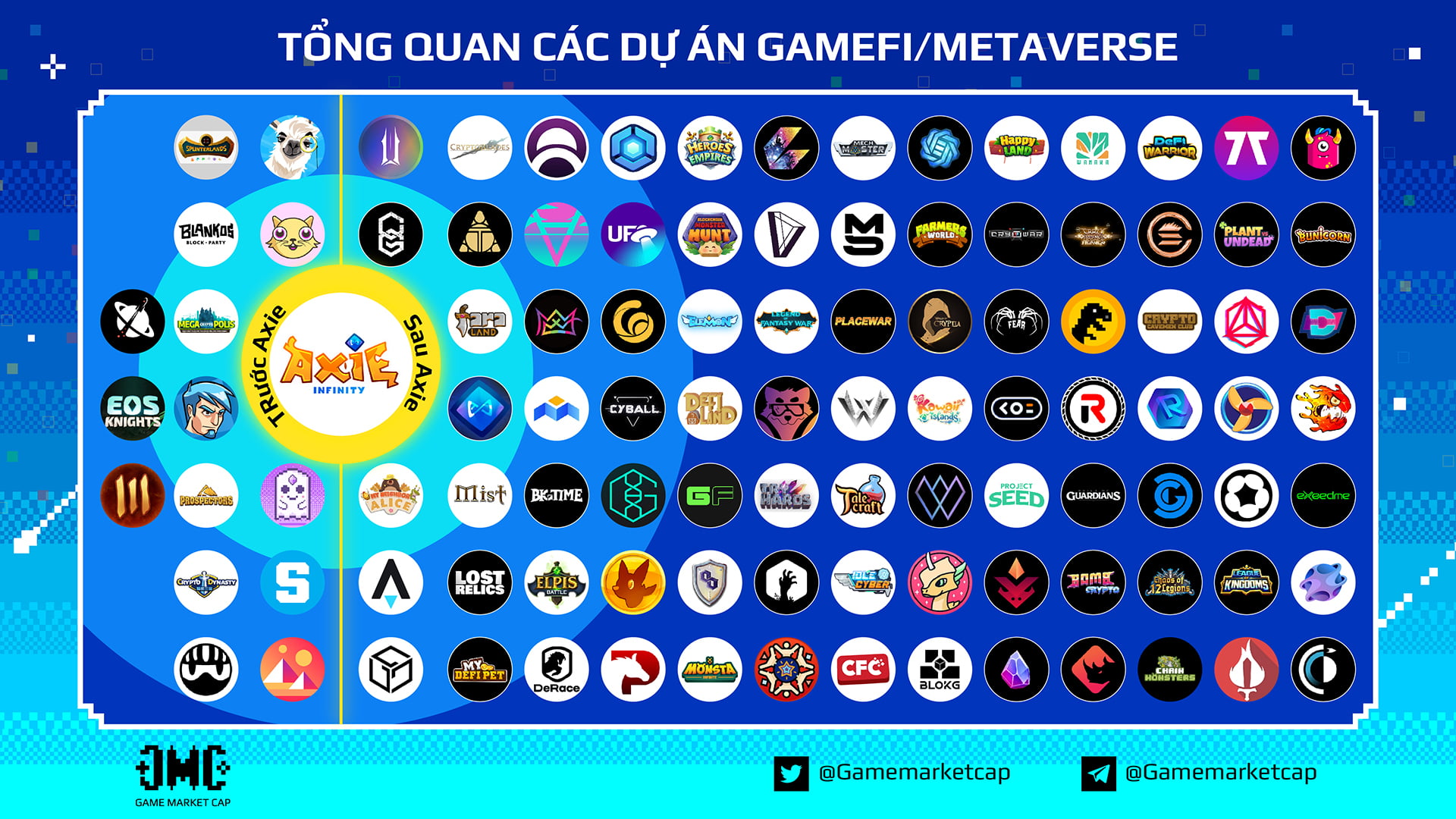

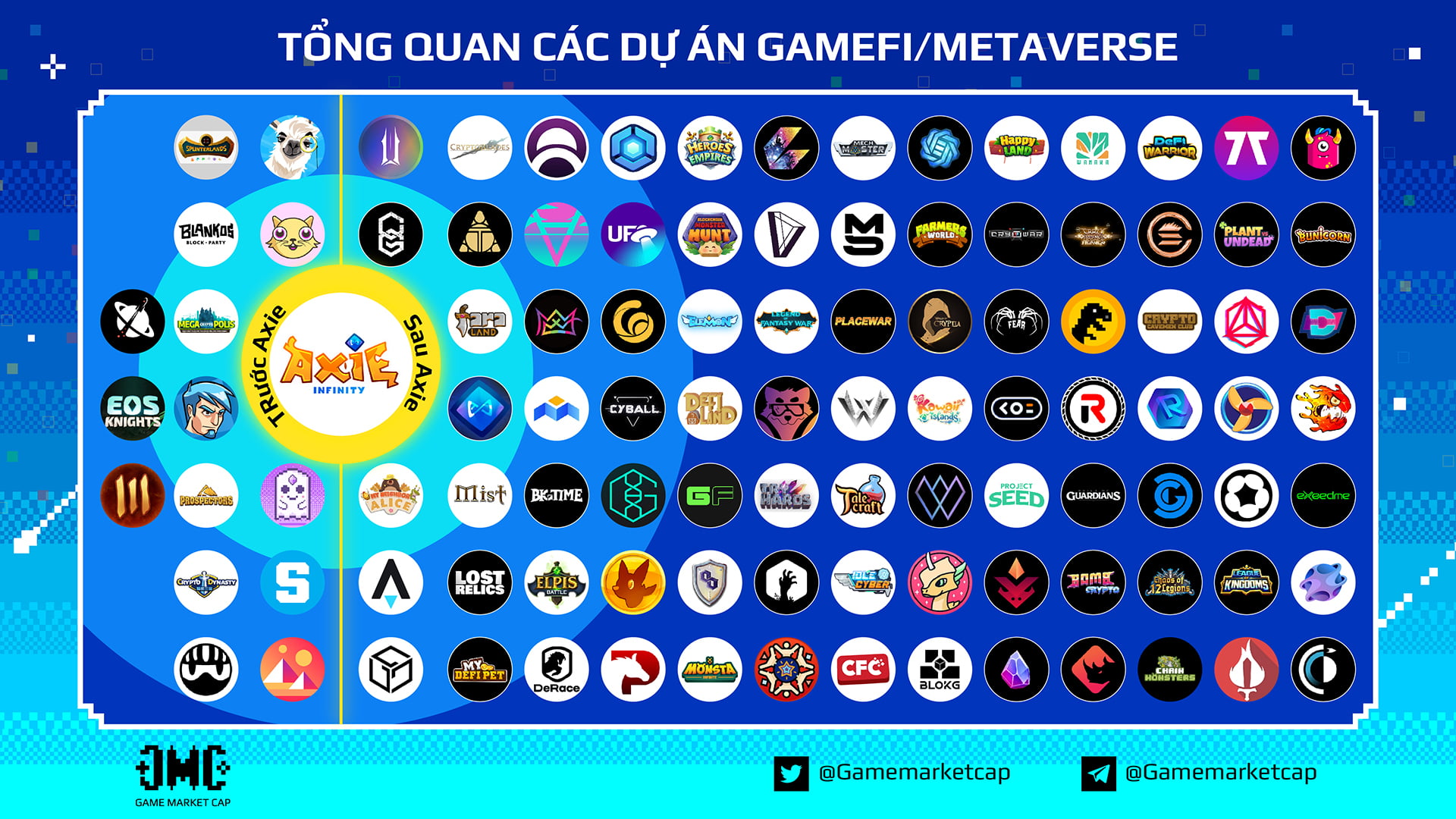

Although it appeared and started to emerge just a 12 months in the past underneath the pioneering identify Axie Infinity, Crypto Gaming has efficiently turn out to be a trend that are not able to be ignored in the investment neighborhood. However, investment funds movement showed indications of retreating from this nascent discipline really speedily immediately after the boom time period, when most customers determined to quit the game when they reached their wanted cash flow degree.

Note: This post might signify the author’s personalized views and opinions. It should not be viewed as investment guidance.

At the minute, the damaging environment that pervades the total crypto area can make the predicament worse for Crypto Gaming. Therefore, it is time for the Crypto Gaming field to do a restructuring or die.

Stop applying speculative contemplating from the NFT market place to GameFi

Spending 1000’s of bucks just to perform a video game is a really foolish choice. But Axie created that threshold a common entry charge all through her peak.

Part of the motive comes from the influence of the NFT market place. At the time, there have been NFT collectibles that have been swollen to hundreds of thousands of bucks but nevertheless attracted significant numbers of speculative-minded traders – purchase and hold right up until the value is increased, then promote. So paying 1000’s of bucks to purchase NFT in-game all of a sudden grew to become not also unreasonable.

However, this value degree not only increases the possibility for traders, it also puts stress on the gaming economic system. Because as soon as you have to invest 1000’s of bucks to perform the game, the player’s mindset will naturally want to get the capital back as speedily as doable. Massively implemented in-game resource mining operations (NFT tokens / assets) can push the game economic system in the direction of inflation, requiring the game to entice significant numbers of new gamers to stability the game and stability demand and give.

