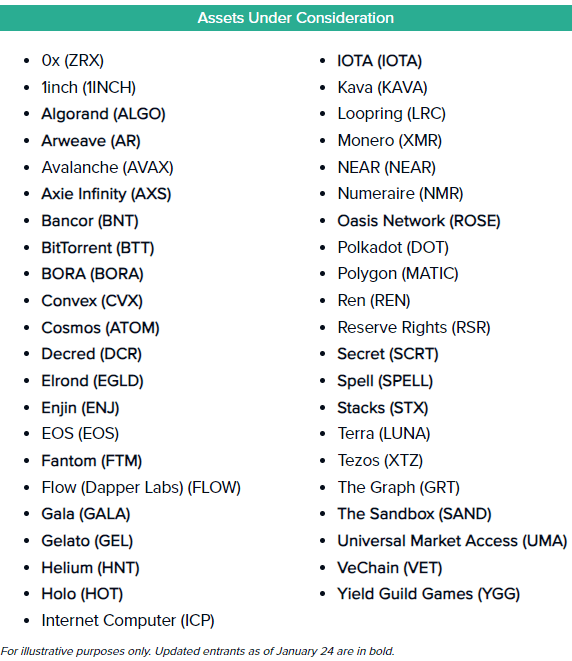

Grayscale, the biggest cryptocurrency investment fund in the planet, just extra 25 new altcoins to its checklist of prospective investments, which includes well-known DeFi and metaverse tasks.

Grayscale’s checklist of assets beneath evaluation stands out for current prominent Level one blockchains this kind of as Algorand (ALGO), Cosmos (ATOM), Fantom (FTM), Oasis Network (ROSE), and so forth. Some acquainted metaverse names, which includes The Sandbox (SAND), Axie Infinity (AXS), Enjin (ENJ), Gala (GALA), and Yield Guild Games (YGG). Grayscale periodically updates this checklist as very well as the assets held by the fund.

We’ve up to date our checklist of digital assets beneath evaluation for 2022. Find out what is new and master far more about what it indicates: https://t.co/GahLhJUgwk$ ALGO $ AR $ ATOM $ AXES $ BORA $ BTT $ CVX $ DCR $ EGLD $ ENJ $ FTM $ GALA $ GEL $ HNT $ HOT $ IOTA $ PINK $ SCRT $ SAND $ SPELL $ STX $ VET $ YGG

– Grayscale (@ Grayscale) January 24, 2022

Grayscale mentioned they are contemplating more candidate representative that may well be integrated in the official investment solution in the potential, but that does not imply each and every asset beneath consideration will be effectively implemented. Grayscale can also look at properties that are not now in the checklist. Currently, there are 44 altcoins found by Grayscale.

The yr 2021 marked an exciting shift in Grayscale’s “investment taste”. Since Ripple started dealing with regulatory hurdles with the SEC, the fund straight away determined to select Chainlink (Website link) to substitute XRP. Subsequently, Grayscale launched investment money for five new altcoins which includes Basic Attention Token (BAT), Chainlink (Website link), Decentraland (MANA), Filecoin (FIL) and Livepeer (LPT).

Additionally, Grayscale continued to launch the DeFi investment fund in mid-July, with best picks in the discipline of Uniswap (UNI), Aave (AAVE), Compound (COMP), Curve (CRV), MakerDAO (MKR), SushiSwap ( SUSHI), Synthetix (SNX), Yearn Finance (YFI), UMA Protocol (UMA), Bancor Network Token (BNT).

However, with apparently undesirable efficiency from UMA Protocol (UMA) and Bancor Network Token (BNT), Grayscale determined to deliver these two tasks back into the revision checklist. Combined with current additions from Cardano (ADA), Solana (SOL) and Amp (AMP), Grayscale’s investment solution portfolio now totals 24 protocols.

As of January 24, Grayscale’s complete crypto assets beneath management (AUM) is approaching $ thirty.six billion, down 50% or $ thirty.three billion from the peak of $ 60.9 billion viewed.This is not an achievement. surprising, simply because Bitcoin has been really stagnant for the previous two months, at a single level it collapsed to USD 33,000, affecting the whole market place.

UPDATE 01/24/22: net assets beneath management, holdings per share and market place rate per share for our investment solutions.

Total AUM: $ thirty.six billion$ BTC $ BAT $ BCH $ LINK $ MANA $ ETH $ ETC $ FIL $ ZEN $ LTC $ LPT $ XLM $ ZEC $ UNI $ AAVE $ COMP $ CRV $ MKR $ SUshi $ SNX $ YFI $ ADA $ SOL $ AMP pic.twitter.com/kNZfy9TYFQ

– Grayscale (@ Grayscale) January 24, 2022

Synthetic currency 68

Maybe you are interested: