Despite being praised and earned a sure repute, however the worth of ICP has gone down go to jail I have never had the power to bounce since I hit the bottom. Many traders have “jumped to the top” of ICP and may’t look ahead to it to return ashore. But why is such an appreciated and potential mission deserted without end? Let’s go together with Blockchain Detective to analyze this “case”!

Detective on the chain

Identify the pockets tackle

To start with, we have to determine the next “objects” concerned:

- Portfolio of the “owner” Dfinity – it is going to be referred to as Portfolio A

- The portfolios of the events which have a “close relationship” with Dfinity – can be referred to as Wallet

- They can be referred to as wallets of exchanges equivalent to Coinbase, Binance, Dfinity Wallet

- An middleman pockets can be referred to as which acts as a “transfer station” for the tokens between the mission pockets (A + B) and the trade pockets (C) EASY pockets

* B, C, D have many wallets, not 1 pockets, however briefly name them collectively for simple monitoring

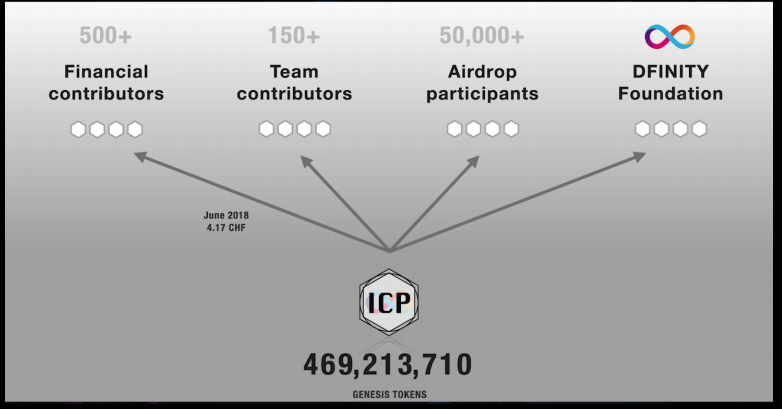

According to the blockchain “spy” survey, Wallet A acquired roughly 107 million ICP tokens from the preliminary tokenization course of. With a most complete provide of ICPs of over 470 million tokens, pockets A alone accounts for practically 1 / 4 of the overall provide of ICPs.

The purpose why Wallet A is acknowledged because the official Dfinity pockets is as a result of there isn’t a different entity in a mission that holds such an quantity of tokens from the beginning, besides the creators of the mission themselves.

This is a quite common phenomenon in tasks. This pockets A may have nothing to say if A doesn’t switch the tokens “no fault” to pockets B. Normally, the mission proprietor’s pockets solely has second token transfers sensible contract to airdrop to the neighborhood, pay for advertising and marketing, divide administration funds or actions associated to mission growth.

The indisputable fact that ICP’s Wallet A transfers tokens to many different wallets makes “detectives” suspect that these wallets are “family” wallets, wallets with “close links” to the mission. This group is collectively often known as Portfolio B – for “children of ancestors”.

These portfolios A and B are typically the “big ears” folks within the Internet Computer mission administration equipment. However, after receiving the tokens, A and B wallets often swap to D wallets – intermediate wallets – to organize to maneuver on to the trade. From these D wallets, the ICP tokens can be transferred to the C pockets.

And then the story grew to become clearer.

Send tokens to the trade for what?

