According to the movement of occasions, the stablecoin issued by TRON’s blockchain, USDD, has been expanded along with a shock statement from founder Justin Sun.

Surprise statement from the founder of Tron

Thought to be bailed out by Binance, FTX’s strategy to “sell itself” has failed and the marketplace has struggled by really complicated days.

But not long ago, it seems that FTX has turned to “Asking for Help” Justin Sun. Tron founder and Huobi’s worldwide advisor also announced yesterday that they will compensate and bail out individuals who hold Sun coins that are held on FTX. But at present only withdrawing TRX from the platform.

A handful of hrs in the past, he announced that he was operating with FTX to come across a remedy to handle the condition.

Following my announcement to be behind all Tron tokens (#TRX, #BTT, #JST, #SUN, #HT) holders #FTXwe are placing collectively a remedy with #FTX to start out a forward path. @FTX_Official

– SE Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) November 10, 2022

But the founder mentioned “this is correct the initial stage in the direction of a worldwide remedy, which assists to revive and carry issues back to ordinary for every person. use FTX. I actually value the collaboration with FTX this time.

Commenting beneath the standing line over, a single account praised the reality that “knowingly, there is really only one man left who can save us”.

Immediately, the price tag of TRX is “pumped” strongly from .06 to two.five USD, ie in just five minutes it has risen 41.six occasions.

USDD loses anchor

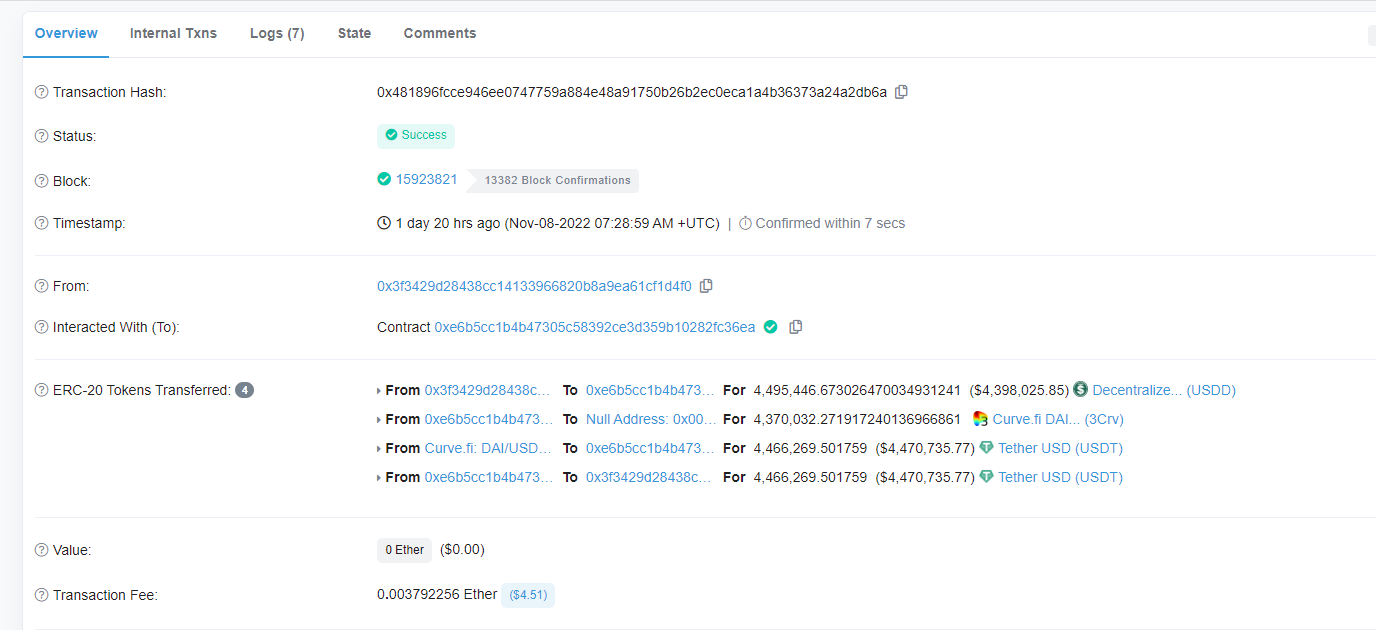

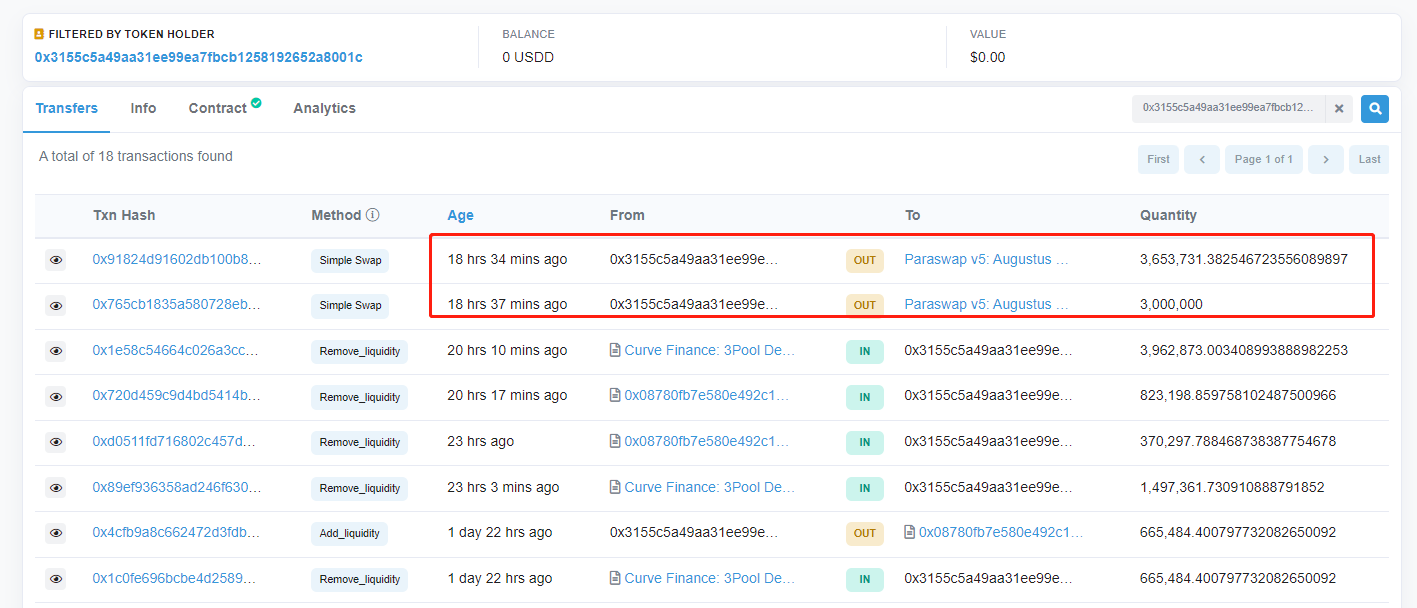

To observe Lookonchainabout two days in the past, whale 0x3f34 converted four,495,446 USDD to four,466,269 USDT, at a fee of .9935. USDD also started out to fall from that stage.

initial/ $ USDD it started out to decline and is trading at $ .9788.

USDD vs. The USDC / USDT / DAI pool is unbalanced, with USDD accounting for 82.27%.

What you need to have to know $ USDD.👇 pic.twitter.com/caVkr8f9F0

– Lookonchain (@lookonchain) November 10, 2022

About 18 hrs in the past, a different whale traded six,653,731 USDD at six,519,662 USDT, at a fee of .9799.

