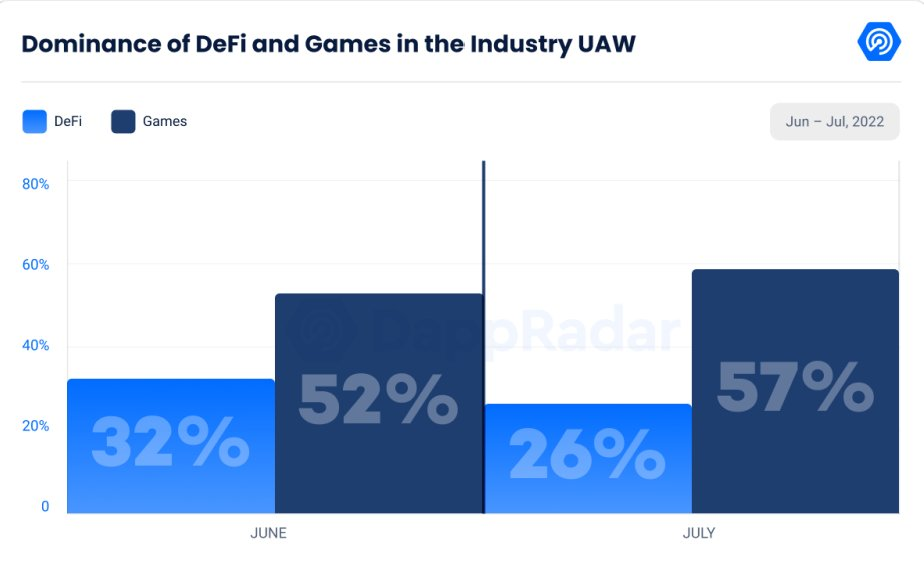

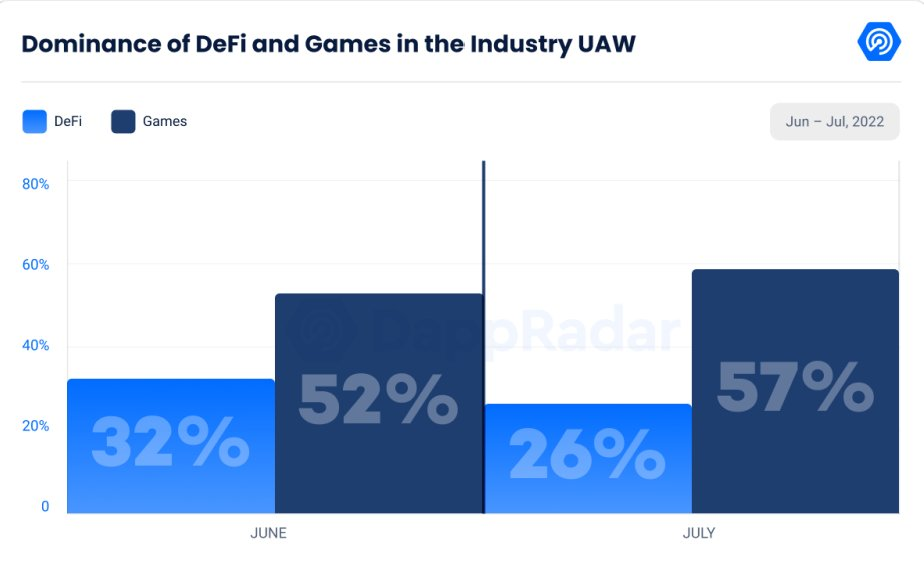

On-chain information demonstrates that practically 60% of present blockchain utilization is carried out on blockchain video games this summer time, averaging UAW 967,662 per day. As reported by DappRadar, the GameFi sector outperformed DeFi by major margins in each June and July.

We’re also beginning to see the greatest game studios in the Web2 area taking their initially actions into the Web3 area. Typically, Square Enix (Final Fantasy) has invested close to $ 35 million in Zebedee in a B franchise round. The Zebedee task has uncovered ideas to produce perform-to-earn versions of traditional video games like Solitaire and Sudoku as a result of integration. of the Lightning engineering of the Bitcoin network.

Popular video games

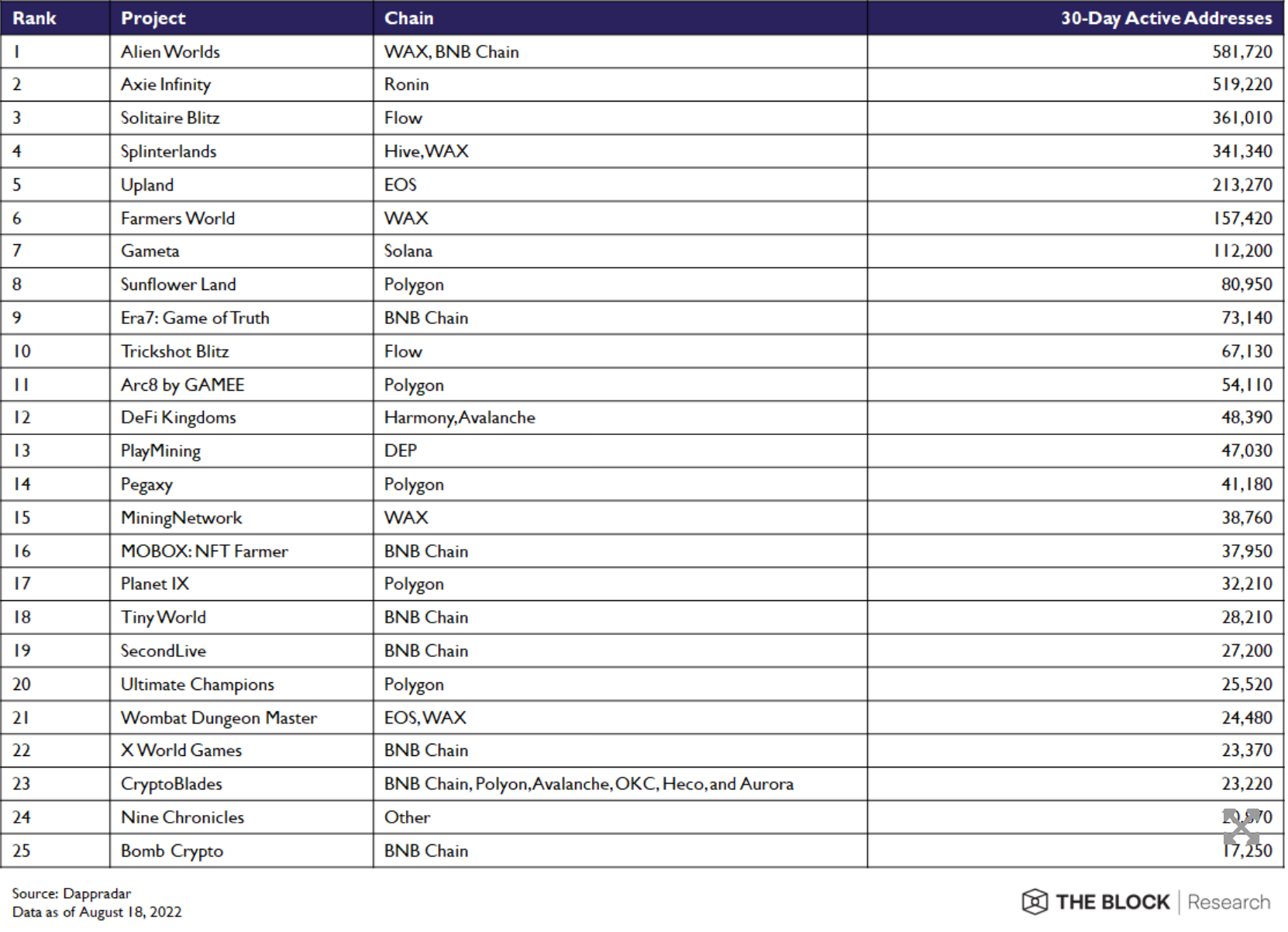

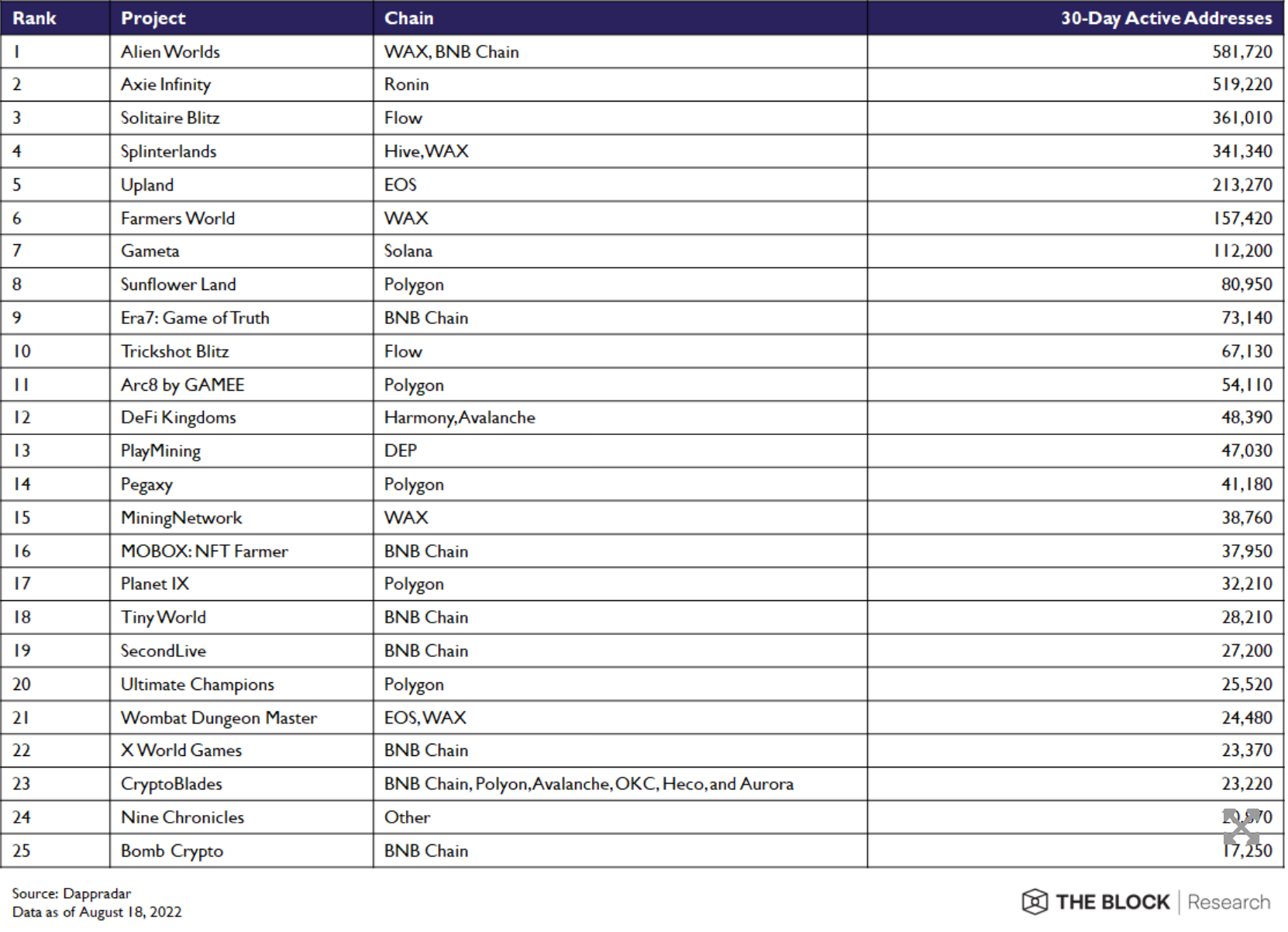

Alien Worlds, Axie Infinity, Solitaire Blitz, Splinterlands, and Upland best the listing of the most common blockchain video games at press time. Precisely due to the fact most blockchain video games are essentially hosted off-chain and only use the blockchain to settle in-game transactions, it is not uncomplicated to confirm the precise variety of gamers. Therefore, day-to-day energetic addresses (DAAs) or these concerned in staking, minting or in-game transactions are utilized as a proxy as a substitute.

Alien Worlds is the game with the highest variety of transactions recorded to date, peaking at 369 million in July of this yr.

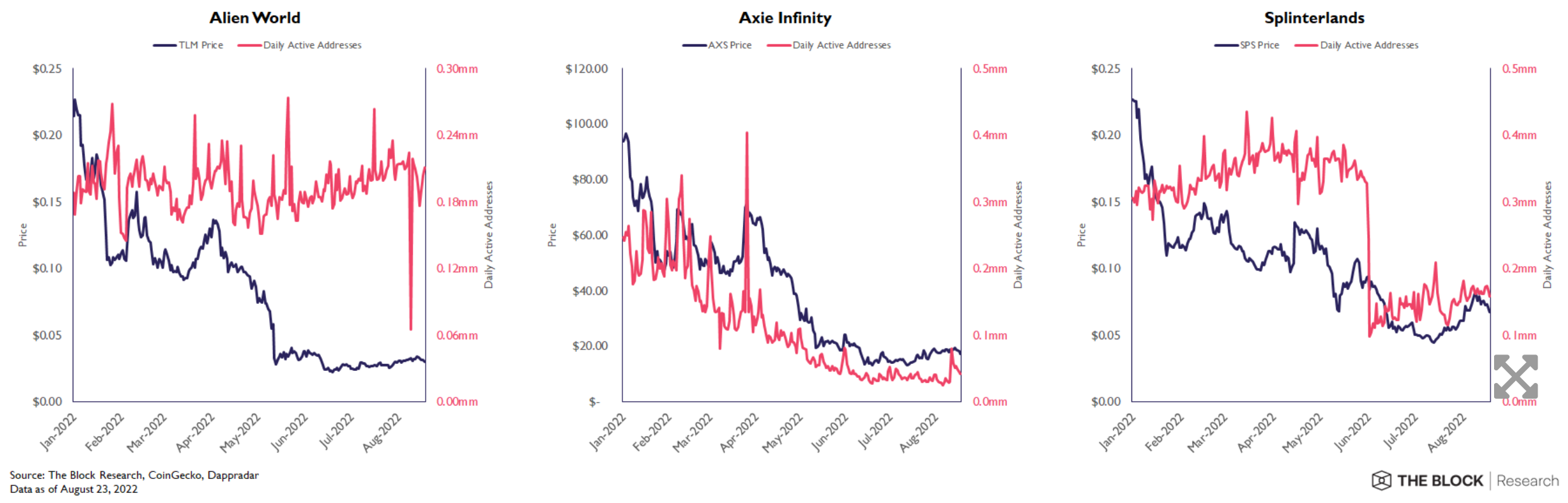

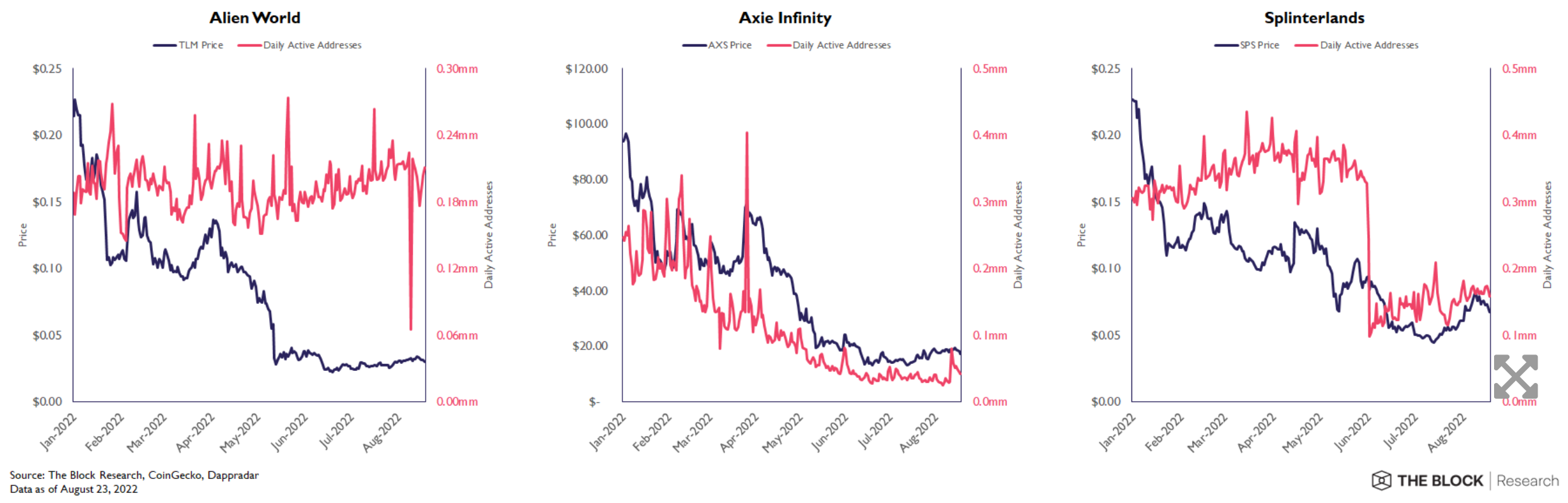

This yr, Alien Worlds created a shock in a initially-generation blockchain game by escalating its DAA (variety of day-to-day energetic accounts) all through the identical time period that the project’s TLM token noticed a reduced higher than the rest of the industry. This implies that most gamers essentially desire taking part in Alien Worlds rather than the money inspiration behind it. For ease of comparison, when SLP costs fell 82% yr-in excess of-yr, Axie Infinity expert an 86% decline in the DAA.

Popular blockchain platform in GameFi

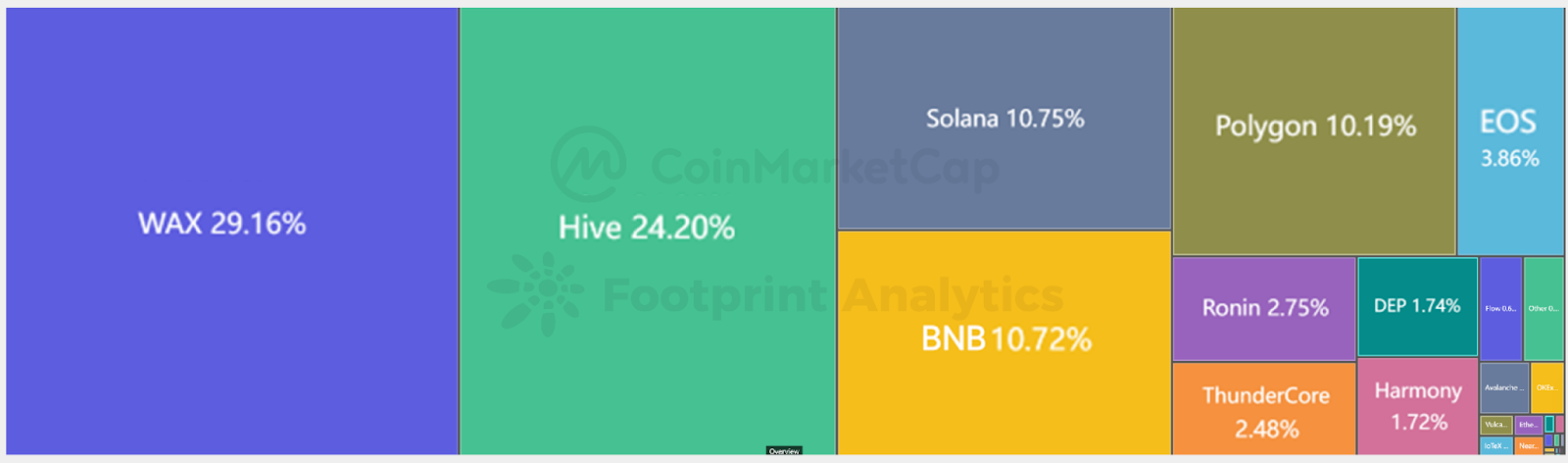

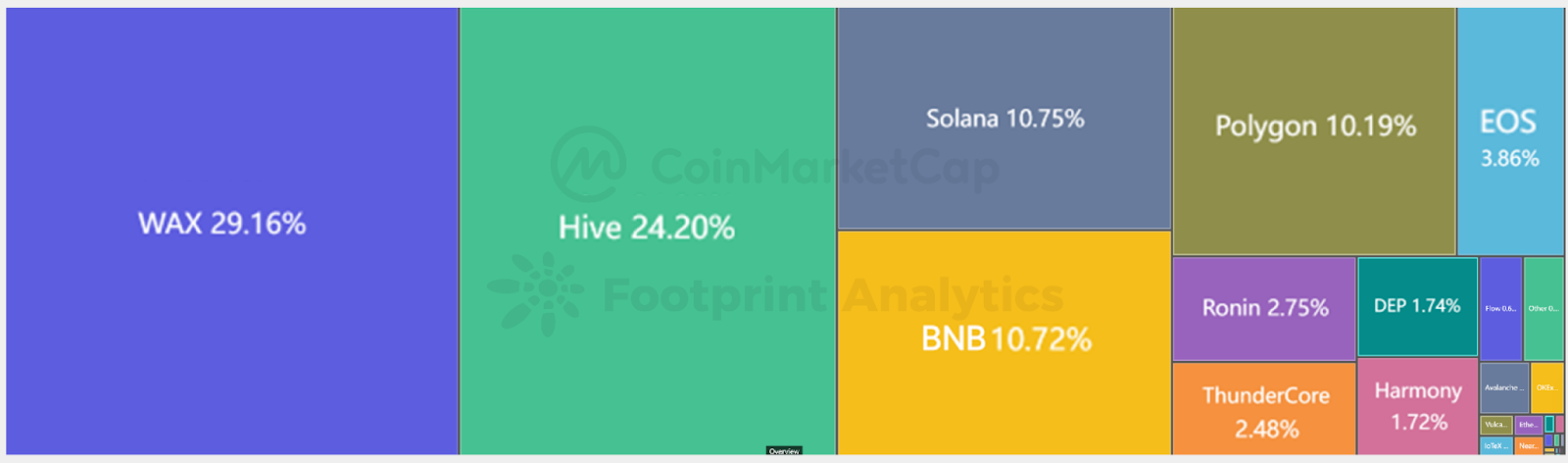

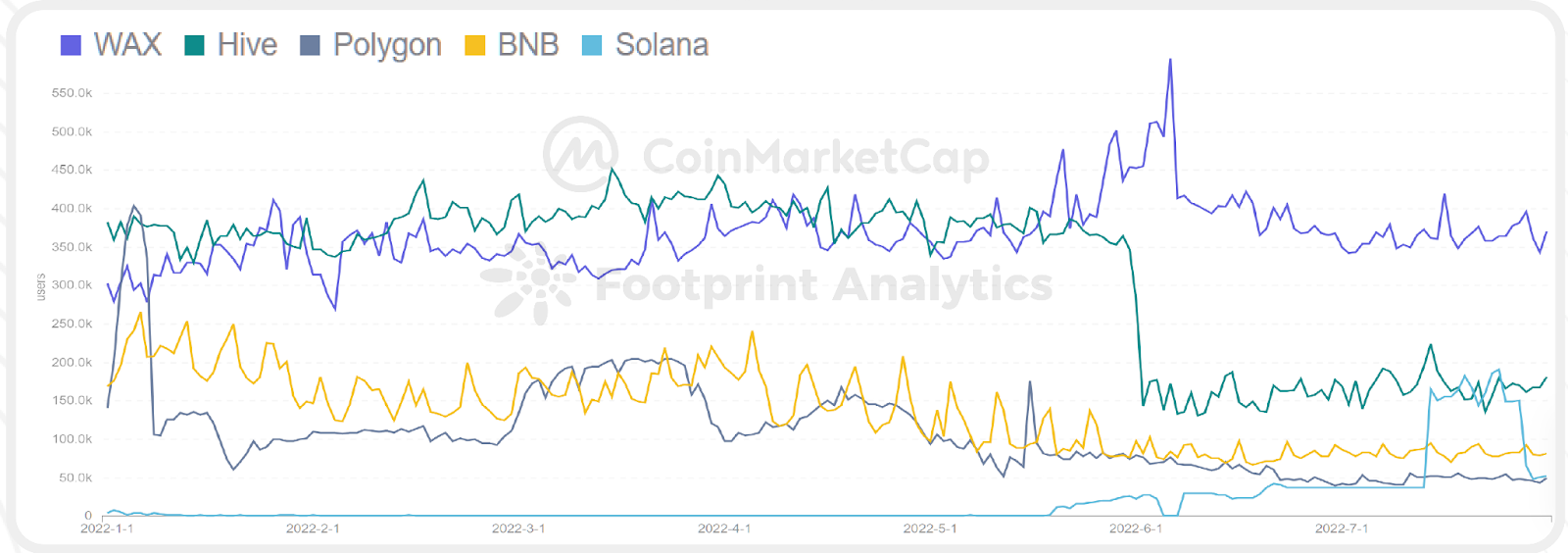

Gaming-centric Blockchain platforms like Wax and Hive are the greatest blockchains in terms of each transactions and regular consumers, attracting close to 29% and 24% of GameFi gamers respectively.

Alien Worlds is the game that accounts for fifty five% of utilization on Wax, whilst Splinterlands draws practically a hundred% of gamers to Hive. Both video games even now preserve an regular of close to 200,000 day-to-day energetic consumers, in spite of the quick-phrase downturn in the NFT industry.

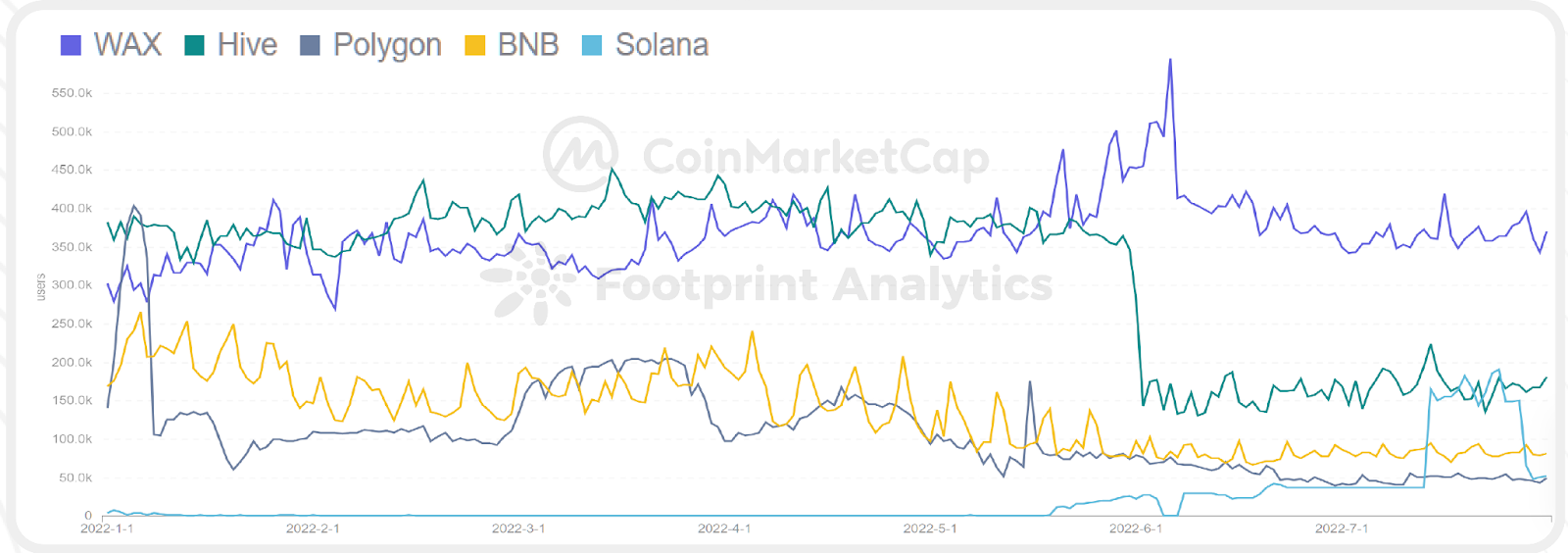

WAX, Hive, Polygon, BNB and Solana are the best five blockchains in terms of energetic consumer website traffic. At the best is WAX with 370,000 energetic consumers in July, whilst Hive recorded a major drop in June from 360,000 to 140,000 due to consumers leaving Splinterlands, the dominant game on the present Hive platform.

From this information, the core worth of any excellent gaming task is the enjoyment worth that the game can carry irrespective of the money return. Both Alien Worlds and Splinterlands have earned a steady player base in spite of getting significantly less “hyped” by the media than Axie (on Ronin, initially Ethereum) or STEPN (BNB, initially on Solana).