Cash circulate monitoring

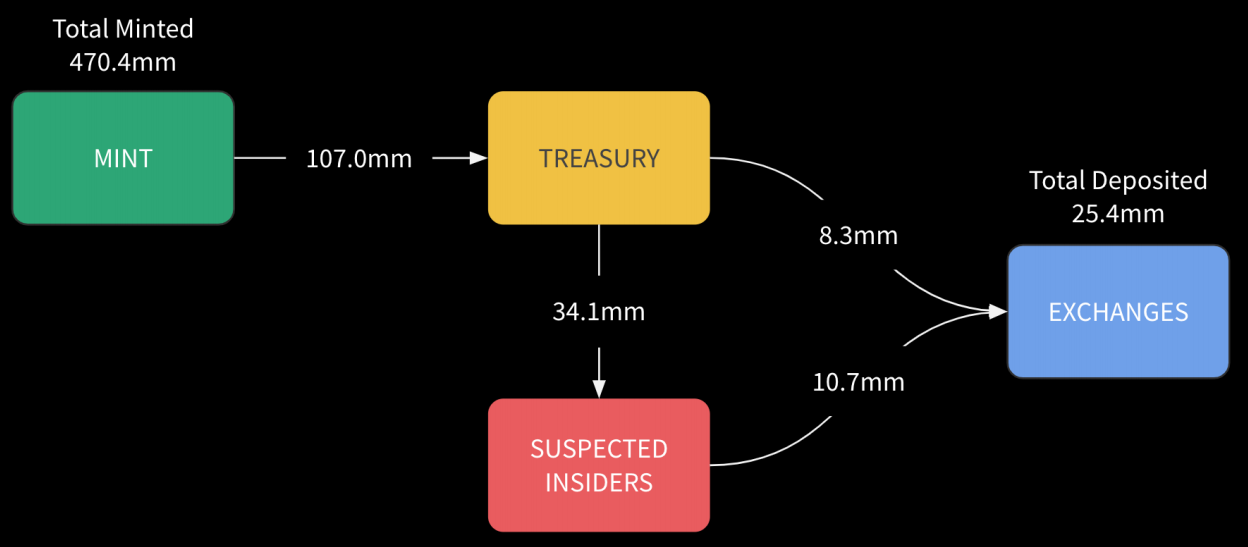

As could be seen from the picture above:

- Total preliminary initialization of ICP tokens is above 470 million tokens -> switch 107 million tokens to pockets A (yellow)

- Portfolio Transfers A 34.1 million ICP for members of the family it’s Portfolio B (pink)

- Portfolio Transfers A 8.3 million tokens to trade pockets – pockets C (blue pockets)

- Portfolio Transfers B 10.7 million tokens in Portfolio

As talked about above, transaction 1 is cheap as a result of A is the primary pockets of the mission and should comprise the biggest variety of tokens. But the remaining 3 transactions are very suspicious. Let’s examine extra with the detective!

1. Portfolio A -> C: 8.3 million ICP

Specifically, 94% of the overall of 8.3 million ICP transfers from that A -> C portfolio occurred inside 2 days:

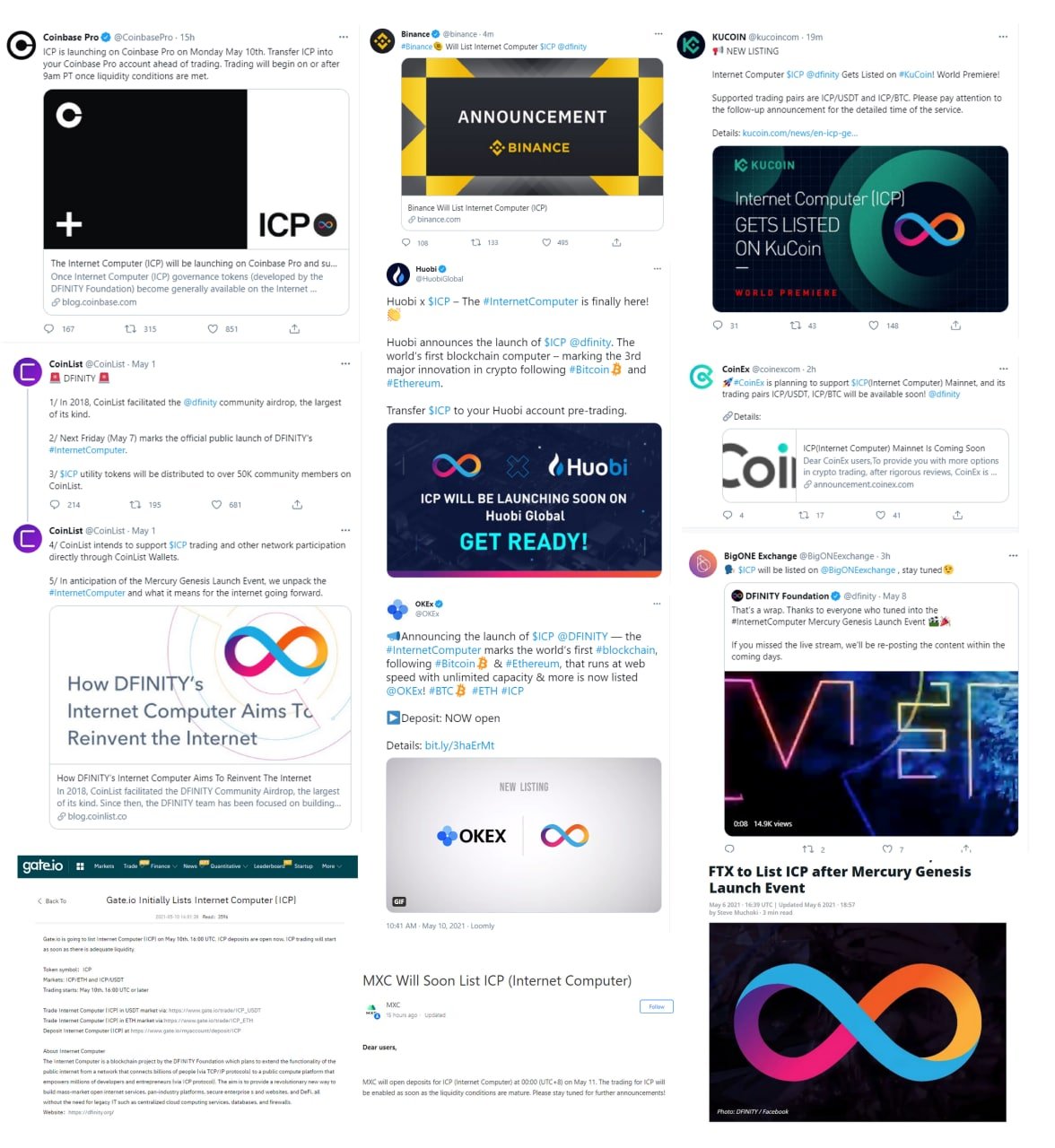

Of course, the aim of the token switch on May 10 is well recognizable. On the day ICP lists all exchanges, it is not uncommon for mission portfolios to switch tokens to the trade to offer liquidity.

But what about June fifteenth?

Review mission exercise round June fifteenth – there isn’t a such exercise that must be transferred to the trade.

So what’s the goal of the switch of ICP to the trade on June 10?

2. Portfolio A -> B: ICP 34.1 million

Portfolio A despatched a complete of 34.1 million ICPs to very suspicious portfolios – portfolio group B.

And talking of 75% These transactions have been made inside 3 hours of Coinbase ICP Lists.

3. Portfolio B -> C: 10.7 million ICP

Well, sending tokens to the Wallet A trade can also be cheap. But what does Wallet B group switch ICP to trade for?

In the weeks following the ICP itemizing, this Wallet B group took turns transferring tokens to wallets like Coinbase or Binance.

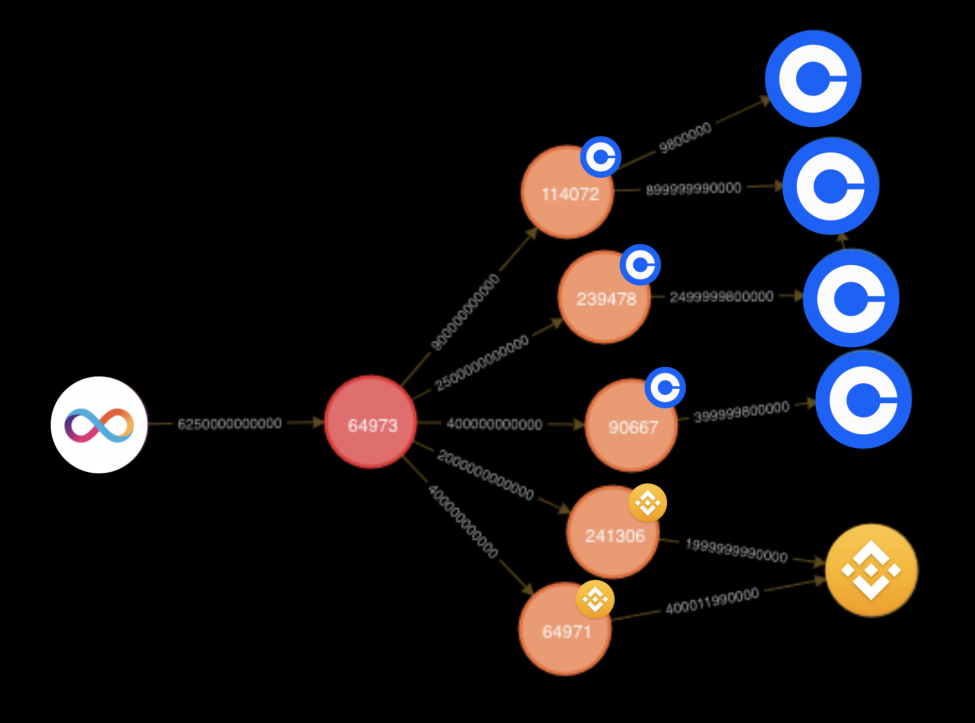

The detective tracked down “suspect object number 1” as follows:

- Portfolio A transfers 62,500 KPIs to portfolio B1 simply 2 hours earlier than the KPI is listed

- Wallet B1 transferred 62,000 KPIs to pockets D (bear in mind pockets D? Transit station!) In 5 days after the KPIs checklist

- The Wallet D group transferred that ICP quantity to Wallet C – the pockets group of the Binance trade, Coinbase – simply 20 minutes later.

The detective on the chain concludes

Of course, it may be defined that the Dfinity pockets that strikes ICP on the trade serves for hedging, to ensure transactions, to keep up the liquidity of the tokens on the trade, and so on.

However, such actions could be carried out with 1-2 “one-on-one” cash switch orders. Not divided and “small” as above.

Also, trying on the worth motion of the ICP because it went ashore, we solely see… candles going underground. Any dealer taking a look at this chart will agree that ICP is experiencing a powerful pullback and there’s no help from consumers.

Here the chain detective’s query was answered:

Send tokens to the trade for what?

What to throw away!

Detective off the chain

tokennomics? Token distribution roadmap? NO YES!

After studying the above, certainly a few of you can find the distribution path of the ICP token.

And increase! We discovered that there was no such info!

Neither the whitepaper, nor the official web site, nor the Medium web page, nor the Twitter web page have made public details about the ICP token launch and distribution program.

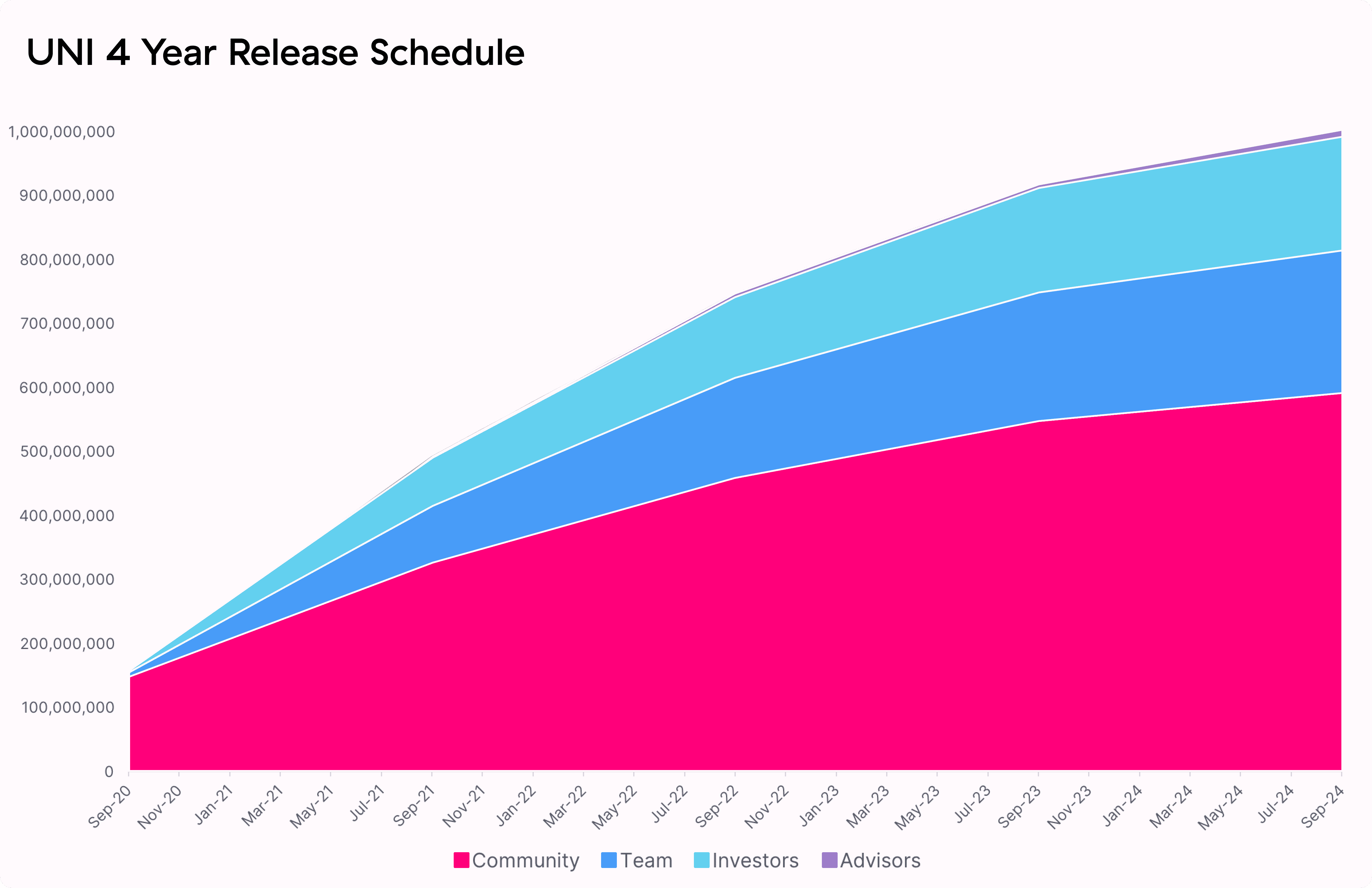

This is a really inconsistent method to the inherent transparency standards of the blockchain. Other DeFi tasks like Uniswap, for instance, promote all of their token unlocking applications. In the Coinlive mission evaluation article, all of us share details about the mission’s tokenomics. This is a particularly vital side of the token worth, resulting in an investor’s choice to purchase that token or not.

The detective discovered only one slide within the video posted 7 months previous to the launch of the token fairly generic About this info:

After looking without end and never discovering info on tokenomics, let’s go and ask the mission straight!

And under is the reply from Dominic Williams – founding father of ICP – when a consumer requested in regards to the unlock time, in regards to the distribution of tokens.

The Foundation hasn’t constructed itself, however plans to place most of its ICP into neurons. It does this rigorously to verify the inspiration and group members do not management the network (you would not imagine it based mostly on what you hear, however in actuality, we care so much about decentralization!)

– Domenico Williams (@dominic_w) May 27, 2021

“Dfinity Foundation has no intention of entrusting the ICP, however intends to insert a lot of the ICP into the neural network. This will make sure that the inspiration and the mission group don’t management the network. (You could not imagine it, however we actually care about decentralizing the mission!) “

The clarification appears credible (?!)

Project no vesting plan – implies that mission members can do something with the token from the very starting of the mission. There isn’t any phased unlock roadmap (just like the UNI token above), the group, the traders, the non-public spherical, the seed spherical, the accomplice, and so on. they get the token instantly and may “do what you want” with none restrictions!

Where are the Seed Round Investors?

Similar to different blockchain tasks, ICP additionally had a Seed Round in early 2017. At that point the mission was open in order that some abnormal customers (small customers) might “contribute” a reasonably small quantity – together with the promise of receiving ICP token when the mission is launched.

In different phrases, Seed Round traders are those who purchase ICP tokens at a really inexpensive worth, only a few cents, which is extraordinarily low in comparison with the ICP worth listed for the primary time on the trade.

This is a particularly regular exercise within the blockchain area. Investors who help the mission from the beginning will obtain a worthy reward later, when the mission launches and resonates.

However, from the on-chain evaluation above, we do not see the place these Seed Round traders are. Only Wallet A (the mission proprietor’s pockets) and Wallet B group (the mission data portfolio) garbage dump thousands and thousands of tokens available on the market, however not Seed Round investor wallets.

So the place have been they?

Go for a stroll Discussion forum at Dfinity, we’ll discover that Seed Round traders have a whole lot of “glitches” with regards to getting their tokens.

According to tutorial For Seed Round traders, the mission requires those that have supported me from the beginning to take action “three seven four nine” It is a really tough step to acquire ICP tokens.

“I have to buy a Macbook to install the Dfinity sdk file …”

“Invested in ICP Seed Round 4 years in the past (December 2017). And what do I get then?

There isn’t any info or directions to assist Seed Round Investors receive ICP Tokens!

I need assistance!”

You can go to the Dfinity Forum to see a sequence of feedback on Seed Round traders who’re unable to obtain tokens. Thousands of feedback have been nearly getting tokens with none steering or help from the Dfinity group.

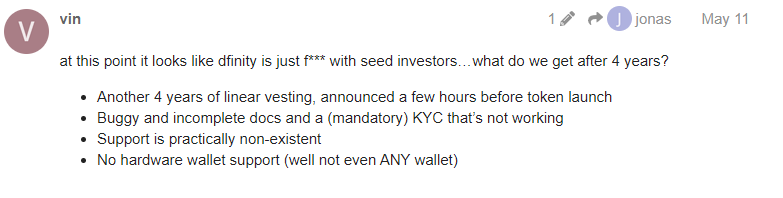

After traders “commented” on one another, one consumer got here to a bitter conclusion:

“What will we get after 4 years of investing within the Seed Round?

- Another 4 years of vesting with only a few hours’ discover earlier than the token launch

- Documentation is stuffed with errors, KYC would not work

- Nobody desires to assist

- No pockets incorporates ICP tokens “

The off-chain detective concludes

After exploring the Dfinity neighborhood, the detective simply got here to the next conclusion:

It may be very tough for Seed Round traders to obtain their ICP tokens. While mission portfolios and household portfolios obtain tokens with none restrictions.

We discover two extraordinarily reverse states:

- Project group: tokens don’t mature, they’re freely dumped on the trade, making it tough for Seed Round traders

- Seed Round Investors: was all of a sudden notified of the vesting, unable to obtain the tokens as a result of “technical issues …