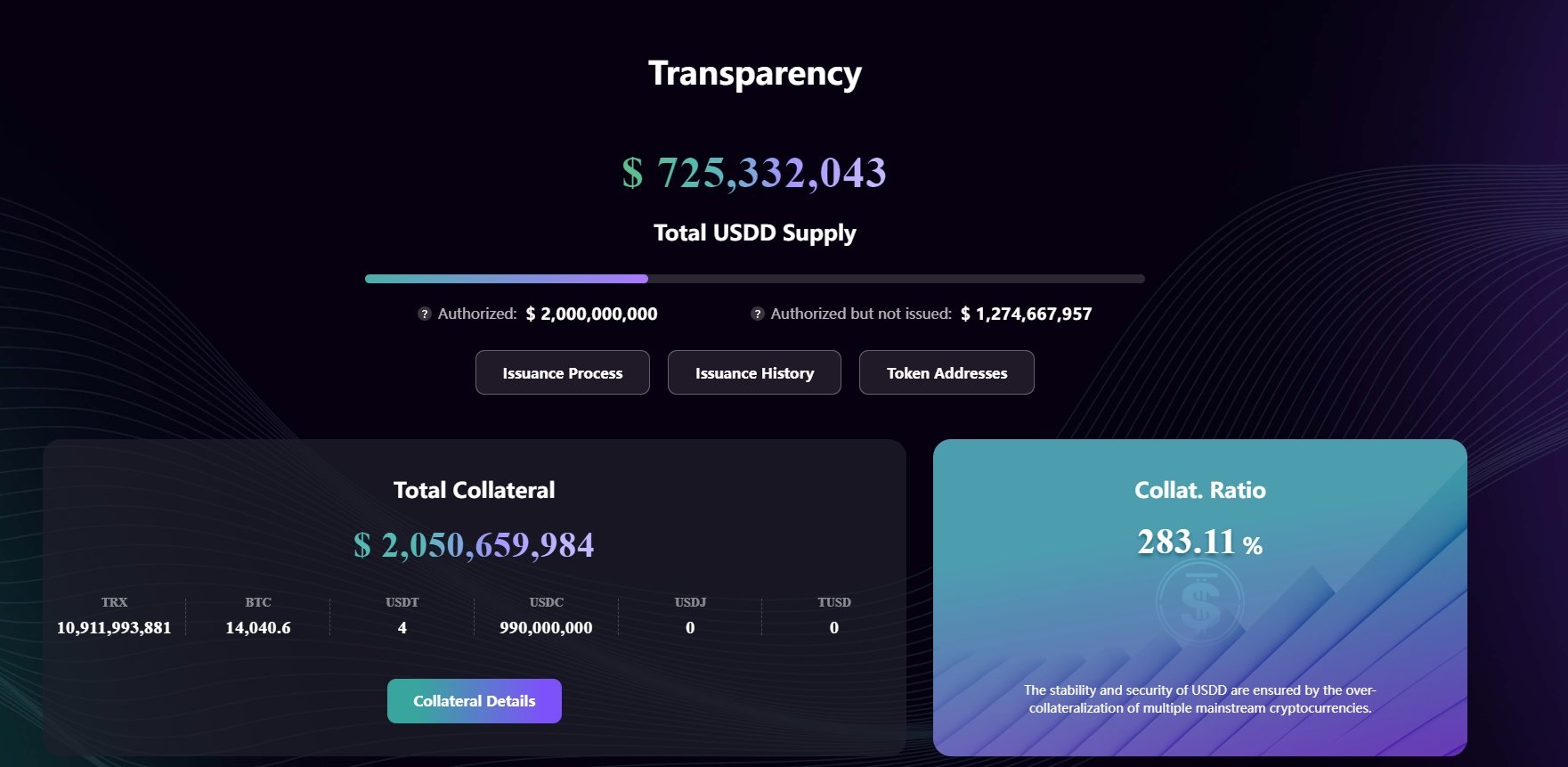

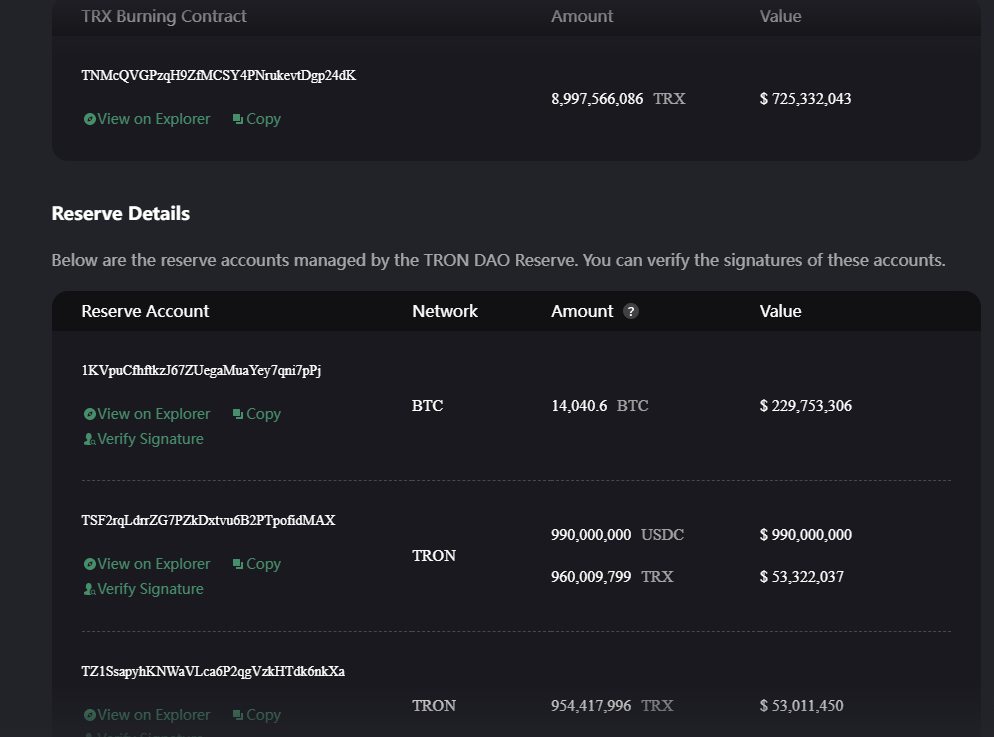

In terms of assets to safe the reserve, the complete provide of USDD is USD 725 million, assured by USD two billion, or 283%, the undertaking is committed and listed on the official site.

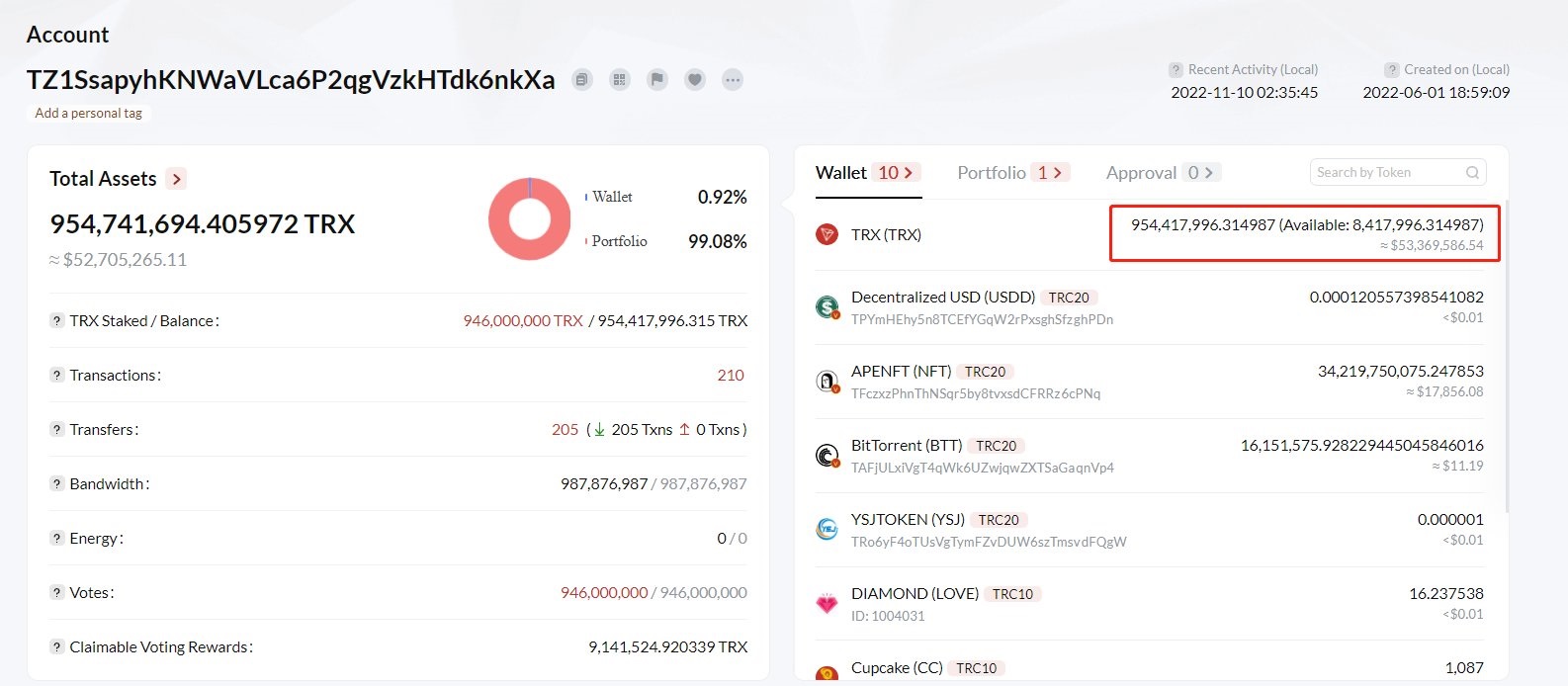

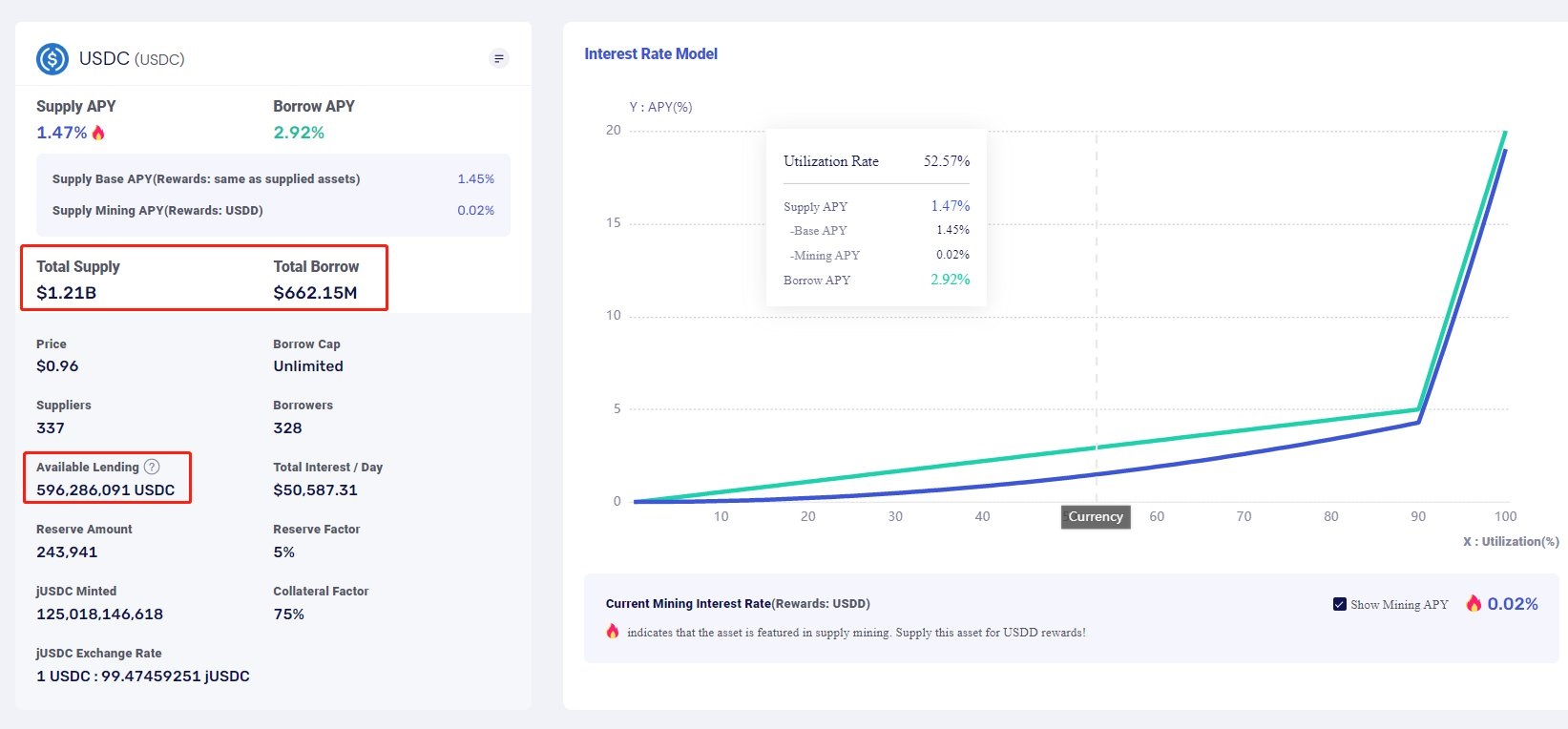

However, just after checking, Lookonchain located that in excess of 99% of TRX is not offered and all USDC has been deposited in Justlend.

This USDC has been loaned and only $ 596 million stays as collateral plus 14,040 BTC ($ 230 million). This signifies that the efficient ensure fee is only all over 114%.

At the finish of the announcement, Lookonchain also issued a recognize to consumers: “If you hold USDD, pay attention to the safety of your funds. “

USDD (decentralized USD) is an algorithmic stablecoin issued by TRON (TRX) which claims to be stablecoin three.. Implementing this thought, TRON officially launched USDD on May five, 2022, just days in advance of LUNA-UST “evaporated”. USDD will work equivalent to UST. USDD will be pegged to USD, one USDD equals one USD.

At the time of updating this short article, one USDD can only be exchanged for .98 USD.

Therefore, the over might be the greatest consequence of the FTX crisis battlefield.

