- Gemini obtains EU license to launch crypto derivatives.

- Positions for deeper European institutional presence.

- Aims for expanded derivatives reach in 2025.

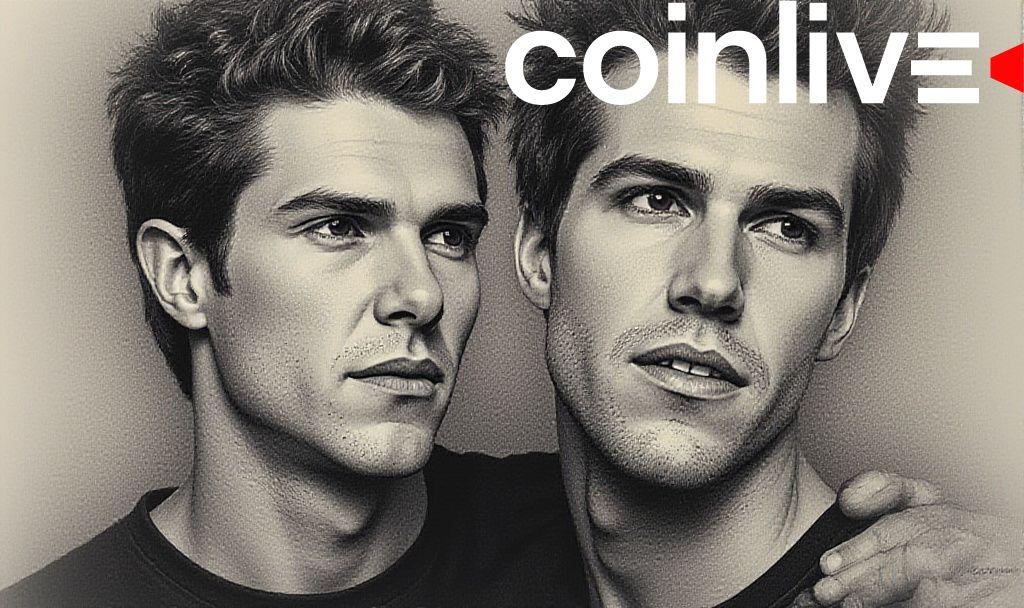

Gemini, a cryptocurrency exchange founded by the Winklevoss twins, received a MiFID II license from the Malta Financial Services Authority to extend its crypto derivatives offerings in the EU on May 8, 2025.

Gemini has ventured deeper into the European crypto market following regulatory approval from the Malta Financial Services Authority. This license permits Gemini to extend crypto derivatives offerings, positioning the firm strategically for future growth.

“This is a hugely exciting development in our 2025 European expansion, as it puts Gemini one step closer to offering our derivative products to both retail and institutional users in the EU and the EEA.” – Mark Jennings, Head of Europe, Gemini

The company, led by the Winklevoss twins and Mark Jennings, secured the MiFID II license through their Maltese entity, Gemini Intergalactic EU Artemis. Jennings emphasized the importance of this step, marking it a milestone in their European expansion.

The license acquisition affirms Gemini’s commitment towards expanding regulated derivatives markets. It aims to bolster participation from both retail and institutional investors in the European Economic Area.

With the strategic license, Gemini targets providing derivatives products beginning with perpetual futures. This initiative is expected to enhance trading volumes for cryptocurrencies like Bitcoin and Ethereum, which are poised for inclusion.

The acquisition aligns with broader market trends where notable exchanges have sought EU expansions, driven by favorable regulatory frameworks post-MiCA regulation introduction. Similar moves previously increased trading volumes significantly.

The approval can potentially lead to heightened trading activity and liquidity for popular cryptocurrencies such as BTC and ETH. Institutional investors may find these regulated platforms attractive, potentially escalating market participation and product depth.

By meeting regulatory standards, Gemini’s expansion could stimulate other platforms to seek licenses in pursuit of European market penetration, contributing to evolutionary shifts in crypto derivatives trading dynamics.