On the element of traders, the good stress of capital input can make them sweat even in the calculations, producing it tricky to truly love the game. Some traders might argue that the Play-to-Earn Gaming Guild was designed to resolve the difficulty. But if you appear at the root of the difficulty, Crypto Gaming was born with the notion of allowing gamers to totally personal their gaming assets. So the Guilds’ NFT “rental” option rendered the notion meaningless.

Stop copying “Ponzi” designs into the DeFi ecosystem

If you are a tiny cautious, traders might have acknowledged that early perform-to-earn stocks have been a mixture of the qualities of the NFT market place and the DeFi model. While a lot of traders agree to purchase in-game NFTs for a large value and hope to resell it for a increased value, other people purchase in-game tokens and want to earn additional passive cash flow by the staking pool.

Applying promotional designs realized from the DeFi ecosystem has truly assisted a lot of crypto video games effortlessly entice early gamers, but in the prolonged run it has also harm the gaming economic system itself.

For instance, the staking model in the present GameFi array is utilized in two major strategies: governance token staking to acquire additional governance tokens or to acquire element of the game income. In essence, each of these designs encourage speculation, producing it less complicated for large-capital traders to make additional revenue with out taking part in. In other phrases, it does not give true which means to the sustainable growth of the game. Conversely, the former model can also lead to steep inflation of governance tokens, raising the possibility of a value collapse.

Of program, the disruptive designs of the DeFi area never normally harm perform-to-earn video games. The difficulty right here is that they want to be utilized additional selectively and creatively. Recently, some tasks like StarShark, Elpis Battle have the notion of giving the course of the gameplay style as nicely as the in-game parameters to the gamers themselves by the possession of governance tokens. This might be an notion really worth observing and studying in the close to long term.

Eliminate the expectation of large revenue from crypto video games

As explained over, most gamers assume to make enormous revenue when they not long ago method crypto video games. However, there is now no perform-to-earn game that can deliver desirable returns to gamers with out struggling hefty inflation.

Therefore, in buy to go a prolonged way, the cryptocurrency game wants to transform the expectations of the gamers, from participation to make fast cash to the enjoyment game getting the major a single and has the skill to recover a portion of the revenue of their misplaced time. in.

DOTA two is a good instance of this model. This game is not a Play-to-earn game, but customers can nevertheless pass their in-game rewards to other people and for a selected quantity of revenue. And in reality, though most gamers invest additional cash on DOTA two than they get, they nevertheless have a great deal of entertaining.

In quick, crypto video games want to transform their operational target from perform-to-earn to perform and earn Only then can we consider about the likelihood of sustainable growth.

Build a “real game”

Most of the crypto video games launched in latest occasions have really inaccurate gameplay. All the player has to do is click and reproduce. Therefore, the skill to retain gamers of these video games when profitability is problematic is near to zero. No consumer is prepared to carry on taking part in with out producing a revenue and stroll away speedily as quickly as he sees indications of a decline in revenue.

Worse nevertheless, a lot of cryptocurrency video games have suffered when selected gambling men and women or guilds have invested a significant quantity of cash obtaining NFT assets, breeding them en masse, and then releasing them to market place.

Hence, the following phase in the direction of sustainable growth of crypto video games is to make “real games” that can deliver joy and entice gamers alternatively of just clicking to make cash.

However, we have to also describe that not all “clicking games” are poor, recall how the farm video games as soon as fascinated gamers. The important right here is that game makers truly want to place in the hard work to make the gameplay. Chill Chat, Nekoverse, Big Time, CyBall or Elpis Battle are some of the “click games” that target on technique in today’s crypto game market place.

Change in the direction of the long term

In basic, not only the GameFi sector, but also the crypto area has been in a tricky place in latest months. Many video games have been wiped out when gamers ran out of capital to depart. However, this is also a required pause for the market place to reflect on the excellent difficulties and locate answers to conquer this sector so that this discipline can create additional secure in the long term.

Julian

See other articles or blog posts by writer Julian:

Although it appeared and started to emerge just a 12 months in the past underneath the pioneering identify Axie Infinity, Crypto Gaming has efficiently turn out to be a trend that are not able to be ignored in the investment neighborhood. However, investment funds movement showed indications of retreating from this nascent discipline really speedily immediately after the boom time period, when most customers determined to quit the game when they reached their wanted cash flow degree.

Note: This post might signify the author’s personalized views and opinions. It should not be viewed as investment guidance.

At the minute, the damaging environment that pervades the total crypto area can make the predicament worse for Crypto Gaming. Therefore, it is time for the Crypto Gaming field to do a restructuring or die.

Stop applying speculative contemplating from the NFT market place to GameFi

Spending 1000’s of bucks just to perform a video game is a really foolish choice. But Axie created that threshold a common entry charge all through her peak.