In terms of trading volume, Ronin, BNB and Harmony present a degree of superiority in excess of other blockchain platforms, nevertheless, Ronin and Harmony are even now displaying comprehensive dependence on their No. one. They are: Axie Infinity and DeFi Kingdoms. Meanwhile, BNB’s trading volume is a lot more evenly distributed amid the best ten stocks developed on the platform. Furthermore, with the assistance of Binance, BNB Chain has attracted a lot more than 650 video games developed on its platform thanks to its uncomplicated transaction charges and easy advancement language ideal for the huge vast majority of blockchain titles.

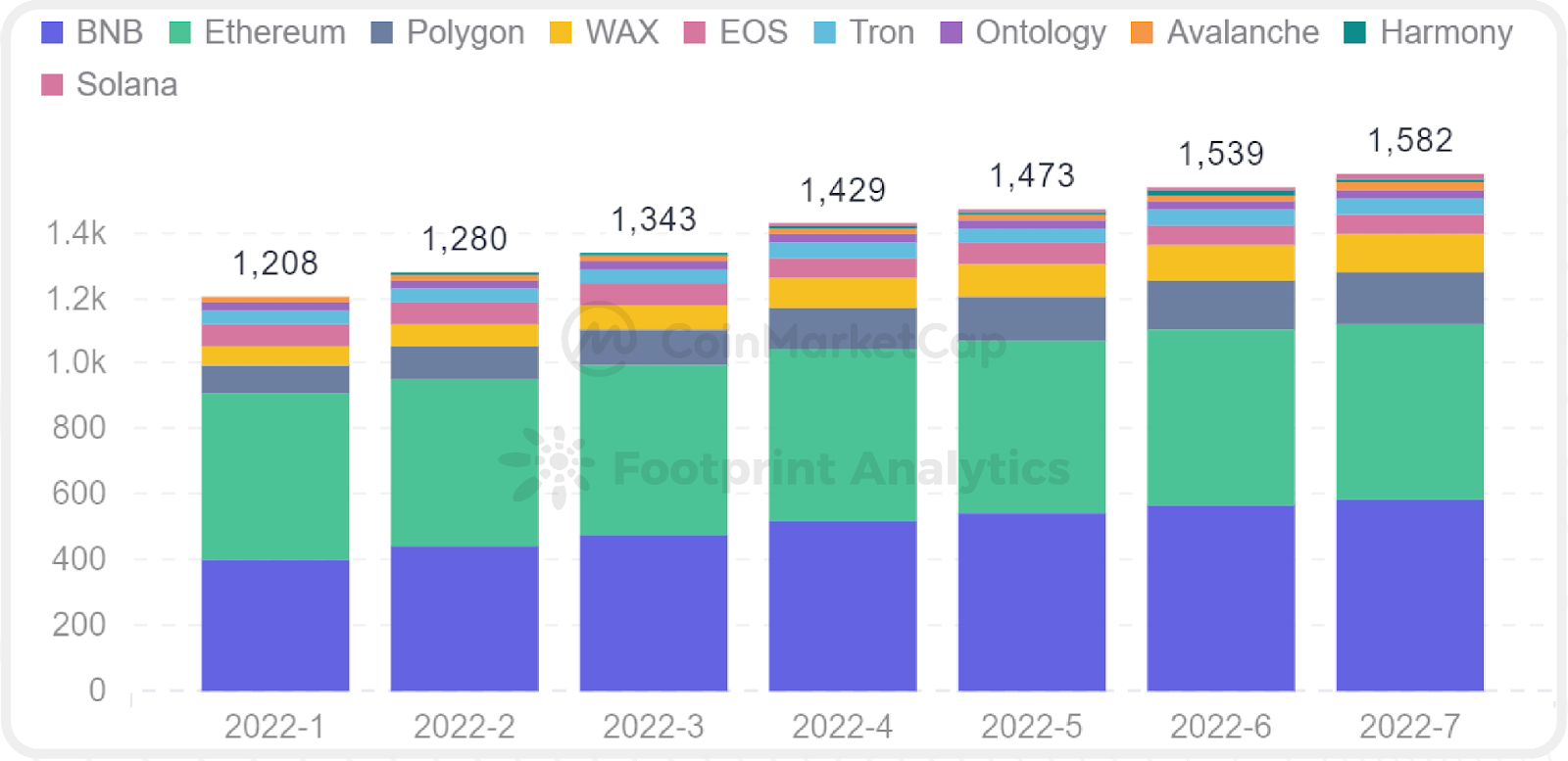

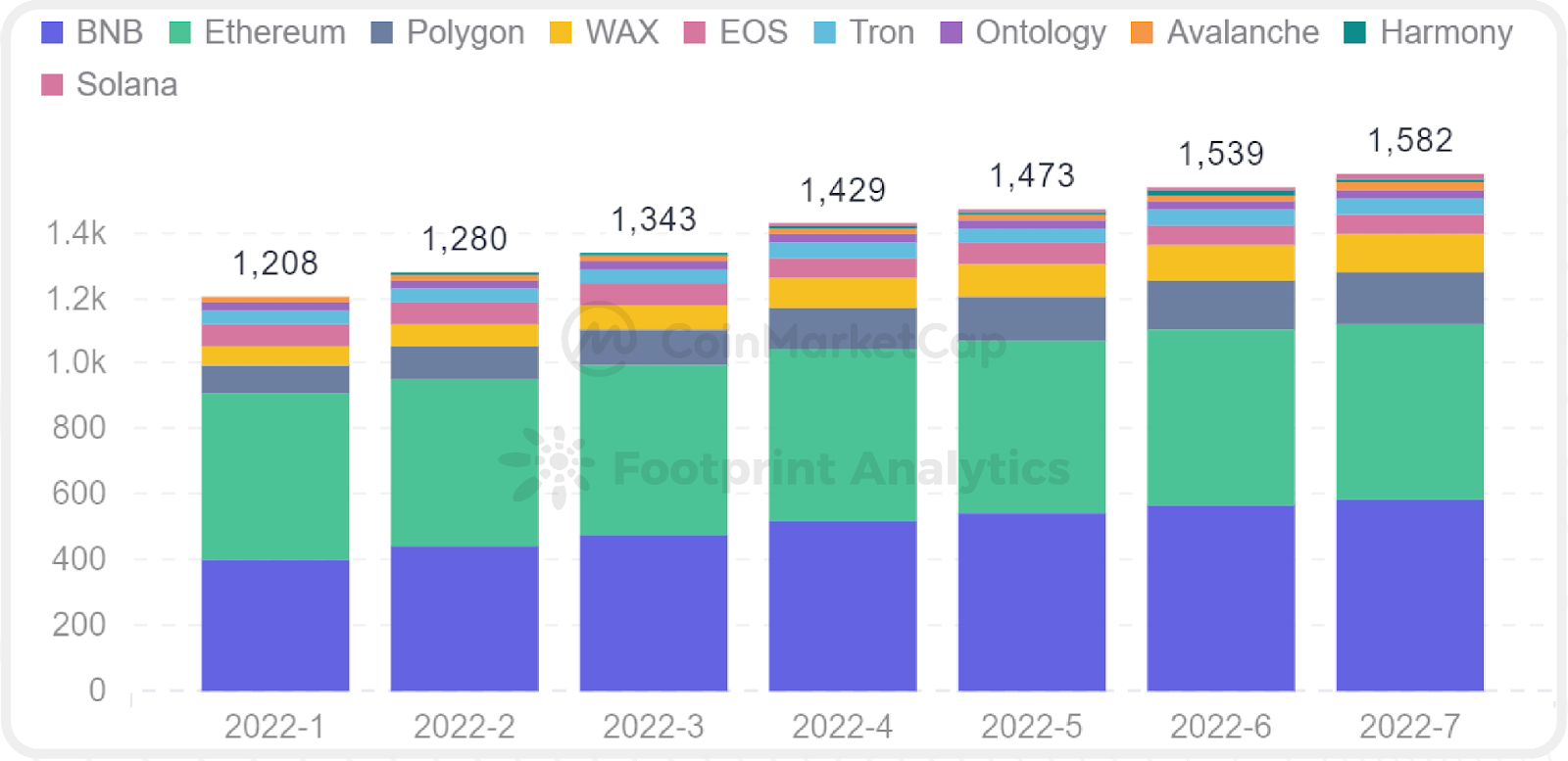

The complete variety of blockchain video games continues to increase to practically one,600 tasks to date, with BNB and Ethereum getting the primary birds in the complete variety of video games developed in their ecosystem. Specifically, forty% of blockchain video games are based mostly on BNB Chain, 26% on Ethereum and 15% on Polygon.

GameFi in direction of multiplatform

Last yr, game developers started the approach of testing their token issuance on a cross-blockchain platform in buy to maximize the consumer base and maximize chance dispersion.

Example: just after creating their core neighborhood on Harmony, Defi Kingdoms made the decision to increase to the Avalanche subnet Likewise, the neighborhood also witnessed the growth of the STEPN task from Solana to BNB Chain in March of this yr.

Expanding to a a lot more steady or common blockchain platform can carry several of the aforementioned advantages, but there are constantly dangers that the task demands to observe out for. The neighborhood on the initially blockchain may perhaps truly feel down and drop faith in the task in the occasion that each blockchains are not additional supported by the task. Furthermore, it is challenging to prevent protection dangers and token arbitrage. At 1 stage in the yr, the cryptocurrency neighborhood noticed a 9-fold variation in the cost of GST (STEPN’s utility token) on Solana versus the BNB chain. More remedies and a strong engineering basis are wanted for tasks to carry on this cross-platform advancement trend with excellent possible.

Trends and the up coming generation of GameFi

In addition to the aforementioned indicators and information displaying GameFi’s possible, enhancements and innovations in the small business model of the up coming generation of tasks are also a vibrant spot that grabs the consideration of several investor folks in the neighborhood. Here are some of the prominent trends and options that have produced rather a stir in the GameFi neighborhood close to the globe.

Free to perform

Most GameFi tasks have discovered useful lessons from the blunders created by the past generation of GameFi, as a result introducing the neighborhood of the Free to Play (F2P) model, generally Axie Origin. ,

overview

Recently, CoinMarketCap, DappRadar and The Block Research concurrently launched up to date reviews on the GameFi industry problem and marketplace efficiency in the initially half of 2022 to readers. The reviews are published in the context of the GameFi industry. going as a result of a Bear Market phase, exactly where the DeFi and GameFi Total Market Cap indices noticed a drop of practically 60% to close to $ 25 billion and $ ten billion respectively.

Despite the gloomy macroeconomic situation, the recorded information demonstrates the resilience, innovation and extended-phrase development of the nascent GameFi marketplace in contrast to its predecessor, now a useful generation of a lot more than $ 300 billion Web2 video games. Investment flows and consumer exercise in blockchain video games have been recorded at a sustainable degree and have outperformed the DeFi sector, reinforcing the thesis of the approaching boom in the GameFi sector and Metaverse aids allow in excess of a hundred million citizens to accessibility the cryptographic area. With a strong basis of money assets and talent, the only piece left for a genuine boom is an impressive small business model that incorporates a sustainable extended-phrase token economic system.

Fortunately, there are in excess of one,500 and increasing candidates for this place.

GameFi’s investment flows are increasing in spite of the present macro problem

Against a backdrop of increasing US dollar worth, Russia’s war-connected power crisis in Ukraine, and a US Federal Reserve-led fiscal tightening to fight the century of higher 10-yr inflation, all of which have produced a macro bearish problem that does not has been viewed considering that the dawn of cryptocurrencies in 2009. All of these occasions have contributed to hedge fund (VC) dynamics and have had a significant effect on the cryptocurrency industry, wiping out practically $ two trillion from complete cryptocurrency industry capitalization considering that all-time. highest in November 2021.

Nonetheless, CoinMarketCap and Footprint Analytics have launched information that estimates a complete of practically $ two.five billion in capital that has been invested in the Web3 gaming marketplace considering that early 2022, a staggering enhance that surprises from the 874 million mark. bucks recorded in the identical final yr. According to DappRadar, the Web3 and Metaverse gaming tasks raised a lot more than $ 300 million in July alone, led by effectively-acknowledged marketplace gamers this kind of as Animoca Brands as a result of a selection of pursuits this kind of as obtaining, investing, utilizing IP and “promoting the Metaverse space “.

This yr, the GameFi and Metaverse & Gaming tasks acquired a increased degree of investment than prominent regions this kind of as blockchain resources, trading and lending. Notably, 48% of these investments have been created early on, an essential reminder of the industry’s nascent state and substantial possible for potential development. All of this funding produces fertile ground for the incubation of up coming-generation Web3 infrastructures and gaming tasks.

Blockchain Gaming is the most energetic sector in the crypto area

On-chain information demonstrates that practically 60% of present blockchain utilization is carried out on blockchain video games this summer time, averaging UAW 967,662 per day. As reported by DappRadar, the GameFi sector outperformed DeFi by major margins in each June and July.

We’re also beginning to see the greatest game studios in the Web2 area taking their initially actions into the Web3 area. Typically, Square Enix (Final Fantasy) has invested close to $ 35 million in Zebedee in a B franchise round. The Zebedee task has uncovered ideas to produce perform-to-earn versions of traditional video games like Solitaire and Sudoku as a result of integration. of the Lightning engineering of the Bitcoin network.

Popular video games

Alien Worlds, Axie Infinity, Solitaire Blitz, Splinterlands, and Upland best the listing of the most common blockchain video games at press time. Precisely due to the fact most blockchain video games are essentially hosted off-chain and only use the blockchain to settle in-game transactions, it is not uncomplicated to confirm the precise variety of gamers. Therefore, day-to-day energetic addresses (DAAs) or these concerned in staking, minting or in-game transactions are utilized as a proxy as a substitute.

Alien Worlds is the game with the highest variety of transactions recorded to date, peaking at 369 million in July of this yr.

This yr, Alien Worlds created a shock in a initially-generation blockchain game by escalating its DAA (variety of day-to-day energetic accounts) all through the identical time period that the project’s TLM token noticed a reduced higher than the rest of the industry. This implies that most gamers essentially desire taking part in Alien Worlds rather than the money inspiration behind it. For ease of comparison, when SLP costs fell 82% yr-in excess of-yr, Axie Infinity expert an 86% decline in the DAA.

Popular blockchain platform in GameFi

Gaming-centric Blockchain platforms like Wax and Hive are the greatest blockchains in terms of each transactions and regular consumers, attracting close to 29% and 24% of GameFi gamers respectively.

Alien Worlds is the game that accounts for fifty five% of utilization on Wax, whilst Splinterlands draws practically a hundred% of gamers to Hive. Both video games even now preserve an regular of close to 200,000 day-to-day energetic consumers, in spite of the quick-phrase downturn in the NFT industry.

WAX, Hive, Polygon, BNB and Solana are the best five blockchains in terms of energetic consumer website traffic. At the best is WAX with 370,000 energetic consumers in July, whilst Hive recorded a major drop in June from 360,000 to 140,000 due to consumers leaving Splinterlands, the dominant game on the present Hive platform.

From this information, the core worth of any excellent gaming task is the enjoyment worth that the game can carry irrespective of the money return. Both Alien Worlds and Splinterlands have earned a steady player base in spite of getting significantly less “hyped” by the media than Axie (on Ronin, initially Ethereum) or STEPN (BNB, initially on Solana).

In terms of trading volume, Ronin, BNB and Harmony present a degree of superiority in excess of other blockchain platforms, nevertheless, Ronin and Harmony are even now displaying comprehensive dependence on their No. one. They are: Axie Infinity and DeFi Kingdoms. Meanwhile, BNB’s trading volume is a lot more evenly distributed amid the best ten stocks developed on the platform. Furthermore, with the assistance of Binance, BNB Chain has attracted a lot more than 650 video games developed on its platform thanks to its uncomplicated transaction charges and easy advancement language ideal for the huge vast majority of blockchain titles.

The complete variety of blockchain video games continues to increase to practically one,600 tasks to date, with BNB and Ethereum getting the primary birds in the complete variety of video games developed in their ecosystem. Specifically, forty% of blockchain video games are based mostly on BNB Chain, 26% on Ethereum and 15% on Polygon.

GameFi in direction of multiplatform

Last yr, game developers started the approach of testing their token issuance on a cross-blockchain platform in buy to maximize the consumer base and maximize chance dispersion.

Example: just after creating their core neighborhood on Harmony, Defi Kingdoms made the decision to increase to the Avalanche subnet Likewise, the neighborhood also witnessed the growth of the STEPN task from Solana to BNB Chain in March of this yr.

Expanding to a a lot more steady or common blockchain platform can carry several of the aforementioned advantages, but there are constantly dangers that the task demands to observe out for. The neighborhood on the initially blockchain may perhaps truly feel down and drop faith in the task in the occasion that each blockchains are not additional supported by the task. Furthermore, it is challenging to prevent protection dangers and token arbitrage. At 1 stage in the yr, the cryptocurrency neighborhood noticed a 9-fold variation in the cost of GST (STEPN’s utility token) on Solana versus the BNB chain. More remedies and a strong engineering basis are wanted for tasks to carry on this cross-platform advancement trend with excellent possible.

Trends and the up coming generation of GameFi

In addition to the aforementioned indicators and information displaying GameFi’s possible, enhancements and innovations in the small business model of the up coming generation of tasks are also a vibrant spot that grabs the consideration of several investor folks in the neighborhood. Here are some of the prominent trends and options that have produced rather a stir in the GameFi neighborhood close to the globe.

Free to perform

Most GameFi tasks have discovered useful lessons from the blunders created by the past generation of GameFi, as a result introducing the neighborhood of the Free to Play (F2P) model, generally Axie Origin. ,