———————————————

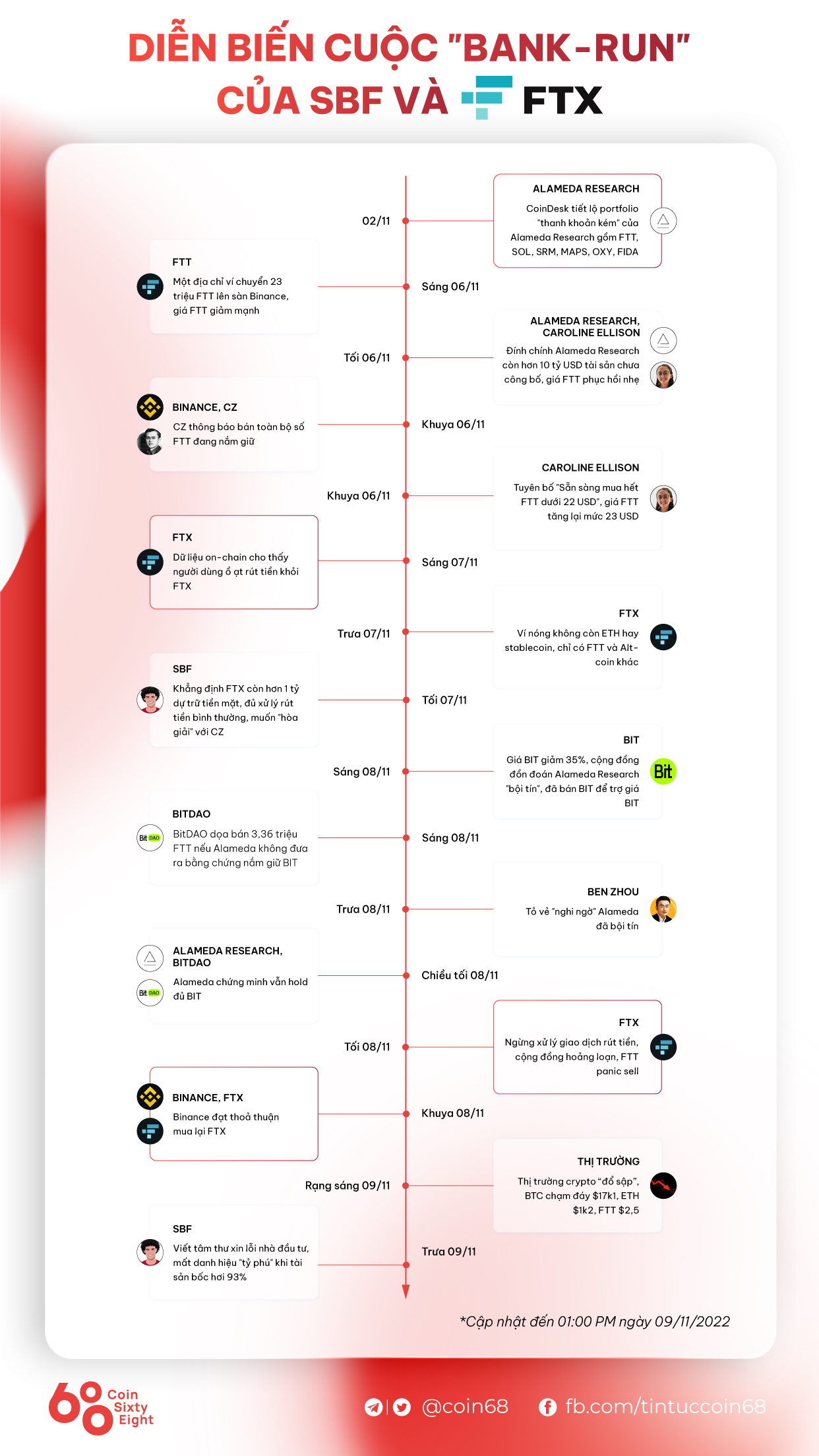

Summary of the Binance drama – FTX

– Binance liquidates its complete $ 580 million investment in FTX tokens

– Users massively withdraw from FTX

– The total marketplace was heavily dumped, FTT misplaced 22 USD

– Binance has reached an agreement to invest in back FTX

– FTX CEO’s equity fell by $ 14.six billion, wrote a letter apologizing to traders

– CZ urges exchanges to present evidence of purchaser deposit

– The Solana procedure “bears the battle”

– Binance cancels FTX acquisition, marketplace is on fire

– Continuously numerous organizations declare “in solidarity” from FTX