Konomi Lending User Manual (Ocean Master)

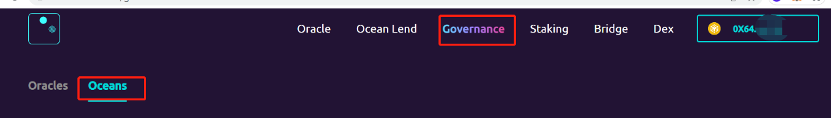

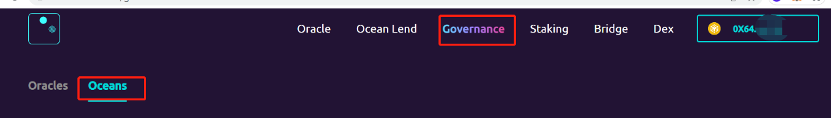

Step one: Link to portfolio, go to webpage “Governance” and select “Oceans”.

Step two: Click “New Proposal”“.

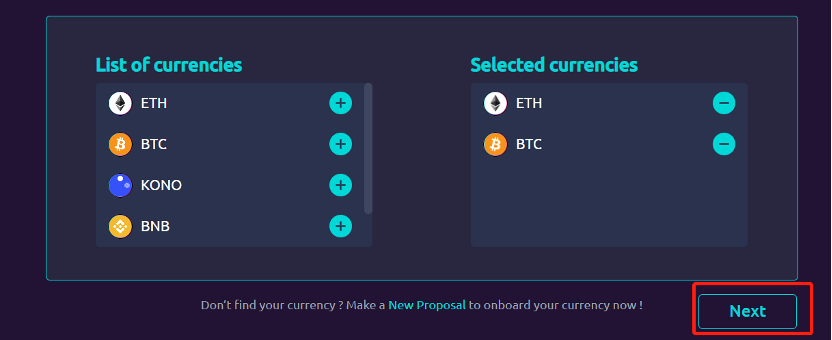

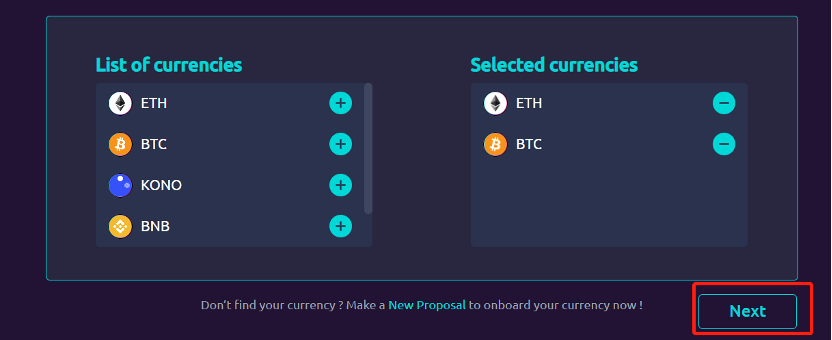

Step three: Select the currency the consumer desires to include to the resource pool. Then click “Next”.

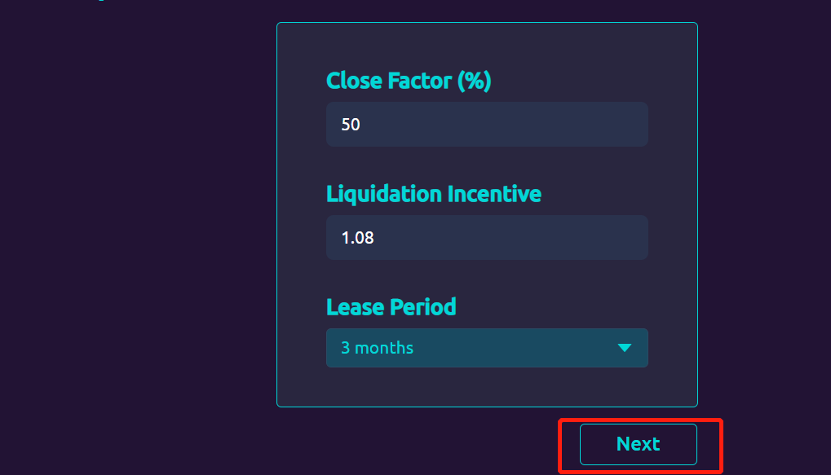

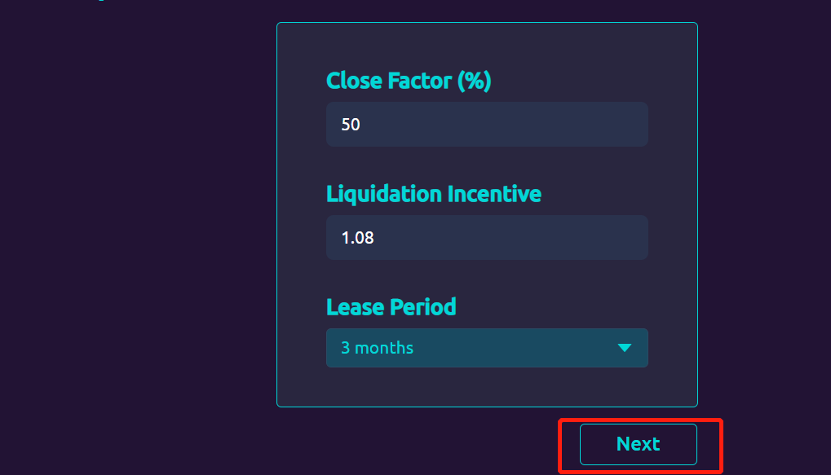

Step four: Set the parameters for the pool assets, which includes Closing Factor, Liquidation Incentives, and Lease Periods. Click “Next” to proceed.

Step five: Enter the corresponding contractual contracts. Then adhere to the guidelines and enter your guarantee settings and curiosity settings.

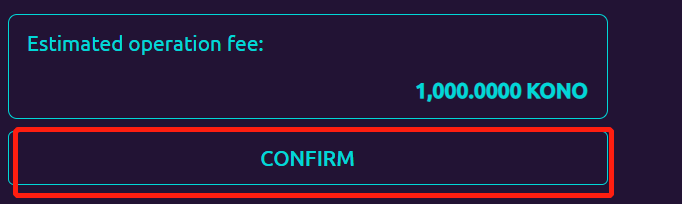

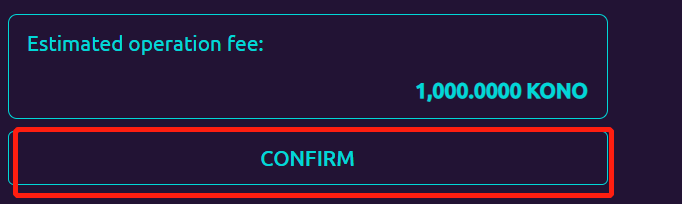

Step six: Make confident there are sufficient KONOs in the wallet following finishing the settings. Click “Confirm”.

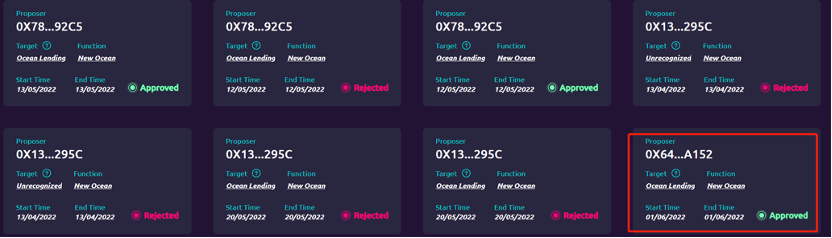

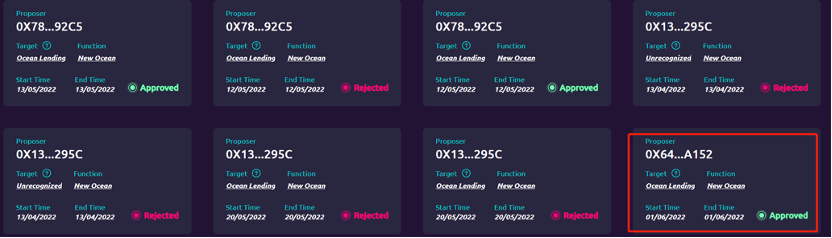

Step seven: The artifact pool is at this time remaining voted on. After this approach, the consumer can come to be the Ocean Master of the pool.

Step eight: Once authorized, the consumer The new asset pool is noticeable on the web page.

User guide Ocean loan (consumer)

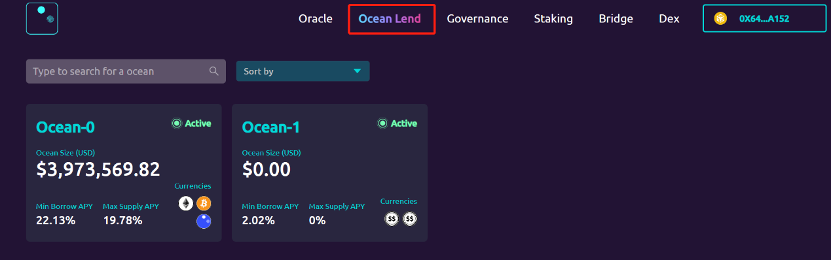

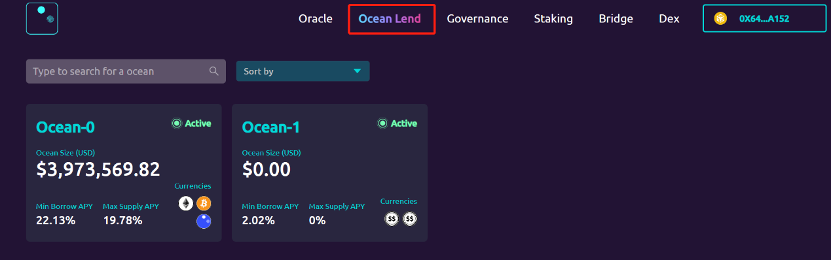

Step one: Link to Wallet, then choose “Ocean lends”.

Step two: Select the sought after asset pool to lend or deposit tokens.

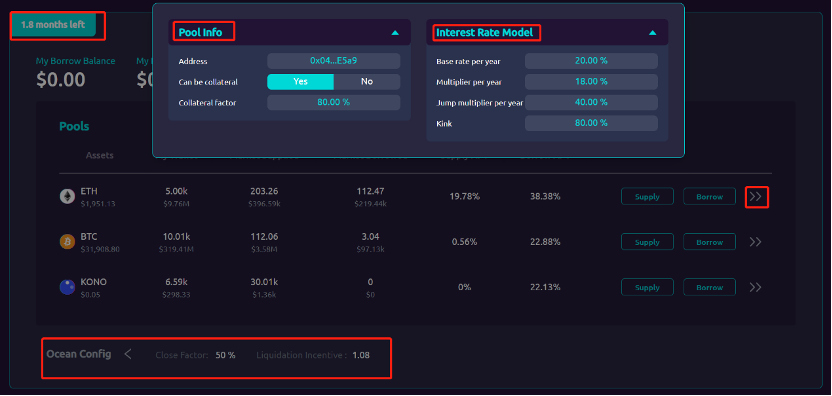

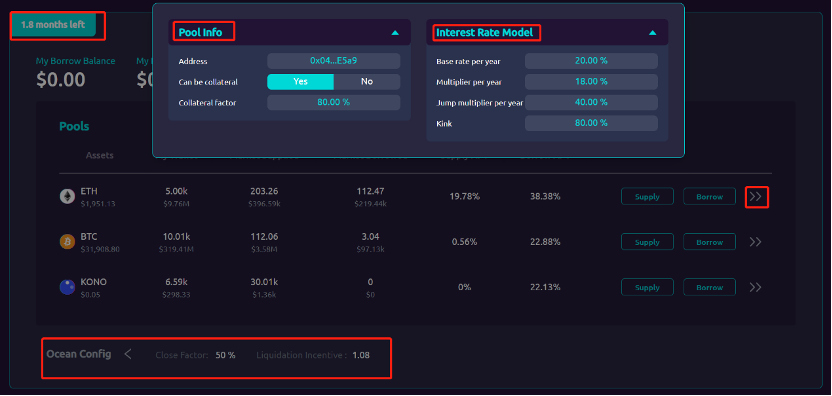

Note: In addition to acquiring to pay out consideration to exchange charges, consumers must also pay out consideration to the facts in the red boxes prior to deciding on an asset pool that matches their chance preferences.

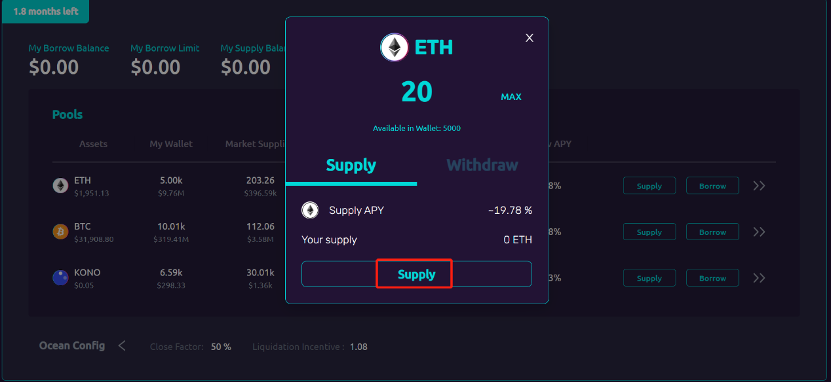

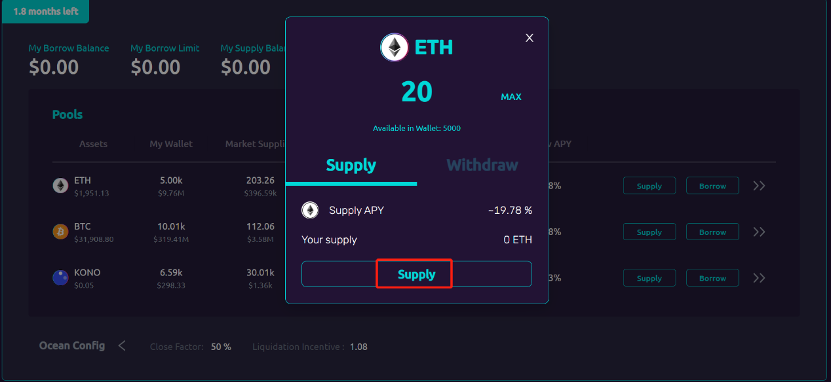

Step three: For consumers who present tokens

Please click “Supply”, enter the amount of tokens you want to present. For the initial time, the consumer has to select “Increase in indemnity”. Click “Supply” once again at the finish of the approach.

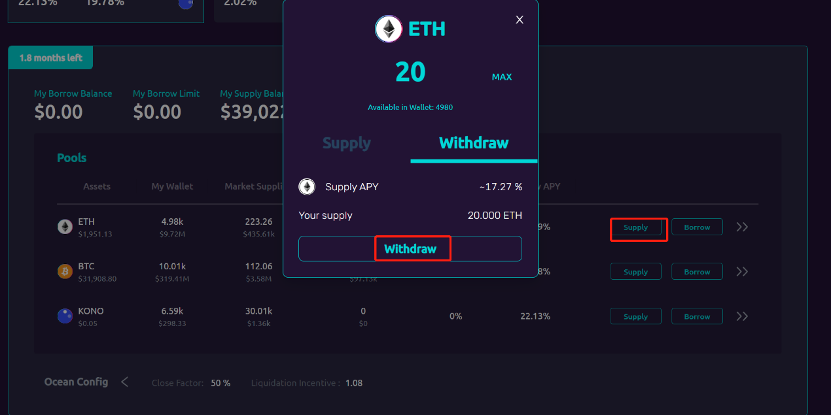

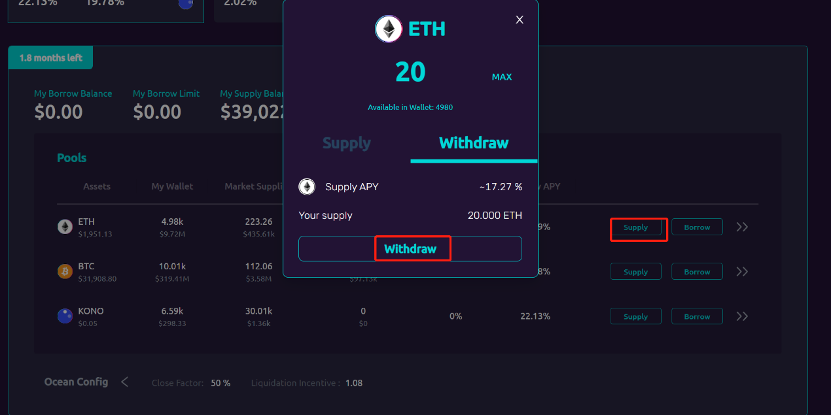

When consumers want to withdraw tokens, click “Supply”select “Retire”, enter the amount of tokens to withdraw. Finally, select “Retire” to full the approach.

Step four: For consumers who want to borrow

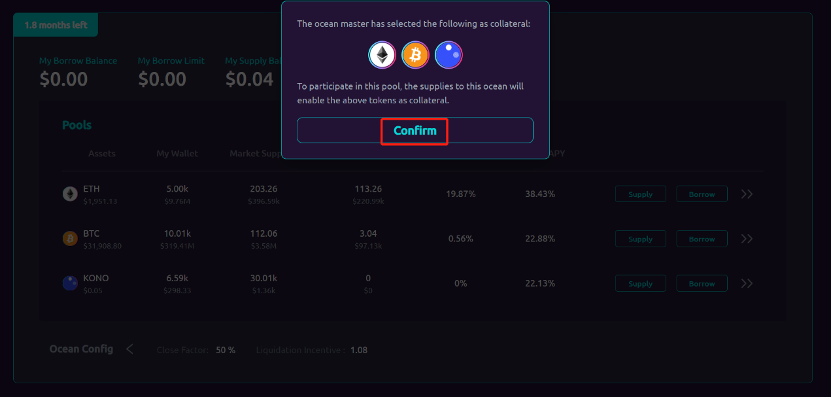

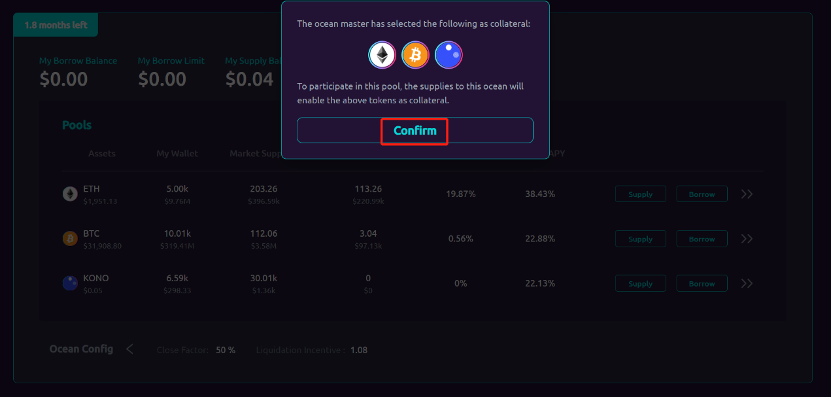

Click on “Loan“In the asset pool, if this is the initial loan, the consumer should select”ConfirmConfirm the collateral supported in the asset pool and full the approach.

For additional guidelines, refer to stage three. After putting collateral in the asset pool, click “Loan” borrow the sought after token.

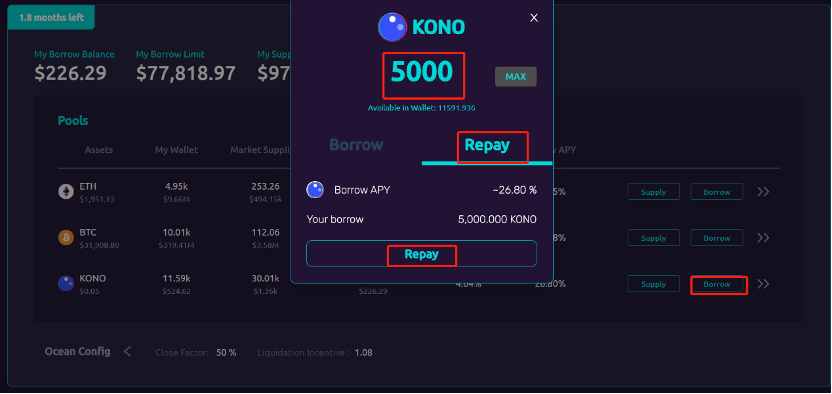

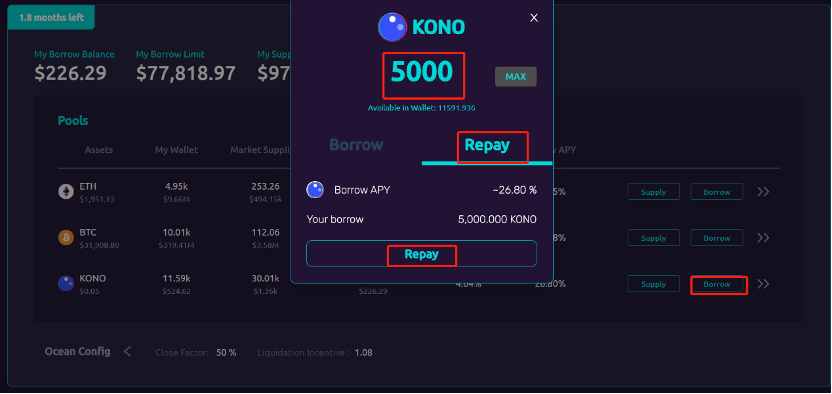

Choose “Refund” return the borrowed tokens.

Information on the Konomi network

Konomi Network is a full management resolution for cross-chain crypto assets. Konomi is designed on Polkadot Substrate, the task was born with the aim of supporting several assets in the Polkadot ecosystem. Users can deal with, exchange assets and earn curiosity by Defi goods. Konomi has also launched its native token to initiate decentralized governance and liquidity.

Maybe you are interested:

Note: This is sponsored material, Coinlive does not right endorse any facts from the over post and does not promise the veracity of the post. Readers must carry out their very own investigate prior to creating choices that impact themselves or their companies and be ready to get duty for their very own selections. The over post is not to be viewed as investment suggestions.

Konomi Lending User Manual (Ocean Master)

Step one: Link to portfolio, go to webpage “Governance” and select “Oceans”.

Step two: Click “New Proposal”“.

Step three: Select the currency the consumer desires to include to the resource pool. Then click “Next”.

Step four: Set the parameters for the pool assets, which includes Closing Factor, Liquidation Incentives, and Lease Periods. Click “Next” to proceed.

Step five: Enter the corresponding contractual contracts. Then adhere to the guidelines and enter your guarantee settings and curiosity settings.

Step six: Make confident there are sufficient KONOs in the wallet following finishing the settings. Click “Confirm”.

Step seven: The artifact pool is at this time remaining voted on. After this approach, the consumer can come to be the Ocean Master of the pool.

Step eight: Once authorized, the consumer The new asset pool is noticeable on the web page.

User guide Ocean loan (consumer)

Step one: Link to Wallet, then choose “Ocean lends”.

Step two: Select the sought after asset pool to lend or deposit tokens.

Note: In addition to acquiring to pay out consideration to exchange charges, consumers must also pay out consideration to the facts in the red boxes prior to deciding on an asset pool that matches their chance preferences.

Step three: For consumers who present tokens

Please click “Supply”, enter the amount of tokens you want to present. For the initial time, the consumer has to select “Increase in indemnity”. Click “Supply” once again at the finish of the approach.

When consumers want to withdraw tokens, click “Supply”select “Retire”, enter the amount of tokens to withdraw. Finally, select “Retire” to full the approach.

Step four: For consumers who want to borrow

Click on “Loan“In the asset pool, if this is the initial loan, the consumer should select”ConfirmConfirm the collateral supported in the asset pool and full the approach.

For additional guidelines, refer to stage three. After putting collateral in the asset pool, click “Loan” borrow the sought after token.

Choose “Refund” return the borrowed tokens.

Information on the Konomi network

Konomi Network is a full management resolution for cross-chain crypto assets. Konomi is designed on Polkadot Substrate, the task was born with the aim of supporting several assets in the Polkadot ecosystem. Users can deal with, exchange assets and earn curiosity by Defi goods. Konomi has also launched its native token to initiate decentralized governance and liquidity.

Maybe you are interested:

Note: This is sponsored material, Coinlive does not right endorse any facts from the over post and does not promise the veracity of the post. Readers must carry out their very own investigate prior to creating choices that impact themselves or their companies and be ready to get duty for their very own selections. The over post is not to be viewed as investment suggestions.