Part of the motive comes from the influence of the NFT market place. At the time, there have been NFT collectibles that have been swollen to hundreds of thousands of bucks but nevertheless attracted significant numbers of speculative-minded traders – purchase and hold right up until the value is increased, then promote. So paying 1000’s of bucks to purchase NFT in-game all of a sudden grew to become not also unreasonable.

However, this value degree not only increases the possibility for traders, it also puts stress on the gaming economic system. Because as soon as you have to invest 1000’s of bucks to perform the game, the player’s mindset will naturally want to get the capital back as speedily as doable. Massively implemented in-game resource mining operations (NFT tokens / assets) can push the game economic system in the direction of inflation, requiring the game to entice significant numbers of new gamers to stability the game and stability demand and give.

On the element of traders, the good stress of capital input can make them sweat even in the calculations, producing it tricky to truly love the game. Some traders might argue that the Play-to-Earn Gaming Guild was designed to resolve the difficulty. But if you appear at the root of the difficulty, Crypto Gaming was born with the notion of allowing gamers to totally personal their gaming assets. So the Guilds’ NFT “rental” option rendered the notion meaningless.

Stop copying “Ponzi” designs into the DeFi ecosystem

If you are a tiny cautious, traders might have acknowledged that early perform-to-earn stocks have been a mixture of the qualities of the NFT market place and the DeFi model. While a lot of traders agree to purchase in-game NFTs for a large value and hope to resell it for a increased value, other people purchase in-game tokens and want to earn additional passive cash flow by the staking pool.

Applying promotional designs realized from the DeFi ecosystem has truly assisted a lot of crypto video games effortlessly entice early gamers, but in the prolonged run it has also harm the gaming economic system itself.

For instance, the staking model in the present GameFi array is utilized in two major strategies: governance token staking to acquire additional governance tokens or to acquire element of the game income. In essence, each of these designs encourage speculation, producing it less complicated for large-capital traders to make additional revenue with out taking part in. In other phrases, it does not give true which means to the sustainable growth of the game. Conversely, the former model can also lead to steep inflation of governance tokens, raising the possibility of a value collapse.

Of program, the disruptive designs of the DeFi area never normally harm perform-to-earn video games. The difficulty right here is that they want to be utilized additional selectively and creatively. Recently, some tasks like StarShark, Elpis Battle have the notion of giving the course of the gameplay style as nicely as the in-game parameters to the gamers themselves by the possession of governance tokens. This might be an notion really worth observing and studying in the close to long term.

Eliminate the expectation of large revenue from crypto video games

As explained over, most gamers assume to make enormous revenue when they not long ago method crypto video games. However, there is now no perform-to-earn game that can deliver desirable returns to gamers with out struggling hefty inflation.

Therefore, in buy to go a prolonged way, the cryptocurrency game wants to transform the expectations of the gamers, from participation to make fast cash to the enjoyment game getting the major a single and has the skill to recover a portion of the revenue of their misplaced time. in.

DOTA two is a good instance of this model. This game is not a Play-to-earn game, but customers can nevertheless pass their in-game rewards to other people and for a selected quantity of revenue. And in reality, though most gamers invest additional cash on DOTA two than they get, they nevertheless have a great deal of entertaining.

In quick, crypto video games want to transform their operational target from perform-to-earn to perform and earn Only then can we consider about the likelihood of sustainable growth.

Build a “real game”

Most of the crypto video games launched in latest occasions have really inaccurate gameplay. All the player has to do is click and reproduce. Therefore, the skill to retain gamers of these video games when profitability is problematic is near to zero. No consumer is prepared to carry on taking part in with out producing a revenue and stroll away speedily as quickly as he sees indications of a decline in revenue.

Worse nevertheless, a lot of cryptocurrency video games have suffered when selected gambling men and women or guilds have invested a significant quantity of cash obtaining NFT assets, breeding them en masse, and then releasing them to market place.

Hence, the following phase in the direction of sustainable growth of crypto video games is to make “real games” that can deliver joy and entice gamers alternatively of just clicking to make cash.

However, we have to also describe that not all “clicking games” are poor, recall how the farm video games as soon as fascinated gamers. The important right here is that game makers truly want to place in the hard work to make the gameplay. Chill Chat, Nekoverse, Big Time, CyBall or Elpis Battle are some of the “click games” that target on technique in today’s crypto game market place.

Change in the direction of the long term

In basic, not only the GameFi sector, but also the crypto area has been in a tricky place in latest months. Many video games have been wiped out when gamers ran out of capital to depart. However, this is also a required pause for the market place to reflect on the excellent difficulties and locate answers to conquer this sector so that this discipline can create additional secure in the long term.

Julian

See other articles or blog posts by writer Julian: